Report Overview

Automotive Lighting Market Report, Highlights

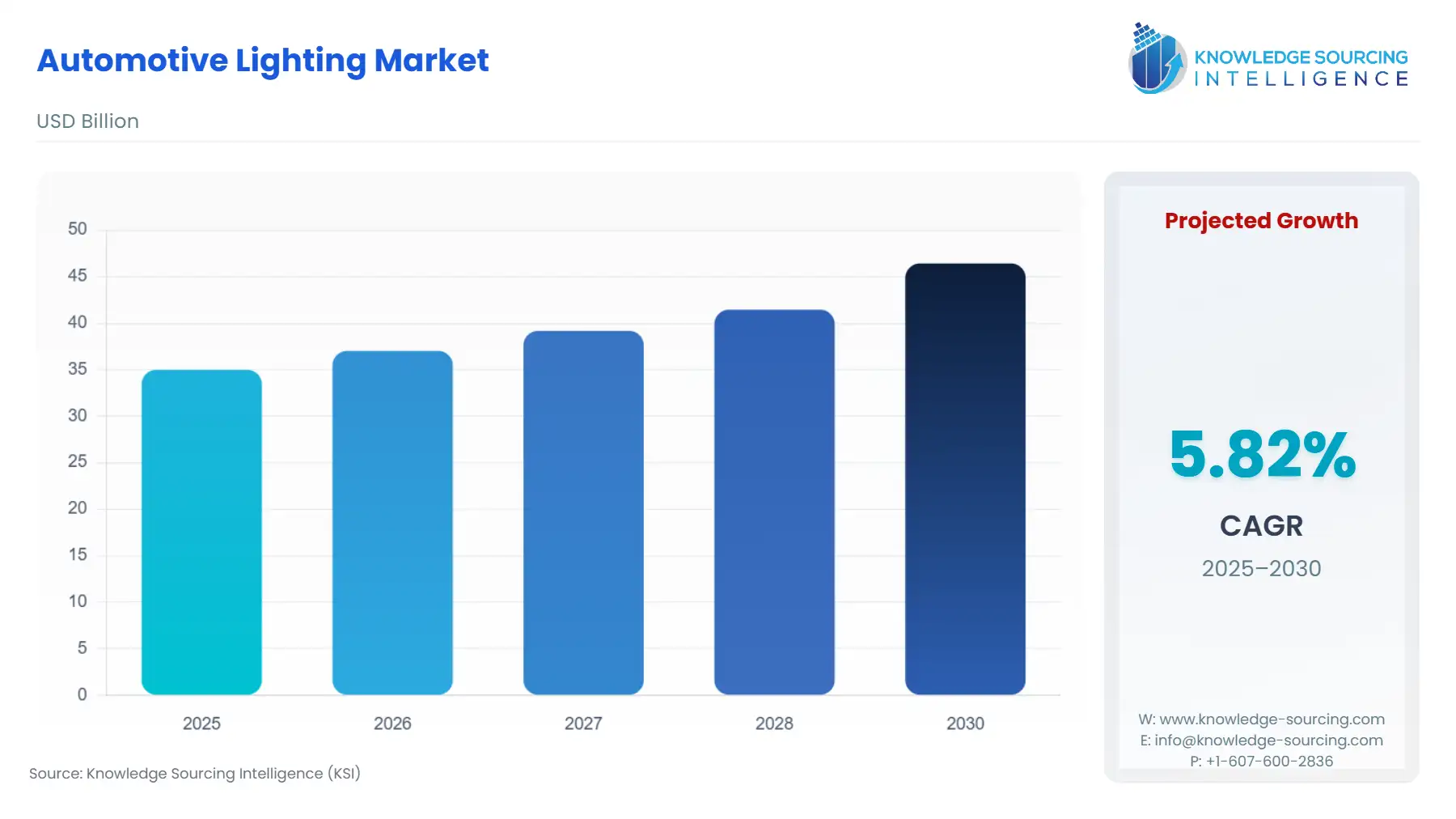

Automotive Lighting Market Size:

The Automotive Lighting Market is expected to grow from US$34.980 billion in 2025 to US$46.419 billion in 2030, at a CAGR of 5.82%.

Car sales have a direct impact on the overall demand for car lights. Lights are more in demand when there are more cars on the road. Governments and regulatory agencies frequently enforce strict lighting requirements for automobiles, such as daytime running lighting, High-Intensity Discharge (HID) headlights, or LED tail lights. As consumers and manufacturers look for more effective, long-lasting lighting solutions, advancements in lighting technology, such as switching from conventional halogen bulbs to LED technology or HID lights, may increase demand.

Automotive Lighting Market Growth Drivers:

- Advancements in Automobile Industry

The automobile industry is going through a technological revolution that is characterized by the fusion of new technology with conventional auto manufacturing. Automotive lighting producers are creating new lighting technologies that will replace outdated standard lights in response to the growing trend of electric vehicles. New vehicle models with the greatest interiors are being introduced by electric vehicle makers. For instance, Lucid Motors introduced Lucid Air in September 2020. This elegant electric car features a full-size luxury-class cabin and is based on Lucid's unique Space Concept philosophy.

- Interior Lighting Advancements

The advancements in interior lighting are mostly motivated by demands for safety, interaction, comfort, and style. Some of the newest lighting technologies include light predictions, smart LEDs, micro-LEDs, smart functioning surfaces, laser-based lighting, directing materials for 3D patterns of light on-demand, and area backlight with hidden-until-lit effects. For instance, Hella FlatLight technology, a new lighting invention for rear combo lamps, was introduced in January 2020. The application of light's scattering properties is made possible by optical technology, which is only a few micrometers in size.

Automotive Lighting Market Geographical Outlook:

- Asia Pacific is Expected to Grow Significantly

The bolstering growth for automotive lighting systems in the region is due to increasing demand & sales for commercial vehicles across different countries. The increasing production of automobiles is a major factor giving a boost to the Automotive Lighting System Market in the China market. The demand for both passenger & commercial vehicles is expected to witness an upward trend coupled with the rising disposable income of middle-income consumers. According to the estimates from the China Association of Automobile Manufacturers (CAAM), the Chinese carmaker produced around 27.02 million units in the year 2022, which is around 3.4% from the year 2021. This highlights positive prospects for the Automotive Lighting System in the China market. Further, the innovations in LED technology are expected to propel market growth till the forecast period.

Automotive Lighting Market Player:

- Valeo SE has well established itself as one of the leading providers of automotive lighting systems. The company’s sophisticated and innovative lighting technology for automobiles makes its products stand out. For instance, the company’s LED Artificial Intelligence-based “PictureBeam Monolithic” technology enhances road safety at night.

Automotive Lighting Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 34.980 billion |

| Total Market Size in 2031 | USD 46.419 billion |

| Growth Rate | 5.82% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Vehicle Type, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Lighting Market Segmentation:

- By Technology

- LED

- Halogen

- Xenon

- By Vehicle Type

- Economy

- Mid-range

- Luxury

- By Application

- Interior Lighting

- Car Body Lighting

- Ambient Lighting

- Reading Lights

- Roof Console

- Exterior Lighting

- Head Lamps

- Rear Lamps

- Side Lighting

- Others

- Interior Lighting

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America