Report Overview

Cooling Paste Market - Highlights

Cooling Paste Market Size:

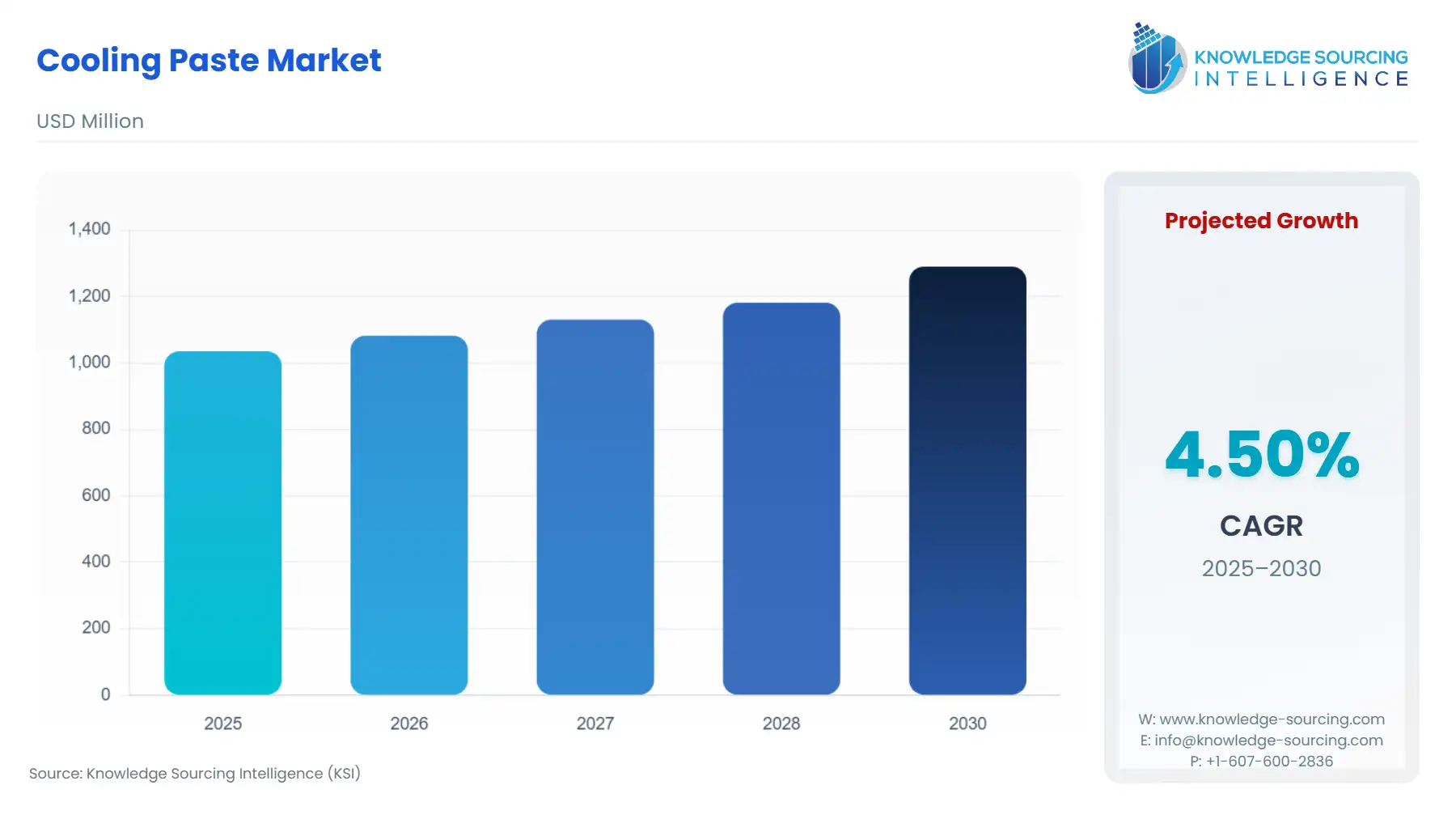

The Cooling Paste Market is expected to grow from USD 1,035.467 million in 2025 to USD 1,290.333 million in 2030, at a CAGR of 4.50%.

The Cooling Paste Market, a specialised sub-segment of the broader Thermal Interface Materials (TIM) sector, supplies critical compounds designed to minimise thermal resistance between heat-generating components (like CPUs, GPUs, and power devices) and their respective heat sinks. These materials, predominantly Greases & Adhesives, Gap Fillers, and Phase Change Materials, function by filling microscopic air gaps on contact surfaces, enabling efficient heat transfer and preventing thermal throttling or premature component failure. The operational environment for this market is defined by rapidly accelerating thermal density across core end-user segments. From OEMs in the server and semiconductor industry to manufacturers of Automotive Electronics, the performance and reliability of high-power components are now fundamentally limited by the efficacy of thermal management.

Cooling Paste Market Analysis:

Growth Drivers

The primary driver of demand for Cooling Paste is the continuous escalation in power density within modern electronic components, which makes effective heat dissipation an absolute performance imperative. The transition from Silicon (Si) Insulated-Gate Bipolar Transistors (IGBTs) to Silicon Carbide (SiC) MOSFETs in Automotive Electronics and power systems, for instance, leads to verifiable junction temperatures exceeding 175°C, creating a high-demand scenario for high-reliability Phase Change Materials and specialised Greases & Adhesives. This high-temperature environment directly propels the market to procure pastes with higher thermal conductivity and superior long-term stability. Simultaneously, the massive global investment in Data Centres and High-Performance Computing by OEMs necessitates the continuous application of cooling pastes to millions of server central processing units (CPUs), thus providing a foundation of high-volume, enterprise-grade demand.

Challenges and Opportunities

The chief constraint facing the market is the dual challenge of raw material cost volatility and compliance with stringent environmental regulations like RoHS and REACH, which restrict the use of certain chemicals and heavy metals. This elevates production costs and complexity for manufacturers, acting as a headwind against commoditization, particularly in the mass-market Greases & Adhesives segment. Conversely, this constraint generates a significant opportunity for innovation. The necessity for non-conductive, high-performance thermal solutions for densely packed electronic modules, especially in Medical Devices and Telecom Devices, accelerates the demand for advanced, proprietary formulations. This drives the adoption of next-generation Carbon-based Thermal Paste and materials that combine high thermal conductivity with excellent dielectric performance, offering a high-margin growth avenue for specialised material providers.

Raw Material and Pricing Analysis

The pricing of Cooling Paste formulations is intrinsically linked to the cost and purity of the primary thermal filler materials, chiefly high-grade ceramic powders (e.g., Boron Nitride, Aluminium Nitride, Alumina, Zinc Oxide) and silicone/non-silicone polymer matrices. Boron Nitride, a critical filler for high-end, electrically non-conductive pastes, exhibits significant price volatility due to complex processing requirements and demand from other industrial sectors. The overall cost structure is also burdened by the proprietary nature of the polymer matrix (e.g., silicone, polyurethane, acrylics) that determines the material’s viscosity, application method, and long-term stability. The demand for increasingly higher thermal conductivity, verified by third-party testing, mandates the use of higher loading percentages of these expensive, high-purity fillers, directly resulting in the substantial price premium observed in advanced Phase Change Materials and performance-focused Greases over commodity formulations.

Supply Chain Analysis

The global supply chain for Cooling Paste is vertically integrated and globally distributed, yet highly dependent on a few key regions for specialised inputs and high-volume manufacturing. The primary production hubs for finished goods are concentrated in North America, Western Europe (home to companies like Henkel AG & Co. KGaA), and Asia-Pacific (critical for volume production of consumer-grade materials). A crucial logistical complexity is the sourcing of high-purity ceramic fillers and refined silicone polymers from a limited pool of global chemical suppliers. This dependency renders the supply chain vulnerable to geopolitical trade friction, particularly US-China trade policy, and unexpected production shutdowns, which can swiftly disrupt the availability and price of base materials. The necessity for manufacturers to custom-blend and test formulations to meet specific OEM thermal and viscosity requirements further complicates large-scale production, creating bottlenecks for mass deployment in the Automotive Electronics and Telecom Devices segments.

Government Regulations

Government regulations, specifically those governing chemical content and material safety, fundamentally restructure the supply chain and restrict the permissible materials in Cooling Paste formulations sold into major economic blocs. The focus on eliminating hazardous substances creates a mandatory shift in R&D and manufacturing practice, directly impacting demand for compliant products.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

European Union | RoHS Directive (Restriction of Hazardous Substances) | Prohibits the use of substances like lead, cadmium, and mercury in electrical and electronic equipment (EEE). This directly eliminates demand for any Cooling Paste formulation that uses these materials, forcing manufacturers to substitute them with compliant alternatives, thereby accelerating the demand for certified "lead-free" and halogen-free silicone or non-silicone Greases & Adhesives. |

European Union | REACH Regulation (Registration, Evaluation, Authorization and Restriction of Chemicals) | Mandates the registration, evaluation, and authorization of chemicals produced or imported into the EU in quantities above one tonne per year. This increases operational and R&D costs for all manufacturers (e.g., Henkel AG & Co. KGaA, 3M) by requiring extensive toxicological and environmental testing for every chemical component in their Cooling Paste products. The compliance cost acts as a barrier to entry and favours established manufacturers. |

United States | Toxic Substances Control Act (TSCA) / EPA | Governs the introduction of new or existing chemicals into the US market. The regulatory process influences the speed of innovation by requiring manufacturers to prove the safety of new, high-performance Metal-Based Thermal Interface Materials or unique polymer matrices before they can be broadly commercialized in the North American OEM and Aerospace segments, thereby impacting the local supply of cutting-edge formulations. |

Global/Voluntary | UL 94 (Flammability Standards) | Standard for Safety of Flammability of Plastic Materials for Parts in Devices and Appliances. While voluntary, meeting the UL 94 V-0 standard creates non-negotiable demand in high-reliability segments like Automotive Electronics and server power supplies. This compels manufacturers to formulate Tapes & Films and Gap Fillers with specific flame-retardant additives, directly favouring products that verifiably achieve this safety benchmark. |

Cooling Paste Market Segment Analysis:

By Type: Phase Change Materials (PCMs) Analysis

The Phase Change Materials (PCMs) segment is experiencing elevated demand driven by their unique capacity to provide consistent, low thermal resistance across the operational lifetime of a component without the pump-out or dry-out issues associated with traditional Greases. Demand for PCMs is specifically created by the OEM sector in high-density computing (data centres) and high-power applications (power electronics, inverters). Unlike traditional greases, PCMs are solid at room temperature, which simplifies automated assembly processes. They transition to a liquid or semi-liquid state at a specific component operating temperature, effectively filling all microscopic voids and achieving minimal bond-line thickness (BLT). This ensures an extremely low thermal impedance, which is a non-negotiable metric for maintaining the performance and reliability of high-frequency processors and next-generation insulated-gate bipolar transistor (IGBT) modules, making them a premium, performance-driven choice over conventional solutions.

By Application: Automotive Electronics Analysis

The Automotive Electronics application segment represents a formidable and non-cyclical growth vector for the Cooling Paste Market, with demand fundamentally driven by the global, verifiable shift towards vehicle electrification and the integration of ADAS. This sector’s thermal management requirements are unique due to the extreme operating temperatures, long service life expectations (10+ years), and exposure to harsh environmental conditions. The critical components requiring robust Cooling Paste include EV battery modules, inverters/converters (often utilising high-heat SiC MOSFETs), and autonomous driving CPUs. This complex environment generates mandatory demand for specialised, high-performance, silicone-based Gap Fillers and thermal Adhesives that exhibit superior dielectric strength, low volatility (minimal outgassing), and verifiable resistance to thermal cycling. This demand is high-value, driven by safety certifications and OEM quality requirements, where component failure is simply not permissible.

Cooling Paste Market Geographical Analysis:

US Market Analysis

The US market for Cooling Paste is defined by its dominance in High-Performance Computing (HPC), Data Centres, and a robust Aerospace sector. Local demand is intensely concentrated in the OEM and enterprise segments, fueled by continuous, heavy investment from major technology companies in cloud infrastructure and AI server build-outs. This creates massive, consistent procurement demand for high-end Gap Fillers and Phase Change Materials that can manage the extreme thermal loads of custom-designed, high-wattage server CPUs and GPUs. Furthermore, the stringent quality and reliability requirements of the US defence and aerospace sectors drive specific, high-specification demand for low-outgassing Tapes & Films and silicone-based greases that must comply with military standards (MIL-SPEC) for use in mission-critical avionics systems.

Brazil Market Analysis

Brazil's Cooling Paste Market exhibits demand primarily within the Industrial Machinery and domestic Personal Computers segments. The industrial sector, including energy and manufacturing, generates moderate but reliable demand for standard silicone-based Greases & Adhesives for power electronics, motor controllers, and instrumentation, prioritising cost-effectiveness and local availability over absolute thermal performance. The consumer electronics market maintains a steady replacement and upgrade demand for basic thermal greases used in mid-range PCs. Market growth potential is constrained by reliance on imported finished goods and economic volatility, which limits the rapid, widespread adoption of premium, high-cost solutions like Metal-Based Thermal Interface Materials or advanced Phase Change Materials, focusing local consumption on proven, lower-cost formulations.

Germany Market Analysis

The German market is a key European hub, characterised by specialised, high-value demand driven by a preeminent Automotive Electronics manufacturing sector and a strong tradition of industrial engineering. Demand is highly concentrated on meeting the rigorous specifications of Tier 1 automotive suppliers for EV battery thermal management and power train inverters, creating a direct imperative for certified, high-stability Gap Fillers and thermal adhesives. Compliance with EU regulations, specifically REACH and RoHS, is a non-negotiable prerequisite, effectively eliminating demand for non-compliant products and reinforcing the competitive advantage of European OEMs like Henkel AG & Co. KGaA that offer certified, high-purity, environmentally compliant formulations. The market prioritises verifiable product longevity and reliability over short-term cost savings.

UAE Market Analysis

The UAE market's demand for Cooling Paste is highly concentrated in the Telecom Devices and developing Data Centre infrastructure segments, driven by major governmental and private investment in smart city initiatives and 5G network expansion. The region's unique climate, characterised by extreme ambient temperatures, creates a specialised demand for Greases & Adhesives and Gap Fillers that can maintain performance integrity and thermal stability under prolonged, high-heat exposure. This necessitates products with superior high-temperature limits and low thermal degradation rates for use in outdoor telecom base stations and networking hardware. Demand in the Personal Computers segment remains modest, but the enterprise and infrastructure investment sectors drive significant, high-specification procurement volumes.

China Market Analysis

China operates as a critical market, acting as both the world's largest OEM manufacturing base and a rapidly expanding end-user market. The massive output of Personal Computers, smartphones, and consumer electronic devices generates phenomenal volume demand for cost-effective, yet thermally adequate, Greases & Adhesives and Tapes & Films. Simultaneously, accelerated domestic investment in Automotive Electronics (EVs) and hyperscale Data Centres drives a parallel, high-specification demand for advanced Phase Change Materials and high-conductivity Gap Fillers. This dual market structure creates significant competitive tension, requiring global suppliers to navigate both high-volume, low-margin supply chains and highly demanding, performance-critical supply chains for domestic automotive and HPC leaders.

Cooling Paste Market Competitive Environment and Analysis:

The Cooling Paste Market exhibits a tiered competitive structure. The high-performance, speciality segment is dominated by multinational chemical and materials science giants (Henkel AG & Co. KGaA, 3M, Parker Hannifin Corp), who compete on proprietary chemical formulations, superior thermal conductivity, and the ability to meet strict OEM qualification standards (e.g., in Automotive Electronics and Aerospace). The mass-market and consumer segments are heavily contested by numerous regional and Asia-Pacific manufacturers, where competition centres on cost-per-gram and distribution reach for consumer-grade Greases & Adhesives and Tapes & Films sold to PC builders and small-scale assemblers. The critical barrier to entry in the premium segment remains the intellectual property surrounding high-purity filler processing and polymer matrix stability, which dictates long-term product reliability.

Cooling Paste Market Company Profiles:

Parker Hannifin Corp (Chomerics Division)

Parker Hannifin Corp, primarily through its Chomerics division, strategically positions itself as a high-reliability supplier focused on mission-critical applications within the Aerospace, defence, and high-end Telecom Devices sectors. The company's competitive advantage is its ability to offer an integrated portfolio of advanced Tapes & Films and Gap Fillers that meet stringent environmental and thermal standards. Verifiable product releases, such as the THERM-A-GAP family of gap fillers, demonstrate their focus on non-silicone and low-outgassing formulations essential for sensitive electronic equipment where contamination is a risk. Their specialised portfolio, including the THERMALCLAD metal-backed circuits, showcases a strategy of vertically integrating thermal management solutions, directly driving demand from OEMs in markets that prioritise compliance and verifiable long-term stability over mass-market cost.

Henkel AG & Co. KGaA

Henkel AG & Co. KGaA operates as a global leader in adhesives and chemical technologies, securing its strategic position in the Cooling Paste Market by integrating advanced thermal solutions into its expansive Adhesive Technologies business unit. The company competes on scale, R&D depth, and a broad portfolio of Greases & Adhesives and high-performance Gap Fillers, primarily under the Loctite brand. Henkel's strategy is heavily focused on penetrating the high-volume, high-specification segments of Automotive Electronics (EV battery packs) and industrial OEMs. Their products, such as their two-component liquid Gap Fillers, directly address the OEM demand for automated, high-throughput dispensing applications, guaranteeing quality control and reducing manufacturing complexity for high-volume producers of power electronics.

3M

3M leverages its globally recognised brand and extensive material science patent portfolio to compete across both the consumer and industrial segments of the market. The company’s strategic focus is on delivering highly engineered Tapes & Films (e.g., 3M™ Thermally Conductive Interface Tape 8926 Series) and specialised Phase Change Materials. 3M's advantage lies in its ability to offer thermally conductive acrylic Adhesives and tapes that provide both mechanical bonding and thermal management in a single solution. This creates direct demand in the Personal Computers and consumer electronics assembly markets, where low bond-line thickness, ease of rework, and the dual function of heat transfer and physical attachment are non-negotiable assembly requirements. The company's global reach and established OEM relationships reinforce its position as a key supplier for high-volume, repeatable assembly processes.

Cooling Paste Market Key Developments:

December 2025: Mitsubishi Chemical Group and Boston Materials partnered to co-develop the second-generation Liquid Metal ZRT for revolutionary AI data center cooling.

August 2025: YINCAE launched TM 150LM liquid metal thermal interface material with enhanced viscosity and reliability for precise printing and high-temperature performance.

May 2025: JunPus announced the upcoming LiquidTherm Coolant release, a next-generation liquid cooling solution engineered for extreme performance and system reliability.

January 2025: Thermal Grizzly launched Duronaut high-performance thermal paste, offering exceptional long-term stability and excellent heat transfer for CPUs and GPUs.

November 2024: Parker Hannifin launched four new silicone and ceramic-based THERM-A-GREASE products, optimized for high-volume applications like automotive control modules and power supplies.

Cooling Paste Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1,035.467 million |

| Total Market Size in 2027 | USD 1,290.333 million |

| Forecast Unit | Billion |

| Growth Rate | 4.50% |

| Study Period | 2020 to 2027 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2027 |

| Segmentation | Type, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Cooling Paste Market Segmentation:

By Type

Tapes & Films

Gap Fillers

Phase Change Materials

Greases & Adhesives

Metal-Based Thermal Interface Materials

Others

By Application

Industrial Machinery

Medical Devices

Automotive Electronics

Telecom Devices

Personal Computers

Others

End-User

OEMs

Aerospace

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others