Report Overview

Cloud Collaboration Market - Highlights

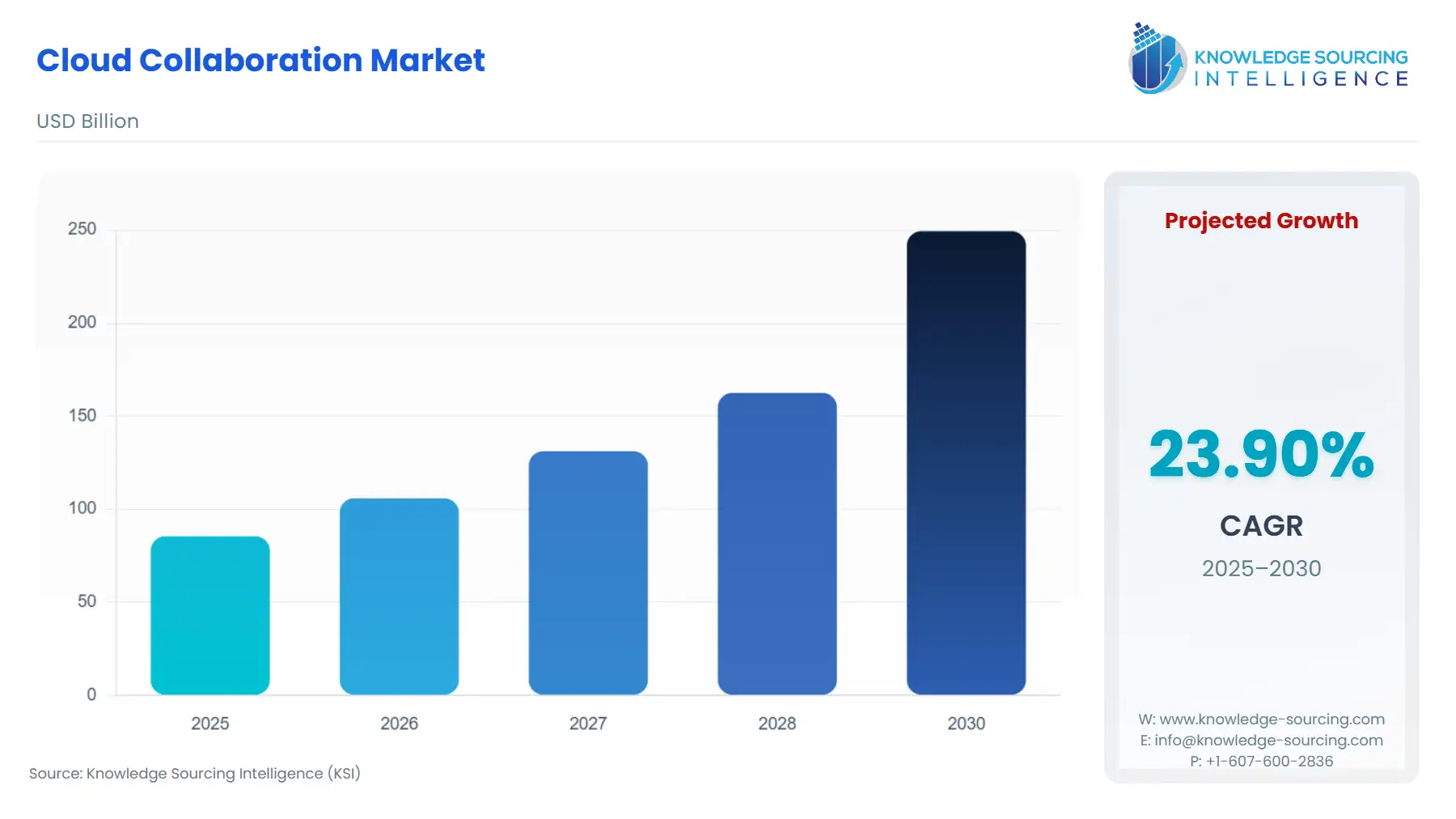

Cloud Collaboration Market Size:

The cloud collaboration market is expected to grow at a CAGR of 23.90%, reaching a market size of US$249.463 billion in 2030 from US$85.452 billion in 2025.

The cloud collaboration market, defined by software-as-a-service (SaaS) applications that facilitate real-time and asynchronous work across geographies, fundamentally re-architects the organizational operating model. This transition moves collaboration from siloed, on-premise systems to unified, web-based environments. The market's current trajectory is overwhelmingly driven by the enterprise-wide adoption of persistent virtual workspaces, transcending simple communication tools. These integrated platforms now underpin core business processes, from product development to customer service, making their reliability, security posture, and deep integration capabilities the central competitive differentiators. The resulting demand is not merely for communication minutes but for a cohesive digital fabric that maintains productivity and regulatory compliance across a distributed workforce.

Cloud Collaboration Market Analysis

Growth Drivers

The permanent establishment of hybrid and remote work is the foremost driver, creating a non-negotiable enterprise demand for platforms that enable seamless, location-agnostic access to applications and data. This shift requires feature sets like real-time co-authoring, project management integration, and secure file sharing, which exclusively cloud collaboration platforms provide. Simultaneously, the accelerating pace of digital transformation across verticals pushes organizations to consolidate disparate legacy communication tools onto unified cloud suites. This consolidation, catalyzed by the necessity for operational efficiencies and centralized data governance, directly increases the average revenue per user (ARPU) for integrated cloud collaboration offerings.

Challenges and Opportunities

Security constraints pose the primary market challenge; customers remain hesitant about trusting third-party providers with highly sensitive data, which reduces demand for public cloud deployments in regulated industries. However, this challenge translates directly into a significant market opportunity: the demand for private and hybrid cloud collaboration solutions has intensified. Providers who can offer verifiable, dedicated hosting options with robust, certified encryption and compliance frameworks (like FedRAMP or sector-specific standards) gain a crucial competitive advantage, driving demand toward high-value, bespoke enterprise contracts.

Supply Chain Analysis

The Cloud Collaboration Market's supply chain is unique in that it is almost entirely digitized, depending on the global network of hyperscale data centers. This infrastructure forms the foundational production hub. The logistical complexity involves ensuring ultra-low latency and high availability across disparate geographical regions, which is a function of provider-owned fiber optic networks and content delivery networks (CDNs). The critical dependency is on the consistent, high-capacity electrical power and cooling infrastructure necessary for the foundational server architecture. Disruptions in the semiconductor supply chain, which impacts server and networking equipment procurement for data centers, can indirectly constrain the growth capacity of the entire cloud collaboration market by slowing capacity additions.

Government Regulations

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

European Union | General Data Protection Regulation (GDPR) | The GDPR mandates stringent data residency and sovereignty rules, driving increased demand for regional data centers and collaboration services that guarantee data storage and processing within the EU. It directly increases demand for auditable security features like end-to-end encryption and detailed audit logs. |

United States | Federal Risk and Authorization Management Program (FedRAMP) | FedRAMP compliance is mandatory for any Cloud Service Provider seeking to contract with federal government agencies. This regulation restricts vendor selection and creates high demand barriers to entry, concentrating public sector demand on a select group of providers with certified, highly secure collaboration platforms. |

Various Countries | Country-Specific Data Localisation Laws (e.g., India, China) | These laws necessitate vendors to maintain separate instances and potentially fork their software to meet local regulatory and censorship requirements. This fragmentation increases operational costs but also unlocks specific national markets, creating demand for locally customized collaboration tools. |

Cloud Collaboration Market Segment Analysis

By Industry Vertical: BFSI (Banking, Financial Services, and Insurance)

The BFSI segment exhibits a distinctive, high-stakes demand profile, propelled by the critical need for regulatory compliance and secure client interaction. Strict regulations, such as the US Securities and Exchange Commission (SEC) record-keeping rules and equivalent international mandates, mandate that all internal and client communications must be meticulously archived, auditable, and immutable. This regulatory pressure drives direct demand for Cloud Collaboration platforms that natively integrate advanced compliance archiving, legal hold, and granular access controls. Furthermore, the shift to hybrid advisory models and digital-first client onboarding requires secure video conferencing and co-browsing capabilities to maintain trust and data integrity. Consequently, BFSI's demand centers on features that de-risk the communication channel, making compliance a core driver of premium subscription uptake.

By Deployment Type: Hybrid Cloud

The need for Hybrid Cloud collaboration is fundamentally driven by the need to reconcile the efficiency of the public cloud with the security imperative of maintaining specific, sensitive workloads on private, on-premise infrastructure. Large enterprises, particularly in sectors like healthcare and government, require the low-latency, real-time communication capabilities of the public cloud for daily operations while keeping proprietary intellectual property or protected health information (PHI) within a controlled private cloud environment. This architecture allows organizations to leverage the public cloud's scalability for non-sensitive functions like general messaging and meeting scheduling, while demanding integration capabilities that securely tunnel into and co-author data stored behind a corporate firewall, thereby minimizing data exposure without sacrificing modern collaboration functionality.

Cloud Collaboration Market Geographical Analysis

US Market Analysis (North America)

The US market’s growth is characterized by intense competition between hyperscale provider ecosystems (e.g., Microsoft and Google) and a strong regulatory influence from federal and sector-specific compliance standards. The large-scale adoption of the hybrid work model by major technology, finance, and professional services firms fuels high demand for integrated software suites that merge collaboration, productivity, and security into a single license. The need for FedRAMP authorization drives specific high-value demand within the sprawling government and defense sectors, creating a segmented market where compliance acts as a non-price competitive barrier.

Brazil Market Analysis (South America)

The Brazilian market is experiencing a significant uplift in demand driven by the rapid growth of the domestic technology sector and the need to connect a geographically vast and diverse workforce. Market growth is particularly sensitive to mobile-first collaboration tools, given the high penetration of mobile internet. Furthermore, the country's General Data Protection Law (LGPD) compels companies to prioritize cloud collaboration solutions that offer clear, locally compliant data processing terms, steering demand towards providers who have established in-country data centers or offer transparent data governance frameworks.

Germany Market Analysis (Europe)

In Germany, the need for cloud collaboration is acutely focused on data privacy and security, largely as a response to the GDPR and a deep cultural preference for sovereignty. Enterprises prioritize providers who can guarantee full data residency within German or EU borders and demonstrate rigorous adherence to the country’s strict works council regulations on employee monitoring. This demand pattern favors private cloud and highly customized hybrid deployments over standard public cloud offerings, focusing on German-language compliance and secure administration features.

UAE Market Analysis (Middle East & Africa)

The UAE market is a critical regional hub, with demand concentrated in large government and semi-government entities and the burgeoning financial free zones. The 'Smart Government' initiatives are the primary catalyst, creating robust demand for secure, high-availability collaboration platforms to digitalize public services. Providers are required to meet specific local regulatory mandates regarding cybersecurity and national data access, with a growing demand for services hosted from newly built regional data centers to address local data residency requirements.

India Market Analysis (Asia-Pacific)

India represents a vast, high-growth market, characterized by demand for highly scalable, cost-effective solutions capable of supporting hundreds of thousands of users across disparate tiers of cities. The massive shift in IT services and BPO sectors to remote delivery models has created sustained, high-volume demand for communication platforms. This necessity is also increasingly focused on services that can efficiently operate over variable bandwidth connections and support regional language interfaces, catering to the country's unique linguistic and infrastructure landscape.

Cloud Collaboration Market Competitive Environment and Analysis:

The Cloud Collaboration Market is dominated by a few hyper-competitive players offering integrated suites, creating a marketplace where platform lock-in and ecosystem strength are pivotal. Competition centers on the breadth of features, integration with other business applications (CRM, ERP), and the deployment of advanced AI capabilities.

Microsoft

Microsoft’s strategic positioning is rooted in the dominant market presence of its Microsoft 365 suite, where Microsoft Teams serves as the central collaboration hub. Teams leverages Microsoft’s existing enterprise software penetration, ensuring its presence in nearly every major corporate account. The company’s verifiable strategic move is the continuous embedding of generative AI capabilities—specifically, the Copilot features—directly into Teams and its surrounding applications. This strategic integration significantly increases the value proposition of the entire suite by automating meeting summarization and content generation, thus compelling enterprises toward a full-suite commitment.

Google

Google competes by offering the Google Workspace suite, anchored by Google Meet and its document collaboration tools. Google’s verifiable strategic advantage lies in its cloud-native architecture and its strength in real-time, simultaneous co-authoring. The company’s positioning targets organizations that prioritize open integration, speed, and asynchronous collaboration, particularly in the technology, media, and education sectors. Their investment in making Meet a deep component of the entire Workspace ecosystem ensures all productivity tasks have a seamless communication layer, driving demand for its platform via utility and ease of use.

Cisco

Cisco’s Webex platform targets the high-end enterprise and regulated sectors, positioning itself as a secure, end-to-end communication and contact center solution. The company’s verifiable strategy focuses on leveraging its historical strength in networking and hardware (e.g., room kits) to offer a unified experience that spans both physical and virtual meeting spaces. Cisco’s consistent investment in security certifications and compliance features caters directly to the demand from government and regulated financial services clients who require assured reliability and audited security protocols across their entire communication infrastructure.

Cloud Collaboration Market Developments:

September 2024: Google announced the general availability of the Google Meet Add-ons SDK, allowing developers to embed their applications into Google Meet, where users can discover, share, and collaborate directly on app content without leaving the meeting. This product launch, verified by the Google Meet REST API release notes, directly increases the utility and integration depth of Google Meet, driving greater adoption by making it a more comprehensive workflow hub.

February 2024: Google announced the general availability of v2 of the Google Meet API and Google Meet events using the Google Workspace Events API. This development, verified via Google’s official documentation, enables developers to programmatically create, manage, and subscribe to events for Google Meet sessions. This enhancement to developer tools drives a measurable increase in the integration of Meet functionality into third-party business process management and scheduling applications.

Cloud Collaboration Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 85.45 billion |

| Total Market Size in 2030 | USD 249.46 billion |

| Forecast Unit | Billion |

| Growth Rate | 23.90% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Deployment Type, Industry Vertical, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Cloud Collaboration Market Segmentation:

By Deployment Type

Public Cloud

Private Cloud

Hybrid Cloud

By Industry Vertical

BFSI

Manufacturing

Education

Government

Communication and Technology

Media and Entertainment

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Italy

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others