Report Overview

Clinical CRO Market Size, Highlights

Clinical CRO Market Size:

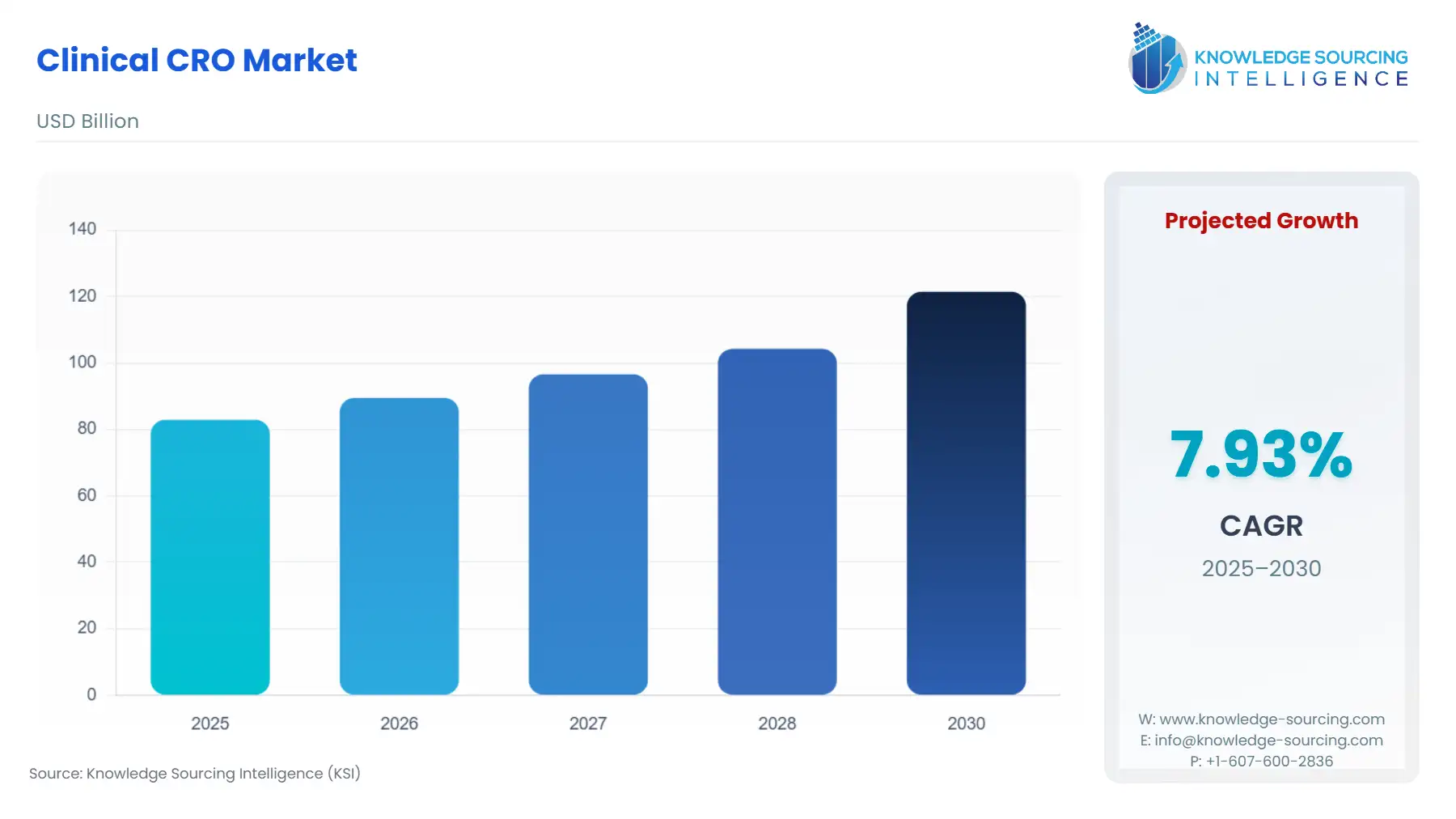

The Clinical CRO Market is projected to grow at a CAGR of 7.93% from 2025 to 2030, reaching US$121.454 billion in 2030 from US$82.916 billion in 2025.

Clinical CRO Market Highlights:

- AI Adoption: AI and machine learning streamline trial design and patient recruitment.

- Personalized Medicine: Focus on precision therapies drives demand for specialized CROs.

- Regulatory Shifts: Evolving global regulations challenge CROs to ensure compliance.

- Digital Trials: Decentralized and virtual trials gain traction for flexibility and reach.

- Biotech Surge: Increased biotech funding fuels outsourcing to CROs for innovation.

The market is driven by increasing outsourcing requirements from large pharma and biotech companies due to a rising number of clinical trials. Clinical CROs help pharmaceutical, biotechnology, and medical device companies to manage all phases of clinical trials from drug development lifecycle, compound selection, discovery, preclinical (pre-human in-vitro and in vivo) research, clinical (in-human) testing, as well as post-approval functions such as commercialization, safety assessment, monitoring, and consulting, and others. The cost-effectiveness and faster time-to-market, along with expertise in phase studies compared to their in-house research and development departments, are key factors driving the demand for CRO. Therefore, it is experiencing strong growth, driven by a combination of strategic outsourcing trends, increasing clinical trial volumes, and rising R&D investments.

One of the key factors driving growth is stringent government regulations. Regulatory bodies such as the U.S. FDA, EMA, and others have established complex and evolving requirements to ensure the safety, efficacy, and ethical conduct of clinical trials, which is leading pharmaceutical and biotechnology companies to prefer outsourcing to CROs as they offer specialization in regulatory compliance along with expertise in clinical studies. For instance, pharmaceutical companies have to adhere to Good Clinical Practice (GCP), is an internationally recognized standard issued by the International Council for Harmonisation (ICH) under its E6 guideline, which demands for compliance with the rights, safety, and well-being of clinical trial participants as paramount, along with other regulatory mandates.

Additionally, the increasing expenditure by the pharmaceutical and biotechnology companies on drug development, early-phase clinical trials, extensive monitoring, data management, and regulatory compliance, and other areas is leading to the clinical CRO market expansion.

The Clinical CRO Market is increasingly investing in AI and machine learning, driving the integration of digital twins, AI-driven analytics, and other technologies. They are broadening their capabilities beyond traditional clinical operations like data analytics, real-world evidence, and others. The market is also witnessing an increasing shift towards phase-specific service delivery, such as different services for Phase I, Phase II, Phase III, and Phase IV.

Clinical CRO Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The Clinical CRO Market is segmented by:

- Type: The Clinical CRO Market is segmented into Phase I Trials, Phase II Trials, Phase III Trials, and Phase IV (Post-Marketing Surveillance). Among them, Phase III will dominate the market.

- Therapeutic Area: By therapeutic area, the market is categorized into oncology, central nervous system (CNS), cardiovascular, infectious diseases, immunology, metabolic disorders, rare diseases, and others (including gene or cell therapies, autoimmune diseases, and respiratory disorders). Oncology will continue to dominate the market due to the high volume of oncology drug development programs.

- Service Type: Based on service category, the market is segmented into Clinical Operations and Monitoring, Data and Analytics, Regulatory and Safety, and Real-World Evidence (RWE) & Health Economics Outcomes Research (HEOR). Client operations and monitoring involve site selection, patient recruitment, clinical trial management, site monitoring, and ensuring compliance with trial protocols and Good Clinical Practice (GCP) guidelines. It holds the largest segment as it is core to the clinical CROs.

- Client Type: The Clinical CRO Market is categorized by client type into large pharma, Small and mid-biotech, Medical Device Companies, Government and Academic Institutes, and CDMOs. Large pharma companies contribute significantly to market revenue.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific. North America leads the market in terms of overall revenue share, while Asia-Pacific is growing at the fastest rate.

Top Trends Shaping the Clinical CRO Market:

1. Growing trend towards phase-specific service delivery

- The clinical CRO market is increasingly shifting towards phase-specific service delivery, such as different services for Phase I, Phase II, Phase III and Phase IV. As CRO clients are increasingly seeking specialized CRO service with deep expertise in each phase of trials, they are increasingly contracting for tailored, phase-specific contracts that helps them with better cost control as well as faster and predictable execution timelines.

- For instance, in June 2024, Novotech launched a dedicated Early Phase Strategic Delivery Unit (EP SDU) to focus exclusively on Phase I clinical trials. It focused on leveraging the unique advantage of Australia and New Zealand (ANZ) for early-phase clinical development. ANZ offers an attractive destination for early-phase biotechs as it offers rapid, cost-effective, and high-quality clinical development solutions.

2. Integration of AI is a major and rapidly growing trend in the market

- There is an increasingly growing trend in the clinical CRO market that is the integration of AI that helps in streamlining the various clinical CRO operations such as study design, protocol development and regulatory compliance. It analyses a vast amount of data to identify potential risks as well as optimizing the trial design. It is increasingly helping in ensuring compliance with regulatory requirements.

- For instance, Worldwide Clinical Trials, a global CRO, has integrated an AI tool to enhance clinical trial optimization. It integrated AI algorithms powered by NetraMarket to analyse complex data sets, including genomics, transcriptomics, and clinical scales.

Clinical CRO Market Growth Drivers vs. Challenges:

Opportunities:

- Cost-effectiveness and faster time-to-market drive clinical CRO market growth: As clinical CROs help pharmaceutical, biotechnology, and medical device companies to manage all phases of clinical trials from drug development lifecycle, compound selection, discovery, preclinical (pre-human in-vitro and in vivo) research, clinical (in-human) testing, as well as post-approval functions such as commercialization, safety assessment, monitoring, and consulting, and others more cost-effectively and with a shorter time-to-market than their in-house research and development departments, leading the market to grow.

- Rising R&D expenditure by pharmaceutical and biotechnology companies: One of the other key factors driving the clinical CRO market is the increasing expenditure by the pharmaceutical and biotechnology companies, such as on drug development, early-phase clinical trials, extensive monitoring, data management, and regulatory compliance, and others. The trend analysis on research and development in the pharmaceutical industry by the Congressional Budget Office of the U.S. Congress highlights that the pharmaceutical industry spent $83 billion on R&D in 2019, which is ten times that 1980s, and the number of new drugs approved for sale increased by 60 per cent between 2010 to 2019 compared with the previous decade. Europe’s R&D expenditure on pharmaceuticals has increased from € 39,442 million in 2020 to € 47,010 million in 2022. China’s R&D investment stands at € 14,817 million, the USA stands at € 71,459 million, and Japan at € 10,363 million.

- Increasing number of clinical trials: The Clinical CRO Market is experiencing significant expansion due to a rising number of clinical trials. The increasing number of clinical trials due to expanding drug development is one of the key factors driving the clinical CRO market’s growth. Drug discovery is rising across therapeutic areas such as oncology, neurology, and rare diseases, leading to growth in clinical studies.

The global surge in clinical trials is also highlighted by WHO data. It states that in the Americas, the number of clinical trials has increased from 11,156 in 2015 to 11,974 in 2023. In Europe, the number of clinical trials has increased from 12,672 in 2016 to 15,390 in 2023. This upward trend reflects the expanding drug development pipeline, which in turn is driving demand for Clinical Research Organizations (CROs).

In addition, there is an increasing expenditure on R&D by pharmaceutical and biotechnology companies. As drug pipelines expand and development costs continue to climb, pharmaceutical companies are increasingly turning to CROs to conduct their clinical studies. By outsourcing to CROs, sponsors can better control expenses, tap into specialized expertise and state?of?the?art technologies, and leverage scalable global infrastructures. This collaboration not only streamlines study start up and patient recruitment but also accelerates timelines and enhances regulatory compliance, ultimately reducing time to market for new therapies.

Thus, the growing investment is leading these companies to outsource clinical trials to CROs as they reduce the cost and improve efficiency.

Challenges:

- Regulatory Complexity: One of the most significant challenges the market faces is the complex and varied regulatory framework across different countries. As there are inconsistent regulations across regions, this leads to a delay in trial approvals, increasing the cost and lengthening market entry. At the same time, complying with country-specific ethical approval and data privacy laws increases the time-to-market for new drugs while raising operational costs, acting as a key barrier for the market.

Clinical CRO Market Regional Analysis:

- North America: The North American region is the leading market in the global clinical CRO market. The market dominance is driven by the presence of major clinical CRO players and high demand driven by stringent regulations in the pharmaceutical industry and rapid growth in its biosimilar and biologics market, and an increase in clinical trial activity.

A crucial factor driving the United States clinical CRO market is the increasing research and development expenditures in the pharmaceutical and biotechnology sectors, which are further fueled by the growing prevalence of chronic diseases like diabetes and cancer. In this regard, according to the American Cancer Society, 2,041,910 new cancer cases are estimated in 2025, out of which 1,053,250 are estimated in males, while the other 988,660 are estimated in females.

The sophistication of drug development, particularly for biologics and personalized medicine, has led firms to outsource clinical trials to CROs for specialized knowledge and cost-effectiveness. Advances in technology, like artificial intelligence (AI), electronic data capture (EDC), and decentralized clinical trials (DCTs), advance trial efficiency, patient recruitment, and data management, and contribute to the market growth. Additionally, a supportive regulatory environment, led by the FDA, and a well-developed healthcare infrastructure with a skilled workforce, positions the U.S. as a global leader in clinical research. Strategic collaborations between pharmaceutical companies and CROs further optimize the advantages of outsourcing, lowering development costs and timelines.

The main drivers of market growth are the rise in clinical trial volumes, with the United States hosting early-phase clinical trials for oncology, neurology, and orphan diseases due to its rich patient base and state-of-the-art medical infrastructure. The expense of in-house R&D, combined with pressure for speed to market in the face of expiring patents, makes outsourcing to CROs favorable since these companies have flexible cost structures and experience with complex regulatory environments.

Additionally, key developments are also playing a crucial role in the market. For instance, in 2023, NAMSA, a world-leading MedTech Contract Research Organization (CRO), entered into an acquisition and acquired CRI- The Clinical Research Institute, which is a German-based full-service CRO. In March 2024, Veeda Clinical Research Limited, a full-service contract research organization (CRO), acquired Heads, a European CRO that specialized in conducting clinical trials in oncology.

- Europe: Europe also holds a significant dominance in the clinical CRO market. High number of clinical trial activities and presence of key infrastructure and improved trial monitoring facilities. The number of clinical trials was 16,185 in 2018, 19,462 in 2021, and 15,390 in 2023 annually (WHO).

- Asia-Pacific: The Asia-Pacific will be growing at the fastest rate during the forecast period, and in the coming years, it is expected to slowly capture the market share. The market will be driven by countries like China, Japan, India, and other Southeast Asian countries, and one of the primary reasons would be the cost-effectiveness of outsourcing from these countries.

For instance, India is emerging as a key destination for early-stage clinical trials, particularly because global pharmaceutical companies are seeking alternatives to regions disrupted by geopolitical tensions like the Russia-Ukraine war, such as Parexel's announcement of expanding in India in 2025. The head of Parexel’s India operation has cited that the country offers several advantages, including lower operational costs and increasing market potential. The data by the WHO also highlights the remarkable growth of clinical trials in the South-East Asia region from 2,852 annually in 2016 to 13,812 annually in 2023, signifying Asia-Pacific as one of the fastest-growing regions driving the surge in outsourcing from regional CROs.

Clinical CRO Market Competitive Landscape:

The market is moderately consolidated, with the key players including IQVIA Holdings Inc., Thermo Fisher Scientific Inc. (PPD), ICON plc, Laboratory Corporation of America Holdings, Syneos Health, Inc., Parexel International Corporation, Charles River Laboratories International, Inc., Medpace Holdings, Inc., WuXi AppTec Co., Ltd., Fortrea Holdings Inc., Novotech Pty Ltd., PSI CRO AG, and Medidata Solutions, Inc.

- Market Expansion: In February 2025, Parexel, a leading U.S.-based Contract Research Organization (CRO), plans to expand its workforce in India by over 2,000 employees within the next 3–5 years, growing from its current 6,000.

- Service Innovation and Strategic Expansion: In December 2024, Lindus Health, a U.S. and UK-based contract research organization (CRO) branding itself as an “anti-CRO” announced the launch of a specialized "All-in-One Cardiovascular CRO" solution designed for cardiovascular clinical trials. It will offer end-to-end CRO services, site operations, and customizable eClinical technology tailored for cardiovascular trials through Technology Platform-Citrus that integrates tools like CTMS, EDC, telehealth, and eConsent into one platform.

Clinical CRO Market Segmentation:

By Clinical Phase

- Phase I Trials

- Phase II Trials

- Phase III Trials

- Phase IV (Post-Marketing Surveillance)

By Therapeutic Area

By Service Category

- Clinical Operations and Monitoring

- Data and Analytics

- Regulatory and Safety

- Real-World Evidence (RWE) & Health Economics Outcomes Research (HEOR)

By Client Type

- Large Pharma

- Small & Mid Biotech

- Medical Device Companies

- Government and Academic Institutes

- CDMOs

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others