Report Overview

Brazil 5G Network Security Highlights

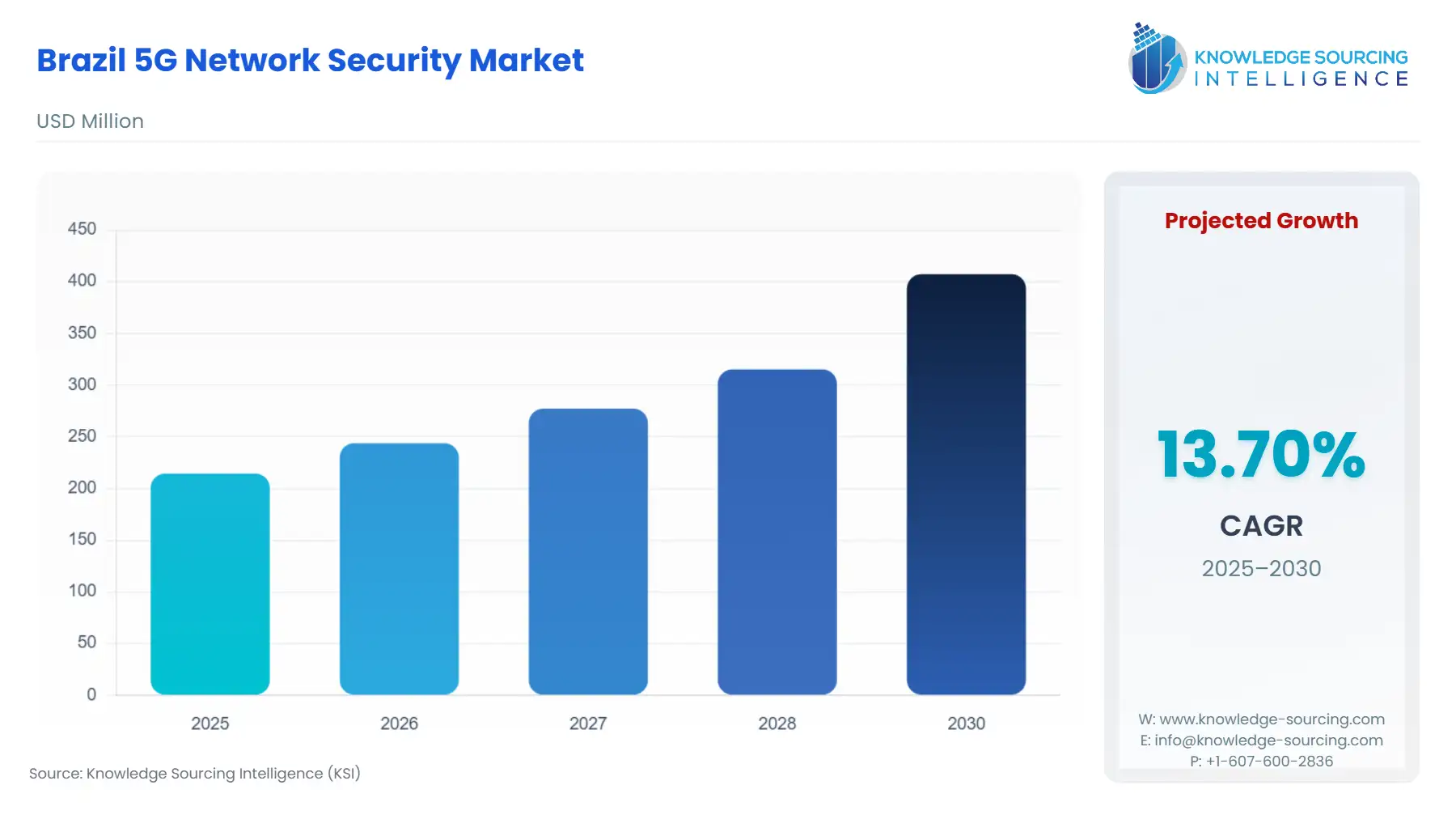

Brazil 5G Network Security Market is forecast to rise from USD 214.490 million in 2025 to USD 407.530 million by 2030, recording a CAGR of 13.70%.

Brazil 5G Network Security Market Key Highlights

Brazil's deployment of fifth-generation mobile technology is fundamentally altering its telecommunications landscape, transitioning the infrastructure from a connectivity tool to a critical national and industrial platform. This paradigm shift, driven by the rollout of the 5G Standalone (SA) core and massive IoT adoption, exposes the network to an exponentially larger and more complex threat surface. The security of this infrastructure is therefore not an ancillary concern but a foundational imperative. The market for 5G network security in Brazil is thus characterized by a mandatory, regulation-driven demand cycle, where operators and enterprise users are compelled to integrate advanced, multi-layered security solutions—spanning RAN, Core, and Edge—to ensure compliance, service continuity, and data integrity.

________________________________________

Brazil 5G Network Security Market Analysis

Growth Drivers

- Regulatory Mandates and Data Protection Laws: The non-negotiable mandates embedded in the 5G spectrum auction documents are the primary growth catalysts. Specifically, the requirement for winning 3.5 GHz bidders to implement a secure, private communication network for the Federal Government directly creates a high-specification, immediate demand for Core and Transport Network Security solutions. Additionally, the national implementation of the LGPD compels companies handling sensitive user data over 5G networks to invest heavily in data protection technologies, particularly encryption and Identity & Access Management, to meet stringent security and breach notification requirements. This regulatory pressure shifts security spending from discretionary to mandatory compliance expenditure. The pervasive risk of equipment theft during the large-scale, geographically dispersed 5G rollout, as noted by industry sources, further creates direct demand for sophisticated physical and logical perimeter security and security monitoring solutions to protect critical infrastructure assets.

Challenges and Opportunities

- Systemic Complexity and Open RAN: A primary challenge facing the market is the systemic complexity introduced by the Open RAN movement and the multi-vendor environment, which creates new security vulnerabilities and integration challenges. This disaggregation elevates the demand for comprehensive Security Testing & Compliance services to validate interoperability and security across disparate vendor components.

- Enterprise 5G Networks and Managed Services: A critical opportunity arises from the rapid deployment of 5G Enterprise Networks, particularly in industrial sectors like manufacturing, which require mission-critical security. This vertical-specific requirement drives an increased need for Managed Security Services (MSS) tailored for low-latency, high-reliability private networks, as many enterprises lack the internal expertise to manage sophisticated 5G security stacks. Furthermore, the 'brain drain' of highly skilled engineers, noted as a domestic manufacturing constraint, intensifies the demand for security automation and managed services.

Supply Chain Analysis

The global supply chain for 5G network security hardware—such as specialized firewalls, intrusion prevention systems, and secure router components—is critically dependent on key production hubs in Asia-Pacific and North America. Brazil's supply chain complexity arises from high import taxes and currency fluctuations, which increase the final cost of essential security hardware components like microchips and advanced cryptographic modules. The domestic supply chain for the software and services segment is comparatively more localized, utilizing Brazilian providers for Consulting & Integration and Managed Security Services. Logistical complexities are high due to Brazil's vast geographical landscape, making the last-mile delivery and secure installation of physical security hardware at geographically dispersed Radio Access Network (RAN) sites challenging, which in turn necessitates robust supply chain security protocols to prevent equipment tampering.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Brazil | ANATEL Act No. 2436/2022 | Mandates cybersecurity requirements for Customer Premises Equipment (CPE) like routers and modems. This directly increases demand for security-by-design principles in hardware and software and validation services to ensure CPE conformity. |

| Brazil | GSI Rule No. 4 (Instrução Normativa 4) | Establishes minimum cybersecurity requirements for 5G network manufacturing, functioning, and operation. This rule compels operators to procure equipment that meets specific national security criteria and mandates external auditing, creating sustained demand for Security Testing & Compliance services. |

| Brazil | Lei Geral de Proteção de Dados (LGPD) | Establishes strict rules for the collection, use, and processing of personal data, with significant penalties for non-compliance. It is the primary driver for high demand in Identity & Access Management (IAM) and Network Encryption solutions to secure data traversing the 5G core. |

________________________________________

In-Depth Segment Analysis

By Technology: Edge/MEC Security

The Edge/MEC (Multi-access Edge Computing) Security solutions segment is experiencing a dramatic increase, driven fundamentally by the proliferation of Enterprise 5G Networks and the latency-sensitive applications they support. By moving computing resources closer to the end-user, 5G's core value proposition—ultra-low latency—is realized, yet this creates a new, distributed perimeter that traditional, centralized security architectures cannot protect. Industrial verticals like manufacturing and energy & utilities, which rely on real-time control systems, demand security solutions, such as micro-segmentation and distributed firewalls, that reside directly at the edge to protect mission-critical data streams. This trend creates a specific and non-negotiable demand for security that is native to the Edge/MEC environment, moving security processing out of the core and into a distributed model. Operators and enterprises are actively seeking cloud-native security products that can scale elastically and protect the integrity of data aggregation points before it ever hits the central network core.

By End-User: Enterprise 5G Networks

The Enterprise 5G Networks segment is characterized by a high-specification, customized profile that significantly exceeds the security requirements of public networks. Companies, particularly those in the agribusiness, mining, and advanced manufacturing sectors, are deploying private 5G networks to enable Industry 4.0 applications, such as autonomous machinery and real-time remote monitoring. These networks are often deployed using dedicated spectrum or network slicing, and their traffic contains proprietary operational technology (OT) data, making them prime targets for industrial espionage or operational disruption. This imperative drives direct demand for specialized solutions, including Network Encryption, DDoS Protection, and bespoke Managed Security Services, capable of handling the unique protocols and high data density of industrial IoT. The necessity here is strictly tied to operational risk mitigation and business continuity, justifying premium expenditure on integrated, zero-trust security frameworks that can guarantee the deterministic performance and isolation required by critical business processes.

________________________________________

Competitive Environment and Analysis

The competitive landscape in the Brazilian 5G Network Security Market is bifurcated, featuring global incumbent network equipment providers and niche cybersecurity specialists. The market exhibits intense competition for Core and RAN infrastructure security, with major global players leveraging deep relationships with Telecom Operators. A key differentiator is the ability to provide security that is native to the cloud-based 5G SA core architecture and compliant with specific Brazilian regulations.

Cisco Systems, Inc.

Cisco maintains a formidable position, leveraging its broad portfolio spanning infrastructure and security. The company's strategy in Brazil focuses on integrating security across the entire network stack, from the traditional IP network to the 5G Core. A key product is their Secure Firewall Threat Defense (FTD), which offers high-throughput, next-generation firewall capabilities essential for securing the massive data plane of a 5G network. Cisco's official newsrooms often highlight its collaboration with major global and local telecom operators, providing end-to-end security architectures that enable operators to meet GSI Rule 4 and LGPD compliance, thus directly addressing mandatory security expenditure.

Ericsson

As a dominant global network infrastructure provider, Ericsson's strategic positioning is to embed security directly into the 5G network platform, minimizing external vendor dependencies for core functionality. Its 5G Core Security portfolio, which includes signaling security, user data protection, and network slicing security, is a cornerstone of this strategy. Ericsson's official publications emphasize its compliance with 3GPP security standards and its role in implementing secure Private 5G Networks, a critical and growing segment in Brazil. By providing the network infrastructure and the foundational security as an integrated solution, Ericsson captures demand at the core network deployment stage.

Tempest Security Intelligence

Tempest Security Intelligence, a prominent Brazilian cybersecurity firm, provides a crucial local competitive element. Their strategic focus is on offering specialized Managed Security Services (MSS) and Consulting & Integration, capitalizing on deep understanding of the national threat landscape and the nuances of the LGPD. Their services include vulnerability assessments, penetration testing, and incident response, which directly address the GSI-mandated requirement for external security auditing and the continuous need for compliance verification, creating demand for local, high-trust security partnerships.

________________________________________

Recent Market Developments

- August 2024: Nokia Corporation announced a partnership with TIM Brazil to expand its 5G Radio Access Network (RAN) coverage across 15 Brazilian states starting in January 2025. While primarily a RAN infrastructure deal, the agreement specifies the supply of advanced 5G equipment from Nokia's AirScale portfolio, which includes products powered by their energy-efficient ReefShark System-on-Chip technology. The increased scale of the RAN deployment proportionally raises the demand for integrated RAN Security solutions to protect this expanded physical and logical perimeter.

________________________________________

Brazil 5G Network Security Market Segmentation

- BY SOLUTIONS/SERVICES

- Solutions

- Firewalls & Threat Protection

- DDoS Protection

- Identity & Access Management (IAM)

- Network Encryption & VPNs

- Security Analytics & Monitoring

- Cloud Security & Virtualization Security

- Services

- Managed Security Services (MSS)

- Consulting & Integration

- Security Testing & Compliance

- Solutions

- BY DEPLOYMENT

- On-Premise

- Cloud-Based

- BY NETWORK ARCHITECTURE

- 5G Security

- RAN Security

- Edge/MEC Security

- Transport Network Security

- BY END USER

- Telecom Operators

- Government & Defense Networks

- Enterprise 5G Networks