Report Overview

Europe AI in Art Highlights

Europe AI in Art Authentication Market Size:

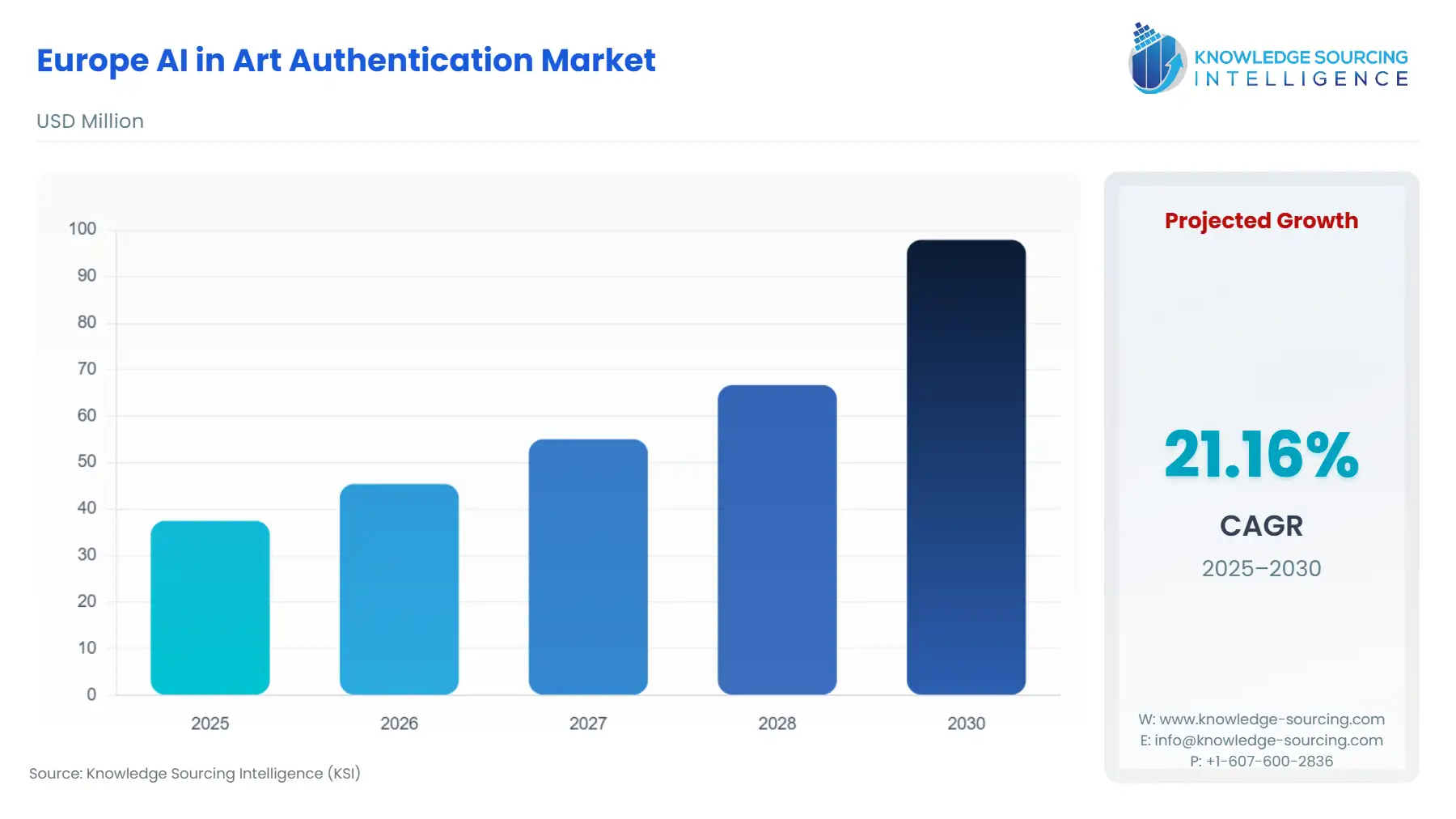

Europe AI in Art Authentication Market is forecast to climb from USD 37.498 million in 2025 to USD 97.906 million by 2030, driven by a CAGR of 21.16%.

The European AI in Art Authentication Market stands at a critical juncture, characterized by the convergence of advanced deep learning technologies and a legacy art ecosystem grappling with mounting issues of provenance integrity and counterfeiting. This market serves as a vital technological overlay for the broader European art market, which is a global hub for both historical and contemporary art transactions. The core value proposition of AI in this context is its capacity to deliver objective, scalable, and non-destructive analysis of artistic style, materials, and authorship through proprietary algorithms trained on vast, high-resolution datasets of authenticated works. This move toward data-centric verification directly addresses the inherent subjectivity and potential bias present in human-only expert authentication, which has historically been vulnerable to error and litigation. The regulatory environment in Europe, particularly the push for digital transformation and ethical AI, is fundamentally reshaping the procurement and deployment strategies of service providers and end-users alike, solidifying AI-driven authentication as a compliance and due diligence imperative, not merely a competitive advantage.

Europe AI in Art Authentication Market Analysis

Growth Drivers:

- The escalating economic impact of art forgery is a primary catalyst, directly driving demand for AI solutions. Verifiable reports of high-profile counterfeits and subsequent litigation create an urgent need for secure, tamper-proof verification methods. This necessitates the adoption of AI-as-a-Service models by Art Institutions and Art Market Intermediaries to safeguard their inventories and reputations. Furthermore, the imperative for digital provenance tracking, spurred by the need for regulatory compliance and enhanced asset securitization, accelerates the demand for AI systems capable of generating technical 'fingerprints' for artworks. These technical identifiers are critical inputs for blockchain-based provenance ledgers, establishing a quantifiable demand for integrated AI-based initial authentication.

Challenges and Opportunities:

A principal challenge facing the market is the existing skepticism and resistance to AI adoption from established art connoisseurs and traditional institutions, which view the technology as an intrusion upon human expertise. This inertia constrains market penetration, reducing the total addressable market of willing early adopters. However, this challenge simultaneously presents a significant opportunity: the demand for transparent, explainable AI (XAI) models. Providers who successfully develop and validate systems that clearly articulate their findings and integrate human expertise into a hybrid workflow will unlock substantial demand, particularly from conservative Art Institutions. The opportunity lies in positioning AI not as a replacement, but as an indispensable analytical co-pilot for traditional experts.

Supply Chain Analysis:

The AI in Art Authentication market supply chain is primarily software-centric, relying on a distributed network of data scientists, proprietary algorithm developers, and cloud infrastructure providers. Key production hubs are concentrated around major European technology and financial centers, such as Zurich, London, and Berlin, leveraging the presence of specialized talent and venture funding. The most critical dependency is the acquisition and curation of high-quality, legally clear, and ethically sourced training datasets of verified artworks and known forgeries. Logistical complexities revolve around establishing secure, low-latency API integration capabilities with end-users' existing collection management or e-commerce platforms. The intangible nature of the product, delivered largely as AI-as-a-Service or API integration, minimizes traditional material and physical logistical costs, shifting the supply focus to data governance and intellectual property licensing.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union | AI Act (Regulation (EU) 2024/1689) | The Act's risk-based framework compels providers to implement robust data governance, transparency, and human oversight for any high-risk AI system. While art authentication is not explicitly High-Risk, the principles of safety, robustness, and accuracy mandated by the Act raise the compliance barrier, thereby increasing demand for solutions from established, compliant European providers who can offer the requisite documentation and system transparency. |

| European Union | General Data Protection Regulation (GDPR) | Though most AI art authentication relies on image data (non-personal data), the GDPR applies when an AI system processes any image that may contain personal data (e.g., provenance documents with personal information). Compliance necessitates sophisticated data anonymization and secure processing protocols, which favors solutions offering on-demand or API integration models that minimize data retention. |

| European Patent Office (EPO) | European Patent Convention (EPC) | The EPO's stance on computer-implemented inventions and AI allows patentability for AI solutions that solve a technical problem. This regulatory clarity fosters a competitive environment, incentivizing companies to secure intellectual property for their unique stylistic analysis algorithms, which is essential for establishing market credibility and justifying higher service fees. |

Europe AI in Art Authentication Market Segment Analysis

- By Application: Art Authentication and Forgery Detection

The Art Authentication and Forgery Detection segment drives the highest current demand in the European market. The primary growth driver is the direct correlation between forgery rates and financial liability for owners, dealers, and insurers. AI systems address this by applying convolutional neural networks (CNNs) to analyze micro-level artistic features, such as brushstroke pressure, pigment application patterns, and sub-surface structure revealed through non-invasive imaging techniques like X-radiography or Infrared Reflectography. Unlike human experts, who rely on subjective connoisseurship and limited visual memory, the AI model offers a quantifiable, statistical probability of authorship. The requirement here is specific: clients require an audit-grade, objective report that can withstand legal scrutiny, particularly for Old Masters and highly-liquid contemporary works where financial exposure is highest. The non-destructive nature of AI analysis further propels demand by eliminating the risks associated with invasive physical sampling traditionally required for material analysis.

- By End-User: Art Market Intermediaries

Art Market Intermediaries, encompassing major auction houses, high-end galleries, and specialized art insurers, are a critical source of demand. Their fundamental driver is the need for rigorous, efficient due diligence at scale to protect their business and client trust. An auction house, for instance, processes thousands of consignments annually, making manual, expert-only authentication a critical bottleneck. AI platforms fulfill the demand for a rapid, initial screening layer that can flag works with a high statistical probability of being non-authentic, allowing human experts to focus their time and costly resources on high-risk, borderline cases. For art insurers, AI-generated authentication reports translate directly into reduced risk and more accurate underwriting models. Therefore, intermediaries demand enterprise-grade, high-throughput solutions, favoring API integration or AI-as-a-Service models that can be seamlessly embedded into their existing pre-sale or valuation workflows.

Europe AI in Art Authentication Market Competitive Environment and Analysis

The competitive landscape in Europe is characterized by specialized, technology-focused startups and academic spin-offs, positioning themselves as objective analytical partners to the legacy art establishment. These firms typically leverage proprietary algorithms and niche datasets, establishing a high barrier to entry based on intellectual property and validated research.

- Art Recognition AG

Based in Zurich, Switzerland, Art Recognition AG operates as an AI-based art authenticity evaluation system. Their strategic positioning emphasizes objective, unbiased results delivered through their core proprietary AI technology, which analyzes a work's photographic reproduction to assess authenticity. The company's official publications highlight its focus on scientific rigor, stating that their technology is backed by models and databases published in peer-reviewed computer science journals, offering a purely data-driven, non-human-intervened evaluation. This positions them as a credible, technical counterpoint to traditional connoisseurship, directly targeting demand from clients who require scientific certainty for insurance and legal purposes.

- ArtDiscovery

ArtDiscovery represents a broader, multi-disciplinary approach, combining advanced scientific imaging and non-invasive technical analysis with deep art historical expertise. Their model integrates state-of-the-art imaging technologies (such as X-ray fluorescence, infrared, and multispectral analysis) with digital data processing. Their strategic positioning focuses on comprehensive, expert-led authentication, where AI and data analytics serve as one component within a full-spectrum technical examination. This hybrid model targets demand from top-tier institutions and ultra-high-net-worth collectors who seek both cutting-edge technology and the established validation of a reputable, human-led firm.

Europe AI in Art Authentication Market Developments

- March 2025: The Swiss company, Art Recognition, applied its AI system to a version of Peter Paul Rubens's The Bath of Diana, long considered a copy. The AI evaluation suggested that portions of the painting were authentic to Rubens or his studio, highlighting the use of AI to re-evaluate and augment traditional connoisseurship on Old Masters within Europe.

- October 2024: The Zürich-based auction house, Germann, offered artworks by artists like Louise Bourgeois and Mimmo Paladino, with AI authenticity certificates provided by the Swiss company, Art Recognition. This was a significant move, as it represented a major auction house directly endorsing and utilizing AI for market-transaction authentication, potentially shifting art market credibility beyond human connoisseurs.

Europe AI in Art Authentication Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 37.498 million |

| Total Market Size in 2031 | USD 97.906 million |

| Growth Rate | 21.16% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Service Model, End-User |

| Companies |

|

Europe AI in Art Authentication Market Segmentation:

- BY APPLICATION

- Art Authentication and Forgery Detection

- Provenance & Ownership Tracking

- Valuation, Restoration and Condition Analysis

- BY SERVICE MODEL

- AI-as-a-Service

- On-Demand Authentication Services

- API integration

- BY END-USER

- Art Institutions

- Art Market Intermediaries

- Private Stakeholders