Report Overview

Door Sensors Market Size, Highlights

Door Sensors Market Size:

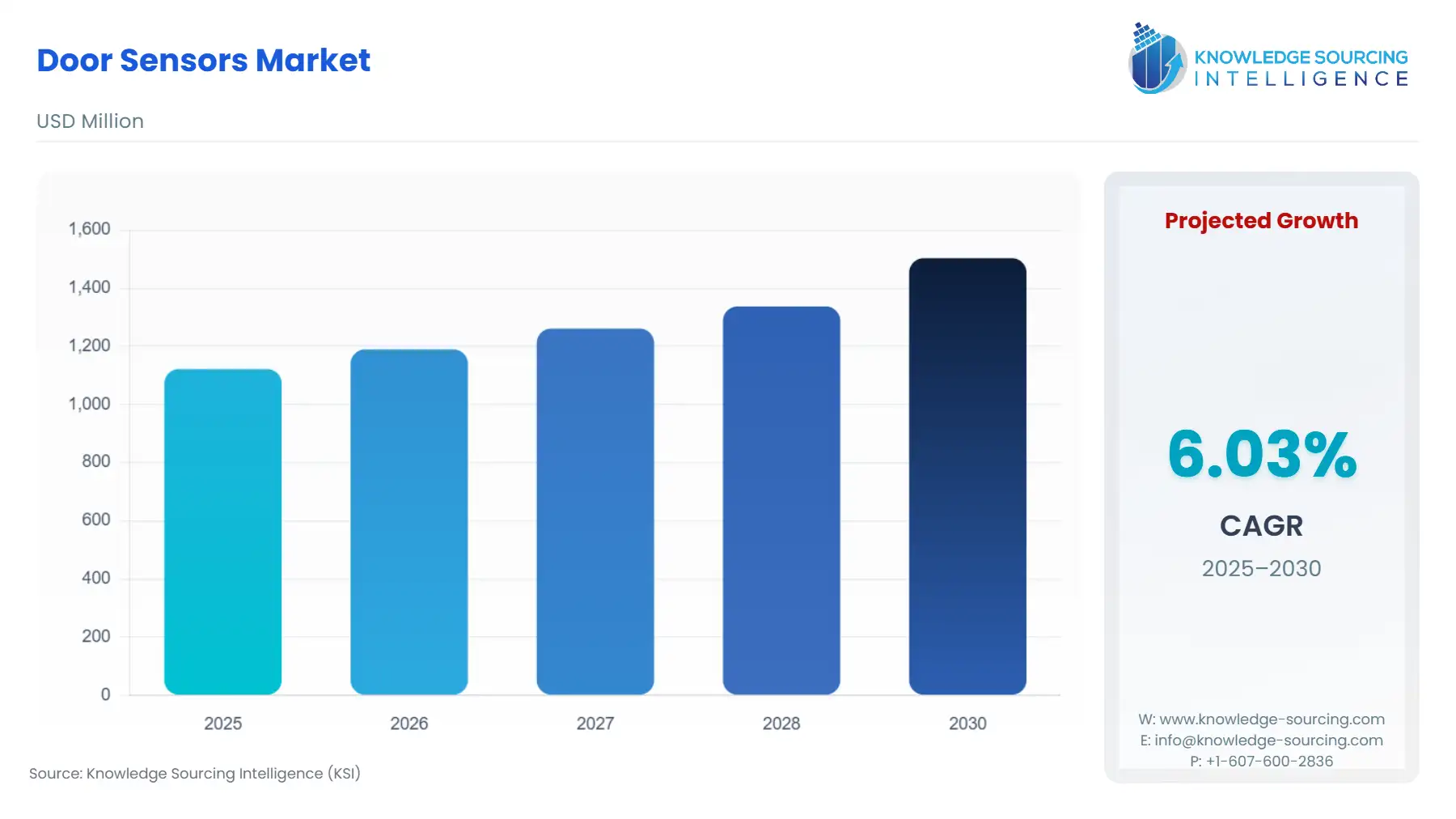

The Door Sensors Market is poised for positive growth and will reach US$1,503.553 million in 2030 from US$1,122.164 million in 2025, growing at a CAGR of 6.03% during the forecast period.

Door sensors are devices used to detect the status or movement of a door and are used in buildings and homes as part of security and automation systems. They detect unauthorized entry and trigger an alarm to a monitoring centre, also they trigger lighting, heating, or cooling systems when a door is opened or closed. Magnetic contact sensors are the most common type of door sensor and are typically installed on the door frame and the door. The door sensors make the monitoring of doors easier, and the repair and maintenance costs associated with door sensors are low. The door sensors market is growing with the increasing demand for security and automation systems in residential and commercial buildings.

Key growth drivers of the door sensors market include the rising demand for energy efficiency, the increasing adoption of automated systems in industrial and commercial settings, and the growing focus on safety and security.

In February 2024, Marantec Group and CEDES collaborated in the field of Internet of Things (IoT) for doors and gates. The partnership also involves Maveo, the proven IoT brand of the family-owned German company.

Door Sensors Market is also witnessing innovative product developments and applications. For instance, in January 2025, Exeger partnered with Leedarson, a leader in smart lighting and IoT solutions. Together, they will co-develop a light-powered door window sensor designed to enhance home automation and security systems. The innovative door window sensor can notify users when a door or window is opened and can trigger customizable actions.

Door Sensors Market Drivers:

- Demand for security and automation systems will boost the door sensors market

Door sensors are used as part of security systems to detect and monitor the opening and closing of doors, alerting property owners or security personnel of any unauthorized entry. The risk of theft, vandalism, and other security threats is increasing, which the demand for door sensors is expected to grow. According to the United Nations Office on Drugs and Crime (UNODC) in 2021, burglary rates vary widely across low- and middle-income countries. According to Interpol's Global Terrorism Index 2020, the number of burglaries and thefts from businesses has been increasing in recent years, and in the United States, the number of commercial burglaries increased by 200% between 2019 and 2020. Door sensors can be integrated with access control systems, allowing only authorized personnel to enter restricted areas. Also, they can trigger the corresponding automation such as turning on/off lights or adjusting the temperature which improves energy efficiency and the overall experience of living in a smart home. The growing adoption of smart home technology is acting as a driving factor for the door sensors market. According to the smart home division of the Consumer Technology Association (CTA), the smart home market in the US was valued at $115.4 billion in 2021 and it is projected to grow to $195.5 billion by 2025 and the global market for smart home devices is projected to reach $262.6 billion by 2025. The integration of door sensors is improving efficiency, security, and convenience, and making them an essential component of many automated systems. This illustrates that the door sensor market will grow with the increasing adoption of smart technologies.

- Increasing building construction

There has been a growing demand for residential housing worldwide. This is propelled by migration and growing urbanization. In the European Union, Germany has 53% of the population being tenants, Austria has 49%, and Denmark has 40%. Living in a house or a flat also differs among the member states in the EU. In cities, 72% of the EU population lived in a flat and 28% in a house. The people living in these urban settings have serious concerns about their house safety, leading to higher adoption rates of door sensors.

Moreover, according to the World Integrated Trade Solution (WITS), the top importers of automatic door closures of base metal are the European Union, having US$157.232 million, and the United States, with US$119.376 million in 2023. These figures indicate a growing focus on safety and security in these regions.

Door Sensors Market Segmentation Analysis:

- The magnetic door sensors are expected to gain a large market share

The magnetic door sensor segment is witnessing growth globally due to rising security concerns across different sectors and residents, demand for home automation, and its increasing adoption by different industries for monitoring, automated lighting, and notification of unauthorized intrusion.

Magnetic door sensors are increasingly used in industries due to their durability and reliability to withstand harsh industrial environments. These sensors are a cost-effective way to upgrade the monitoring and security aspect of industries.

As per FBI data, on property crimes related to a burglary in the US was 58,727 in February 2023, which rose to 70,608 in December 2023. Market players maintain diverse product lines of magnetic door sensors because of diverse industry end users’ demand for light-powered, energy-efficient, and safer door sensor systems.

Moreover, rising advancements in sensor technology, such as improved accuracy, wireless connectivity, and miniaturization, are also increasing the application of magnetic door sensors. Tata Communications' IoT Network, powered by LoRaWAN® and Tata Communications IoT Platform, developed a product, WDSM-LR. This is a battery-operated wireless door magnetic sensor (WDMS) that features 865 MHz wireless LoRa® technology. It offers LoRaWAN class A protocol, which enables the sensor to seamlessly connect with its compliant network ecosystem, assisting in responding to any unauthorized entry detection for diverse purposes, including offices, homes, factories, and warehouses, among others.

- The residential sector is growing significantly

The residential door sensor segment is witnessing consistent growth due to the growing requirement for smart home security appliances. This growth is attributed to the rise in user demands for safety, convenience, and energy efficiency system solutions for their resident. There is an increasing demand for the integration of real-time monitoring and alarm systems in smart homes owing to the growing rate of property crimes and burglary cases. This is raising the need for advanced door sensors as they add a layer of protection for the homeowners from unauthorized entry.

According to the Eurostat data of 2024, there is a rise in the number of police recorded burglary offenses in Europe, accounting for an increase from 10,98,629 to 11,79,573 from 2021 to 2022. This contributes to the rise in demand for residential door sensor systems across the region in the coming years.

Moreover, there is a rise in collaborations between door sensor market players with smart home platform provider companies to upgrade user experience by providing them with effortless integration and interoperability. This offers security to the user, leading to overall market growth during the projected period. In January 2025, Exeger partnered with Leedarson to develop an advanced light-powered door window sensor for application in smart homes. This sensor is produced to advance home automation with security system enhancement by informing users whenever a door or window is opened and acting in leading to a customized trigger response. This will be launched at CES 2025.

- The surface mount type is gaining substantial growth

Surface mount door sensors, typically magnetic or contact-based, are installed directly onto door frames and sashes, making them ideal for both new constructions and retrofitting existing structures. Their compact design, cost-effectiveness, and compatibility with modern smart home and building automation systems have positioned them as the leading segment in the door sensors market. These sensors detect door or window openings by monitoring changes in magnetic fields or physical contact, ensuring reliable performance in security and automation applications.

The dominance of surface mount sensors is driven by their adaptability to diverse environments, including residential homes, commercial buildings, and industrial facilities. Unlike rollerball or overhead sensors, which are often specialized for specific door types, surface mount sensors offer universal applicability, making them the preferred choice for manufacturers and end-users. Their integration with wireless technologies, such as Zigbee, Z-Wave, and Wi-Fi, has further accelerated their adoption in smart home ecosystems and automated building management systems.

Recent advancements in the surface mount door sensors segment underscore its market leadership. In 2023, Honeywell introduced the SiXCT, a next-generation surface mount contact sensor designed for residential and commercial security systems. This sensor features enhanced encryption for secure communication, a longer battery life of up to seven years, and compatibility with Honeywell’s SiX platform, enabling seamless integration with smart home hubs. The launch reflects the industry’s focus on improving security and user experience through advanced surface mount technologies.

Several factors contribute to the prominence of surface mount door sensors. The global rise in smart home adoption, driven by consumer demand for enhanced security and convenience, has significantly boosted the segment. According to a 2024 report by the International Data Corporation (IDC), the smart home device market, including door and window sensors, is expected to grow at a CAGR of 10.2% through 2028, with surface mount sensors leading due to their affordability and ease of installation.

Urbanization and the expansion of commercial infrastructure also drive demand. Surface mount sensors are widely used in automatic sliding and swinging doors in retail, hospitality, and office buildings, where they ensure safety and energy efficiency. The European Union’s push for sustainable building standards, such as the Energy Performance of Buildings Directive (EPBD), has further encouraged the adoption of surface mount sensors in smart building applications to optimize energy use.

The surface mount door sensors segment is poised for continued growth, driven by advancements in wireless connectivity, battery efficiency, and integration with IoT platforms. Their versatility makes them a cornerstone of both residential and commercial applications, from smart home security systems to automated access control in high-traffic environments. As manufacturers invest in R&D to enhance sensor sensitivity and durability, the segment is expected to maintain its market leadership.

Emerging trends, such as the adoption of AI-driven analytics for predictive maintenance and the integration of sensors with 5G networks, are likely to further elevate the segment’s value proposition. For instance, AI-enabled surface mount sensors could analyze door usage patterns to optimize building operations, a feature already being explored by companies like Bosch in their 2025 smart building solutions roadmap.

Door Sensors Market Geographical Outlook:

- During the forecast period, the Asia Pacific region is expected to hold a significant market share.

The increasing adoption of IoT technologies, urbanization, rising disposable incomes, growing awareness of home security, and the growing trend of smart homes in countries such as China, India, and Japan are expected to fuel demand for door sensors in the Asia Pacific region. The Japanese government launched the "Society 5.0" initiative in 2019 with the aim of creating a human-centered society that leverages advanced technologies such as IoT, AI, and robotics. In 2019, China's National Development and Reform Commission (NDRC) released a guideline to promote the development of the smart home industry in the country. In 2019, the Indian government launched the India Smart Home Automation Alliance (ISHAA), which aims to promote the adoption of smart home technologies in the country. These factors all add to the market growth of door sensors in the Asia Pacific region.

- The US market is also predicted to hold a considerable share

The US market will thrive in the field of modern innovations, such as smart sensors fueled by the growing need for improved solutions that follow the modern approach and meet the requirements. Hence, it is at the forefront of the security sector due to continuous funding in new sensor technologies aimed at reducing crime rates, including theft and burglary, opening new opportunities for market expansion.

Over the years, there has been a constant growth in the rates of burglary incidence, especially in non-residential establishments, which has raised concerns regarding security. For instance, according to the data provided by the Council on Criminal Justice in January 2025, there was a 12.9% growth in the incidence of non-residential burglary, which was significantly higher in 2023 with 20% and in 2022 with 23%.

Moreover, the same source also specified that shoplifting increased by 1%. However, the ongoing implementation of stringent rules by authorities for such crimes and growing concern regarding personal safety are integral driving factors for adopting smart technologies, thereby augmenting the door sensor market expansion.

Constant growth in living standards, followed by improvement in disposable income, has increased the demand for residential establishments and including condominiums and private housing, in the United States. For instance, according to the data provided by the US Census, in 2024, nearly 1,627,900 housing units were completed in the country, which represented a 12.4% increase over the number of units completed in the preceding year.

Various market players, namely Honeywell International, OPTEX Group, and Samsung, have established their base in the country and are undergoing constant product innovation to improve their market competitiveness is also driving regional market expansion.

Door Sensors Market Key Developments:

- Advancements in Commercial Door Sensors (2024): The commercial door sensors market saw significant innovation, with companies like BEA and Optex releasing advanced motion and presence sensors for automatic doors. These sensors incorporate enhanced infrared and microwave technologies for improved accuracy and energy efficiency

- CP Plus Door Contact Sensor Introduction (2022): CP Plus, a global security solutions provider, launched its Door Contact Sensor with DIY plug-and-play functionality and cloud-based alarm triggers. Marketed as “SmartNazar,” it notifies users of unauthorized door openings, targeting both residential and commercial applications.

- June 2021: Xiaomi launched a new product called the Aqara Door and Window Sensor that uses Zigbee technology to detect when a door or window is opened or closed.

- September 2020: Ring, a subsidiary of Amazon, announced the release of a new product called the "Ring Alarm Contact Sensor", which is a door and window sensor that sends alerts to users' smartphones when triggered.

Door Sensors Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Door Sensors Market Size in 2025 | US$1,122.164 million |

| Door Sensors Market Size in 2030 | US$1,503.553 million |

| Growth Rate | CAGR of 6.03% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Door Sensors Market |

|

| Customization Scope | Free report customization with purchase |

Door Sensors Market Segmentation:

- By Type

- Surface Mount

- Rollerball

- Overhead

- Others

- By Technology

- Mechanical

- Optical

- Magnetic

- On-Axis

- Off-Axis

- By Connectivity

- Wired

- Wireless

- Wi-fi

- Bluetooth

- Others

- By Application

- Security System

- Access Control

- Industrial Automation

- Others

- By End Users

- Residential

- Commercial

- Industrial

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Other

- North America