Report Overview

Companion Robot Market - Highlights

Companion Robot Market Size:

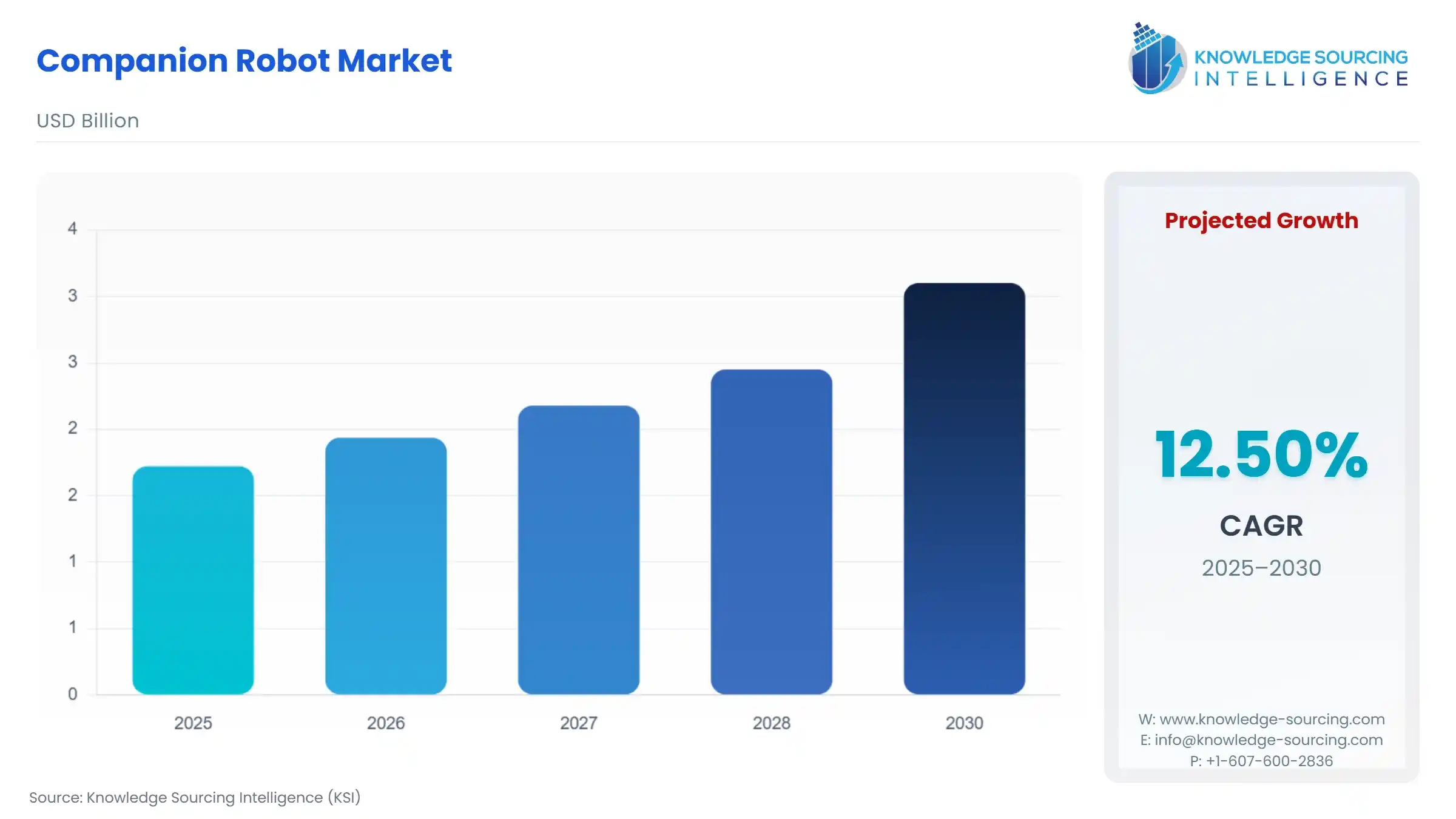

Companion Robot Market, sustaining a 12.50% CAGR, is projected to expand from USD 1.721 billion in 2025 to USD 3.101 billion by 2030.

Companion Robot Market Overview & Scope

The companion robot market is segmented by:

- Component: Software is the backbone of the companion robot, enabling intelligence, adaptability, and interactivity. It powers functions such as speech recognition, emotion detection, movement control, and AI-driven decision-making. Advanced software platforms integrate cloud services, machine learning algorithms, and IoT connectivity, allowing robots to learn from user behaviour, update features remotely, and seamlessly interact with smart home ecosystems and mobile apps.

- Operating System: Android-based systems are increasingly used in companion robots due to their open-source flexibility, wide developer community, and compatibility with various sensors and hardware. Android enables seamless integration of mobile apps, voice assistants, and cloud connectivity, allowing robots to deliver interactive features like voice communication, video streaming, real-time updates, and smart home control.

- Technology: Artificial Intelligence (AI) plays a significant role in advancing companion robotics by enabling natural language processing, emotional recognition, and personalised interactions. AI allows robots to understand user needs, adapt to behaviours, and provide meaningful engagement. As generative AI evolves, companion robots are becoming more intuitive, responsive, and capable of delivering real-time assistance in home and healthcare environments.

- End User: Hospitals hold a notable share of the companion robots market because they use these robots to assist with patient care, provide emotional support, and help reduce the workload of medical staff.

- Region: The Asia-Pacific region is witnessing rapid growth in the companion robotics market, driven by ageing populations, tech-savvy consumers, and strong government support. Countries like Japan, China, and South Korea are leading innovation in eldercare, smart homes, and AI-powered social robots.

Top Trends Shaping the Companion Robot Market

- Generative AI Integration: Companies are increasingly investing in data centres powered by solar, wind, and hydro energy to reduce carbon emissions and meet sustainability targets.

- Home Automation Synergy: AI companion robots are being designed to control smart home ecosystems, managing lighting, security, appliances, and daily routines.

- Child & Elderly-Focused Design: Organisations are embracing circular economy principles by extending the lifecycle of IT equipment through refurbishment, reuse, and responsible e-waste management.

- Cloud-Connected Intelligence: Robots are now connected to cloud-based platforms, allowing real-time updates, enhanced processing, and integration with decentralised AI protocols.

Companion Robot Market Growth Drivers vs. Challenges

Drivers:

- Rising Demand for Personalised Home Assistance: The companion robots are being designed to control smart home ecosystems, managing lighting, security, appliances, and daily routines. The rising elderly population increases the need for home assistance. According to WHO, by 2030, one in six people globally will be aged 60 or older, with the population in this age group rising from 1 billion in 2020 to 1.4 billion. By 2050, this number is expected to double, reaching approximately 2.1 billion worldwide.

- Advancements in Generative AI and Sensor Technologies: The breakthroughs in generative AI and improved sensor integration have enabled more responsive, emotionally aware, and contextually intelligent robots, accelerating adoption across homes and caregiving settings. According to the IFR report 2025, the Singapore United Medicare Centre (UMC) in Toa Payoh, a purpose-built nursing home inaugurated in 2003 by then Health Minister Mr. Khaw Boon Wan, has embarked on integrating intelligent robotics and AI into its rehabilitation services. In addition to this, in February 2024, researchers at the University of Southern California (USC) developed an open-source, low-cost robotics platform aimed at helping high school and college students build their AI-powered robot companion. It is designed as an educational tool; the kit allows students to customise the robot’s physical appearance, program it to mimic head movements, and explore key topics like AI ethics and algorithmic fairness.

Challenges:

- High Cost: The companion robotics market faces challenges including high development costs, data privacy concerns, limited emotional intelligence, and consumer scepticism. Ensuring natural interaction, personalisation, and ethical AI use remains complex. Additionally, market adoption is hindered by affordability issues, unclear regulations, and the need for robust language and cultural adaptability.

Companion Robot Market Regional Analysis

- United States: The U.S. leads the companion robot market, driven by tech giants, strong R&D investment, and a mature consumer electronics ecosystem. Companies like Amazon, Google, and emerging startups are rapidly deploying home robots with generative AI capabilities.

- China: China is a major player in AI robotics, supported by state-led innovation policies and a massive domestic market. Local firms are producing affordable, multifunctional companion robots targeting both children and the elderly.

- Japan: Japan focuses on humanoid and socially assistive robots for ageing populations. Companies like SoftBank and Sony continue to innovate in AI, emotional intelligence and household integration.

- South Korea: South Korea is advancing AI robotics through smart home integration and high consumer tech adoption. Backed by firms like Samsung and LG, the country is pushing AI-powered robots as lifestyle companions in modern homes.

Companion Robot Market Competitive Landscape

The market has many notable players, including Intuition Robotics Inc., Blue Frog Robotics, ASUSTeK Computer Inc., UBTECH ROBOTICS CORP LTD., Hanson Robotics, Luvozo, Honda Motor Co., Ltd., Aeolus Robotics, Andromeda, Enabot, and Samsung, among others.

- Product Launch: In May 2025, X-Origin AI launched its first AI companion robot, Yonbo, on Kickstarter. It is designed as a smart AI companion for families with children. Yonbo has completed development and entered mass production.

- Product Launch: In April 2025, DAI robotics startup Rice Robotics launched the FLOKI minibot M1, a custom AI-powered companion robot natively integrated with the RICE AI decentralised protocol.

- Partnership: In April 2025, Samsung and Google Cloud announced an expanded partnership to integrate Google Cloud’s generative AI technology into Ballie, Samsung’s new home AI companion robot. Ballie will be capable of engaging in natural, conversational interactions to assist users in managing their home environments, adjusting lighting, greeting visitors, personalising schedules, setting reminders, and more.

Companion Robot Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Companion Robot Market Size in 2025 | USD 1.721 billion |

| Companion Robot Market Size in 2030 | USD 3.101 billion |

| Growth Rate | CAGR of 12.50% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Companion Robot Market |

|

| Customization Scope | Free report customization with purchase |

Companion Robot Market Segmentation:

- By Component

- Hardware

- Software

- Services

- By Operating System

- Android

- iOS

- By Technology

- Artificial Intelligence (AI)

- Machine Learning

- Internet of Things (IoT)

- Computer Vision

- Others

- By End User

- Hospitals

- Nursing Homes

- Others

- By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

Navigation:

- Companion Robot Market Size:

- Companion Robot Market Key Highlights:

- Companion Robot Market Overview & Scope

- Top Trends Shaping the Companion Robot Market

- Companion Robot Market Growth Drivers vs. Challenges

- Companion Robot Market Regional Analysis

- Companion Robot Market Competitive Landscape

- Companion Robot Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 8, 2025