Report Overview

Anemometer Market - Strategic Highlights

Anemometer Market Size:

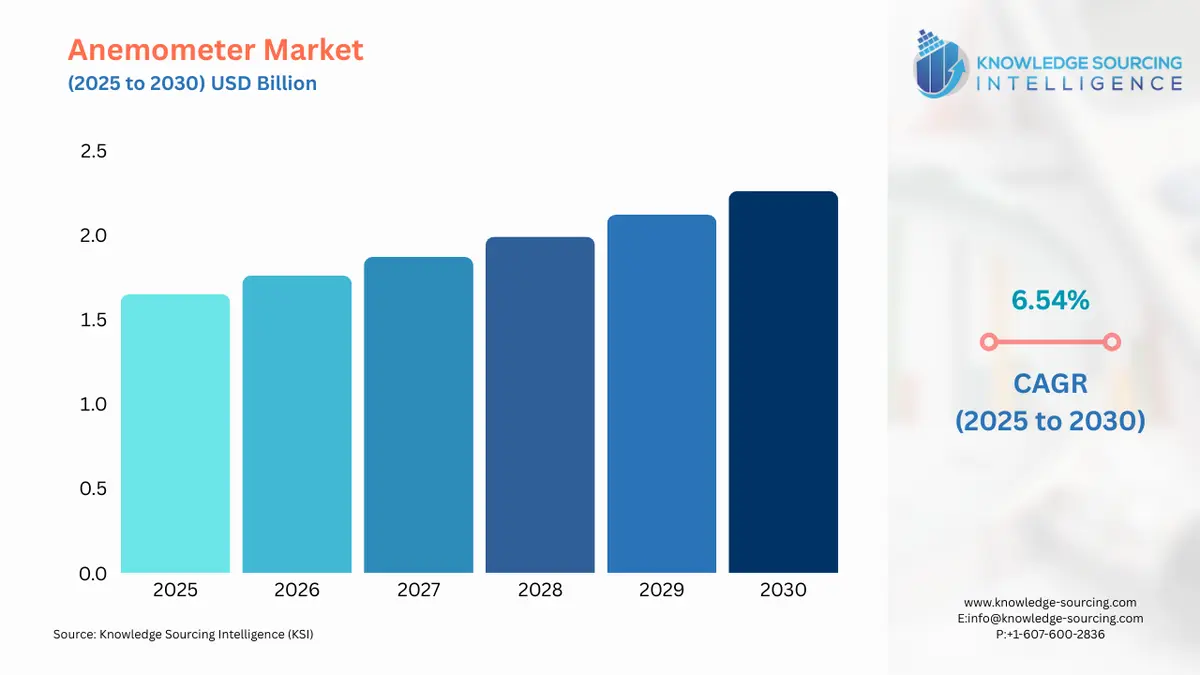

The anemometer market, at a 6.34% CAGR, is anticipated to reach USD 2.385 billion in 2031 from USD 1.649 billion in 2025.

Anemometer Market Trends:

An anemometer is a device designed to quantify both the speed and direction of the wind. Anemometers find applicability in aerospace, marine, energy & power, meteorology, and other sectors that rely on such devices to gather accurate wind data for operational efficiency, safety, and decision-making. Vane anemometers, cup anemometers, and hot-wire anemometers are different types of anemometers. The growth of industries such as aerospace and marine sectors significantly contributes to the expansion of the anemometer market size.

Anemometer Market Drivers:

Growing demand for wind energy bolsters the anemometer market growth.

The booming global demand for clean energy, particularly wind power, has emerged as a pivotal catalyst for the expansion of the anemometer industry. Anemometer by providing accurate wind speed and direction data enables effective assessment and utilization of wind resources, thereby contributing to the overall growth of the anemometer market. According to the International Energy Agency, in 2020, India added 0.3 GW of wind capacity. Similarly, in the European region, net onshore wind electricity capacity stood at 13.7 GW in 2022 and 17.9 GW in 2023 respectively.

The booming aviation sector drives the anemometer market expansion.

Anemometers provide accurate wind speed and direction measurements, essential for safe take-offs, landings, and in-flight operations. Such devices facilitate real-time weather monitoring and wind assessment which enable pilots and air traffic controllers to make informed decisions and enhance flight safety. According to the Bureau of Transportation Statistics, in 2022, the number of passengers carried by U.S. airlines experienced an increase of 194 million passengers compared to the previous year, representing a remarkable 30% year-to-year rise. For the entire year, from January to December, U.S. airlines transported a total of 853 million passengers (unadjusted), surpassing the figures of 658 million passengers in 2021 and 388 million passengers in 2020.

Rise in the marine sector drives anemometer market growth.

Anemometers, which measure wind speed and direction, are crucial instruments for maritime operations, including ship navigation, offshore platforms, and port management. With the increasing emphasis on safety and efficiency in marine transportation, the demand for accurate and reliable anemometers is rising. These instruments aid in optimizing vessel routes, enhancing fuel efficiency, and ensuring the safety of ships and crew. According to the United Nations Conference on Trade and Development, in 2022, shipments in the global market witnessed a positive growth of approximately 3.2%, reaching a notable volume of 11 billion tons. This remarkable improvement of 7 percentage points compared to the decline experienced in 2020 highlights the recovery in the shipping industry.

Anemometer Market Geographical Outlook:

North America is anticipated to dominate the anemometer market.

The North American region is expected to dominate the anemometer market primarily due to the region's growing wind energy capacity which has fuelled the demand for anemometers in wind farm installations and wind resource assessment. Technological advancements, robust infrastructure development, and a well-established meteorological network have also contributed to regional market growth. According to the Department of Energy, in 2021, the wind industry in the United States successfully added an impressive 13,413 megawatts (MW) of new wind capacity. This significant achievement propelled the cumulative total of installed wind capacity to reach an impressive 135,886 MW. Additionally, according to the Canadian Renewable Energy Association, in 2022, Canada possessed an installed capacity exceeding 19 gigawatts (GW) of utility-scale wind and solar energy.

High initial cost restrains the anemometer market size.

The cost of advanced and highly precise anemometer models is relatively higher compared to standard alternatives. Such high-cost factors can particularly pose a limitation for small businesses and individuals with budget constraints, potentially restricting their ability to invest in these sophisticated devices and integrate them into their operations or research activities. As a result, the potential benefits of utilizing advanced anemometers, such as improved accuracy in wind speed measurement and a better understanding of atmospheric conditions, may not be fully realized by these entities, leading to a gap in their capabilities and potential insights that could be derived from comprehensive wind data.

Anemometer Market Company Products:

IM124 cup anemometer: Munro Instruments offers the highly regarded IM124 cup anemometer, which has become an industry standard for wind speed assessments. This reliable device stands out for its ability to operate independently without the need for an external power source. The anemometer generates an output signal that accurately reflects the wind speed, allowing for precise measurements. Its design makes it particularly suitable for various applications, including crane operations, offshore rigs, ports, harbors, and shipping terminals.

HHF141 rotating vane anemometer: Omega Engineering’s HHF141 rotating vane anemometer, is a top-tier instrument renowned for its exceptional quality and ability to deliver highly accurate air velocity measurements even in demanding environments. This user-friendly device features an intuitive interface, making it easy for users to operate and obtain precise airflow data.

List of Top Anemometer Companies:

Munro Instruments Limited

Omega Engineering, Inc.

Thermo Fisher Scientific Inc.

Konomax USA Inc.

Gill Instruments Limited

Anemometer Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Anemometer Market Size in 2025 | USD 1.649 billion |

Anemometer Market Size in 2030 | USD 2.264 billion |

Growth Rate | CAGR of 6.54% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Anemometer Market |

|

Customization Scope | Free report customization with purchase |

Anemometer Market Segmentation

By Type

Vane Anemometer

Cup Anemometer

Hot-Wire Anemometer

Others

By Product Type

Digital

Analog

By End-User

Aerospace

Marine

Energy & Power

Meteorology

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others