Report Overview

Contrast Injector Market Report Highlights

Contrast Injector Market Size:

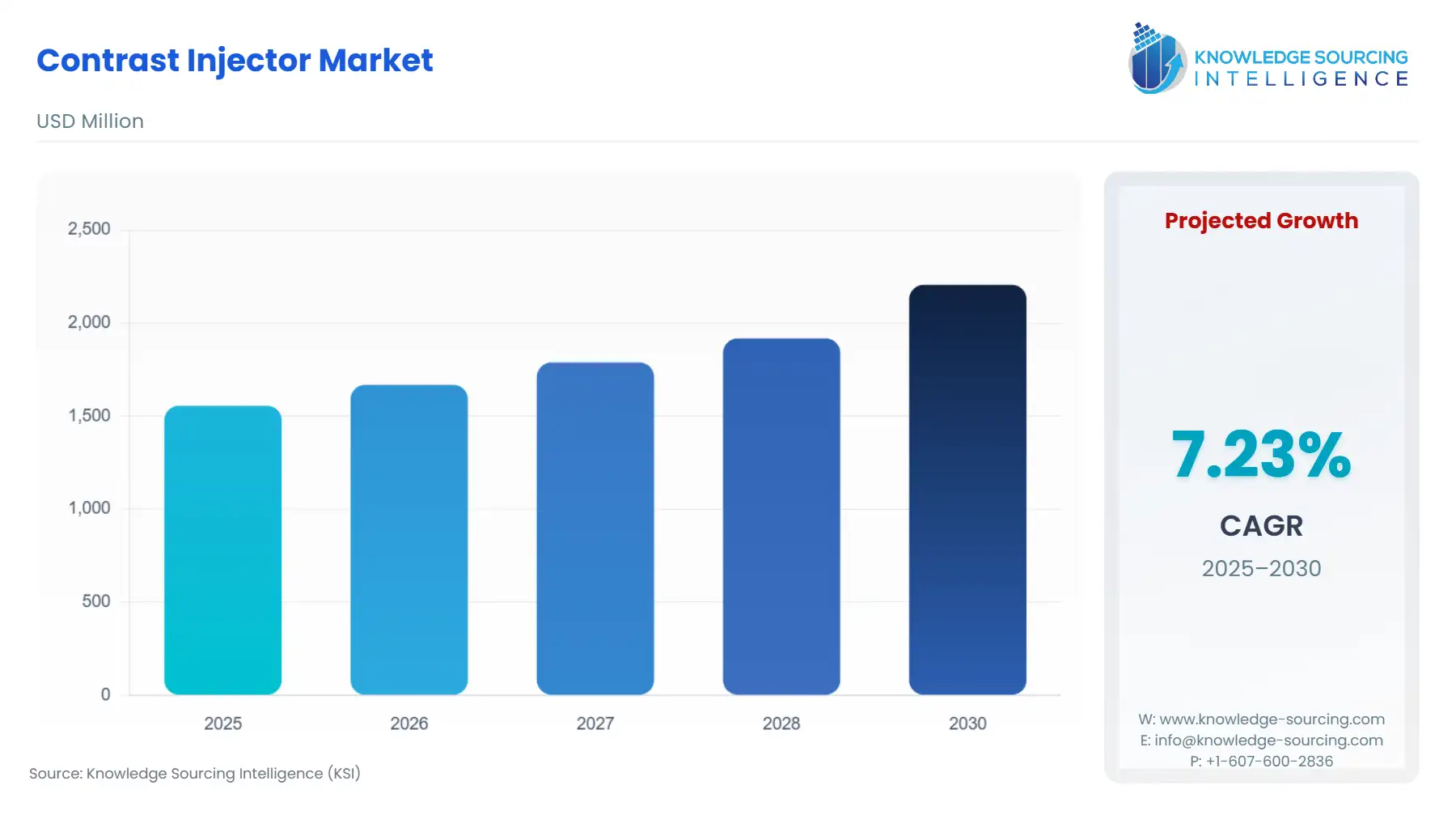

The Contrast Injector Market is expected to grow from USD 1.556 billion in 2025 to USD 2.206 billion in 2030, with a 7.24% CAGR.

Introduction to the Contrast Injector Market:

The contrast injector market plays a pivotal role in modern medical imaging, enabling precise delivery of contrast agents to enhance diagnostic accuracy in procedures such as computed tomography (CT), magnetic resonance imaging (MRI), and angiography. Contrast injectors are advanced medical devices that administer contrast media—specialized dyes or agents—into patients’ bloodstreams to improve the visibility of tissues, organs, or blood vessels during imaging. These devices have become indispensable in radiology departments, diagnostic centers, and hospitals worldwide, driven by the growing demand for accurate, non-invasive diagnostic tools. As healthcare systems prioritize early detection and precise diagnosis of chronic and acute conditions, the contrast injector market is experiencing significant growth, fueled by technological advancements, rising disease prevalence, and an aging global population. However, the market also faces challenges, including high costs and regulatory hurdles, which impact adoption rates and market expansion.

Contrast injectors are automated systems designed to deliver precise volumes of contrast media at controlled rates, ensuring optimal imaging results while minimizing patient discomfort and risks. These devices are critical in enhancing the clarity of images produced by CT, MRI, and other imaging modalities, enabling clinicians to diagnose conditions such as cardiovascular diseases, cancers, and neurological disorders with greater accuracy. The market encompasses a range of injector types, including single-head, dual-head, and syringeless injectors, each tailored to specific imaging needs. Applications span diagnostic imaging, interventional radiology, and research settings, with hospitals and diagnostic centers being the primary end-users.

The global demand for contrast injectors is closely tied to the increasing reliance on diagnostic imaging. According to the WHO, non-communicable diseases (NCDs) such as cardiovascular diseases and cancer account for approximately 71% of global deaths annually, necessitating advanced diagnostic tools for early detection and treatment planning. The rise in imaging procedures, coupled with innovations in injector technology, has positioned the contrast injector market as a critical component of the broader medical imaging industry. In early 2025, a major medical device company partnered with a leading AI firm to develop injectors with predictive analytics, enabling personalized contrast dosing based on patient profiles. Additionally, manufacturers are focusing on eco-friendly designs, with one company launching a recyclable syringe system in 2024 to reduce medical waste. These developments underscore the industry’s commitment to improving efficiency, safety, and sustainability.

Contrast Injector Market Drivers:

- Rising Prevalence of Chronic Diseases

The global surge in chronic NCDs, such as cardiovascular diseases, cancer, and diabetes, significantly drives demand for diagnostic imaging, where contrast injectors play a pivotal role. According to the World Health Organization (WHO), NCDs account for approximately 71% of global deaths annually, with cardiovascular diseases alone causing 17.9 million deaths each year. In 2024, the American Heart Association reported that cardiovascular diseases remain the leading cause of mortality in the United States, with over 800,000 deaths annually, necessitating advanced imaging for diagnosis and monitoring. Contrast-enhanced imaging, facilitated by injectors, is essential for detecting conditions like coronary artery disease, tumors, and vascular abnormalities. The increasing incidence of these conditions, particularly in aging populations, fuels the need for high-quality imaging, directly boosting the contrast injector market.

- Technological Advancements in Injector Systems

Innovations in contrast injector technology are transforming radiology workflows, improving patient safety, and enhancing diagnostic accuracy. Modern injectors feature automated flow control, real-time pressure monitoring, and integration with imaging systems, reducing the risk of complications and optimizing contrast media usage. In 2024, a leading medical device manufacturer launched a dual-head injector with AI-driven dose optimization, capable of reducing contrast waste by up to 20% while ensuring precise delivery. Additionally, wireless connectivity and cloud-based data integration allow injectors to interface seamlessly with hospital information systems, streamlining operations in busy radiology departments. A 2025 collaboration between a major device company and an AI firm introduced injectors with predictive analytics, tailoring contrast dosing to individual patient profiles, further improving outcomes. These advancements attract healthcare providers seeking to enhance efficiency and patient care, driving market adoption.

- Aging Population and Increased Diagnostic Demand

The global aging population is a significant driver, as older adults require more frequent diagnostic imaging for age-related conditions such as cardiovascular disease, cancer, and neurological disorders. The United Nations projects that the population aged 65 and older will reach 1.5 billion by 2050, with significant growth in regions like Europe, North America, and Asia. This demographic shift increases the demand for contrast-enhanced imaging to diagnose conditions like stroke, dementia, and osteoporosis. For example, a 2024 study by the National Institute on Aging highlighted that imaging procedures for elderly patients have risen by 12% globally over the past five years, with contrast injectors playing a critical role in ensuring diagnostic accuracy. As healthcare systems adapt to this growing need, the contrast injector market is poised for sustained growth.

- Shift Toward Minimally Invasive Procedures

The growing preference for minimally invasive diagnostics and interventions, such as angioplasty, embolization, and endovascular procedures, relies heavily on contrast-enhanced imaging. Contrast injectors ensure precise delivery of contrast agents, improving visualization during these procedures and enhancing procedural success rates. According to a 2025 report by the Society of Interventional Radiology, contrast-enhanced interventional procedures have increased by 15% over the past two years, driven by advancements in imaging and injector technologies. Additionally, the trend toward outpatient and ambulatory care settings, where minimally invasive procedures are often performed, further amplifies demand for compact, efficient injectors. This shift aligns with patient preferences for less invasive treatments, supporting market expansion.

Contrast Injector Market Restraints:

- High Costs of Equipment and Maintenance

Contrast injectors are sophisticated devices with high acquisition, installation, and maintenance costs, posing a barrier to adoption, especially for smaller hospitals and clinics. For instance, a dual-head injector can cost upwards of $50,000, with additional expenses for service contracts, software updates, and consumables like syringes and tubing. These costs are particularly prohibitive in low- and middle-income countries, where healthcare budgets are constrained. Furthermore, ongoing maintenance and the need for trained personnel to operate and service these devices add to the total cost of ownership, limiting market penetration in resource-constrained settings. This financial barrier restricts the market’s ability to expand uniformly across global healthcare systems.

- Regulatory and Safety Concerns

Stringent regulatory requirements for medical devices, enforced by agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), can delay product approvals and market entry. The approval process for contrast injectors involves rigorous testing for safety, efficacy, and compatibility with contrast agents, which can take years and increase development costs. Additionally, safety concerns related to contrast media, such as nephrotoxicity and allergic reactions, necessitate strict protocols and monitoring, complicating clinical workflows. A 2024 FDA safety communication highlighted the risks of contrast media-related adverse reactions, urging healthcare providers to adopt advanced injector systems with built-in safety features. These regulatory and safety challenges can slow market growth and increase operational complexity for manufacturers and end-users.

- Limited Access in Developing Regions

Inadequate healthcare infrastructure and limited access to advanced imaging technologies in developing countries significantly restrict market growth. The WHO estimates that over 50% of low-income countries lack sufficient radiology services, with many regions facing shortages of imaging equipment and trained radiologists. This gap in infrastructure limits the adoption of contrast injectors, as many facilities rely on outdated or manual imaging methods. Furthermore, the high cost of contrast media and injectors exacerbates access challenges, particularly in rural and underserved areas. While global health initiatives aim to improve access, the pace of progress remains slow, constraining the market’s expansion in these regions.

Contrast Injector Market Segmentation Analysis:

- By Product, the injector systems segment is growing steadily

Injector Systems, encompassing single-head, dual-head, and syringeless injectors, represent the largest product segment in the contrast injector market due to their critical role in delivering contrast media during imaging procedures. These systems are the backbone of contrast-enhanced imaging, offering precision, safety, and integration with advanced imaging modalities like CT and MRI. Their dominance is driven by widespread adoption in hospitals and diagnostic centers, fueled by technological advancements and the increasing volume of imaging procedures.

The demand for injector systems is propelled by the rising prevalence of chronic diseases requiring diagnostic imaging, such as cardiovascular diseases and cancer. The American Heart Association reported in 2024 that cardiovascular diseases account for over 800,000 deaths annually in the U.S., necessitating advanced imaging solutions. Innovations, such as AI-driven dose optimization and real-time pressure monitoring, enhance system efficiency and safety. For instance, a 2024 product launch introduced a next-generation dual-head injector system that reduces contrast waste by up to 20%, improving cost-effectiveness. The shift toward integrated systems that sync with hospital information systems further boosts adoption, as seen in a 2025 collaboration introducing predictive analytics for personalized dosing.

Injector systems dominate due to their essential functionality and ongoing technological upgrades, which cater to the growing need for precise diagnostics. Their versatility across applications like radiology and interventional procedures ensures sustained demand.

- By Technology, the automated injectors are gaining considerable traction

Automated Injectors, which include programmable systems with features like flow control and dose monitoring, are the leading technology segment. Their precision, efficiency, and ability to reduce human error make them the preferred choice in high-volume imaging settings, outpacing manual and dual-head injectors in market share.

Automated injectors are favored for their ability to deliver consistent contrast media doses, minimizing risks like extravasation and overdosing. The integration of AI and connectivity features enhances their appeal. A 2024 advancement introduced automated injectors with wireless connectivity, streamlining radiology workflows. The growing emphasis on patient safety, highlighted by a 2024 FDA safety communication on contrast media risks, drives demand for automated systems with built-in safety protocols. Additionally, the rise in imaging procedures, with a 12% global increase in diagnostic imaging for elderly patients reported by the National Institute on Aging in 2024, underscores the need for automated efficiency. Automated injectors lead due to their technological superiority and alignment with the healthcare industry’s focus on automation and precision, making them indispensable in modern radiology.

- By Application, the radiology sector is growing significantly

Radiology, encompassing diagnostic imaging procedures like CT and MRI, is the largest application segment for contrast injectors. The widespread use of contrast-enhanced imaging in radiology to diagnose conditions like tumors, vascular diseases, and organ dysfunction drives this segment’s prominence.

The increasing burden of chronic diseases fuels radiology’s demand for contrast injectors. The WHO notes that non-communicable diseases cause 71% of global deaths, with cancer and cardiovascular conditions requiring frequent imaging. Technological advancements, such as injectors with real-time monitoring, enhance radiology outcomes, as seen in a 2024 product launch, improving image clarity. The shift toward early diagnosis, supported by a 15% rise in contrast-enhanced procedures reported by the Society of Interventional Radiology in 2025, further drives this segment. Radiology’s dominance stems from its critical role in diagnostics, with contrast injectors enabling high-quality imaging essential for accurate disease detection and management.

- By End-User, Hospitals & Clinics are expected to gain a larger market share

Hospitals & Clinics are the primary end-user segment, accounting for the largest market share due to their high volume of imaging procedures and access to advanced infrastructure. These facilities rely on contrast injectors for routine diagnostics and specialized interventions.

The increasing number of imaging procedures in hospitals, driven by an aging population and chronic disease prevalence, supports this segment’s growth. The United Nations projects that the global population aged 65+ will reach 1.5 billion by 2050, increasing imaging demand. Hospitals adopt advanced injector systems to meet this demand, with a 2025 report noting a 10% rise in hospital-based contrast-enhanced imaging. Investments in integrated technologies and outpatient services further drive adoption in hospitals.

Contrast Injector Market Geographical Outlook:

- The North American market is rising notably

North America, particularly the U.S. and Canada, dominates the contrast injector market due to its advanced healthcare infrastructure, high imaging procedure volumes, and strong adoption of innovative technologies. The region’s market leadership is driven by significant healthcare spending and a high prevalence of chronic diseases.

The U.S. leads due to its high incidence of cardiovascular diseases and cancer, with over 800,000 annual cardiovascular deaths reported in 2024. Advanced imaging facilities and regulatory support from the FDA drive adoption, with safety-focused injector innovations gaining traction. A 2024 launch of AI-enhanced injectors in the U.S. market improved diagnostic efficiency, reinforcing regional growth. Canada’s aging population, projected to grow significantly by 2050, further supports demand. North America’s leadership is driven by its technological advancements, high disease burden, and strong healthcare infrastructure, making it the largest market for contrast injectors.

Contrast Injector Market Key Developments:

- GE Healthcare’s AI-Powered Contrast Injector with Predictive Analytics: In early 2025, GE Healthcare partnered with an AI technology firm to launch an advanced contrast injector system with predictive analytics for CT and angiography procedures. This injector uses machine learning to tailor contrast dosing to individual patient profiles, improving diagnostic accuracy and reducing adverse reactions.

- Bracco’s Eco-Friendly Syringeless Injector System for MRI: In 2024, Bracco introduced a syringeless contrast injector system for MRI, designed to reduce medical waste and improve sustainability in imaging departments. The system uses recyclable components and a closed-loop contrast delivery mechanism, minimizing environmental impact while maintaining precision in contrast administration.

Contrast Injector Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.556 billion |

| Total Market Size in 2031 | USD 2.206 billion |

| Growth Rate | 7.24% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product, Technology, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Contrast Injector Market Segmentations:

- By Injector Type

- Single-Head Injector

- Dual-Head Injectors

- Syringeless Injector

- By Application

- Radiology

- Intervention radiology

- Intervention cardiology

- By End-User

- Hospitals & Clinics

- Diagnostic Centres

- Ambulatory Surgical Centres

- Clinics and Research Institutes

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America

Contrast Injector Market Scope:

| Report Metric | Details |

| Contrast Injector Market Size in 2025 | US$1,236.072 million |

| Contrast Injector Market Size in 2030 | US$1,717.488 million |

| Growth Rate | CAGR of 6.80% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Contrast Injector Market |

|

| Customization Scope | Free report customization with purchase |