Report Overview

Drone Flight Control Software Highlights

Drone Flight Control Software Market Size:

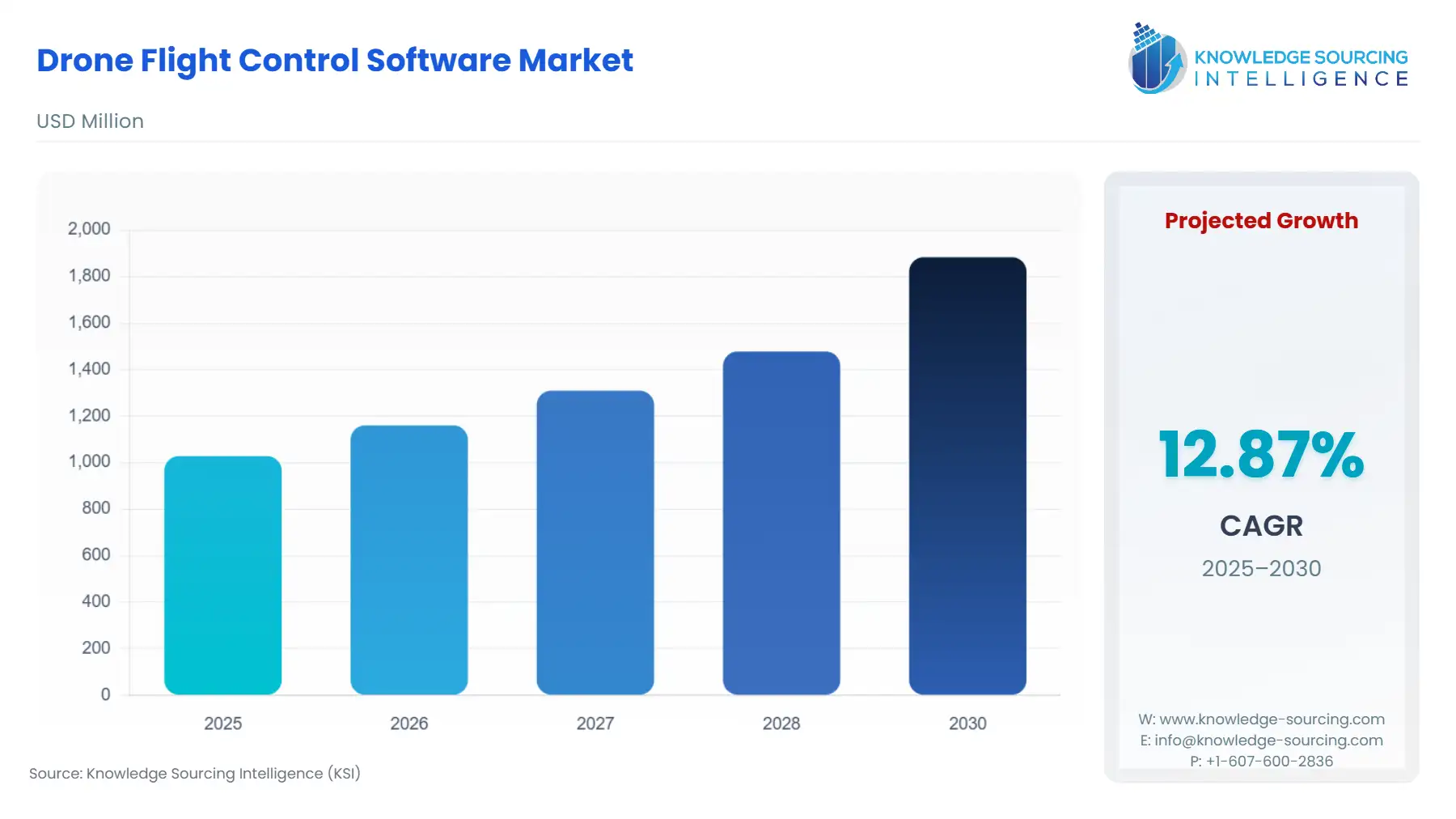

The Drone Flight Control Software Market is projected to grow at a CAGR of 12.87% from 2025 to 2030, reaching US$ 1,883.643 million by 2030 from US$1,028.078 million in 2025.

The rising adoption of drones across commercial, military and consumer sectors drives the demand for drone flight control software to ensure precise navigation, autonomy, and data processing. The ongoing trend towards technological advancement, such as AI-powered flight control software, enhances features like object detection and adaptive path planning, helping in the improvement of drone capabilities. Also, the increasing role of the government in ensuring drone safety is encouraging investment in compliant flight control software.

________________________________________

Drone Flight Control Software Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The Drone Flight Control Software Market is segmented by:

- Solution Type: The market is segmented by solution type into Ground Control Station (GCS) Software and Onboard Flight Control Software.

- Drone Type: By drone type, the market comprises fixed-wing drones, rotary-wing drones and hybrid drones. Rotary-wing drones dominate, while hybrid is gaining traction as demand is increasing in logistics and border surveillance. Nano and macro are expanding in niche applications.

- Platform: In terms of platform, the market is segmented into Open Source and Proprietary software. Proprietary software dominates the commercial segment due to better integration, support, and security features.

- Application: The application segment includes Mapping and Surveying, Inspection, Agriculture, Surveillance and Monitoring, and Others. Mapping and Surveying constitute a major share of the application.

- End-User: By end-user, the market is segmented into military and defense, commercial, consumer, and government, with military and defense holding the significant share due to rising defense budgets and surveillance needs. However, the commercial segment is estimated to grow at the fastest rate due to increases in the use of drones across a variety of sectors, such as in logistics, agriculture and infrastructure inspection.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific. Asia-Pacific is expected to witness the fastest growth, while North America will constitute a major share of the market.

________________________________________

Top Trends Shaping the Drone Flight Control Software Market:

1. Increasing integration of artificial intelligence and machine learning

- Artificial intelligence and automation are bringing new and significant changes to the drone flight control software. Artificial intelligence, particularly machine learning, is embedded in drone flight control software that enhances its navigation, obstacle avoidance and real-time decision-making. As the demand for more enhanced and more reliable drones is increasing in commercial and industrial settings, the market is trending towards increasing integration of AI and ML technologies.

- Companies are aligning themselves with this trend. For instance, Skydio has integrated NVIDIA Jetson Orin GPU and Spatial AI in its Autonomy Engine software. It has used computer vision algorithms to analyse the surroundings and has used predictive AI for decision making. It also uses I-driven vision instead of GPS or external lighting.

________________________________________

Drone Flight Control Software Market Growth Drivers vs. Challenges:

Opportunities:

- Rapid adoption of drones across industries: The rapid adoption of drones across industries is a major driver for the growth of drones, leading the drone flight control software market to grow. Drones are increasingly used in diverse sectors, including agriculture, logistics, surveying, media, and defense, driving demand for advanced flight control software to ensure precise navigation, autonomy, and data processing. For instance, as per JOUAV, the agriculture drone market is booming and revolutionizing the agriculture industry by analysing the information and identifying issues like crop diseases, irrigation irregularities, or nutrient deficiencies. As per the data by Drone Industry Insights, the Global drone market size is forecast to reach US$57.8 billion by 2030, with the commercial market growing at a 7.9% CAGR. Thus, driving the flight control software for advanced navigation and autonomy and processing data and making decisions.

- Surge in military and defense budgets accelerating the demand for advanced drone flight control software: The growing expenditure by the military and defence across nations for advanced Intelligence, Surveillance, and Reconnaissance (ISR) drone systems is a key factor driving the market for drone flight control software as it rely heavily on sophisticated flight control software for autonomous operation, real-time data analysis, and mission execution. As reported by the Teal Group, by 2033, the total drone-related spending is projected to reach $258.6 billion, with military UAS R&D accounting for approximately 27.8% of that amount. This surge in investment will propel the development of more advanced flight control software.

Challenges:

- Regulatory Compliance: The market is witnessing evolving, stringent regulations across many regions, such as FAA rules in the U.S. and EASA standards in Europe, that require flight control systems to meet strict safety and reliability standards and have to meet certain certification standards. Thus, these regulations require advanced drone software with public safety and reliability features. As safety is becoming a major concern, the regional variations in regulations are creating significant hurdles, especially for the smaller firms and emerging businesses.

________________________________________

Drone Flight Control Software Market Regional Analysis:

- North America: The North American region will dominate the market due to robust private investment, strong governments' support, and a well-established drone ecosystem. The presence of leading software developers and extensive research and development leads the market to dominate. Also, the widespread adoption defense, agriculture, logistics, and public safety further boosts demand for advanced flight control software.

- Asia-Pacific: The Asia-Pacific is anticipated to grow at the fastest rate in the market. The market is witnessing growth due to an increase in demand for drone services across multiple industries, such as agriculture to mining to surveillance and disaster management. The dominant share of China in the drone market will drive the growth in the drone flight control software market as well. The growing demand in China, India, Japan, and South Korea will lead the region in growth.

________________________________________

Drone Flight Control Software Market Competitive Landscape:

________________________________________

Drone Flight Control Software Market Segmentation:

By Solution Type

- Ground Control Station (GCS) Software

- Onboard Flight Control Software

By Drone Type

- Fixed-Wing Drones

- Rotary-Wing Drones

- Hybrid Drones

By Platform

- Open Source

- Proprietary

By Application

- Mapping and Surveying

- Inspection

- Agriculture

- Surveillance and Monitoring

- Others

By End-User

- Military and Defense

- Commercial

- Consumer

- Government

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others