Report Overview

Artificial Intelligence (AI) In Highlights

Artificial Intelligence (AI) in Oil And Gas Market Size:

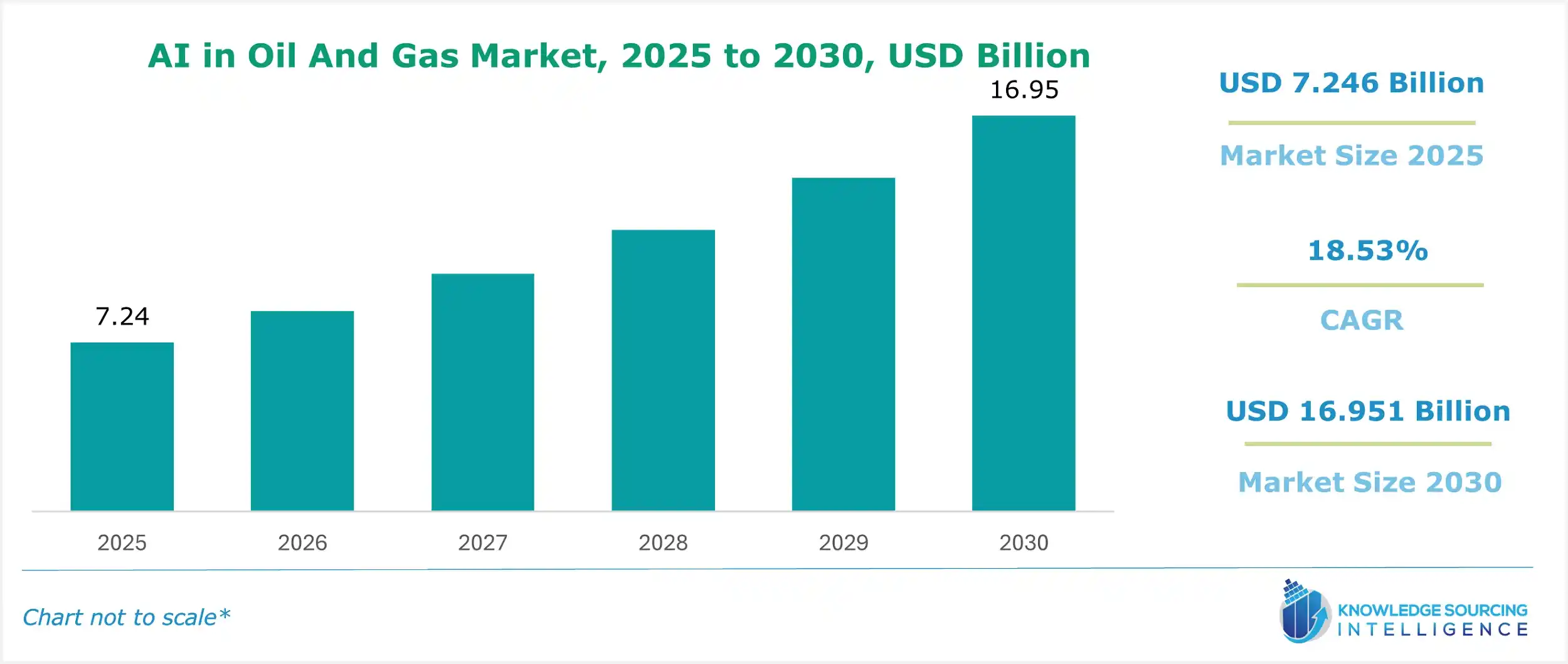

Artificial intelligence (AI) in the oil and gas market is estimated to reach US$16.951 billion by 2030 from US$7.246 billion in 2025, growing at a CAGR of 18.53%.

Artificial Intelligence (AI) in the Oil and Gas Market Introduction:

In the oil and gas industry, AI is set to play a key role in multiple applications. The AI-based tools and platforms can understand and analyze the oil reserve patterns and help in accurately exploring new oil reserves and reducing the cost of operations. These tools also help in monitoring the overall operations of drilling and reducing the occurrence of accidents and fatalities.

Artificial intelligence energy sector applications are revolutionizing oil and gas digitalization. The digital oilfield leverages machine learning upstream to optimize exploration and drilling, enhancing efficiency and reducing costs. Deep learning oilfield models analyze seismic data, improving reservoir characterization and production forecasting. Data analytics oil and gas solutions process vast datasets, enabling predictive maintenance and real-time decision-making. By integrating AI, operators streamline operations, minimize downtime, and enhance safety. This technological shift drives smarter resource management, positioning the industry for sustainable growth in a data-driven era.

A major factor propelling the utilization of AI in the oil and gas industry is forecasted to be the increasing demand for oil and gas worldwide. With this increasing demand, production will witness an increase. Various companies and organizations are applying AI-based tools to reduce operation time and cost, and also to identify new exploration locations to boost production.

The global production of oil and gas has increased significantly over the years. The Enerdata, in its report, stated that in 2022, the total crude oil produced by the USA was recorded at 756 Mt, whereas Canada and China produced about 285 Mt and 205 Mt, respectively. In 2023, the production of crude oil by the USA increased to 820 Mt, whereas Canada produced 289 Mt, and China produced 209 Mt of crude oil.

Artificial intelligence (AI) in the oil and gas market is estimated to grow at a steady rate during the forecast period. The increasing global oil and gas production is pushing the market forward. Furthermore, the rising integration of AI across multiple industries will also boost the market for AI in oil and gas during the forecasted timeline.

Artificial Intelligence (AI) in Oil and Gas Market Trends:

AI is reshaping the oil and gas industry, driving cost reduction in oil and gas through optimized drilling and predictive maintenance. Operational efficiency energy improves with smart oilfield technologies, leveraging real-time data for streamlined operations. Enhanced oil recovery AI boosts production by refining reservoir management. Risk mitigation AI minimizes safety and environmental hazards through advanced analytics. ESG in oil and gas AI aligns operations with sustainability goals, supporting decarbonization energy AI initiatives. Energy transition AI facilitates cleaner practices, reducing emissions while maintaining productivity, positioning the industry for a sustainable, technology-driven future.

Artificial Intelligence (AI) in Oil and Gas Market Growth Drivers:

- Higher rate of accidents in oil and gas production

In the oil and gas industry, AI will play a key role in applications, like detecting defects, maintaining services, understanding the drilling pattern, and exploring oil & gas reserves. The major application of AI in the industry is the detection of defects in systems and machinery, which can help reduce accidents and fatalities during the production of oil and gas.

The number of accidents and fatalities during the production of oil and gas worldwide is increasing, and this figure can be reduced by integrating AI into the operations. The International Association of Oil & Gas Producers, or IOGP, in its report, stated that in 2023, the total cost of the work day (LWDC), which involves incidents of injuries, was recorded at 563 incidents related to contractors and 187 incidents related to the company. The report further stated that by activity, maintenance caused about 20.6% of the total loss of work days in 2023, followed by 17.6% caused by drilling and 16.4% caused by production.

- Integration of new-age technology in the sector.

The Oil and Gas industry has been driven significantly by AI and reinvention in recent years. AI impacted the exploratory upstream use cases and unlocked the efficiencies for new, less carbon-intensive business models and customer-facing scenarios in energy retail. GenAI will play a growing role in the sector’s AI applications. The integration of AI can be helpful for demand forecasting models, optimum inventory levels in the supply chain network, and algorithm-driven pricing strategies.

In the upstream Oil and Gas sector, AI-enabled technologies such as deep learning are being used to analyze complex seismic data for identifying potential hydrocarbon reservoirs. Additionally, AI-based prediction of drilling complications and real-time optimization of drilling parameters have provided organizations with operational efficiency. The integration of AI tools across the energy value chain, from upstream exploration and production to midstream storage and downstream refining and distribution, makes a significant shift toward safety, security, and operational efficiencies.

With the growing energy needs worldwide, the need for oil and gas will also increase. As the world’s crude reserves discoveries are increasing year on year, the demand for upstream operations to extract these fuels will increase the application of artificial intelligence in extracting the technologies. The total crude oil reserves were 1558.63 billion barrels in 2021, increased to 1563.74 billion barrels in 2022, and reached 1569.52 billion barrels in 2023. The growing investment in upstream operations will likely increase the overall number of AI technological applications.

Artificial Intelligence (AI) in Oil and Gas Market Geographical Outlook:

- The North American region is expected to witness significant growth in artificial intelligence (AI) in the oil and gas market.

The North American region is expected to propel the growth of the global AI in the oil and gas market during the forecasted timeline. The USA held the dominant share in artificial intelligence, owing to the concentration of major industries, favorable government policies, and increasing construction expenditure. OPEC America's crude reserves were 52.23 billion barrels in 2021, which increased to 55.71 billion barrels in 2022 and reached 58.27 billion barrels in 2023.

The United States has produced more crude oil and condensate than any nation, according to the International Energy Statistics, for the past six years. U.S. crude oil and lease condensate production increased 6% in 2022. Crude oil production in the United States, including condensate, averaged 12.9 million barrels per day (b/d) in 2023, followed by Russia with 10.1 million barrels per day (b/d), and Saudi Arabia with 9.7 million barrels per day (b/d).

This increased production of crude oil led the U.S. Department of Energy (DOE) to take a series of actions delivering on the development and use of Artificial Intelligence. Further, in June 2024, TGS announced a strategic partnership with PetroAI. This collaboration aimed to provide E&P companies with an integrated solution that allows users to access TGS's licensed data via the PetroAI platform. PetroAI would utilize TGS's extensive subsurface, production, and well data to create advanced AI models capable of accurately predicting performance and identifying design sensitivities.

In January 2024, SLB announced an investment and technology partnership agreement with Geminus AI. This gives SLB exclusive access to deploying the first physics-informed AI model builder for Oil and Gas operations. The Geminus model builder fuses physics-based approaches with process data to produce accurate AI models that can be deployed.

Moreover, the United States has become a major hub for global artificial intelligence research, development, and deployment. The number of foundation models in 2023 was 109 for the United States, way higher than the second most prominent country, China, with 20 foundation models. Foundation models represent frontier AI research.

Asia-Pacific, led by China and India, is a fast-growing market due to energy demand and digital transformation. Europe focuses on sustainable energy solutions, while the Middle East and Africa, and South America are emerging markets. Challenges like data security persist, but secure AI frameworks mitigate these issues. The AI in oil and gas market thrives on energy innovation, data-driven solutions, and regional leadership, with North America at the forefront.

Artificial Intelligence (AI) in Oil and Gas Market Key Developments:

- In November 2024, ADNOC, or Abu Dhabi National Oil Company, announced the development of a state-of-the-art Agentic AI solution, which is aimed at transforming the global energy market, in partnership with AIQ. The company stated that the solution aims to bring autonomy and enhance precision for multiple critical tasks.

List of Top Artificial Intelligence (AI) In Oil And Gas Companies:

- Wipro

- NVIDIA Corporation

- Advanced Micro Devices, Inc.

- Huawei Technologies Co., Ltd.

- Signity Software Solutions

Artificial Intelligence (AI) in Oil And Gas Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Artificial Intelligence (AI) In Oil And Gas Market Size in 2025 | US$7.246 billion |

| Artificial Intelligence (AI) In Oil And Gas Market Size in 2030 | US$16.951 billion |

| Growth Rate | CAGR of 18.53% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Artificial Intelligence (AI) In Oil And Gas Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Intelligence (AI) in the Oil and Gas Market is analyzed into the following segments:

- By Operation

- Upstream

- Midstream

- Downstream

- By Application

- Surface Analysis

- Defect Detection

- Drilling and Completions

- Gathering and Transportation

- Processing and Refining Maintenance

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

- Others

- Asia Pacific Region

- China

- Japan

- India

- Indonesia

- Taiwan

- Others

- North America