Report Overview

Biohazard Bags Market - Highlights

Biohazard Bags Market Size:

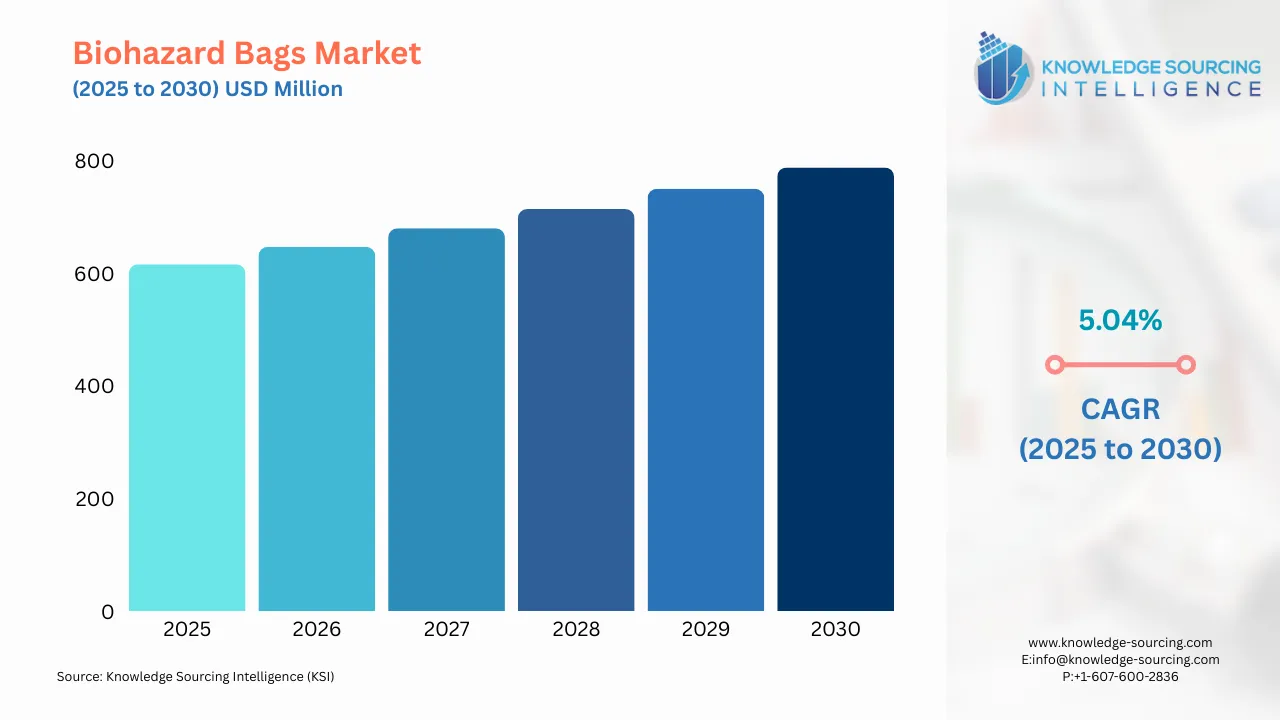

The global biohazard bags market is projected to grow at a CAGR of 5.04%, from US$616.256 million in 2025 to US$787.964 million in 2030.

The biohazard bags market is propelled to grow in the forecast period with the rising global patient population and several diseases, including cardiac, infectious, and many more.

The growing number of hospital beds with an improved healthcare facility is further driving the market expansion in the forecast period. The increasing global elderly population and health expenditure are further augmenting market growth in the forecast period.

Additionally, growing awareness regarding medical waste management provides an opportunity for the market to thrive in the forecast period. Furthermore, concerns regarding hospital-associated infections are further impetus for fueling market growth over the next five years. Geographically, the North American region is estimated to hold a significant market share with advanced medical facilities, a high rate of coronavirus infection cases, and a high prevalence of chronic diseases requiring hospitalization.

On the other hand, the Asia Pacific region is projected to show high growth prospects due to the high prevalence of the geriatric population, requiring better healthcare facilities to treat their age-associated diseases. Additionally, significant investments for efficient waste management in a healthcare setting are further raising the market growth prospects.

Biohazard Bags Market Growth Drivers:

- The growing patient population is fueling the biohazard bags market growth

The increasing patient population, with the rise in chronic diseases such as cancer and heart diseases, is driving market growth in the forecast period. In addition, the global geriatric population affected by age-associated diseases is contributing to market growth in the forecast period. The rising health expenditure with improved healthcare facilities further expands the market with an increasing patient population. For example, in the United States, there is a high prevalence of diseases; lower back pain is one of the most common causes of disability in adult citizens of the United States. The presence of an elderly population with diseases seeking better medical facilities is further fuelling the market growth.

Additionally, with the growing number of geriatric people aged 65 years and above in the United Kingdom, the number of age-associated diseases, such as cardiovascular diseases, will increase. Hence, the biohazard bag market will continue to soar over the next five years. According to the U.S. Department of Health and Human Services, almost half of the U.S. adults who suffer from arthritis have persistent pain, and many undergo several treatments in a medical facility. Furthermore, it is projected that the number of adults with doctor-diagnosed arthritis will reach around 78 million by 2040.

Moreover, as per the Population Reference Bureau, the number of Americans above 65 is projected to grow significantly from 58 billion in 2022 to 82.5 billion by 2050, which is a 47% increase. Additionally, the proportion of people aged 65 or older will grow from 17% to 23% in the future.

Additionally, the rising health expenditure of Saudi Arabia is further providing an opportunity for the market to grow in the forecast period. The Saudi Arabian government intends to invest more than $65 billion under Vision 2030 to build the nation's healthcare infrastructure, restructure and privatize insurance and health services, establish 21 "health clusters" nationwide, and increase the availability of e-health services. Similarly, private sector participation is aimed to be increased from 40 % to 65 % by 2030.

This has increased the number of transplantations, further fueling the market growth in the forecast period. For instance, as per the 2022 articles published by the National Institute of Diabetes and Digestive and Kidney Disease, nearly 8,08,000 people in the United States are suffering from End-Stage Kidney Disease (ESKD), out of which 69% are on dialysis, and 31% of the people need a kidney transplant.

- Growing awareness regarding proper waste management

There has been a rise in awareness about the benefits of proper waste management in previous years. This is particularly noticeable in hospitals' pharmaceutical industries, clinical trial organizations, and diagnostic centers. The foremost step regarding the disposal of hospital waste consists of using safe, sturdy, and properly labeled waste collection bags. These are usually colored according to the type of waste to dispose of and are accordingly used per the country’s healthcare standards.

Biohazard bags for the disposal of sharps, surgical tools, and other contaminated metal items are usually discarded in tough and puncture-proof materials. Additionally, these bags are highly resistant to high pressure and temperature conditions of sterilization equipment like an autoclave. This is because these contaminated or infectious hospital wastes are sterilized in an autoclave before being discarded.

According to the WHO statistics, out of the total waste generated by healthcare activities, around 85% of waste generated is non-hazardous. In comparison, 15% of the waste is hazardous and contains infectious, toxic, or radioactive materials. It has been noticed that each year, around 16 billion injections or syringes are administered globally, but not all of them are appropriately discarded. Hence, the need for efficient waste management arises to avoid spreading infections in the surrounding environment.

Effective measures for ensuring safe and eco-friendly management of medical wastes will prevent untoward health and environmental impacts from such contaminated wastes, including the harmful release of chemicals or biological hazards. This may consist of drug-resistant microbes, so protecting the health of patients, healthcare workers, and the general public becomes necessary.

Biohazard Bags Market Geographical Outlooks:

- The global biohazard bags market is segmented into five regions worldwide

Geography-wise, the global biohazard bag market is divided into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The increasing requirement for safe, compliant, and medical and biological waste disposal in the North American market is backed by stringent regulations provided by organizations like OSHA and the EPA. The growth in the healthcare industry, such as hospitals, diagnostic labs, and research facilities, produces high amounts of biomedical waste, thus fostering demand for biohazard bags.

Market dynamics are further added by growing awareness of the ecological and health damages caused by improper disposal, the advancement of durable and watertight pouch materials, and biodegradable bag options.

List of Top Biohazard Bags Companies:

- Thermo Fisher Scientific

- Bel-Art Products

- International Plastics Inc.

- Cole-Parmer Instrument Company, LLC.

- Medegen Medical Products

Biohazard bags market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Biohazard Bags Market Size in 2025 | US$616.256 million |

| Biohazard Bags Market Size in 2030 | US$787.964 million |

| Growth Rate | CAGR of 5.04% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Biohazard Bags Market |

|

| Customization Scope | Free report customization with purchase |

The global biohazard bags market is analyzed into the following segments:

- By Biohazardous Waste Type

- Solid Biohazardous Waste

- Liquid Biohazardous Waste

- Sharp Biohazardous Waste

- Pathological Biohazardous Waste

- By End-Use Application

- Hospitals

- Clinics

- Diagnostic Centers

- Pharma/Medical Research Laboratories

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Navigation

- Biohazard Bags Market Size:

- Biohazard Bags Market Key Highlights:

- Biohazard Bags Market Growth Drivers:

- Biohazard Bags Market Geographical Outlooks:

- List of Top Biohazard Bags Companies:

- Biohazard bags market scope:

Page last updated on: September 15, 2025