Report Overview

Compound Feed Market - Highlights

Compound Feed Market Size:

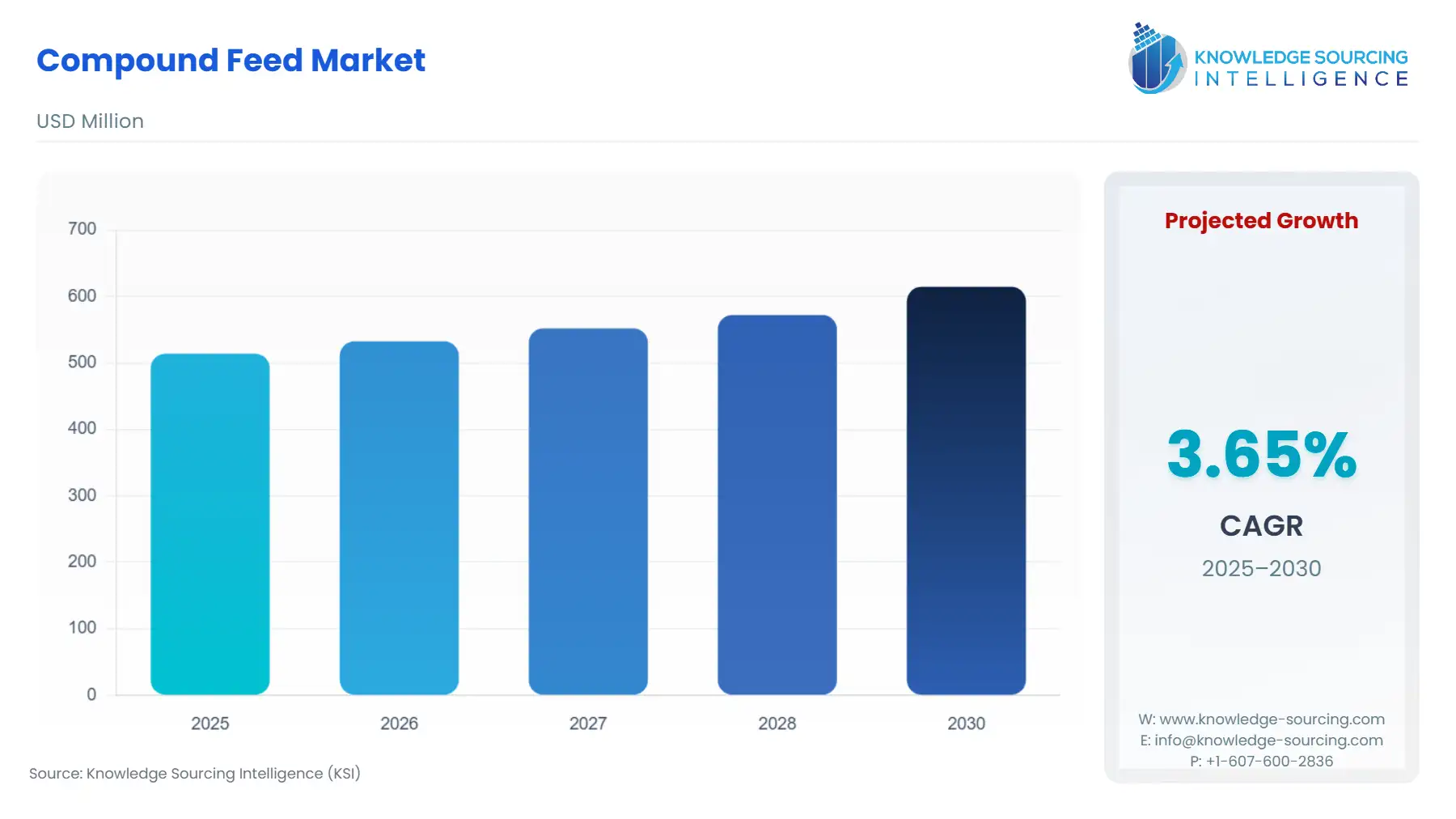

The Compound Feed Market will reach USD 614.788 million in 2030 from USD 513.970 million in 2025 at a CAGR of 3.65% during the forecast period.

Compound Feed Market Introduction:

The Compound Feed Market is a critical pillar of global agriculture, underpinning the animal nutrition market by providing balanced, nutrient-rich livestock feed tailored to the specific needs of various species, including poultry, swine, ruminants, and aquatic animals. Compound feed consists of blended ingredients such as grains, oilseeds, vitamins, minerals, and feed additives, formulated to optimize animal health, growth, and productivity. This market supports the animal protein production sector, which includes meat, dairy, eggs, and seafood, addressing the rising global demand for protein-rich foods driven by population growth, urbanization, and changing dietary preferences. The Asia Pacific region, particularly China and India, leads in compound feed consumption due to its large livestock populations and robust poultry feed, swine feed, ruminant feed, and aquafeed sectors. As a cornerstone of modern livestock and aquaculture industries, the compound feed industry plays a pivotal role in ensuring food security, enhancing animal welfare, and supporting sustainable farming practices.

The Compound Feed Market is characterized by its focus on precision nutrition, where feed additives like amino acids, enzymes, probiotics, and vitamins are integrated to improve feed efficiency and animal performance. For instance, Evonik Industries AG launched an enhanced Biolys® product, a lysine-based feed additive for livestock feed, delivering higher nutrient concentration for poultry and swine. The market’s scope extends across diverse applications, with poultry feed dominating due to the global preference for affordable, low-fat poultry meat and eggs. Swine feed supports pork production, particularly in the Asia Pacific, while ruminant feed caters to the dairy and beef industries. Aquafeed is a fast-growing segment, driven by the expansion of aquaculture to meet seafood demand. For example, Cargill invested $50 million in R&D facilities in China and the Netherlands to advance aquafeed formulations, reflecting the sector’s innovation focus.

The animal nutrition market is shaped by technological advancements, such as automation in feed production and the use of AI to optimize formulations. In June 2024, IFF’s Danisco Animal Nutrition & Health unit received EU approval for two chicken feed additives, Axtra® XAP and Syncra® AVI, enhancing poultry feed efficiency. The industry also responds to consumer demands for sustainability, with compound feed manufacturers incorporating alternative protein sources like insect meal and algae to reduce environmental impact. The Asia Pacific region, with 47.5% of the world’s top feed producers, drives innovation and production scale, as noted in Feed International’s report.

The Compound Feed Market is propelled by several key drivers. First, rising global demand for animal protein production fuels the need for high-quality livestock feed. The FAO projected a 14% increase in global meat consumption by 2030, driven by population growth and rising incomes. Second, technological advancements in feed additives and precision nutrition enhance feed efficiency, as seen in Nutreco’s launch of a Hyderabad facility for poultry and aquafeed. Third, the expansion of aquaculture drives aquafeed demand, with the Asia Pacific leading production. Finally, sustainability initiatives, such as using by-products in compound feed, support eco-friendly practices, aligning with global environmental goals.

The market faces challenges, including volatile raw material prices, such as corn and soybeans, which impact compound feed costs. Stringent regulations, like the EU’s ban on certain antibiotic feed additives, increase compliance costs. Additionally, disease outbreaks, such as African swine fever, disrupt swine feed demand, particularly in the Asia Pacific. Consumer shifts toward plant-based diets also pose a long-term challenge to animal protein production.

The Compound Feed Market is integral to the animal nutrition market, supporting animal protein production through specialized poultry feed, swine feed, ruminant feed, and aquafeed. Driven by rising protein demand, technological advancements, and sustainability efforts, the market is poised for growth, particularly in the Asia Pacific. Despite challenges like raw material price volatility and regulatory constraints, innovations in feed additives and precision nutrition ensure the industry’s resilience. As global food systems evolve, the compound feed industry will remain essential for efficient, sustainable livestock and aquaculture production, meeting the nutritional needs of a growing population.

Compound Feed Market Overview:

The compound feed market is a cornerstone of the global agricultural industry, providing essential nutrition to livestock, poultry, aquaculture, and other animal sectors. Compound feed, a blend of raw materials and additives formulated to meet the specific nutritional needs of animals, plays a critical role in ensuring efficient animal growth, health, and productivity. As global demand for animal-derived products like meat, dairy, and eggs continues to rise, the compound feed market has become increasingly vital in supporting sustainable and efficient food production systems.

Compound feed is a scientifically formulated mixture of ingredients such as grains, protein meals, vitamins, minerals, and additives designed to optimize animal performance. Unlike traditional feed, which may consist of single ingredients like hay or grains, compound feed is tailored to meet the precise nutritional requirements of different animal species, ages, and production goals (e.g., growth, milk production, or egg-laying). The market encompasses feed for poultry, swine, cattle, aquaculture, and other animals, with applications spanning commercial farming, smallholder operations, and integrated agribusinesses.

The global compound feed market is a dynamic and rapidly evolving sector, driven by the increasing global population, rising per capita income, and shifting dietary preferences toward protein-rich foods. According to the Food and Agriculture Organization (FAO), global meat consumption is projected to increase by 14% by 2030 compared to the 2020-2022 baseline, driven largely by population growth and urbanization in developing regions. This surge in demand for animal-based products directly fuels the need for high-quality compound feed to support efficient livestock and aquaculture production.

The market is characterized by a diverse supply chain, including raw material suppliers (e.g., corn, soybean, and wheat producers), feed manufacturers, and distributors. Major players in the industry, such as integrated agribusinesses and specialized feed producers, leverage advanced technologies like precision nutrition and automated feed formulation to enhance product quality and meet regulatory standards. The market also operates within a complex regulatory framework, with governments and international bodies setting standards for feed safety, quality, and environmental sustainability.

Compound Feed Market Trends:

The Compound Feed Market is evolving rapidly, driven by technological innovation and sustainability demands. Precision nutrition is a key trend, leveraging AI and data analytics to formulate feeds that optimize animal health and feed conversion ratio (FCR). IFF’s Danisco Animal Nutrition & Health unit introduced AI-driven feed additives to enhance poultry efficiency, improving nutrient absorption.

Sustainable animal feed is gaining traction, with manufacturers adopting bio-based ingredients like insect meal and algae to reduce environmental impact. For instance, Nutreco launched a sustainable animal feed initiative in India, incorporating plant-based proteins.

The circular economy is reshaping the market, with by-products like food waste being repurposed into feed. This approach aligns with traceability efforts to ensure supply chain transparency. Cargill expanded its circular economy feed program in Asia, enhancing feed safety.

Feed safety remains critical, with stricter regulations driving quality control. Recently, India’s National Livestock Mission emphasized traceability in feed production to meet global standards. These trends position the market to meet rising animal protein demand sustainably and efficiently.

Compound Feed Market Drivers:

- Rising Demand for Animal Protein

The global population is projected to reach 8.5 billion by 2030, with significant growth in developing regions such as Asia, Africa, and Latin America. Urbanization and rising disposable incomes are driving a shift toward protein-rich diets, particularly meat, dairy, and eggs. According to the FAO, global meat consumption is expected to increase by 14% by 2030 compared to the 2020-2022 baseline, with poultry meat consumption in Asia projected to grow by 16%. This surge in demand for animal-derived products necessitates expanded production of compound feed to support efficient livestock and poultry farming. For instance, poultry, which accounts for a significant share of compound feed consumption, requires high-quality feed to achieve rapid growth and feed conversion efficiency, driving market growth.

- Advancements in Feed Technology

Innovations in feed formulation and production technologies are enhancing feed efficiency, animal health, and productivity. Precision nutrition, enabled by data analytics and IoT, allows manufacturers to tailor feed compositions to specific animal needs, optimizing nutrient uptake and reducing waste. In 2024, the International Feed Industry Federation (IFIF) reported the introduction of a new enzyme-based feed additive that improved nutrient absorption in poultry by 10%, reducing feed costs and environmental impact. Additionally, advancements in feed additives, such as probiotics, prebiotics, and phytogenics, are improving gut health and immunity in animals, further driving market demand. These technological developments enable producers to meet stringent quality standards and cater to the growing demand for high-performance feed.

- Sustainability and Circular Economy Initiatives

The push for sustainable agriculture is transforming the compound feed market, with increased focus on eco-friendly feed solutions. Manufacturers are incorporating by-products like distillers’ grains, food waste, and agricultural residues into feed formulations to reduce reliance on virgin resources and minimize environmental impact. In 2025, the European Feed Manufacturers’ Federation (FEFAC) launched comprehensive guidelines promoting the use of circular feed ingredients, aligning with the European Union’s Green Deal objectives to achieve climate neutrality by 2050. These initiatives not only address environmental concerns but also reduce production costs, making sustainable feed solutions attractive to producers. The adoption of circular economy principles is particularly significant in regions with stringent environmental regulations, driving innovation in the market.

- Growth in Aquaculture

The aquaculture sector is a rapidly growing segment of the compound feed market, driven by increasing global demand for fish and seafood. The FAO estimates that aquaculture will account for 59% of global fish supply by 2030, fueled by consumer preferences for healthy, protein-rich foods. Specialized aquafeed, designed to optimize fish growth and minimize environmental pollution, is a critical driver. Recent developments include the use of alternative protein sources, such as insect meal and algae-based feeds, to reduce reliance on fishmeal. In 2025, the Global Seafood Alliance highlighted a partnership between a major feed producer and a biotech firm to develop algae-based omega-3 supplements for aquafeed, addressing sustainability concerns. The growth of aquaculture, particularly in the Asia-Pacific region, is a significant catalyst for the compound feed market.

Compound Feed Market Restraints:

- Raw Material Price Volatility

The prices of key feed ingredients, such as corn, soybeans, and fishmeal, are highly volatile due to factors like weather conditions, geopolitical tensions, and trade disruptions. For example, in 2024, drought conditions in South America led to a 15% increase in soybean prices, significantly impacting feed production costs, as reported by the United States Department of Agriculture (USDA). This volatility creates uncertainty for feed manufacturers, who must balance cost increases with competitive pricing. Small and medium-sized producers, in particular, face challenges in absorbing these price fluctuations, which can erode profit margins and limit market growth.

- Stringent Regulatory Constraints

The compound feed industry operates under strict regulatory frameworks governing feed safety, quality, and environmental impact. Governments and international bodies impose restrictions on the use of certain additives, such as antibiotics, to address concerns like antimicrobial resistance. According to the European Medicines Agency, in 2023, the European Union implemented tighter regulations on antibiotic use in animal feed, requiring manufacturers to reformulate products and invest in alternative solutions. Compliance with these regulations increases production costs and complexity, particularly for manufacturers operating in multiple regions with varying standards. Additionally, regulations on genetically modified organisms (GMOs) and feed additives can limit innovation and market access in certain regions.

- Environmental Concerns

The environmental footprint of feed production, particularly related to deforestation for soybean cultivation and overfishing for fishmeal, is a significant challenge. The World Resources Institute reported in 2024 that 20% of global soybean production for animal feed contributes to deforestation, raising concerns about biodiversity loss and carbon emissions. Similarly, overfishing for fishmeal production has led to declining fish stocks, prompting calls for sustainable alternatives. Public pressure and regulatory scrutiny are pushing manufacturers to adopt eco-friendly practices, such as using plant-based or lab-grown feed ingredients. However, these solutions often involve higher costs and require significant investment in research and development, posing a restraint on market growth.

- Competition from Alternative Feed Sources

The rise of alternative feed sources, such as single-cell proteins, insect-based feeds, and plant-based diets for animals, is creating competition for traditional compound feed. While these alternatives align with sustainability goals, their scalability and cost-effectiveness remain challenges. For instance, a 2025 IFIF report noted that insect-based feed, while promising, is 20-30% more expensive than conventional feed due to limited production capacity. This competition could fragment the market, particularly in regions where cost sensitivity is high, and slow the adoption of traditional compound feed in certain segments.

Compound Feed Market Segment Analysis:

- By Ingredients, Cereals will hold a major market share

Cereals, such as corn, wheat, barley, and rice, are the dominant ingredient segment in the compound feed market due to their widespread availability, cost-effectiveness, and high carbohydrate content, which provides energy for livestock, poultry, and aquaculture. Cereals account for a significant portion of feed formulations, often comprising 50-70% of the total composition, depending on the animal type and production goals. Their prominence is driven by their role as a primary energy source, supporting rapid growth and efficient feed conversion ratios (FCR).

The demand for cereals in compound feed is closely tied to global agricultural production and consumption trends. According to the FAO, global cereal production reached 2.8 billion tonnes in 2024, with corn and wheat being the most widely used in animal feed due to their high starch content and affordability. Corn, in particular, is a staple in poultry and swine feed, especially in regions like North America and Asia, where large-scale farming is prevalent. In 2024, the United States Department of Agriculture (USDA) reported that approximately 40% of U.S. corn production was directed toward animal feed, underscoring its critical role.

Recent developments highlight efforts to improve cereal-based feed efficiency. For instance, precision milling and processing techniques are being adopted to enhance the digestibility of cereals, reducing waste and improving nutrient uptake. In 2025, the International Feed Industry Federation (IFIF) noted that advanced cereal processing technologies increased feed efficiency by 8% in poultry diets. However, cereal prices are subject to volatility due to weather patterns, trade policies, and competing demands from the human food and biofuel sectors. For example, drought conditions in 2024 led to a 10% rise in global corn prices, impacting feed production costs, as reported by the USDA. Despite these challenges, cereals remain the backbone of the compound feed market due to their scalability and nutritional value.

- By Nutrients, the feed enzymes segment is growing notably

Feed enzymes are one of the largest and fastest-growing nutrient segments in the compound feed market, driven by their ability to enhance nutrient digestibility, improve feed efficiency, and reduce environmental impact. Enzymes such as phytases, proteases, and amylases break down complex nutrients like phytate, proteins, and starches, making them more bioavailable to animals. This segment is particularly significant in poultry and swine feed, where enzymes help optimize growth rates and reduce feed costs.

The adoption of feed enzymes is fueled by the need for sustainable and cost-effective feed solutions. In 2024, the IFIF reported that enzyme-based feed additives improved nutrient absorption in poultry by 10%, lowering feed requirements and reducing phosphorus excretion by up to 30%. This is critical in addressing environmental concerns, as excess phosphorus in animal waste can contribute to water pollution. Additionally, enzymes enable the use of lower-cost, less digestible ingredients, such as barley or wheat by-products, without compromising animal performance.

Regulatory support for reducing antibiotic use in animal feed has further boosted the enzyme market, as enzymes serve as a natural alternative to growth promoters. In 2023, the European Medicines Agency noted that stricter EU regulations on antibiotics increased demand for enzyme-based solutions. Innovations in enzyme technology, such as thermostable phytases that withstand high pelleting temperatures, are also driving growth. In 2025, a leading feed additive company introduced a new phytase enzyme that improved phosphorus utilization in swine by 15%, as highlighted by the IFIF. The feed enzyme segment is expected to continue its upward trajectory as producers prioritize sustainability and efficiency.

- By Feed Form, solid feeds are expected to have a large market share

Solid feed, encompassing pellets, crumbles, and mash, dominates the compound feed market due to its ease of handling, storage, and consumption compared to liquid feed. Solid feed is widely used across poultry, swine, and ruminant sectors, with pellets being the most common form due to their uniformity, reduced waste, and improved palatability. Solid feed accounts for the majority of global feed production, as it supports efficient delivery of balanced nutrients and is compatible with automated feeding systems.

The preference for solid feed is driven by its practicality and cost-effectiveness in large-scale farming. Pelleted feed, in particular, improves feed conversion efficiency by 5-10% compared to mash, as noted by an IFIF report, due to reduced feed wastage and better nutrient absorption. Advances in pelleting technology, such as high-pressure extrusion, have further enhanced the quality of solid feed, ensuring consistent nutrient distribution and durability during transport. In 2025, the European Feed Manufacturers’ Federation (FEFAC) reported that modern pelleting systems reduced energy consumption in feed production by 12%, aligning with sustainability goals.

Solid feed’s dominance is also supported by its adaptability to diverse animal types and production systems. For example, in poultry farming, pelleted feed is tailored to different growth stages, ensuring optimal nutrition delivery. However, challenges such as high production costs for pelleting and the need for specialized equipment can limit adoption in smallholder farms, particularly in developing regions.

- By Animal Type, the Poultry segment will witness significant growth

Poultry is the largest animal type segment in the compound feed market, driven by the global demand for poultry meat and eggs, which are affordable and widely consumed protein sources. The FAO projects that poultry meat consumption will increase by 16% in Asia by 2030, reflecting urbanization and rising incomes. Poultry feed, formulated for broilers, layers, and breeders, requires precise nutrient profiles to support rapid growth, egg production, and feed efficiency.

The poultry segment benefits from advancements in feed formulation, such as the use of enzymes and amino acids to optimize FCR. In 2024, the Global Poultry Trends report noted that precision nutrition in poultry feed reduced feed costs by 8% in large-scale operations. Additionally, the shift toward antibiotic-free production has driven demand for alternative additives like probiotics, which enhance gut health. In 2025, the IFIF highlighted a new probiotic feed additive that improved poultry weight gain by 7%.

The poultry feed market is also influenced by consumer preferences for sustainable and ethical products, prompting producers to adopt eco-friendly ingredients like insect meal. However, disease outbreaks, such as avian influenza, pose risks to the poultry sector, impacting feed demand, as noted by the World Organisation for Animal Health in 2024.

Compound Feed Market Geographical Outlook:

- The Asia Pacific market is growing substantially

The Asia Pacific region is the largest and fastest-growing market for compound feed, driven by its large population, rapid urbanization, and increasing demand for animal protein. Countries like China, India, Japan, Thailand, and Indonesia are key contributors, with China and India leading due to their massive livestock and poultry sectors. The FAO estimates that the Asia Pacific will account for over 50% of global meat consumption by 2030.

In China, the world’s largest pork and poultry market, compound feed demand is driven by industrial-scale farming and government support for modern agriculture. In 2024, the Asian Development Bank reported that IoT-enabled feed monitoring systems improved feed efficiency in Chinese poultry farms.

System: 10% in aquaculture by 12%, as documented by the Asian Development Bank. The Asia Pacific region’s growth is further supported by rising investments in alternative protein sources, such as insect-based feed, which saw a 20% increase in production capacity in 2025, according to the IFIF.

Compound Feed Market Key Developments:

- January 2026: ADM and Alltech announced the official first-quarter launch of their North American animal feed joint venture, consolidating 43 feed mills to serve livestock and equine customers.

- December 2025: Nutreco announced a strategic collaboration with Fork & Good and Extracellular to develop cost-efficient, large-scale cultivated red meat ecosystems, advancing alternative protein sources in animal nutrition.

- November 2025: Cargill announced a significant expansion of its micronutrition production capacity, aiming to meet the rising global demand for specialized, high-performance feed additives for various species.

- November 2025: Louis Dreyfus Company inaugurated a new specialty feed protein production line in Tianjin, China, focused on fermented soybean meal (60,000 t capacity) to supply high-quality protein ingredients for livestock feed.

- September 2025: ADM and Alltech agreed to form a North American animal-feed joint venture, combining U.S. and Canadian feed mills with launch expected in Q1 2026 to strengthen compound feed supply and specialty nutrition business.

- September 2025: De Heus announced expansion with a new feed mill in India, investing ~$20 million to build a 250,000 t/year compound feed facility (dairy, buffalo, and poultry feed) scheduled to begin Q3 2025 operations.

Compound Feed Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 513.970 million |

| Total Market Size in 2031 | USD 614.788 million |

| Growth Rate | 3.65% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Ingredients, Nutrients, Feed Form, Animal Type |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Compound Feed Market Segmentation:

The compound feed market is analysed by ingredients into the following:

- Cereals

- Cereal's by-product

- Oil

- Oilseed meal

- Supplements

- Molasses

- Others

Compound Feed Market Segmentation by Nutrients:

Feed enzymes is one of the largest market segments. The report analysed the compound feed market into different services as below:

- Antioxidants

- Antibiotics

- Feed Enzymes

- Vitamins

- Feed Acidifiers

- Amino Acids

- Others

Compound Feed Market Segmentation by Feed Form:

- Solid

- Liquid

Compound Feed Market Segmentation by Animal Type:

The report analysed the compound feed market for 4 animal type segments as following:

- Swine

- Poultry

- Ruminants

- Others

Compound Feed Market Segmentation by regions:

The study also analysed the Compound Feed Market into the following regions, with country-level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and the Rest of South America)

- Europe (Germany, UK, France, Spain, and the Rest of Europe)

- Middle East and Africa (Saudi Arabia, UAE, and the Rest of the Middle East and Africa)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)