Report Overview

China AI in Military Highlights

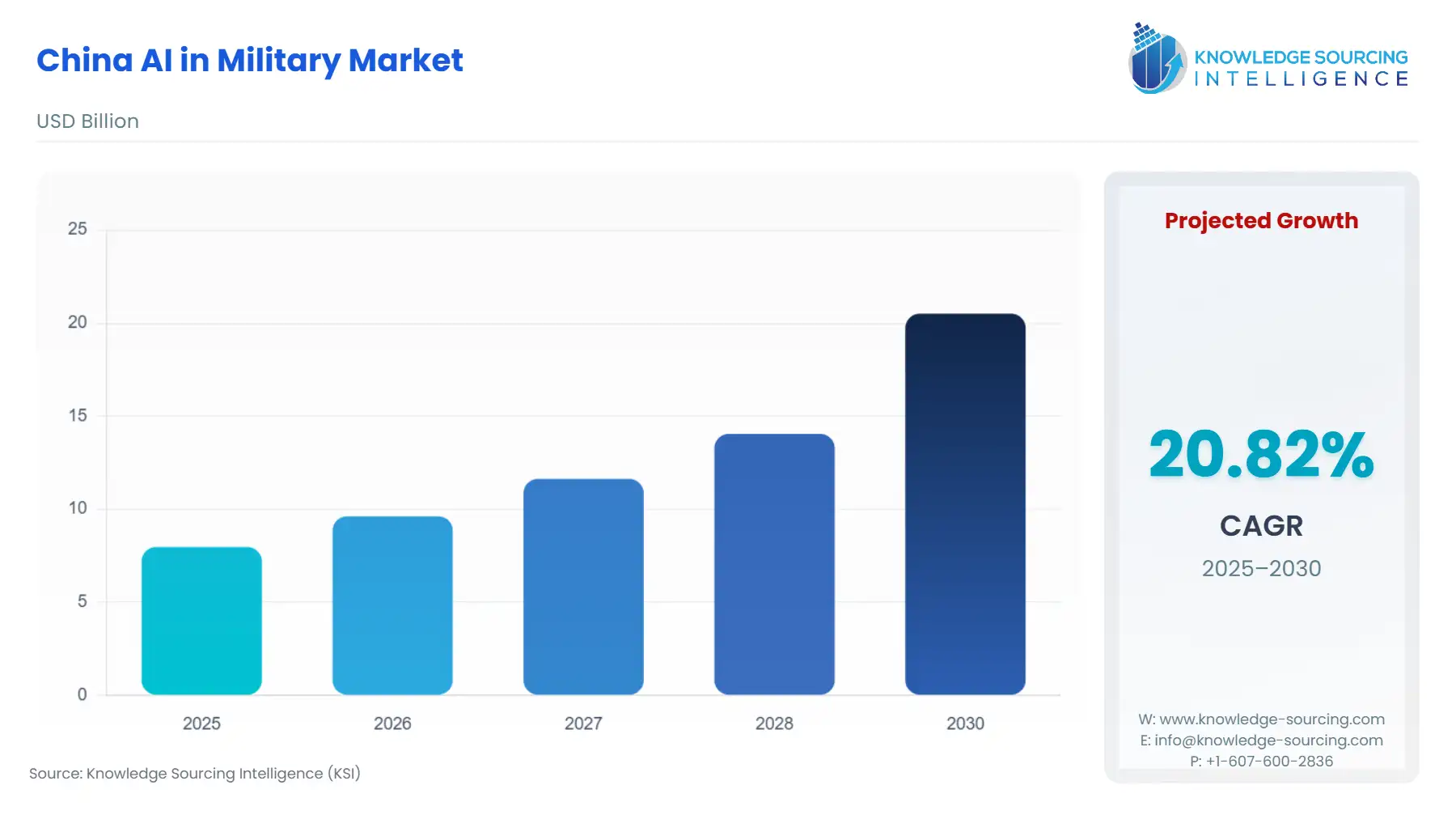

China AI in Military Market Size:

The China AI in Military Market is expected to grow at a CAGR of 20.82%, reaching USD 20.512 billion in 2030 from USD 7.966 billion in 2025.

The Chinese AI in Military Market represents a fundamental transformation of the nation's defense apparatus, moving from an informatized to an "intelligentized" force structure. This strategic shift is centrally planned, driven by national-level mandates such as the New Generation Artificial Intelligence Development Plan (2017), which sets clear goals for the integration of AI across national defense. Beijing views AI as the foundation for achieving "world-class" military status by mid-century, ensuring that the development and adoption of military-grade AI systems are a top-tier national priority supported by massive state investment and policy coordination. The market dynamics are therefore unique, being less influenced by traditional commercial factors and almost entirely propelled by a state-controlled, top-down demand structure centered on technological supremacy in an emerging "intelligent warfare" paradigm.

China AI in Military Market Analysis:

Growth Drivers

The primary catalyst for market expansion is the Chinese Communist Party's elevation of Military-Civil Fusion (MCF) to a national strategy, directly translating civilian AI breakthroughs into military demand. MCF compels private AI enterprises specializing in computer vision, autonomous navigation, and Big Data analytics to channel their core products and expertise into the defense supply chain, rapidly expanding the pool of available technology for military application. Concurrently, the PLA's pursuit of "Intelligentization" by 2027 dictates aggressive adoption of AI for Multi-Domain Operations (MDO), creating explicit demand for systems that fuse data from air, sea, land, and cyber domains to improve situational awareness and target precision. This systemic mandate creates a guaranteed demand floor for AI software, hardware, and services across all branches of the PLA.

Challenges and Opportunities

A primary challenge remains supply chain constraints in advanced semiconductor hardware, particularly high-end GPUs and FPGAs crucial for training and operating sophisticated deep learning models. External export controls limit the availability of these components, directly constraining the pace and scale of AI system deployment and creating an intense, compensatory demand for domestic hardware alternatives. This constraint simultaneously presents a major opportunity: the government’s imperative for indigenous capability drives massive State-Owned Enterprise (SOE) investment in domestic AI chip and sensor development, guaranteeing sustained long-term revenue streams for local hardware manufacturers that can verify reliability and performance standards acceptable to the PLA.

Raw Material and Pricing Analysis

The underlying physical AI systems, including airborne radar and autonomous vehicle hardware, are profoundly exposed to critical mineral export controls. China’s global dominance in materials like gallium and germanium, essential for advanced semiconductors and infrared technologies, influences the global pricing leverage, but also creates a domestic pricing dynamic. Since China controls over 90% of the world’s primary gallium supply, domestic defense contractors are insulated from the external supply shocks their international competitors face. The raw material supply risk for the China AI in Military Market is therefore inverted; it is an internal pricing priority dictated by the state, rather than a geopolitical supply risk. However, the domestic fabrication of the most advanced chips still requires complex, specialized equipment, maintaining internal price pressure on the final AI hardware components.

Supply Chain Analysis

The supply chain for military AI in China is characterized by a high degree of state-directed vertical integration facilitated by the MCF strategy. Key production hubs are concentrated in the 'Tech Cities' of the Yangtze River Delta and Pearl River Delta, where SOEs like China Electronics Technology Group Corporation (CETC) and Aviation Industry Corporation of China (AVIC) collaborate with private AI firms. The primary logistical complexity is the secure and rapid transfer of dual-use intellectual property (IP) from the civilian sector to military applications, managed through dedicated MCF administrative mechanisms. The most critical dependency remains the initial fabrication of advanced, sub-10nm chipsets, which restricts the performance envelope of the most sophisticated on-platform AI processing. The reliance on foreign Electronic Design Automation (EDA) tools also presents a latent, strategic vulnerability that the government is rapidly moving to mitigate via domestic toolchain development.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| China (State Council) | New Generation Artificial Intelligence Development Plan (2017) | The Plan is the foundational mandate, specifically calling for the use of AI to enhance national defense and ensure military-civil fusion. This policy creates the explicit and highest-level demand for all AI technologies within the military sector. |

| China (Central Military Commission - CMC) | Military-Civil Fusion (MCF) Strategy | MCF systematically dismantles barriers between the defense and civilian industrial bases, forcing a technology transfer pipeline. This regulation directly increases the supply side by compelling private-sector AI firms to compete for defense contracts, accelerating the market's commercialization. |

| China (Ministry of Commerce - MOFCOM) | Export Control Law (2020) | While focused on international technology transfer, domestic application includes the control of critical dual-use materials (e.g., gallium and germanium). This insulates domestic military supply from external market shocks but can increase the internal cost structure and complexity for manufacturers utilizing controlled materials. |

China AI in Military Market Segment Analysis:

By Application: Surveillance & Reconnaissance (ISR)

The need for AI within the Surveillance & Reconnaissance segment is a function of the Data Overload Imperative inherent in modern, multi-domain sensor networks. The sheer volume of raw data generated by satellite imagery, airborne sensors, ground radars, and maritime sonar exceeds the human capacity for timely processing and analysis. This creates a direct, urgent demand for AI models based on Computer Vision and Deep Learning to perform autonomous feature extraction, target recognition, and pattern-of-life analysis. Specifically, the PLA requires systems capable of real-time, high-fidelity object classification in dense electromagnetic environments, pushing demand for robust, on-the-edge processing units. The military's growing emphasis on persistent monitoring of vital maritime and territorial zones further drives the demand for AI-enabled systems that can operate unattended, minimize false-positive alerts, and automatically fuse disparate sensor data streams into a unified, actionable operational picture for commanders.

By Platform: Air Force

The Air Force platform segment experiences concentrated growth as a direct result of the Unmanned Systems Integration Mandate. The PLA Air Force (PLAAF) is strategically moving toward integrating large-scale swarms of unmanned aerial vehicles (UAVs) and advanced electronic warfare (EW) platforms. This complex undertaking requires AI for several critical functions: cooperative autonomy (where multiple uncrewed systems coordinate their actions without constant human input), real-time mission re-planning in dynamic airspace, and advanced cognitive electronic warfare (EW) systems. The demonstrated need for an AI-powered cognitive radar system that can instantly adapt its frequency and processing parameters to defeat sophisticated electronic jamming (as developed by SOE research institutes) directly translates into a high-priority, high-value demand for specialized AI chipsets and sophisticated reinforcement learning software tailored for airborne platforms. This operational requirement establishes the Air Force segment as a leading consumer of AI systems designed for speed, low latency, and high-stakes reliability.

China AI in Military Market Competitive Environment and Analysis:

The competitive landscape is dominated by a select group of State-Owned Enterprises (SOEs) that act as prime contractors, alongside a growing tier of commercial AI firms integrated through the MCF strategy. Competition is less about market share in a traditional sense and more about demonstrating superior technological capability and alignment with the PLA's strategic intelligentization objectives. Key players leverage their established relationship with the government, secure funding, and access to protected intellectual property.

China Electronics Technology Group Corporation (CETC)

CETC is a crucial player, acting as a central pillar for the PLA's electronic information systems and intelligence infrastructure. Its strategic positioning is centered on digital and information dominance, covering a wide array of AI applications from cyber warfare to intelligence, surveillance, and reconnaissance (ISR). CETC has verifiably deployed large-scale sensor and transmission platforms and, through its subsidiaries and research institutes, develops key components for the BeiDou satellite network and advanced radar systems. The firm’s key strategic objective is the development and integration of AI to create "one-way transparency"—the ability to observe, jam, and target adversaries while remaining largely hidden in the electromagnetic domain. This is exemplified by the verifiable testing of advanced, AI-powered airborne cognitive radar systems capable of maintaining near-perfect tracking accuracy under heavy electronic jamming.

China North Industries Group Corporation (NORINCO)

NORINCO positions itself as the primary contractor for land-based, unmanned, and intelligent combat systems. Its strategic focus is the integration of AI into ground platforms and armament. The company's key products include unmanned ground vehicles (UGVs) and integrated fire control systems that leverage machine learning for target identification, classification, and precise engagement. NORINCO’s verifiable activities center on developing the AI layers necessary for autonomous navigation in complex terrains and providing commanders with improved situational awareness and decision support for ground operations, aligning with the PLA's move toward highly automated battlefield systems.

China AI in Military Market Recent Developments:

- September 2025: A key research institute under a major SOE (historically affiliated with CETC) successfully flight-tested an AI-powered airborne cognitive radar system. The official reports verified the system achieved near-perfect (99%) tracking accuracy while operating under conditions of sophisticated electronic warfare jamming. This development is not a product launch but a crucial technology demonstration confirming the capacity addition of a fundamental, cutting-edge AI component designed to give the PLA Air Force a distinct edge in electronic warfare and directly validates the high-priority demand for Deep Learning in the Air Force platform segment.

- May 2025: China Electronics Technology Group Corporation (CETC) invested in the company ACAE, a firm associated with advanced computing. This move, sourced from an official investment tracker, indicates a strategic acquisition or investment in a core AI infrastructure provider. This type of action directly supports CETC’s mandate to bolster its indigenous capability in developing the complex hardware and software platforms required for military AI systems, representing an in-organic capacity addition to strengthen its vertical supply chain position in the defense electronics sector.

China AI in Military Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 7.966 billion |

| Total Market Size in 2031 | USD 20.512 billion |

| Growth Rate | 20.82% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component Type, Technology, Application, Platform |

| Companies |

|

China AI in Military Market Segmentation:

- BY COMPONENT TYPE

- Hardware

- Software

- Services

- BY TECHNOLOGY

- Machine Learning

- Deep learning

- Computer Vision

- Natural Language Processing

- Robotics

- Others

- BY APPLICATION

- Warfare Platforms

- Cybersecurity

- Logistics & Transportation

- Surveillance & Reconnaissance

- Command & Control

- Battlefield Healthcare

- Simulation & Training

- Gathering Intelligence

- Others

- BY PLATFORM

- Land-based Force

- Naval Force

- Air Force

- Space Force