Report Overview

Artificial Intelligence Engineering Market Highlights

Artificial Intelligence Engineering Market Size:

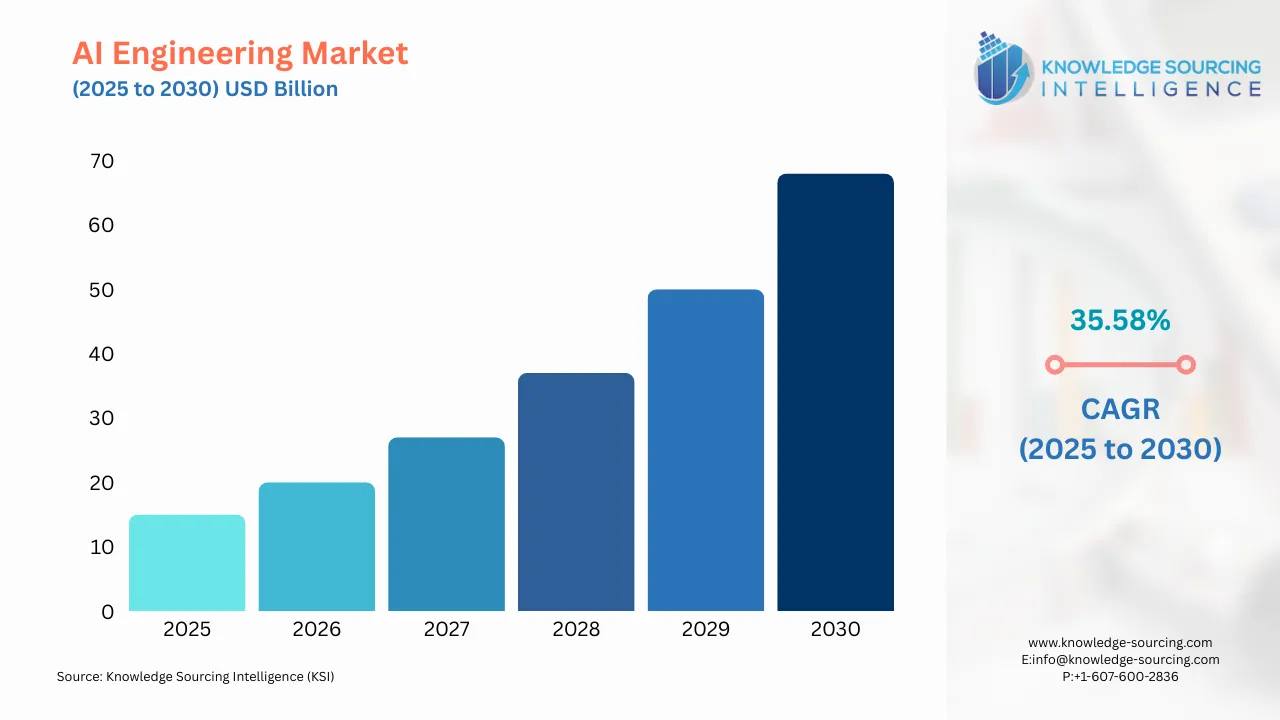

The Artificial Intelligence Engineering Market is projected to witness a CAGR of 35.58% during the forecast period to reach a total market size of US$67.730 billion by 2030, up from US$14.780 billion in 2025.

Artificial intelligence engineering is an interdisciplinary field that customizes and integrates computer science concepts and information technology infrastructure to develop new software solutions and tools of artificial intelligence that can be applied across various industries in a real-world context. As per the requirements of their target client or industry, AI engineers develop diversified AI products using deep learning concepts, machine learning models, natural language processing abilities, neural network system algorithms, and computer vision technology.

Furthermore, companies in different industries, such as automotive, healthcare, retail, communications, and manufacturing, are integrating AI-based software, hardware, and services into their business operations due to the numerous benefits associated with AI technology. Hence, the extensive embrace of AI technology and the increase in demand for AI-powered technological solutions across the majority of an economy's sectors will encourage the further expansion of the artificial intelligence engineering market during the forecast period.

Artificial Intelligence Engineering Market Growth Drivers:

- Growing adoption of AI technology across different sectors is expected to increase the demand for AI engineering solutions globally.

Increased usage of AI in different sectors is culminating in a higher demand for services related to AI engineering. AI is becoming increasingly common in business to improve efficiency, automate tasks, and stay ahead in the competitive market. The increase can be attributed to several factors, including the integration of AI with new areas such as finance, production lines, and customer service solutions. Additionally, the growing complexity of projects supporting deep learning technologies, which require expertise in areas such as machine/deep learning, has contributed to this rise.

Additionally, the extensive adoption of AI technology across various industries, including the fashion and retail sector, transportation sector, healthcare sector, and other manufacturing sectors, is fueling the demand for AI engineers and AI-based applications and services. For instance, in July 2022, Europe's leading beauty and health platform, DOUGLAS, introduced a new AI skin type analysis tool in collaboration with the AI & AR Technology provider PERFECT CORP. The tool is designed to assist customers in identifying their skin type and conditions by using the camera on a smartphone through the DOUGLAS app.

In addition, the automotive sector is actively investing in adopting AI technology in vehicles to manufacture autonomous driving features and other driver assistance applications. Other than these industries, AI technology is being engineered to meet the requirements of several other sectors due to the convenience and flexibility of adopting AI software in companies' business operations.

- The increasing requirement for business automation is anticipated to drive the market growth.

The maximization of operational productivity of business tasks and the enhancement in accuracy levels due to the reduction in human errors are promoting the automation of business operations. The IBM Global AI Adoption Index, released by IBM in 2023, established that approximately 42% of enterprise-level organizations have AI in operation for their business, while 59% utilize AI and plan to extend investment at an early stage. Financial services and telecommunications businesses are the most AI-active industries, with about half of IT professionals reporting deployment of AI in their companies in the financial service industry and a similar percentage for the telecommunication sector, which is 37% of IT experts report the same.

Therefore, the increasing demand for business automation and the adoption of AI technology by various industries are propelling the artificial intelligence engineering market. For instance, in April 2024, Microsoft and Iprova teamed up to organize the AI-Assisted Invention Summit, a conference dedicated to sharing experiences of what works in AI-assisted invention in practice, as well as challenges and open issues. This symposium aimed to cater to technology experts, academics, and existing and budding future users of AI-assisted invention by diving into an already potentially saturating field.

Artificial Intelligence Engineering Market Restraint:

- The shortage of qualified AI engineers could hinder the artificial intelligence engineering market expansion.

Since the software and technology industry constantly evolves, there is a large demand for AI engineers and AI-based products. However, there is a lack of AI experts and engineers to fulfill this demand. AI engineer distribution is low, as existing AI engineers demand higher salaries, leading to increased operating expenses for companies working in an AI technology setting. AI engineers must also stay up-to-date with what is happening in the AI industry to prevent the redundancy of their skills.

Artificial Intelligence Engineering Market Geographical Outlook:

- The North American region is expected to hold a substantial artificial intelligence engineering market share.

The gradual shift of leading companies and brands in North America towards digitalization is promoting the automation of business operations and other related activities. Consequently, this is generating a high demand for products engineered using artificial intelligence. The presence of international technology conglomerates such as Google and Amazon and the emergence of new AI software startups in the last few years, such as Cruise Automation, Palantir Technologies, and Tempus Labs in the US, are further creating market opportunities for AI engineering in North America.

In addition, Veritone analyzed the US BLS job report to understand the AI job trend in the country. Analysis of Aspen Tech Labs' Job Market Pulse then revealed a 32 percent increase in artificial intelligence jobs national listing compared to BLS aggregate, which is +14,117 job vacancies in April 2024 based upon a real-time database with more than five million U.S. jobs from 112 thousand employers. Hence, it can be anticipated that the North American AI engineering market will expand prominently over the forecast period.

Artificial Intelligence Engineering Market Key Developments:

- September 2023- Netcracker Technology partnered with Google Cloud to promote generative AI into telecom. Implementing the solution comes with access to Google Cloud's Vertex AI. It thus provides CSPs, most importantly, an assurance of total control over their telecom data, driving satisfaction among customers and partners, including the entire business.

List of Top AI Engineering Companies:

- Intel Corporation

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- NVIDIA Corporation

Artificial Intelligence Engineering Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

AI Engineering Market Size in 2025 |

US$14.780 billion |

|

AI Engineering Market Size in 2030 |

US$67.730 billion |

| Growth Rate | CAGR of 35.58% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in AI Engineering Market |

|

| Customization Scope | Free report customization with purchase |

The Artificial Intelligence Engineering Market is analyzed into the following segments:

- By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Computer Vision

- By Deployment

- Cloud

- On-premise

- By Solution

- Software

- Services

- Hardware

- By End-User

- Automotives

- Communications

- Manufacturing

- Healthcare

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Singapore

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Artificial Intelligence Engineering Market Size:

- AI Engineering Market Highlights:

- Artificial Intelligence Engineering Market Growth Drivers:

- Artificial Intelligence Engineering Market Restraint:

- Artificial Intelligence Engineering Market Geographical Outlook:

- Artificial Intelligence Engineering Market Key Developments:

- List of Top AI Engineering Companies:

- Artificial Intelligence Engineering Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 22, 2025