Report Overview

China AI-Driven Hypothesis Generation Highlights

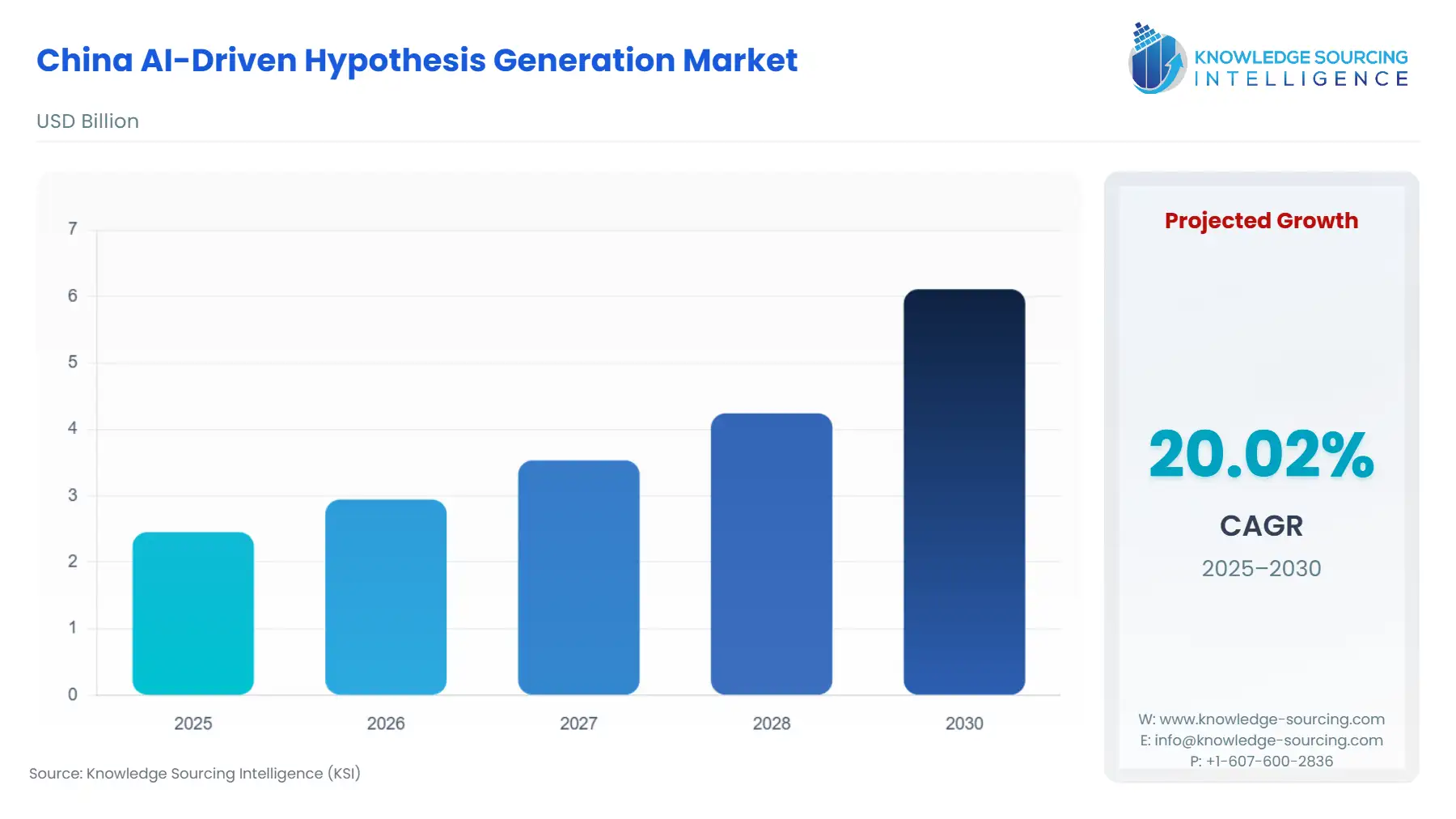

China AI-Driven Hypothesis Generation Market is expected to escalate from USD 2.454 billion in 2025 to USD 6.111 billion by 2030, at a CAGR of 20.02%.

China AI-Driven Hypothesis Generation Market Key Highlights

The Chinese AI-Driven Hypothesis Generation Market has solidified its position as a strategically vital component of the nation's broader "new infrastructure" initiative. Its core function is to systematically accelerate the early stages of scientific inquiry—specifically in the life sciences, materials research, and financial modeling—by leveraging deep learning, natural language processing, and advanced graph-based neural networks to extrapolate novel insights from massive, heterogeneous datasets. This technology shifts the scientific method's bottleneck from empirical trial-and-error to intelligent pre-screening, fundamentally changing the economics and timelines of research and development. The market's high growth trajectory is fundamentally demand-driven, underpinned by an ecosystem where state industrial policy, immense data access, and an escalating private-sector innovation imperative converge.

China AI-Driven Hypothesis Generation Market Analysis

Growth Drivers

- The primary catalyst for market expansion is the mandate for R&D self-reliance under the central government’s long-term planning, exemplified by the AIDP. This top-down policy created direct demand by funneling state-backed capital and research mandates into domestic companies focused on intelligent drug discovery and materials science. Second, the exponential accumulation of biomedical and chemical data—enabled by the largest internet user base globally—compels research institutions and pharmaceutical companies to adopt automated hypothesis platforms. Only AI-driven solutions can effectively mine this scale of data, directly increasing the demand for tools like graph-based neural networks and multimodal AI to identify non-obvious correlations, thus reducing time-to-target identification.

Challenges and Opportunities

The primary market challenge is the talent supply-demand imbalance, with the need for skilled AI professionals in China projected to significantly outstrip supply by 2030, increasing operating costs and constraining the ability of firms to scale deployment. This scarcity reduces the immediate addressable market for sophisticated hypothesis generation platforms that require expert oversight. The key opportunity lies in vertical specialization and integration. Companies that embed AI-driven hypothesis tools directly into enterprise workflows—such as Materials & Chemical Research or Financial & Business Analytics—create unique, high-value demand. This pivot from generalized tools to domain-specific, integrated solutions provides a critical pathway to higher margins and greater adoption among industrial and financial end-users.

Supply Chain Analysis

The supply chain for the AI Hypothesis Generation market is primarily digital, centered on three critical components: high-performance computing infrastructure, domain-specific training data, and specialized talent. The government actively supports the computing layer, with over 30 cities planning or building Intelligent Computing Centers (????) and local governments issuing compute vouchers to subsidize the rental of high-end computational power. However, access to advanced Graphics Processing Unit (GPU) hardware, critical for training large models, remains structurally constrained by foreign export controls. This dependency on hardware imports forces domestic developers to focus on algorithmic efficiency and architectural innovation to optimize performance. The specialized talent pool, while large, is a bottleneck for deployment, necessitating continued investment in the national AI curriculum and recruitment incentives.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Central Government | New Generation Artificial Intelligence Development Plan (AIDP) (2017) | Establishes a national imperative for AI leadership by 2030, directly driving state and private capital into domestic AI research. This fundamentally creates the demand for all segments of the market by treating AI-driven R&D as a strategic national priority. |

| National Medical Products Administration (NMPA) | Regulations on the Supervision and Administration of Medical Devices (2024 Revision) | Streamlines the regulatory pathway for AI-assisted medical devices and AI-discovered drugs. This pro-innovation approach reduces commercialization risk, directly increasing demand from pharmaceutical and biotech end-users for hypothesis tools that accelerate target and candidate identification. |

| Local/Provincial Governments | Subsidized Compute Vouchers & Talent Incentives | Reduces the financial barrier to entry for AI startups and research institutions to access the necessary computing power, thereby stimulating grassroots demand and accelerating the pace of new AI hypothesis tool development in regional AI innovation zones. |

In-Depth Segment Analysis

By Application Area: Drug Discovery & Life Sciences

The Drug Discovery & Life Sciences segment drives the highest demand, positioned as an imperative for national health security and economic competitiveness. This growth is catalyzed by the documented failure rate and escalating cost of traditional R&D, which averages over a decade and billions of dollars per drug. AI-Driven Hypothesis Generation platforms directly address this failure by utilizing vast omics and chemical data to predict novel drug targets and design synthesizable molecules de novo. Pharmaceutical firms like WuXi AppTec and Hengrui Medicine are compelled to adopt these systems to secure a competitive advantage in global R&D pipelines, prioritizing tools that can rapidly iterate through millions of hypotheses to identify the one most likely to clear preclinical hurdles. The NMPA’s pro-innovation stance further de-risks investment in this application area, creating an environment where a validated AI-generated candidate can achieve accelerated regulatory review, thereby multiplying the economic value of the underlying AI software.

By Software Type: AI-Powered Literature Mining Tools

The AI-Powered Literature Mining Tools segment is driven by the sheer scale of global scientific publication and patent data, which exceeds human capacity to synthesize. These tools, which fall under the broader umbrella of Natural Language Processing (NLP), utilize algorithms to identify emerging themes, conflicting experimental results, and non-obvious relationships between genes, diseases, and chemical compounds across billions of academic abstracts and patent filings. This accelerates the initial stage of scientific inquiry—the formation of a novel hypothesis—for academic and corporate research teams. For a drug discovery firm, literature mining tools generate direct demand by identifying underserved targets or novel indications for existing compounds. They serve as the scouting layer of the AI ecosystem, justifying their purchase through an immediate return on investment by eliminating hundreds of hours of manual review and ensuring that R&D efforts are based on the most comprehensive global knowledge base available.

Competitive Environment and Analysis

The Chinese AI-Driven Hypothesis Generation competitive landscape is dominated by a trifecta of specialized domestic biotech startups, large-scale technology conglomerates, and traditional pharmaceutical giants. The primary competitive vector is the integration of proprietary data and domain-specific algorithms, transitioning from offering generalized platforms to full-stack, end-to-end R&D solutions. This minimizes the friction between the hypothesis generation and the empirical validation phases, increasing client stickiness.

Insilico Medicine

Insilico Medicine, with its end-to-end proprietary Pharma.AI platform (which includes Chemistry42, TargetPro, and TargetBench 1.0), is strategically positioned as a pioneer in full-cycle AI drug discovery. Its core value proposition is the rapid nomination of preclinical candidates for novel targets, often demonstrated publicly to validate the platform's predictive capabilities. The company’s success in moving multiple AI-discovered programs, such as its nominations for novel PHD2 and immuno-oncology targets, into clinical development serves as a powerful market proof point, driving demand for its platform among large global pharmaceutical partners seeking validated, de-risked R&D assets.

XtalPi

XtalPi focuses on integrating computational physics, high-throughput AI algorithms (XFEP, XMolGen), and autonomous robotics to create an "AI + Robotics" R&D platform. This hybrid strategy positions XtalPi to solve the critical hypothesis validation bottleneck by automating the synthesis and testing of AI-generated molecular candidates. Their strategic deals, such as the multi-target, multi-billion-dollar potential collaboration with US biotech firms, underscore a market strategy focused on validating their computational predictions with automated wet-lab results, creating a closed-loop system that shortens the pre-clinical timeline and attracts premium global partnerships.

Tencent AI Lab

Tencent AI Lab strategically leverages the deep computing power of Tencent Cloud and its expertise in large language models (LLMs) to target the drug discovery sector. Its platform, iDrug, is a modular AI-driven software platform comprising core components like tFold (protein structure prediction) and modules for generative chemistry and ADMET prediction. Tencent's positioning is to act as a crucial infrastructure and algorithmic provider, offering high-precision quantitative calculations via "AI + quantum chemistry" and robust deep graph learning to empower pharmaceutical partners, thereby driving demand by serving as the essential AI backbone for traditional R&D firms.

Recent Market Developments

- September 2025: XtalPi’s collaboration with PharmaEngine on the PRMT5 inhibitor (PEP08) reached a key strategic milestone by receiving regulatory clearances to initiate Phase 1 clinical trials. This development, sourced from the company's official newsroom, demonstrates the successful translation of an AI-assisted hypothesis generation project into a validated, clinical-stage asset, reinforcing the credibility and commercial viability of XtalPi's integrated platform.

- August 2025: XtalPi announced a major, multi-target strategic partnership with US biotech firm DoveTree with a potential value of up to $6 billion. The agreement involves deploying XtalPi's integrated AI platform for preclinical research on both small- and large-molecule programs. This represents a significant capacity addition and strategic commercial development, validating the cross-border demand for China-based AI hypothesis generation services.

- May 2025: Viva Biotech launched its new AI-Driven Drug Discovery (AIDD) platform, featuring the V-Scepter, V-Orb, and V-Mantle core modules. This product launch signifies a capacity addition to the broader contract research organization (CRO) market by integrating advanced AI tools into service offerings, increasing the available options for outsourced, AI-assisted hypothesis generation for both domestic and international clients.

China AI-Driven Hypothesis Generation Market Segmentation

- BY SOFTWARE TYPE

- AI-Powered Literature Mining Tools

- Graph-Based Hypothesis Generation Platforms

- Domain-Specific Predictive Modeling Tools

- Multimodal AI Platforms

- Others

- BY APPLICATION AREA

- Drug Discovery & Life Sciences

- Healthcare & Diagnostics

- Materials & Chemical Research

- Financial & Business Analytics

- Academic

- BY DEPLOYMENT MODE

- Cloud-Based

- On-Premise