Report Overview

Brazil 5G Fuel Cell Highlights

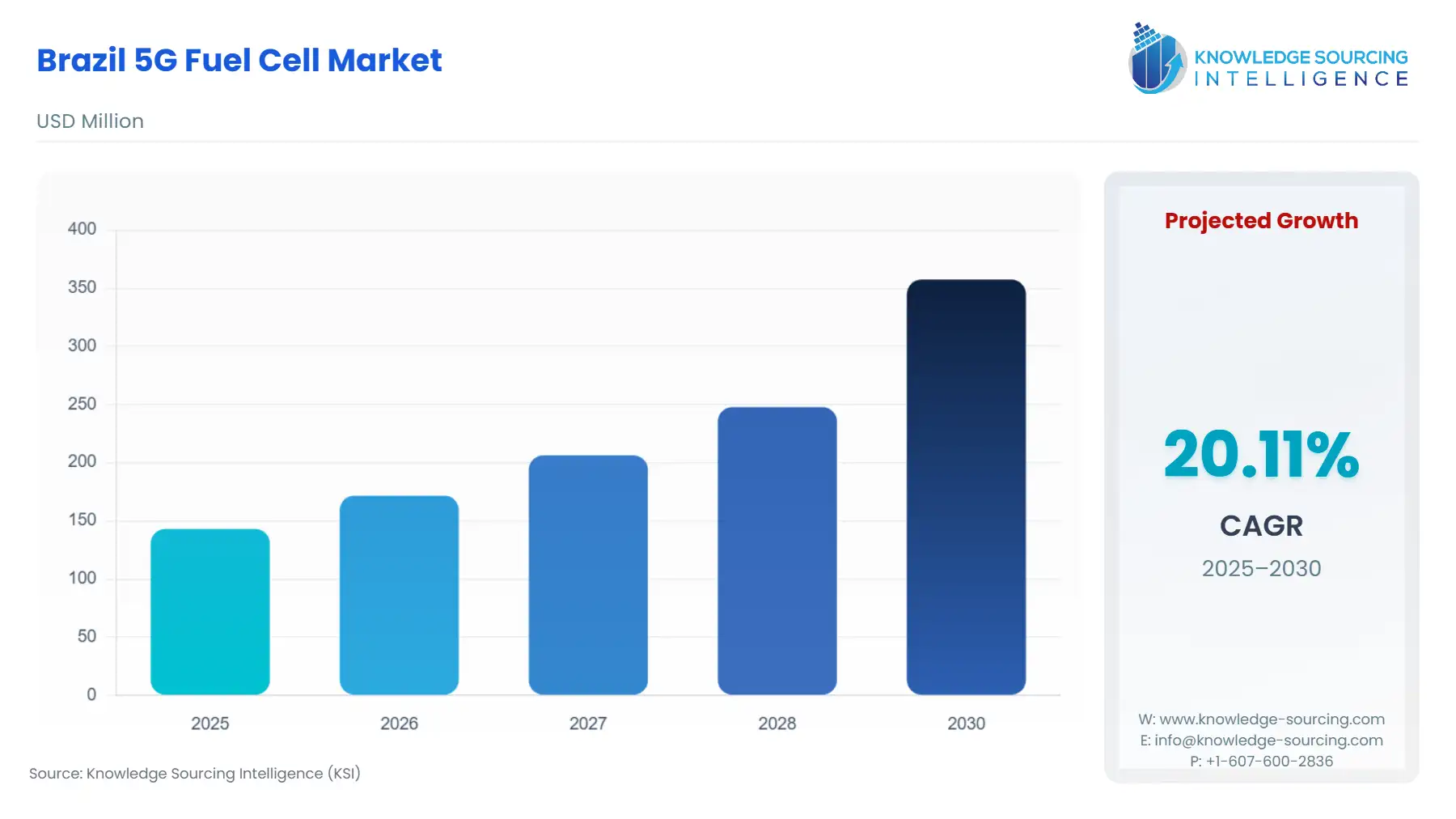

Brazil 5G Fuel Cell Market is projected to expand from USD 142.993 million in 2025 to USD 357.483 million by 2030, at a CAGR of 20.11%.

Brazil 5G Fuel Cell Market Key Highlights

The proliferation of fifth-generation (5G) mobile technology across Brazil represents a paradigm shift from macro-site architecture to network densification, creating an imperative for a substantial increase in telecommunication infrastructure, particularly at the network edge. This transition to a denser array of cell sites mandates new energy solutions to ensure uninterrupted service across an expansive and climatically variable geography. Unlike legacy 4G networks, 5G requires ultra-reliable power to support its low-latency, high-bandwidth applications, a requirement challenged by the operational instabilities of the National Interconnected System (SIN). Fuel cell technology, leveraging Brazil's emerging low-carbon hydrogen economy, offers an analytical solution to bridge the critical power gap between conventional battery backup and the extended runtime required to maintain 5G coverage commitments and high service availability.

________________________________________

Brazil 5G Fuel Cell Market Analysis

Growth Drivers

- 5G Network Densification: 5G network densification is the most immediate catalyst propelling fuel cell demand. ANATEL's mandates require continuous, reliable coverage; consequently, as major operators deploy thousands of new cell sites, the total load requiring extended-duration backup power escalates. The growing frequency of extreme weather events directly challenges the grid's resilience, increasing the average duration of power outages. This structural grid deficit creates explicit demand for hydrogen fuel cells, which, unlike battery-only solutions, provide days, rather than hours, of uninterrupted power for remote and difficult-to-access 5G towers, thereby securing network uptime and avoiding regulatory penalties.

Challenges and Opportunities

- Capital Expenditure and Fuel Logistics: The primary challenge constraining market acceleration is the initial capital expenditure (CAPEX) associated with deploying fuel cell systems and establishing a distributed hydrogen fuel logistics chain. These upfront costs often exceed those of conventional diesel generator and battery combinations.

- Government Tax Incentives: However, the government's strategic promotion of low-carbon energy directly addresses this cost constraint: Federal Law No. 14.948 (August 2024) provides a five-year suspension of PIS/PASEP and COFINS taxes for low-carbon hydrogen projects. This tax relief significantly lowers the hydrogen cost for fuel cell operations, transitioning the solution's value proposition from a niche reliability premium to a commercially viable alternative with superior operational expenditure (OPEX) over the life of the asset, thus boosting demand.

Raw Material and Pricing Analysis

The economic viability of the Brazilian 5G Fuel Cell Market hinges on the domestic production and supply of low-carbon hydrogen. Brazil's unique position, with abundant and competitive renewable energy resources (hydro, solar, wind) and an established ethanol infrastructure, allows for diverse, cost-effective hydrogen pathways. Projects such as the operational ethanol-to-hydrogen reforming station, which utilizes Hytron's technology, validate a local, decentralized production route that leverages existing biofuel supply chains, fundamentally mitigating international price volatility and logistical risk. Further, the industrial-scale capacity addition, such as White Martins' second green hydrogen plant in Jacarei (800 tonnes/year capacity), directly increases the bulk supply availability for industrial gases and energy applications, pressuring down the average cost of delivered hydrogen fuel.

Supply Chain Analysis

The fuel cell supply chain for the Brazilian telecom sector is characterized by international dependence at the core hardware level, coupled with increasing local strength in fuel generation and system integration. High-purity fuel cell stacks (e.g., Proton Exchange Membrane, Solid Oxide) are primarily sourced from established global manufacturing hubs, introducing currency exchange and import tariff complexities. However, the system's balance of plant, integration engineering, and hydrogen supply are increasingly localized. Brazilian entities manage the distribution, storage, and maintenance of the complete system, utilizing locally-produced hydrogen or hydrogen derived from national feedstock like ethanol and natural gas, which minimizes dependence on global energy logistics for operational needs.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Brazil | ANATEL (National Telecommunications Agency) Coverage Mandates | Mandates for accelerated 5G rollout, including coverage in all major municipalities, intensify the need for reliable power infrastructure at new cell sites. This directly increases the demand for highly available backup power solutions like fuel cells to prevent service disruptions and subsequent regulatory fines. |

| Brazil | Federal Law No. 14.948 (August 2024) | Establishes the legal framework for low-carbon hydrogen, including a five-year suspension of PIS/PASEP and COFINS taxes. This policy substantially reduces the operational cost (OPEX) of hydrogen-powered 5G systems, acting as a direct financial incentive to propel demand. |

| Brazil | ANEEL (National Electric Energy Agency) and General Grid Quality Initiatives | Initiatives aimed at grid modernization and resilience, while beneficial long-term, currently highlight the existing instability (driven by weather events), reinforcing the necessity of autonomous, extended-run backup systems for mission-critical infrastructure like 5G networks. |

________________________________________

In-Depth Segment Analysis

By Deployment: Backup Power Solutions

The Backup Power Solutions segment dominates initial demand, directly correlated with the 5G network's power consumption and high uptime requirements. The transition to 5G Standalone (SA) networks—which leverage new spectrum bands and require more energy-intensive radio access network (RAN) equipment—increases the base load at thousands of cell sites. This amplified power requirement strains existing battery and small diesel generator backup configurations. Fuel cells, by offering multi-day, autonomous power generation, satisfy the specific demand for extended runtime in rural or climatically vulnerable urban areas where utility power repair times are unpredictable. This extended run-time capability is essential for Telecom Operators to meet stringent Service Level Agreements (SLAs) and ANATEL's continuous service obligations, thereby making fuel cells a demand imperative, not merely a preference.

By End User: Telecom Operators

Telecom Operators represent the largest segment of end-user demand due to their core business model centered on network availability. The competitive pressure and regulatory environment compel these entities to invest in superior power redundancy. The deployment of 5G across Brazil, encompassing thousands of sites spread across vast and varied terrain, mandates a standardized, high-reliability backup solution that can be monitored remotely. Fuel cells offer reduced maintenance requirements and lower emissions compared to diesel generators, aligning with corporate sustainability goals while delivering the necessary extended power. This combination of operational reliability, reduced environmental impact, and superior performance in remote, high-power 5G applications validates the demand from operators like Vivo, TIM, and Claro as they manage their rapidly expanding and densifying networks.

________________________________________

Competitive Environment and Analysis

The Brazilian 5G Fuel Cell Market's competitive landscape features a convergence of global industrial gas players, local energy technology firms, and major utility/telecom infrastructure groups. Competition is currently focused on technology demonstration, supply chain localization, and strategic partnerships to secure future hydrogen fuel supply. The verified participation of major international groups, primarily through their Brazilian subsidiaries, provides the necessary scale and capital, while local firms drive application-specific, domestic engineering solutions.

Hytron

Hytron, a Brazilian technology company, holds a strategic position due to its proven expertise in hydrogen production systems, notably through its steam reforming technology. The firm's strategic positioning is anchored by its verifiable role in making the world's first experimental station producing renewable hydrogen from ethanol operational in 2025. This project, a partnership with USP and Shell Brasil, directly addresses the fuel supply challenge by demonstrating a locally scalable and reliable method for hydrogen generation using Brazil's abundant ethanol feedstock. This product, ethanol-to-hydrogen reforming, creates immediate demand for Hytron's conversion technology as it mitigates the logistical constraints of gaseous hydrogen delivery for remote 5G sites.

White Martins Gases Industriais Ltda.

White Martins, part of the Linde group, is positioned as a critical supplier for the hydrogen feedstock itself, a crucial element for fuel cell deployment at scale. The company's strategic leverage is its massive capacity and logistical network. Its verifiable commitment to the low-carbon hydrogen economy is evidenced by the planned launch of its second green hydrogen plant in Jacarei, São Paulo, with a capacity of 800 tonnes/year in 2025. This capacity addition significantly increases the supply of certified green hydrogen, directly lowering the cost and risk profile for Telecom Operators considering large-scale fuel cell adoption, thereby solidifying its indispensable role in the market's competitive structure.

________________________________________

Recent Market Developments

- October 2025: White Martins, a subsidiary of Linde, started operations at its second green hydrogen plant in Jacarei, São Paulo, with a verifiable capacity of 800 tonnes/year. The production, powered by local solar and wind farms, will allocate over 80% to the industrial market. This capacity addition directly impacts the 5G fuel cell market by increasing the commercial availability of certified green hydrogen, providing a scalable, low-carbon fuel supply option that enhances the value proposition and operational stability of hydrogen fuel cell systems for telecom infrastructure.

________________________________________

Brazil 5G Fuel Cell Market Segmentation

- BY PRODUCT TYPE

- Fuel Cell Systems

- Fuel Cell Stacks & Components

- Fuel Supply Solutions

- BY DEPLOYMENT

- Backup Power Solutions

- Off-grid / Remote Power Solutions

- Hybrid Energy Systems

- High-capacity Solutions

- BY POWER OUTPUT RANGE

- <5 kW

- 5–50 kW

- >50 kW

- BY END USER

- Telecom Operators

- Tower & Infrastructure Providers

- Government & Defense Communication Networks

- Enterprise 5G Networks