Report Overview

Counterfeit Money Detection Market Highlights

Counterfeit Money Detection Market Size:

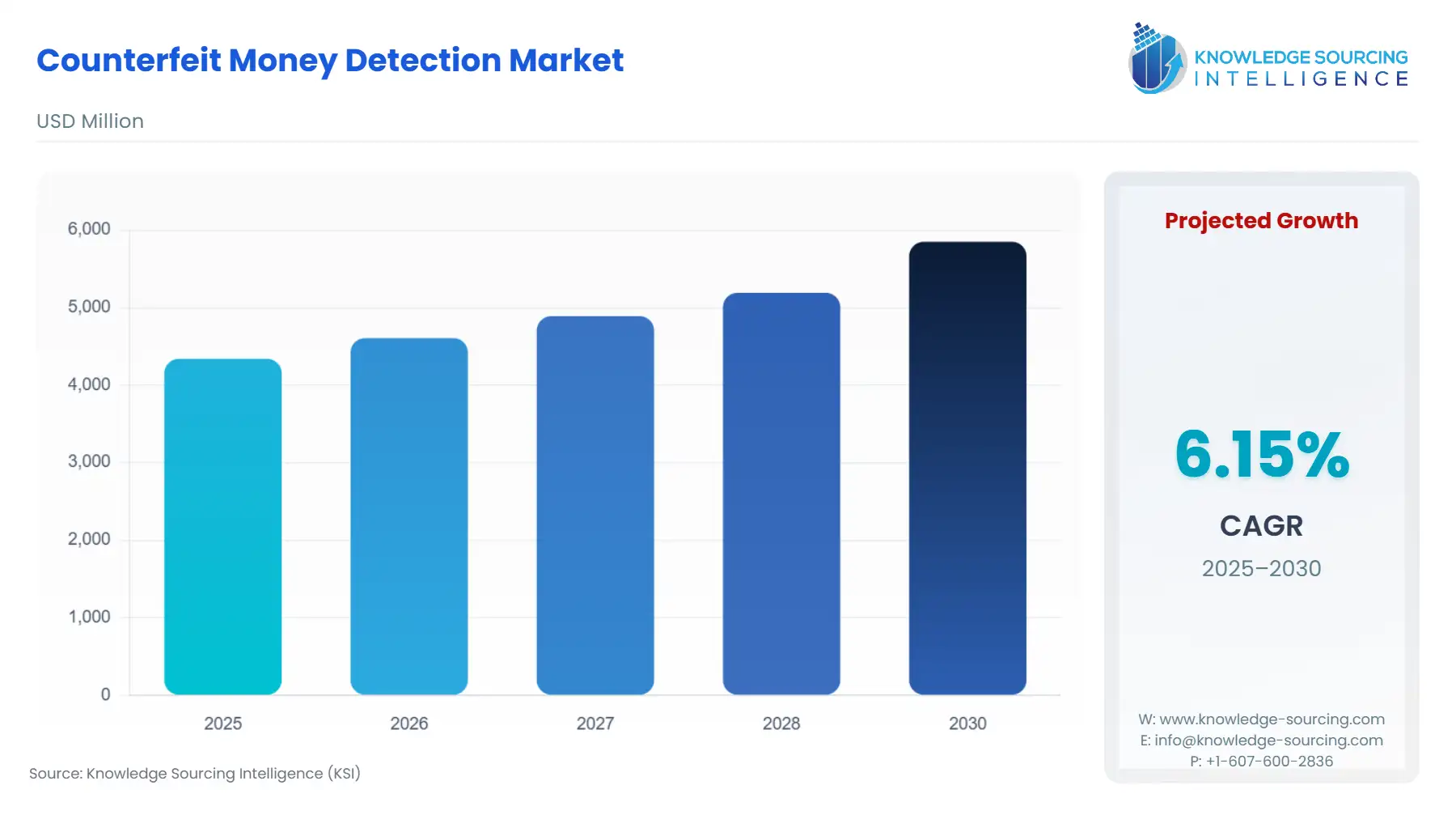

Counterfeit money detection market will grow at a CAGR of 6.15% to be valued at US$5.85 billion in 2030 from US$4.34 billion in 2025.

The Counterfeit Money Detection Market is an essential subset of the broader financial security and cash automation industry, primarily concerned with protecting the integrity and public trust in physical currency.

The market's structural demand is fundamentally inelastic, driven by the persistent threat posed by counterfeiters who continually leverage advancements in affordable printing and scanning technology. This dynamic forces a constant technological arms race, where security features in banknotes (like holograms, micro-printing, and optically variable inks) must be countered by ever-more sophisticated detection systems utilizing Infrared, Magnetic Ink, and advanced machine-vision (Others) technologies. For BFSI and high-volume Retail sectors, investing in certified detection equipment is a necessary operational cost directly tied to maintaining zero-loss cash processing and complying with central bank regulations.

Counterfeit Money Detection Market Analysis

- Growth Drivers

A primary driver is the pervasive, globally reported circulation of high-quality forged currency, which necessitates preventative investment. For instance, the US Secret Service records tens of millions of dollars in counterfeit US currency passed domestically annually, creating an enduring demand for advanced Currency Detector machines in BFSI. A second powerful catalyst is the continuous redesign of major world currencies (Euro, US Dollar, Yen) by central banks to integrate new security features. These redesigns directly render older detection equipment obsolete, compelling Hospitals and Transportation & Logistics End-Users to purchase upgraded hardware and software to remain compliant and avoid accepting new counterfeits.

- Challenges and Opportunities

A significant challenge is the high upfront capital cost of advanced multi-sensor detection equipment, which can deter Small and Medium Enterprises (SMEs) within the Retail sector from adopting high-security Infrared and machine-vision technologies. This constraint limits penetration into the long-tail of cash-handling businesses. The key opportunity, conversely, lies in the accelerated integration of Artificial Intelligence (AI) and machine-vision into software platforms. This allows for remote, continuous algorithm updates to counteract newly identified counterfeits, offering a critical advantage over static hardware-based systems. This software-centric model creates high-margin recurring revenue and lowers the physical obsolescence risk for the BFSI segment.

- Raw Material and Pricing Analysis

The Counterfeit Money Detection Market, predominantly physical hardware (Currency Detector and Currency Sorter), relies heavily on specialized electronic components. Key raw materials include advanced optical sensors (CCD/CMOS arrays), Infrared emitters/receivers, specialized magnetic sensors, and high-speed microprocessors for image processing. Pricing is impacted by the global supply chain for precision electronics, and competition for high-end components drives up manufacturing costs for multi-sensor machines. The final product price reflects the degree of technological sophistication, with low-cost Ultraviolet pens priced at a few dollars and high-speed Currency Sorter machines for banks priced in the tens of thousands.

- Supply Chain Analysis

The global supply chain is complex, anchored in Asia-Pacific, specifically China, which serves as the primary production hub for basic Ultraviolet and handheld detection devices. High-end, multi-sensor Currency Sorter machines are primarily manufactured by specialized firms in Japan and Europe (e.g., Glory Ltd., Crane NXT Co.). The supply chain is highly dependent on precision optics manufacturers and software developers capable of integrating complex Infrared and Magnetic Ink detection algorithms. Logistical challenges involve maintaining high quality control for sensitive electronic sensors and efficiently distributing complex hardware systems to BFSI branches and large Retail distribution centers globally.

Counterfeit Money Detection Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Euro Area |

European Central Bank (ECB) - Decision ECB/2010/14 and subsequent updates on fitness/authenticity checking. |

Mandates that all banknote handling machines used by professional cash handlers (e.g., BFSI, large Retail) must pass rigorous, verifiable tests for counterfeit detection, generating mandatory, cyclical demand for machine compliance and software updates. |

|

United States |

US Federal Reserve / US Secret Service - Banknote Recirculation Policy. |

The Federal Reserve encourages, and implicitly mandates for banks, the use of detection equipment to ensure notes recirculated are genuine. This drives demand for high-speed Currency Sorter machines that integrate both counterfeit and fitness detection. |

|

China |

People's Bank of China (PBOC) - Regulations on cash management and anti-counterfeiting requirements. |

PBOC regulations require specific accuracy and technology standards for Currency Detector and sorter machines used by banks and financial institutions, fueling domestic demand and ensuring manufacturers must tailor products to highly specific local security features. |

Counterfeit Money Detection Market Segment Analysis

- By Technology: Infrared (IR)

The Infrared (IR) technology segment experiences significant demand because it is the most crucial verification layer for modern, high-security banknotes. Central banks strategically incorporate IR-opaque and IR-transparent inks that reveal distinct patterns only under IR light, making this feature impossible to replicate accurately with standard digital printers. The need for IR detection is therefore non-negotiable for Currency Sorter machines used by BFSI and high-volume Retail sectors, where the risk of sophisticated "supernote" counterfeits is highest. The continuous need for machines to accurately map new IR security feature patterns, as new currency series are introduced, ensures recurrent demand for software and sensor upgrades.

- By End-User: BFSI (Banking, Financial Services, and Insurance)

The BFSI sector represents the cornerstone of the Counterfeit Money Detection Market, driving demand for the highest-specification and highest-throughput equipment. The growth is intrinsically driven by the need to eliminate all financial loss from counterfeiting and to adhere strictly to central bank and governmental mandates concerning cash recirculation integrity. This translates into compulsory demand for high-speed Currency Sorter and Currency Collector machines that integrate multiple sensors (Infrared, Magnetic Ink, Ultraviolet) and advanced software for simultaneous batch counting, sorting, and authenticated recycling of cash. Their strategic objective is efficiency and zero loss, justifying the significant capital investment in fully automated cash management systems.

Counterfeit Money Detection Market Geographical Analysis

- US Market Analysis

The US market is a high-value sector driven by the need to authenticate the highly circulated US Dollar, which remains the most counterfeited currency globally. Market growth focuses on high-precision, multi-sensor detection devices to counter sophisticated "superdollars." The competitive advantage lies in devices that can quickly and accurately authenticate complex security features like the 3D security ribbon on the $100 note. This necessity is particularly robust in the BFSI segment, driven by large financial institutions' operational requirements for high-speed, accurate Currency Sorter machines used in cash centers.

- Brazil Market Analysis

The Brazilian market is strongly influenced by the high velocity of cash transactions, particularly in the informal economy, and by localized counterfeit threats. The market leans toward mid-range Currency Detector and Currency Counter machines that offer a cost-effective blend of speed and reliability, primarily utilizing Ultraviolet and Magnetic Ink detection. Government initiatives to formalize parts of the economy and upgrade local currency security features create intermittent spikes in demand for basic to mid-level detection equipment across the Retail and Hospitality sectors.

- Germany Market Analysis

The German market, as part of the Eurosystem, is strictly governed by the ECB's mandatory testing and certification requirements for all banknote handling machines. This regulatory framework creates highly predictable, compliance-driven demand for continuous software and firmware updates across the BFSI sector. Growth is concentrated on high-specification Currency Sorter machines from certified manufacturers (Glory Ltd., Crane NXT Co.), ensuring a quality-over-cost purchasing environment focused on guaranteed compliance and high-volume, automated processing.

- Saudi Arabia Market Analysis

The Saudi Arabian market is propelled by ambitious governmental infrastructure projects and high cash usage in the domestic Retail and pilgrimage-related Hospitality sectors. The market demonstrates a specific requirement for high-durability machines capable of operating reliably in harsh climate conditions. Local demand is concentrated on multi-currency detection systems capable of authenticating both the Saudi Riyal and high volumes of foreign currencies, necessitating robust Infrared and Magnetic Ink technologies within integrated Currency Collector solutions.

- China Market Analysis

China is a massive volume market driven by the sheer scale of its population and the persistence of cash transactions, despite the rise of digital payments. Local demand is influenced by the People's Bank of China (PBOC) standards for Renminbi (Yuan) authentication. The market is saturated with low-cost, domestically produced Ultraviolet and Magnetic Ink detection devices. However, large commercial banks drive significant, high-value demand for advanced, high-speed Currency Sorter machines from global players to ensure accuracy and efficiency in major cash processing centers.

Counterfeit Money Detection Market Competitive Environment and Analysis

The competitive environment is stratified, with a few large multinational corporations dominating the high-end, automated Currency Sorter and cash recycling segments (primarily BFSI), and a diverse, fragmented base of smaller companies competing in the low-cost, standalone Currency Detector and UV pen markets (Retail and Hospitality). Competition at the high end is based on technological sophistication, central bank certification, and global service networks. Low-end competition focuses on price and ease of use. The constant evolution of counterfeit threats necessitates heavy, ongoing R&D investment, favoring the scale of the multinational players.

- Glory Ltd.

Glory Ltd. is a dominant global force in cash management solutions, strategically focused on high-speed, high-capacity, multi-sensor Currency Sorter and cash recycling technologies for the BFSI and large Retail sectors. The company's competitive advantage is derived from its established global service network and deep R&D investment that ensures its machines (like the UW-F Series) maintain continuous compliance with central bank mandates (ECB, BoJ). Its product positioning emphasizes complete cash cycle automation, from the teller station to the cash vault.

- Crane NXT Co.

Crane NXT Co., through its Crane Payment Innovations (CPI) brand, strategically positions itself as a leader in payment automation, with a strong focus on self-service and unattended payment applications within Retail & E-Commerce and Transportation & Logistics. The company's Currency Detector products, often integrated into vending, gaming, and self-checkout kiosks, specialize in providing robust, multi-sensor authentication in high-throughput, limited-space environments. This focus allows Crane to capture demand created by the accelerating global shift toward automation in cash transactions.

- Innovative Technology

Innovative Technology (ITL) is a specialized supplier of banknote and coin validators, primarily targeting the self-service and gaming industries. The company's strategy focuses on delivering compact, highly secure validation modules that use advanced spectral sensing and Infrared technology (e.g., its Spectral series) to ensure near-perfect counterfeit detection within constrained machine spaces. By concentrating on embedded technology, ITL captures demand from manufacturers seeking to build highly secure automated payment devices for the growing Transportation & Logistics and Hospitality segments.

Counterfeit Money Detection Market Developments:

- February 2025: AlpVision launched a new mobile application, "AV-Check," to autonomously safeguard goods against counterfeiting. This app allows users to verify product authenticity, leveraging the company's existing technologies like Cryptoglyph and AlpVision Fingerprint. It utilizes a smartphone camera to take images of goods, eliminating the need for extra verification hardware.

- November 2024: Digimarc introduced its most advanced anti-counterfeit solution, integrating secure digital watermarks with new mobile authentication technology. This cutting-edge offering is designed to safeguard physical assets against fraud, building on Digimarc's long history of deterring currency counterfeiting for central banks.

- October 2024: Digimarc launched the "Digimarc Validate" mobile application as a dedicated brand protection tool. The app provides examiners with real-time product authentication in the field. This empowers inspectors to combat counterfeiting instantly, thus protecting brand revenue and reducing costs associated with fraudulent goods.

Counterfeit Money Detection Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Counterfeit Money Detection Market Size in 2025 | US$4.34 billion |

| Counterfeit Money Detection Market Size in 2030 | US$5.85 billion |

| Growth Rate | CAGR of 6.15% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Counterfeit Money Detection Market |

|

| Customization Scope | Free report customization with purchase |