Report Overview

Citric Acid Market - Highlights

Citric Acid Market Size:

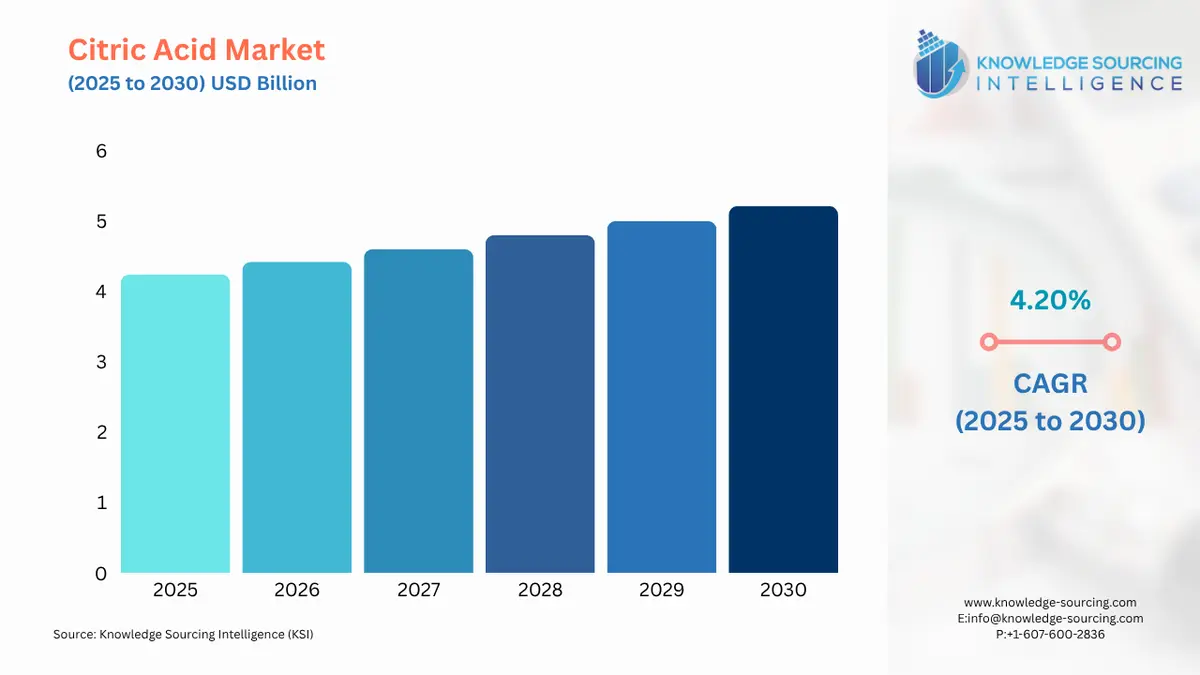

Citric Acid Market, with a 4.20% CAGR, is anticipated to rise from USD 4.241 billion in 2025 to USD 5.209 billion by 2030.

Citric Acid Market Overview & Scope

The citric acid market is segmented by:

- Product Type: Anhydrous citric acid possesses a large market share due to its use in dry mixes, powdered beverages, and pharmaceutical formulations that are moisture sensitive. With excellent solubility and stability, it is a preferred ingredient in effervescent tablets, instant drinks, and nutritional supplements. As convenience foods gain popularity and demand for pharmaceuticals grows, the continued robust use of anhydrous citric acid as a functional ingredient will ensure steady market growth across global sectors.

- Function: Citric acid has a large portion of this market as a preservative because it is natural, safe, and effective for prolonging the shelf lifespan of food and beverages by preventing microbial growth, spoilage, and stable pH development. It is most popular in soft drinks, packaged foods, jams, and sauces. Citric acid is a consumer-accepted and appropriate chemical substitution for synthetic preservatives, and reflects the growing interest of consumers for clean-label, natural ingredients. It has both flavour enhancement and preservation functionality, which further facilitates its acceptance and usage rate in the food and beverage industries.

- Grade: Food-grade citric acid represented a considerable share of the citric acid market, as it is extensively used in the food and drink industry as an acidulant, flavour enhancer, and preservative. It improves taste by adding a refreshing tartness, balancing sweetness, and stabilising packaged foods and beverages. Food-grade citric acid prevents spoilage by managing the growth of microbes and is an important ingredient in soft drinks, confectionery, baked goods, jams, sauces, and ready-to-eat meals. The increasing global demand for processed and convenience foods and the consumer trend towards natural additives enhance food-grade citric acid's market share.

- End User: The food and beverage sector is considered to be the single largest consumer of citric acid, mainly as a preservative, acidulant, and flavouring agent. It is used in carbonated drinks, candies, packaged foods, sauces, and any other food products to provide balance to the flavour, freshness and shelf life. Global consumer trends toward increasing demand for processed and convenience food, and the desire for consumers for a more 'natural' additive, provide solid drivers for this sector and thus citric acid.

- Region: The Asia-Pacific citric acid market has the largest share because of the large food and beverage sector industry, growth in the pharmaceutical sector, and increasing demand for processed foods. Countries including China and India are the greatest sources of growth, with China being the largest producer and exporter of citric acid, and India exhibiting growth in consumption of packaged foods, soft drinks, and even medicines. With urbanisation and population growth, convenience products are increasingly in demand in this region. In addition, growing interest in ingredients that are natural, environmentally friendly, and sustainable is also contributing to the increased citric acid usage within several categories, e.g. cleaning and personal care products.

Top Trends Shaping the Citric Acid Market

- Clean-Label and Natural Ingredients: The increase in usage of natural preservatives or additives has driven the use of citric acid in beverages, packaged foods, and personal care products.

- Rising Pharmaceutical Applications: The growing use of citric acid in effervescent tablets, syrups, anticoagulants, and drug formulations is fueling demand from the healthcare industry.

- Expansion into New Application Segments: Citric acid is increasingly adopted beyond the food & beverage space, particularly in pharmaceuticals (as excipients and pH regulators), personal care, cosmetics, eco-friendly cleaning products, and biodegradable polymers.

Citric Acid Market Growth Drivers vs. Challenges

Drivers:

- Rising demand from the food and beverage industry: One of the key drivers of the citric acid market is rising demand from the food and beverage industry. Citric acid is widely used as a preservative, flavour enhancer, and acidulant in processed foods and beverages, driving consistent market growth. According to Union Minister of Commerce & Industry, Shri Piyush Goyal, India can achieve a combined exports target of $100 billion in the Food & Beverage (F&B) indicating, agriculture and marine products sectors in the next five years. In this press release, it was mentioned that for an interaction with stakeholders in the F&B industry on the sidelines of Indusfood 2025 in New Delhi, these industries must grow at a combined growth rate of 14-15%.

- Expanding applications in pharmaceuticals: Another key driver of the citric acid market is expanding applications in pharmaceuticals and personal care. Its use in formulations for medicines, skincare, and cleaning products continues to grow due to its safety, biodegradability, and multifunctional properties. According to PIB, India’s pharmaceutical market for FY 2023–24 is valued at USD 50 billion, with domestic consumption accounting for USD 23.5 billion and exports contributing USD 26.5 billion.

- Growth of Export Opportunities: Globally, China is considered the largest exporter of citric acid. In total, approximately 1.17 billion kilograms of citric acid were exported from China to the global market at 982,522.84 units. Export volume was significant in destinations such as India (126.19 million kg), Japan (48.16 million kg), Mexico (60.65 million kg), and Germany (45.17 million kg). These numbers illustrate China's importance in meeting the global demand for citric acid, also drawing extensive export volume in Asia, Europe, and the Americas.

Challenges:

- Volatile Pricing: In the citric acid market, there are many constraints in the form of challenges. One of the most critical challenges is the volatility of raw material prices, as corn and sugar are critical to the acid's production. The citric acid industry also faces pressure from competition, sourcing alternative acidulants such as malic acid and phosphoric acid that can replace citric acid in some applications. Other factors include reliance on a few manufacturers, especially in China, as well as environmental-related costs for compliance with disposal and waste regulations, along with fermentation processes, all of which place a hold on growth.

Citric Acid Market Regional Analysis

- China: As the largest manufacturer and exporter of citric acid in the world, China holds the major share of the global citric acid market.

- United States: Demand for citric acid is high in the U.S. in beverages, processed foods, pharmaceuticals, and household cleaner applications. Consumer preference is turning towards natural preservatives and clean-label products, which points to increasing steady consumption of citric acid.

- Germany: One of the largest citric acid markets in Europe, Germany has demand for food processing, personal care products, pharmaceuticals, and a strengthening health and wellness market, tied directly to citric acid. The EU has heavy regulations to push natural additives, which increases citric acid potential.

- India: Positive growth in the food and beverage sector, a rapidly expanding pharmaceutical market, and increased consumption of packaged food indicate that demand trends for citric acid will continue to grow significantly, creating an important emerging market for citric acid.

Citric Acid Market Competitive Landscape

The Citric Acid market is competitive, with a mix of established players like Jungbunzlauer Suisse AG, RZBC Group Co., Ltd., Shandong Ensign Industry Co., Ltd., Gadot Biochemical Industries Ltd., Citribel., Archer Daniels Midland Company (ADM), Cargill, Incorporated, Huangshi Xinghua Biochemical Co., Ltd., Jiangsu Guoxin Union Energy Co., Ltd.

- Collaboration: In November 2024, Jungbunzlauer partnered with the Technical University of Vienna (TU Wien) to foster innovative research to optimise citric acid production through modifying fungal strains in the recent Christian Doppler (CD) Laboratory.

Citric Acid Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Citric Acid Market Size in 2025 | USD 4.241 billion |

| Citric Acid Market Size in 2030 | USD 5.209 billion |

| Growth Rate | CAGR of 4.20% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Citric Acid Market |

|

| Customization Scope | Free report customization with purchase |

Citric Acid Market Segmentation:

- By Type

- Anhydrous

- Liquid

- By Function

- Preservative

- Antioxidant

- Flavouring Agent

- Others

- By Grade

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

- Reagent Grade

- By End User

- Food and Beverage

- Pharmaceutical

- Personal Care and Cosmetic

- Pharmaceutical

- Others

- By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

Navigation:

- Citric Acid Market Size:

- Citric Acid Market Key Highlights:

- Citric Acid Market Overview & Scope

- Top Trends Shaping the Citric Acid Market

- Citric Acid Market Growth Drivers vs. Challenges

- Citric Acid Market Regional Analysis

- Citric Acid Market Competitive Landscape

- Citric Acid Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 8, 2025