Report Overview

AI Solutions Market - Highlights

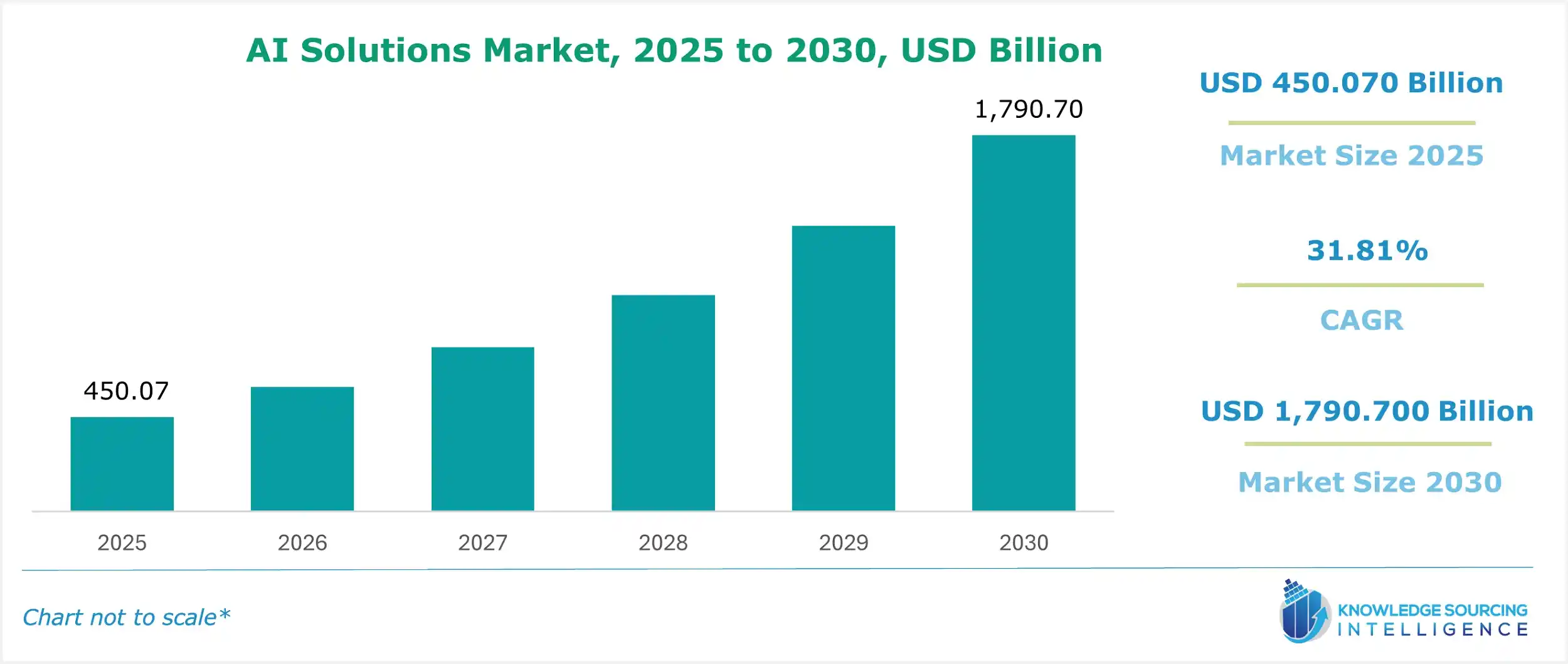

AI Solutions Market Size:

The AI Solutions Market is estimated to reach US$1,790.700 billion by 2030, growing at a CAGR of 31.81% from US$450.070 billion in 2025.

AI solutions are revolutionizing various industries by automating tasks, optimizing processes, and providing valuable insights. These solutions utilize advanced algorithms and techniques such as machine learning, natural language processing, and computer vision to analyze large amounts of data and make intelligent decisions. From customer service chatbots and recommendation systems to predictive maintenance and fraud detection, AI solutions are transforming businesses and improving efficiency, productivity, and customer satisfaction. As technology advances, AI solutions' capabilities will only continue to grow, offering even more opportunities for innovation and improvement across diverse sectors. Increasing adoption of fruit-based beverages is anticipated to propel market growth.

The increasing utilization of artificial intelligence worldwide is expected to boost the global AI solution market. Multiple industries worldwide, like manufacturing, infrastructure, telecommunication, healthcare, and automotive, among many others, have adopted AI-based technologies. Similarly, the investments by governmental and private corporations across the globe have increased significantly, propelling the market forward.

AI Solutions Market Growth Drivers:

- The rising utilization of artificial intelligence

The growing adoption of AI drives demand for AI solutions because businesses and industries seek to leverage AI technology to improve efficiency, productivity, and innovation in various domains, such as healthcare, finance, manufacturing, and customer service. This increased demand for AI solutions creates opportunities for companies specializing in AI development, leading to market growth.

While various AI technologies and applications, such as machine learning, natural language processing, and predictive analytics, are widespread, recent data from BTOS indicates a contrary trend. According to surveys conducted between October 23 and November 5, 2023, only an estimated 3.9% of businesses utilized AI to produce goods or services.

However, adoption rates varied significantly across different economic sectors. In the Information sector, for instance, 13.8% of businesses reported using AI, surpassing the national average. Similarly, the Professional, Scientific, and Technical Services sector exhibited a notable adoption rate of 9.1%. Conversely, sectors like Accommodation and Food Services demonstrated lower levels of AI adoption, with only 1.2% of businesses utilizing AI technology.

- Increasing investments in AI-based technology development.

A key factor propelling the global AI solutions market is the increasing investments by governmental and private organizations in developing artificial intelligence technologies. Countries worldwide, such as India, Japan, Germany, and Taiwan, have introduced multiple policies and investment opportunities to boost AI development in their nations. Similarly, multiple global corporations in technological sectors have also introduced various research programs and development strategies to develop advanced AI-based technologies.

For instance, the Government of India, in 2023, announced its National Strategy for Artificial Intelligence, an initiative aimed at developing the research and development program in the nation. Through this strategy, the government also created a protocol that encourages sharing anonymized data for public benefit. This strategy also aims to enhance the computing power of the nation and deploy AI-based technologies across multiple industries like healthcare, manufacturing, and telecommunications, among others.

The governments of the UK and Japan have also introduced multiple policies and strategies to develop AI technologies in their nations. In 2022, the UK government announced its National AI Strategy and Action Plan for AI, aimed at offering a package of about US$1.3 billion to support AI development in the nation. The government also created a new department, namely the UK Department for Science, Innovation, and Technology, in February 2023, to offer assistance and monitor the development of the nation's technological sector. Similarly, the Japanese Government, in November 2022, announced the "Five-Year Plan for Startup Development", aimed at boosting the growth of start-ups, especially those working in the AI and other technological sectors.

AI Solutions Market Geographical Outlook:

- North America is forecasted to hold a major share of the AI Solutions Market.

The North American region is forecasted to attain a greater global market share for AI solutions. This region is among the biggest developers of AI-based technologies worldwide, and some of the major global players like Google, Microsoft, Intel, Nvidia, and AMD are based here. In the North American region, countries like the USA are among the biggest adopters of AI technologies, integrating the technologies across multiple industries like healthcare, BFSI, manufacturing, logistics, and administration. Similarly, the US and Canadian governments have also introduced key strategies and investment opportunities, which are further forecasted to propel the AI solutions market forward in the region.

AI Solutions Market Key Players and Products:

- IBM Corporation, one of the biggest global technological corporations, offers a wide range of products and solutions for multiple industries, like automotive, banking, life science, and healthcare, among many others. The company also offers various solutions, like automation, securities, data & AI, and infrastructure. In the global AI solutions market, the company offers AI solutions that can provide higher automation performance and can also streamline data science workflows.

- Oracle Corporation is an American multinational technology corporation that offers a wide range of cloud-based technologies. The company offers various types of solutions based on multiple industries, like finance, retail, healthcare, communication, and manufacturing, among many others. In the AI solutions market, the company offers generative AI, AI Services, and ML Services, including digital assistance, generative AI agents, data science, and AI infrastructures.

AI Solutions Market Key Developments:

- In February 2024, a leading technology services and consulting provider, Wipro Limited, released a new service called Wipro Enterprise Artificial Intelligence (AI)-Ready Platform, enabling customers to build fully integrated, customized, enterprise-level AI environments. Moreover, in December 2023, Intel unveiled an unparalleled array of AI technologies at its "AI Everywhere" launch in New York City, enabling customers' AI solutions across the data center, cloud, and network.

- In October 2022, Dynam Al, an AI software development company specializing in automating crucial decision-making in the industrial sector, joined forces with CloudFactory, a prominent provider of human-in-the-loop AI technology. This partnership agreement enables both firms to enhance the implementation of AI solutions for decision-making processes. Additionally, users of Dynam.AI will gain access to CloudFactory's team of data analysts, facilitating the creation of large-scale, high-quality datasets.

List of Top AI Solution Companies:

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Accenture

- Oracle

AI Solutions Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI Solutions Market Size in 2025 | US$450.070 billion |

| AI Solutions Market Size in 2030 | US$1,790.700 billion |

| Growth Rate | CAGR of 31.81% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the AI Solutions Market |

|

| Customization Scope | Free report customization with purchase |

AI Solutions Market Segmentation:

- By Deployment

- Cloud

- On-Premise

- By Function

- Computer Vision

- Machine Learning

- Natural Language Processing

- Forecasting and Optimization

- By Industry Vertical

- Automotive

- Consumer Electronics

- Healthcare

- Pharmaceuticals

- Food and Beverage

- Manufacturing

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America