Report Overview

Composite Coatings Market Size, Highlights

Composite Coatings Market Size:

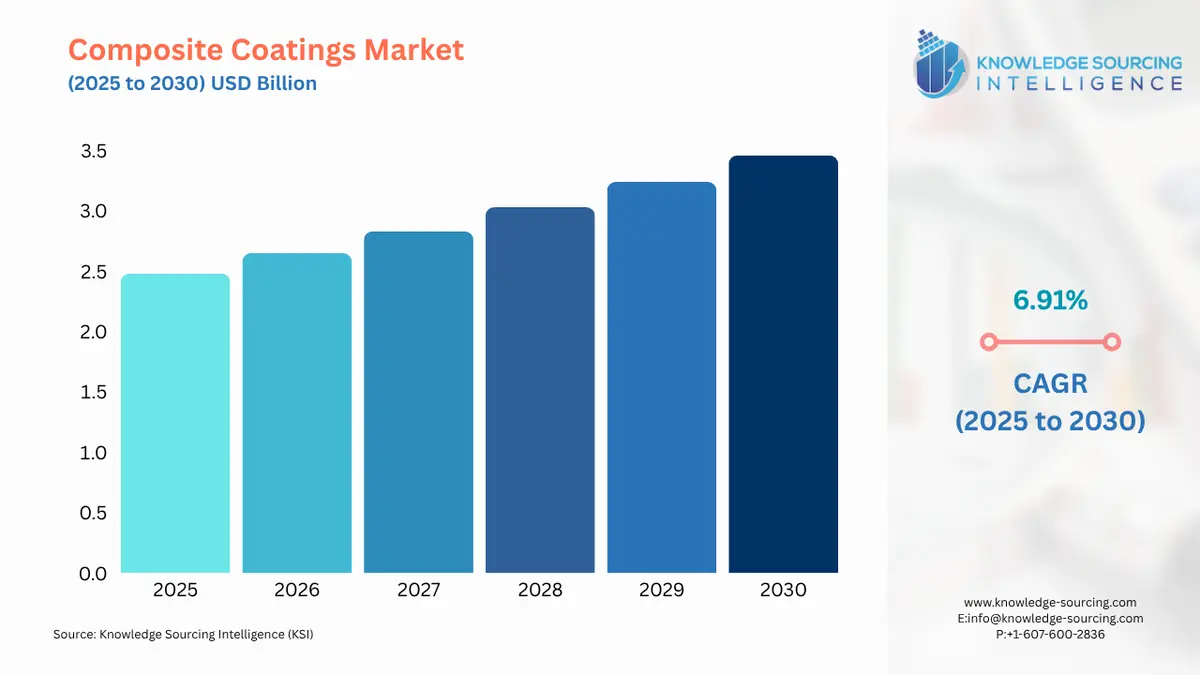

The composite coatings market is anticipated to grow from US$2.477 Billion in 2025 to US$3.460 Billion in 2030 at 6.91% CAGR.

The most common use for composite coatings is in construction. They are generally applied to protect steel from corrosion. However, they also have intumescent and thermal barrier applications on concrete and other materials. In such applications, they would be low VOC and very lightweight.

Other applications are in the manufacturing, automobile, aerospace, and oil and gas industries. Composite coatings made in all these industries vary from one another. All carry out the same purpose: to protect and reinforce the host substrate.

What are the drivers of the composite coatings market?

- Growing demand from the paint and coating industry

The construction and building industry worldwide is growing at a significant rate. One of the major reasons for this industry's expansion is the growing global urbanization. Urbanization causes the rapid industrialization of the country and region. The majority of urbanization is taking place in the Asia Pacific, Middle East, and Africa regions. The coatings market's growth is mainly due to the rising requirement for corrosion-resistant coatings in different industries. Furthermore, the demand for powder coatings and high-performance coatings for industrial applications is also a growth factor. According to the European Union, in December 2023, compared with December 2022, construction increased by 1.9% in the euro area and by 2.4% in the European Union.

Eurostat states that in the European Union, building construction increased by 1.1% in 2023 compared to 2022, and civil engineering increased by 4.1%. This rise in the construction industry reflects an overall increase in raw materials for its inputs.

- Rising production of automotive industries

Increased production by the automobile industry further expands the market for composite coatings. Any new automobile needs a composite coat not only for protection but also for aesthetic purposes. The refinishing market also needs composite coats for its repair and restoration requirements. As stated by the OICA (International Organization of Motor Vehicle Manufacturers), overall vehicle production rose 10% in 2023 compared to 2022. Further, the total number of vehicles produced is 93,546,599, of which 67,133,570 are cars and 26,413,029 are commercial vehicles. These figures come from the major economies of India, China, Canada, Germany, France, Japan, the United States, etc.

Apart from this, the technological advancements in the automobile industry foster the development of novel, highly durable formulations of composite coating with desirable properties like improved durability, UV resistance, and good gloss. For example, in March 2023, PPG began selling paint and composite film solutions to automotive and industrial customers through PPG Advanced Surface Technologies, a new joint venture with Entrotech, Inc., a developer of technology-driven film solutions.

The consumer demand for quality finishes and customization further fuels the demand for specialty composite coats. As a result, the demand for high-performance composite coatings continues to be strong with the growth and evolution of the automotive industry.

Composite Coatings Market Geographical Outlook:

- The composite coatings market is segmented into five regions worldwide:

By geography, the composite coatings market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific.

North America is estimated to have a large market share for composite coatings in the chemical synthesis industry as the U.S. Chemical Sector transforms raw materials into more than 70,000 diverse chemical products. The automotive and construction industries and customers' demand for durability and aesthetic appeal are driving the North American composite coatings market. Growing demand for fuel-efficient vehicles and severe pollution restrictions have resulted in using lightweight materials and innovative coating techniques.

Europe has a demand for adhesives, paints, emulsions, and coatings from several industries, including the automotive industry. In this regard, Europe produced 14.8 million vehicles in 2023, including 12.2 million cars.

Additionally, the major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. The composite coatings market will observe the highest growth within the Asia Pacific region during the forecast period because its usage will grow due to rising demand within the automobile, packaging, and construction sectors. For example, Invest India claims that the Indian construction market will reach USD 1.4 trillion by 2025, whereas the cities alone will contribute 70% of the national GDP.

Composite coatings market key developments:

The major composite coatings market leaders are Evonik and Avient Corporation, among others. These players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For Instance,

- In September 2024, Coating Additives from Evonik presented innovative biosurfactants for use in coatings and ink formulations. High performance is expected to pair with an outstanding sustainability profile owing to the new TEGO Wet 570 Terra and TEGO Wet 580 Terra products.

- In July 2024, Allnex, the global leader in sustainable and innovative resins for industrial coatings, launched the latest addition to the extensive Composite product line, POLYPLEX 200E.

- In October 2023, Avient Corporation, a leading supplier of specialty and sustainable material solutions and services, showcased its range of composite solutions, including new ballistic-resistant panels, at the Composite and Advanced Materials Expo (CAMX) in Atlanta next week.

Composite coatings market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Composite Coatings Market Size in 2025 | US$2.477 Billion |

| Composite Coatings Market Size in 2030 | US$3.460 Billion |

| Growth Rate | CAGR of 6.91% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Composite Coatings Market |

|

| Customization Scope | Free report customization with purchase |

Composite Coatings Market Segmentation:

- By Technique

- Laser Melt Injection

- Brazing

- Electroless Plating

- Others

- By Application

- Anti-Corrosion

- UV Protection

- Thermal Protection

- Others

- By End User Industry

- Aerospace

- Automotive

- Construction

- Marine

- Oil & Gas

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America