Report Overview

Antimony Free Film Market Highlights

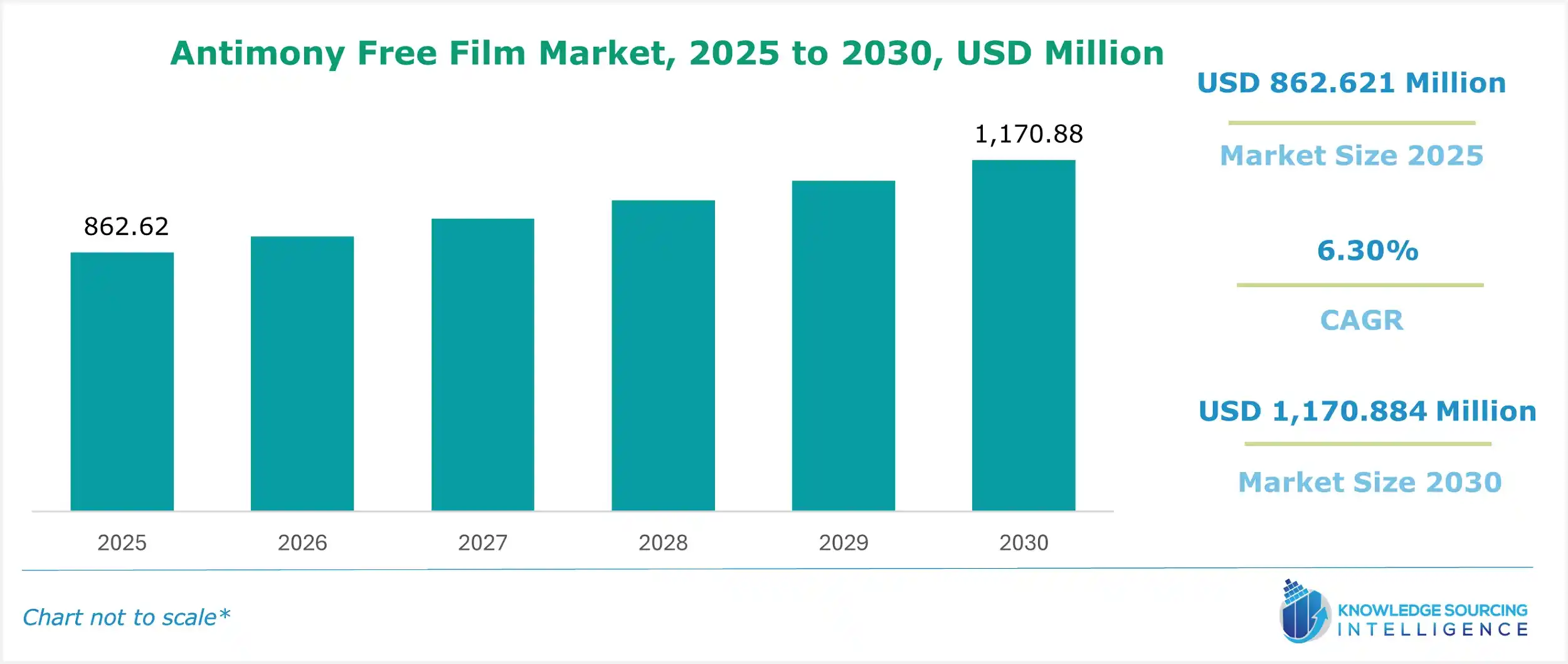

Antimony Free Film Market Size:

The antimony-free film market, with a 6.11% CAGR, is anticipated to rise from USD 862.621 million in 2025 to USD 1231.353 million in 2031.

Antimony Free Film Market Key Highlights:

Antimony-free film refers to a type of thin plastic material used in various applications such as packaging, electronics, and textiles. Unlike traditional films that contain antimony compounds, which can have environmental and health concerns, antimony-free film is formulated without these potentially harmful substances. This innovation aims to enhance sustainability and safety by providing a safer alternative for industries while maintaining the functional properties and performance of the film in its intended uses.

Antimony Free Film Market Introduction:

Antimony-free film is a form of film material that is produced using new-generation catalyst material and offers no risk of harmful antimony migrating into food and other materials.

The antimony-free film material enhances the safety of the food products and increases the sustainability of the packaging solution. It is also applied across multiple sectors, including the packaging of foods, beverages, pharmaceuticals, and electronics, among others.

The increasing demand for pharmaceutical products is among the key factors propelling the growth of the antimony-free films during the estimated timeline. In the pharmaceutical sector, the films are utilized to produce various types of packaging materials, like blister packaging.

The global pharmaceutical sector witnessed a major growth in its production, especially in the European region.

This market has gained prominence due to growing environmental and health awareness, driving demand for safer and more sustainable alternatives. Antimony-free films offer a solution by addressing potential concerns associated with antimony while meeting functional requirements, thereby catering to a diverse range of applications and contributing to the overall shift towards environmentally responsible practices.

Antimony Free Film Market Drivers:

The growing demand for packaged food and beverages:

The increasing global demand for packaged food and beverage products is among the key factors pushing the antimony-free packaging market expansion during the forecasted timeline.

In the food and beverage sector, the antimony-free films help in increasing the safety of the packed food products. The film material helps in preventing the migration of antimony into the food product, which can cause severe damage to the consumer’s health.

The demand for packaged food products in the global retail market witnessed major growth due to the increasing urbanization and growing disposable income of consumers.

The Agriculture and Agri-Food Canada (AAFC), in its report, stated that the sales of packaged food products in Canada were recorded at Can$ 77,578.3 million in 2023. The agency further stated that the retail sale of dairy products & alternatives was recorded at Can$18,044.3 million, whereas the sale of staple foods and snacks was recorded at Can$26,331.3 million and Can$17,650.9 million, respectively.

Environmental Concerns and Regulations:

Growing global awareness of environmental degradation and the need for sustainable practices has significantly influenced the demand for antimony-free films. Antimony, a metalloid commonly used in polyester film production as a catalyst, is associated with environmental risks due to its toxicity and persistence in ecosystems. Mining and processing antimony can lead to soil and water contamination, posing threats to biodiversity and human health. As industries face increasing pressure to adopt sustainable practices, antimony-free films have emerged as a viable solution to reduce environmental impact.

Stringent regulations are a key driver of this shift. The European Union’s Restriction of Hazardous Substances (RoHS) directive and the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation have set strict limits on the use of hazardous substances, including antimony compounds, in manufacturing processes. For instance, REACH classifies antimony trioxide as a substance of very high concern (SVHC) due to its potential carcinogenic and environmental effects, prompting manufacturers to seek compliant alternatives. Similarly, regulations in Asia, such as China’s updated environmental protection laws, emphasize reducing hazardous material usage, further accelerating the adoption of antimony-free films.

Recent industry developments underscore this trend. In 2024, the European Commission proposed amendments to REACH to further restrict antimony compounds in consumer goods, signaling a broader regulatory push toward safer materials. This has spurred innovation in antimony-free catalysts, such as titanium-based or aluminum-based alternatives, which maintain the performance of polyester films while aligning with environmental goals. Companies like DuPont and Toray Industries have invested in research to develop eco-friendly films, with Toray announcing in 2025 a new line of antimony-free polyethylene terephthalate (PET) films for packaging applications, citing compliance with global sustainability standards.

Health and Safety:

Health and safety concerns are another critical driver propelling the antimony-free film market. Antimony compounds, particularly antimony trioxide, have been linked to potential health risks, including respiratory irritation and suspected carcinogenicity, as noted by the International Agency for Research on Cancer (IARC). These risks are particularly concerning in applications like food packaging, where antimony migration from films into consumables could pose health hazards. As consumer awareness of these risks grows, demand for safer packaging materials has surged, driving the adoption of antimony-free films.

Industries are responding to these concerns by prioritizing materials that eliminate the use of antimony-based catalysts. Antimony-free films offer a safer alternative, reducing the risk of chemical migration and ensuring compliance with food safety standards, such as those set by the U.S. Food and Drug Administration (FDA) and the European Food Safety Agency (EFSA). For example, the EFSA has established strict migration limits for antimony in food-contact materials, prompting manufacturers to reformulate their products to meet these standards.

A notable development in this space occurred in 2024 when Amcor, a global leader in packaging solutions, launched a new range of antimony-free PET films for food and beverage applications. The company highlighted the films’ compliance with EFSA and FDA regulations, emphasizing their role in ensuring consumer safety while maintaining high performance. Similarly, in the electronics sector, where antimony-free films are used in flexible displays and circuit boards, companies like LG Chem have introduced antimony-free polyester films to address workplace safety concerns during manufacturing processes.

These health-driven innovations are also supported by consumer trends. A 2025 report by the World Health Organization (WHO) highlighted increasing public demand for non-toxic materials in everyday products, further pressuring manufacturers to adopt antimony-free solutions. This shift not only mitigates health risks but also enhances brand reputation and consumer trust, providing a competitive edge in the market.

Sustainability Drive: The global push for sustainability prompts industries to seek packaging materials that minimize their carbon footprint. Antimony-free films, being free of a potentially harmful element, contribute to sustainable practices, making them an attractive choice for environmentally conscious brands and consumers.

Brand Reputation and Consumer Perception: Companies increasingly prioritize brand reputation by opting for safer and environmentally responsible packaging solutions. Utilizing antimony-free films showcases a commitment to consumer well-being and environmental stewardship, positively impacting brand image and customer loyalty.

Market Demand for Safer Alternatives: As consumers become more informed about product ingredients and packaging materials, there is a growing market demand for transparent and safer packaging choices. Antimony-free films address this demand, offering a tangible way to communicate a commitment to product safety and responsible sourcing.

Innovation in Material Science: Advances in material science have led to the development of high-performance antimony-free film alternatives that match or surpass the properties of traditional materials. These innovative materials provide manufacturers with the means to maintain packaging integrity and functionality while eliminating antimony-related concerns.

Supply Chain Resilience: The potential disruption in the supply chain of antimony compounds due to geopolitical factors or market volatility can prompt manufacturers to seek alternative solutions, such as antimony-free films, to ensure consistent and reliable packaging material availability.

Industry Collaboration and Advocacy: Collaborative efforts between industry associations, regulatory bodies, and advocacy groups play a pivotal role in promoting awareness and driving the adoption of safer packaging materials. Such initiatives emphasize the importance of antimony-free alternatives, encouraging manufacturers to explore and adopt these options.

Global Market Trends: The adoption of antimony-free films aligns with broader global trends favouring sustainable and responsible packaging practices. As countries and regions increasingly adopt eco-friendly policies and standards, antimony-free films offer a pathway for businesses to remain competitive and compliant.

Technological Advancements: Research and development efforts focused on antimony-free film technologies contribute to the creation of new and improved materials. These advancements result in films with enhanced attributes, including better barrier properties, printability, and sealing capabilities, making them more appealing to diverse industries and applications.

Antimony Free Film Market Segmentation Analysis:

PET films are expected to lead the market growth:

Polyethylene terephthalate (PET) films, based on material type in the antimony-free film market, are the most widely used material type. During the forecast period, PET films will hold a major share in the antimony-free film market.

The demand for PET as a material in the antimony-free film market is driven by the increasing demand for health-safe and environmentally sustainable products across various industries such as food & beverage packaging, pharmaceuticals, and electronics. The increasing awareness about the health concerns related to antimony-based PET films is shifting the demand towards the antimony-free films market.

The dominance of PET in the antimony-free film market is attributed to various factors such as:

PET is the most widely used polymer for packaging as it offers superior mechanical strength, clarity, and a better gas and moisture barrier. It also has high temperature resistance compared to PP and PE, leading to its dominance in high-performance applications such as food and medical packaging, electronics, and industrial films. As per the data by the European PET Bottle Platform, bottles represent 68% of total PET use in Europe, highlighting the high market share of PET in bottle packaging, signifying the established market preference of PET in major industries.

Due to the growing governmental regulation and increasing environmental consciousness, there is more demand for recyclable materials. PET films can meet this demand as it has superior recyclability compared to PP and PE, and there is more recycling infrastructure for PET. Thus, the recyclability and demand for recycled materials are leading to the dominance of PET in the antimony-free film market.

As per the data by the National Association of PET Container Resource, PET plastic is the most recycled plastic as it can be fully recycled. This highlights its higher recyclability rate than other plastics such as PP and PE.

In 2023, the rate of rPET content in US bottles reached an all-time high of 16.2%, increasing from 870 million pounds in 2022 to 966 million pounds, highlighting the increasing adoption of PET for bottle packaging.

The food and beverage segment is predicted to lead the market expansion

Food and Beverage sector will hold the largest share of the antimony-free films market. The market dominance is due to the high demand from antimony-free films for food and beverage packaging.

There is increasing demand for antimony-free films in the food and beverage industry as antimony-based catalyst possess serious health concerns. This leads the governments to implement stringent regulations that is driving the need for antimony-free films in this industry.

For instance, California Safe Drinking Water and Toxic Enforcement Act of 1986 under proposition 65 listed antimony trioxide as a chemical that exposes consumers to chemicals possessing health threats. This has prompted companies to demand antimony-free alternatives, including antimony-free films in the food and beverage industry.

The increasing health and safety concerns among consumers over the use of antimony-catalysts in packaging is driving the consumers' demand for antimony-free films.

The food and Beverage industry uses antimony-free films in several applications, such as for packaging bottled water, soft drinks, and juices. It is used for flexible packaging, such as the use of PP and PE films for ready-to-eat meals and dairy products. It is also used as microwave trays like PET antimony-free film due to its strong mechanical strength and chemical resistance. It is also used for label sleeves.

As the demand for organic food is growing, there is an increasing need for sustainable and health-safe packaging products. As per the International Federation of Organic Agriculture Movement (IFOAM), Germany and FiBL Switzerland in 2022, the Global Organic Market has been growing at a CAGR of 8.7 % during the last six years (2015-2020). As per APEDA, the Indian organic market is also growing.

In the food and beverage industry, the North American region will constitute a large share due to stringent government policies. Asia-Pacific will also be growing significantly due to the increasing demand for sustainable packaging.

Positive growth in the Pharmaceutical segment:

This growth is driven by increasing awareness of environmental concerns and regulatory requirements in the pharmaceutical industry. As sustainability becomes a priority, antimony-free films, such as PE Films and PET Films, are being preferred for packaging pharmaceutical products due to their reduced environmental impact and compliance with stringent regulations. The pharmaceutical sector's commitment to eco-friendly practices and safe packaging is propelling the demand for antimony-free films, leading to their significant growth in this segment.

Antimony Free Film Market Geographical Outlook:

North America, particularly the US, will hold a considerable market share:

The USA antimony-free film market is witnessing growth primarily due to rising environmental and health concerns regarding the use of antimony material, as they are toxic substance utilized in the production of PET films. Moreover, the stringent government policies and regulations for environmental and growing sustainability practices are also promoting market growth, as strict rules against hazardous materials like antimony are being imposed.

Companies are following the sustainability practices as per the US government environmental standards, such as the Toxic Substances Control Act (TSCA). This act was last updated in September 2024 and works against harmful substances and requires monitoring of chemical substances and/or mixtures in diverse industries such as food, drugs, pesticides, and cosmetics.

Antimony-free films are gaining popularity across the country in the food, beverage, pharmaceutical, and cosmetic industries due to the rising demand for sustainably packaged goods and growing retail sales of these products.

According to the USDA data, updated as of 2025, the retail food sales witnessed a steady increase, which was valued at US$16.19 billion in April 2023, and rose to US$16.92 billion in May 2023.

The country is promoting recycling and the circular economy to minimize waste generation from plastic and increase recycling by diverse industries. Further, consumers are increasingly demanding safer alternatives to toxic substances like antimony. This rising health awareness is leading to the antimony-free film market’s expansion due to its health and environmental benefits.

The Asia Pacific region is expected to hold a significant share:

Asia Pacific is expected to dominate the antimony-free film market share. This is attributed to the region's robust manufacturing and packaging industries, particularly in sectors like pharmaceuticals, food and beverages, and agriculture, where antimony-free films find extensive applications. Additionally, the increasing emphasis on sustainable packaging solutions and stringent environmental regulations in countries like China, India, and Japan are driving the adoption of antimony-free films, positioning Asia Pacific as a key player in the market's growth.

Antimony Free Film Market Products offered by Key Companies:

Amcor launched its No Compromise range of antimony-free films. These films are designed to meet the same performance standards as traditional films but without the use of antimony. Amcor's No Compromise films are used in a variety of applications, including food packaging, pharmaceutical packaging, and electronics packaging.

BASF launched its Ecovio range of antimony-free films. Ecovio films are made from renewable materials and are certified compostable. They are used in a variety of applications, including food packaging, retail packaging, and industrial packaging.

List of Top Antimony Free Film Companies:

Mitsubishi Polyester Film GmbH

Ester Industries Limited

Polyplex

FlexFilms

DuFor

Antimony Free Film Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Antimony Free Film Market Size in 2025 | US$862.621 million |

Antimony Free Film Market Size in 2030 | US$1,170.884 million |

Growth Rate | CAGR of 6.30% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Antimony Free Film Market |

|

Customization Scope | Free report customization with purchase |

Antimony Free Film Market Segmentation

By Material Type

PE Films

PP Films

PET Films

By Thickness

<50 microns

50-100 microns

100-200 microns

200 micron

By Application

Packaging

Printing and lamination

Labels

Optical Films

Protective Films

Decorative Films

By End-User

Pharmaceutical

Food and Beverages

Agriculture

Automotive

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others