Report Overview

Argentina Home Fragrance Market Highlights

Argentina Home Fragrance Market Size:

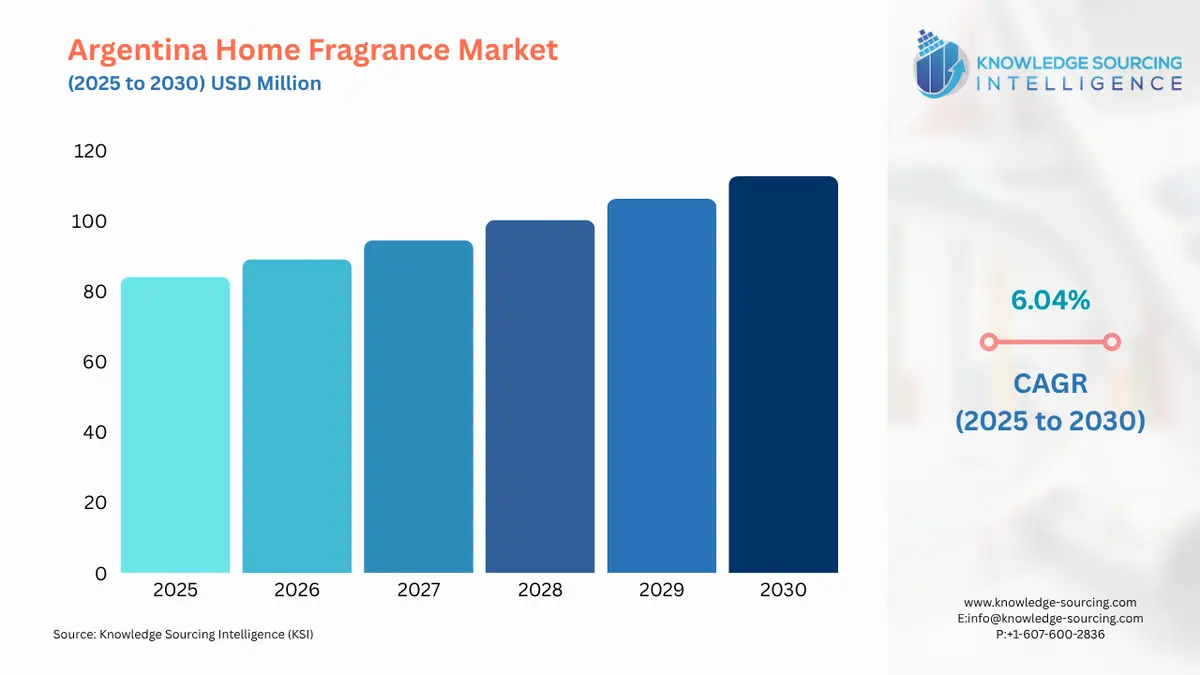

The Argentina Home Fragrance Market is forecasted to increase at a CAGR of 6.04%, rising from USD 84.056 million in 2025 to USD 112.693 million in 2030.

Argentina Home Fragrance Market Overview & Scope:

The Argentina's fragrance sector is undergoing significant transformation due to shifting customer preferences and cultural traits. One significant market driver is the growing demand for natural and organic products. Businesses are developing fragrances with natural ingredients because of consumers' growing apprehension about the chemicals in personal care goods. This shift is in line with an increasing trend toward sustainability and eco-friendly activities, especially among younger people in cities like Buenos Aires. Local Argentine products are growing in popularity because they offer distinctive scents inspired by the country's diverse landscapes and rich cultural heritage.

- Fragrance: The Argentina home fragrance market is anticipated to be led by the fresh/citrus sector. This is mostly because these fragrances are so widely accessible and well-liked. Essential oils made from the peels and fruits of different citrus trees, such as colorful limes, tart lemons, sweet oranges, sour grapefruits, and fragrant bergamot, are used to create fresh and citrusy scents. These fragrances are popular not only for their revitalizing properties but also for their many advantages, which include mood-boosting, aromatherapy applications, smell blending, and other uses that promote general well-being.

- Product Type: The market is separated into many segments based on product type, candles, sprays, diffusers, essential oils, incense sticks, plug-in devices, potpourri and sachets, wax melts, and others. The market for home fragrances is anticipated to be led by the candles category. This is mostly because scented candles are becoming more and more popular. Customers can choose fragrances that suit their emotions due to the wide variety of fragrance options available in scented candles, which range from fruity and floral to spicy and earthy. The segment is also supported by the growing appeal of scented candles as a gift option. During the holiday season, these candles are becoming more and more popular. They frequently function as considerate hostess presents, housewarming gifts, or expressions of gratitude. Additionally, these candles are used for a variety of festivities.

- Distribution Channel: The market is divided into Specialty stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their hair care requirements. The segment's rise was aided by the new trend of buying personal care goods in bulk at department stores and supermarkets.

Top Trends Shaping the Argentina Home Fragrance Market:

- Innovations and Product Preferences

The market has a wide variety of goods, such as air fresheners, scented candles, diffusers, and incense. Scented candles are becoming more and more popular because they add aroma and improve home décor. Demand for diffusers, especially reed and heat-based models, is rising following the global trend towards multipurpose and attractive house accents. There has been a noticeable shift towards natural and environmentally friendly formulations.

- Innovations in Technology

In Argentina, incorporating technology into home fragrance items is becoming more and more popular. Smartphone apps that operate smart diffusers are becoming more and more popular since they let users set their own timetables and adjust the intensity of their scents. This technical advancement meets the increasing need for convenience and customization in the atmosphere of the house.

Argentina Home Fragrance Market Growth Drivers vs. Challenges:

- Opportunities:

- Growing Middle-Class Spending and Urbanization: Argentina's urban population is still expanding, and towns like Rosario, Córdoba, and Buenos Aires are home to a lot of middle class. There is a greater need for goods that improve comfort and ambiance because urban living has resulted in small living areas. These days, home fragrances like candles, diffusers, and sprays are seen as essentials for well-being rather than just luxury items. Middle-class consumers increased discretionary income also indicates their increased willingness to spend on goods that improve their quality of life.

- Changing Consumer Behaviour and Gender Norms: Home fragrance goods were traditionally sold to women, but now the business is growing because of changing social norms. In Argentina, male consumers are becoming more involved in self-care and home care routines, which increases the appeal of products. Brands have responded to this change by launching more gender-neutral fragrances and simple packaging that complements contemporary design trends.

- Challenges:

- Costs of Compliance and Regulatory Complexity: Home fragrance goods have to follow safety and labeling regulations set by organizations like the National Administration of Drugs, Food, and Medical Technology (ANMAT). Although consumers are protected, local producers and new market players have to deal with regulatory obstacles and compliance expenses. Without a large investment, smaller firms could find it difficult to comply with regulations.

- Market Fragmentation and Low Brand Loyalty: There are numerous small and medium-sized businesses selling comparable goods in Argentina's highly fragmented home fragrance market. It is challenging for brands to build loyalty because of this fragmentation and the high degree of product substitutes available. Companies find it difficult to establish consistent repeat purchasing patterns since consumers frequently experiment with scents.

Argentina Home Fragrance Market Competitive Landscape:

The market is moderately fragmented, with many key players including Espacio Aroma, Citratus Argentina SRL, Givaudan Argentina, and International Flavors & Fragrances (IFF).

- Collaboration: In January 2024, with fifteen years of experience in the industry, Auria fragrances, a third-party maker of cosmetics, fragrances, and home décor items, joined Stradivarius as a perfume supplier in Argentina.

Argentina Home Fragrance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 84.056 million |

| Total Market Size in 2031 | USD 112.693 million |

| Growth Rate | 6.04% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Fragrance, Product Type, Distribution Channel, Geography |

| Geographical Segmentation | Buenos Aires Province, Córdoba, Santa Fe, Mendoza, San Luis, Others |

| Companies |

|

Argentina Home Fragrance Market Segmentation:

- By Fragrance

- Floral

- Fresh/Citrus

- Woody

- Oriental/Spicy

- Herbal

- Fruity

- Sweet/Gourmand

- Oceanic

- Others

- By Product Type

- Candles

- Sprays

- Diffusers

- Essential Oils

- Incense Sticks

- Plug-in Devices

- Potpourri and Sachets

- Wax Melts

- Others

- By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Stores

- Others

- By Region

- Buenos Aires Province

- Córdoba

- Santa Fe

- Mendoza

- San Luis

- Others