Report Overview

Corrosion Detector Sensor Market Highlights

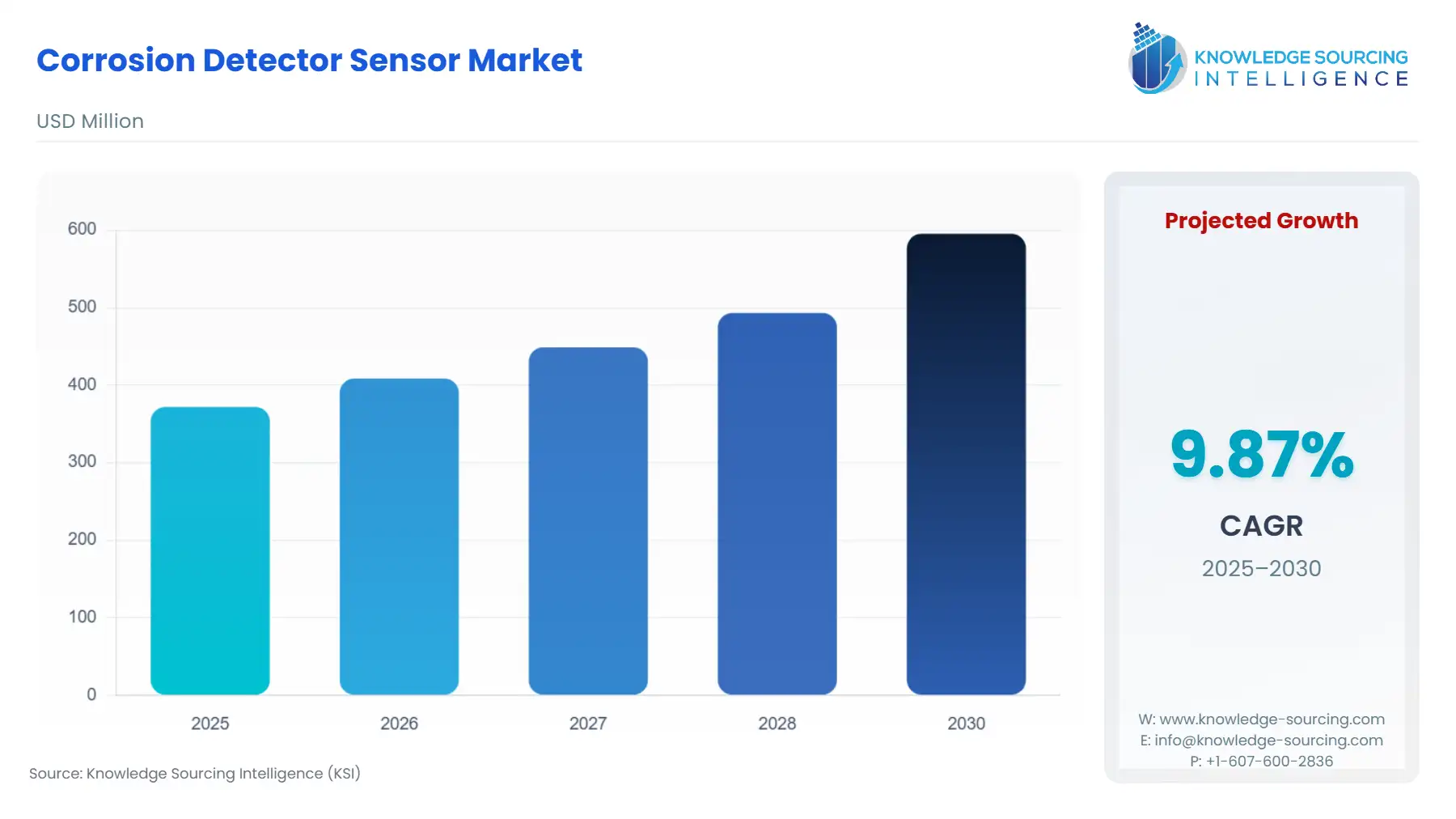

Corrosion Detector Sensor Market Size:

The corrosion detector sensor market will be valued at $595.321 million in 2030, rising from $371.834 million in 2025 and growing at a CAGR of 9.87% during the forecasted period.

The Corrosion Detector Sensor Market is a critical segment of the industrial sensors market, providing advanced technologies to detect, monitor, and mitigate corrosion in infrastructure and equipment across industries such as oil and gas, aerospace, marine, and civil engineering. Corrosion, the gradual degradation of materials due to environmental interactions, poses significant risks to process safety and asset longevity, resulting in substantial economic losses. The National Association of Corrosion Engineers (NACE) estimates that corrosion costs the global economy over $2.5 trillion annually, underscoring the importance of effective corrosion management solutions. Corrosion detector sensors, including electrochemical, ultrasonic, and wireless connectivity-enabled devices, enable real-time monitoring and predictive maintenance, enhancing operational efficiency and reducing life cycle cost analysis burdens.

Corrosion Detector Sensor Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

Companies

- Emerson Electric Co.

- Honeywell International Inc.

- Siemens AG

- Teledyne Marine Technologies

- Eddyfi Technologies

- SGS SA

:

- Emerson Electric Co.

- Honeywell International Inc.

- Siemens AG

- Teledyne Marine Technologies

- Eddyfi Technologies

- SGS SA

The corrosion detector sensors are focused equipment meant to detect, quantify, and monitor the amount and extent of corrosion present in the materials, especially for alloys and metals. These devices operate with diverse principles and are specialized for diverse environmental conditions and a range of industrial applications. The major application of this sensor is to provide actionable data to industries to enable them to manage their cost while also preventing any catastrophic negligence and extending the lifespan of industrial equipment and critical infrastructure.

The adoption of varied IoT technologies in corrosion detector sensors is a key trend driving market growth. This enables real-time data collection, remote monitoring, and seamless integration with centralized systems. IoT-enhanced sensors are vital in industries like oil and gas, often situated in remote or hazardous locations, as they transmit data to cloud platforms for informed decision-making by operators.

Global regulatory bodies are enforcing corrosion monitoring mandates, prompting industries to adopt sensors to meet compliance standards. For example, the U.S. Environmental Protection Agency (EPA) has established protocols for optimal corrosion control treatment, including technical guidelines for various industries.

The Asia Pacific region is poised to become a significant market for corrosion detector sensors, driven by rapid industrialization, infrastructure development, and increased energy project investments. Countries like China and India are expanding their manufacturing and oil and gas sectors, boosting demand for these sensors.

Some of the major players covered in this report include Teledyne Marine Technologies, Emerson Electric Co., Pepperl+Fuchs, Novosound, and CorrosionRADAR, among others.

Corrosion Detector Sensor Market Trends:

The Corrosion Detector Sensor Market is evolving rapidly, driven by the need for advanced corrosion management solutions across critical industries. Oil and gas pipelines are a key focus, with sensors enabling real-time monitoring to prevent leaks and ensure process safety. In 2025, CorrosionRADAR launched a wireless connectivity-enabled sensor for oil and gas pipelines, addressing corrosion under insulation (CUI) with predictive analytics. Civil infrastructure monitoring is gaining traction, as aging bridges and tunnels require sensors to extend lifespans and reduce life cycle cost analysis burdens. In 2024, the U.S. Federal Highway Administration emphasized sensor use for bridge corrosion detection.

Aerospace corrosion monitoring is advancing, with sensors ensuring aircraft structural integrity. For instance, Teledyne Marine Technologies introduced ultrasonic sensors for marine corrosion in subsea structures, enhancing industrial plant maintenance. IoT and AI integration enables predictive maintenance, reducing downtime in industrial plant maintenance and marine corrosion applications. These trends highlight the market’s shift toward smart, data-driven solutions for oil and gas pipelines, CUI, and civil infrastructure monitoring, ensuring safety and efficiency.

Corrosion Detector Sensor Market Drivers:

-

Increasing Demand for Oil and Gas Pipeline Safety: The Corrosion Detector Sensor Market is driven by the critical need for process safety in oil and gas pipelines, where corrosion can lead to leaks, environmental damage, and costly downtime. Corrosion management solutions are essential to monitor pipeline integrity, especially for aging infrastructure in regions like the Middle East and North America. Advanced sensors, such as those with wireless connectivity, provide real-time data to prevent failures. In 2024, CorrosionRADAR introduced a wireless connectivity-enabled sensor system for oil and gas pipelines, targeting corrosion under insulation (CUI) to enhance safety and operational efficiency. The global push for energy security and stricter environmental regulations further drives demand for these sensors, as operators seek to minimize risks and comply with standards like those from the U.S. Environmental Protection Agency (EPA), ensuring the industrial sensors market continues to expand in this high-stakes sector.

-

Aging Civil Infrastructure Monitoring Needs: The aging global infrastructure, particularly in developed regions like North America and Europe, is a significant driver for the Corrosion Detector Sensor Market. Bridges, tunnels, and highways are increasingly susceptible to corrosion, necessitating corrosion management solutions to extend asset lifespans and reduce life cycle cost analysis burdens. Sensors, including ultrasonic and electrochemical types, enable real-time civil infrastructure monitoring to detect corrosion early, preventing structural failures. In 2024, the U.S. Federal Highway Administration emphasized the role of sensors in monitoring bridge corrosion, highlighting their importance for public safety and cost savings. The integration of IoT and AI enhances predictive maintenance, allowing infrastructure managers to prioritize repairs and optimize operational efficiency. As governments invest in infrastructure modernization, the demand for advanced sensors to address corrosion in aging assets drives market growth, particularly in urbanized regions with extensive public works.

-

Advancements in IoT and AI Technologies: Technological advancements in IoT and AI are transforming the Corrosion Detector Sensor Market by enabling smarter, data-driven corrosion management solutions. IoT-enabled sensors provide continuous monitoring and cloud-based data analytics, while AI algorithms predict corrosion progression based on environmental factors, improving process safety. In June 2024, Siemens launched an AI-powered corrosion monitoring platform for industrial plant maintenance, leveraging predictive analytics to reduce downtime in chemical facilities. These technologies enhance operational efficiency by reducing manual inspections and enabling remote monitoring, particularly in hazardous environments like oil and gas pipelines and marine corrosion applications. The integration of wireless connectivity further supports scalability, driving adoption across industries like aerospace corrosion and marine, where precise corrosion detection is critical for safety and cost management.

Corrosion Detector Sensor Market Restraints:

-

High Costs of Corrosion Management Solutions: The high costs associated with developing and deploying advanced corrosion management solutions pose a significant restraint on the Corrosion Detector Sensor Market. IoT- and AI-enabled sensors, while effective, require substantial investment in R&D, manufacturing, and installation, particularly for wireless connectivity systems used in oil and gas pipelines and civil infrastructure monitoring. Additional expenses for calibration, maintenance, and life cycle cost analysis further burden smaller enterprises. In 2024, a report noted that the high upfront costs of wireless connectivity sensors limit adoption in budget-constrained industries, such as smaller marine or industrial plants. These costs restrict market penetration, particularly in emerging economies, where financial resources for advanced industrial sensors market solutions are limited, slowing the adoption of cutting-edge corrosion monitoring technologies.

-

Integration Challenges with Existing Systems: Integration challenges with existing infrastructure and systems significantly restrain the Corrosion Detector Sensor Market. Many industries, such as aerospace corrosion and industrial plant maintenance, rely on legacy systems that are incompatible with modern IoT and wireless connectivity-enabled sensors. Retrofitting these systems requires technical expertise, additional hardware, and potential operational disruptions, impacting operational efficiency. In 2024, Teledyne Marine Technologies highlighted difficulties in integrating wireless connectivity sensors with older subsea equipment for marine corrosion monitoring, citing compatibility issues as a barrier. These challenges increase implementation costs and time, deterring adoption, particularly in industries with complex or outdated infrastructure. The need for skilled personnel to manage integration further complicates deployment, limiting the scalability of advanced corrosion management solutions across diverse applications.

Corrosion Detector Sensor Market Segmentation Analysis:

-

By Deployment Type, the Fixed segment is predicted to lead the market expansion: The Fixed segment dominates the Corrosion Detector Sensor Market due to its widespread use in continuous, real-time monitoring of critical infrastructure, ensuring process safety and operational efficiency. Fixed sensors, such as electrochemical and ultrasonic types, are permanently installed in high-risk environments like oil and gas pipelines, chemical plants, and bridges, providing consistent data for corrosion management solutions. These sensors integrate with IoT and wireless connectivity to enable remote monitoring and predictive maintenance, reducing life cycle cost analysis burdens. CorrosionRADAR launched a fixed sensor system with wireless connectivity for oil and gas pipelines, targeting corrosion under insulation (CUI) to enhance safety and longevity. The segment’s leadership is driven by the need for reliable, long-term corrosion detection in static assets, particularly in industries prioritizing process safety, making fixed sensors the cornerstone of the industrial sensors market.

-

By Application, the Oil and Gas segment is growing rapidly: The Oil and Gas segment is the largest application area in the Corrosion Detector Sensor Market, driven by the critical need to monitor oil and gas pipelines, offshore platforms, and refineries for corrosion to ensure process safety and prevent environmental disasters. Corrosion in pipelines, often exacerbated by corrosion under insulation (CUI), poses significant risks, necessitating advanced corrosion management solutions. Sensors with IoT and AI integration provide real-time data to predict and mitigate corrosion risks. For example, Emerson Electric introduced a fixed sensor system for oil and gas pipelines, leveraging wireless connectivity to reduce maintenance costs and enhance operational efficiency. The segment’s dominance is fueled by stringent regulations, such as those from the U.S. Environmental Protection Agency, and the high cost of corrosion-related failures, driving demand for sensors in this critical industry.

-

The Americas is expected to hold a large market share: The Americas, particularly the United States, lead the Corrosion Detector Sensor Market due to extensive oil and gas infrastructure, aging civil infrastructure monitoring needs, and advanced technological adoption. The U.S. has significant investments in oil and gas pipelines and refineries, where corrosion management solutions are critical for process safety. The region’s aging bridges and highways also drive demand for sensors to reduce life cycle cost analysis burdens. In 2024, the U.S. Federal Highway Administration emphasized sensor deployment for civil infrastructure monitoring to address corrosion in bridges. The Americas benefit from widespread IoT and AI adoption, with companies like Siemens launching AI-powered corrosion monitoring platforms for industrial plant maintenance. The region’s robust regulatory framework and technological innovation position it as the market’s epicenter for advanced sensor solutions.

Corrosion Detector Sensor Market Key Developments:

-

April 2025: NTT developed a groundbreaking image-based technology to accurately predict the progression of steel corrosion in infrastructure like road bridges several years into the future. Unlike traditional sensors that measure current conditions, this world-first technology uses images combined with environmental data (temperature, precipitation) and a custom Generative Adversarial Network (GAN) model to generate predictive visuals of future corrosion spread. This shift from detection to high-precision prediction allows infrastructure owners to optimize inspection intervals and repair schedules, significantly improving maintenance efficiency and safety.

-

2024: GE launched a new Artificial Intelligence (AI)-driven analytics platform designed to enhance predictive maintenance capabilities across industrial sectors, particularly for asset integrity management. While a platform rather than a standalone sensor, it is a major product that integrates with existing and new corrosion sensor data. The platform utilizes advanced machine learning algorithms to analyze real-time data from various sensors, including corrosion probes, to provide early warnings and more accurate forecasts of potential equipment failures, thereby reducing operational costs and unplanned downtime.

Corrosion Detector Sensor Market Segmentation:

-

By Type

-

Direct

-

Indirect

-

-

By Deployment Type

-

Fused

-

Portable

-

-

By Application

-

Oil and Gas

-

Energy Sector

-

Water and Wastewater Treatment

-

Manufacturing and Industrial Equipment

-

Others

-

-

By Region

-

Americas

-

Europe, Middle East & Africa

-

Asia Pacific

-