Report Overview

Europe Drug Delivery Market Highlights

Europe Drug Delivery Market Size:

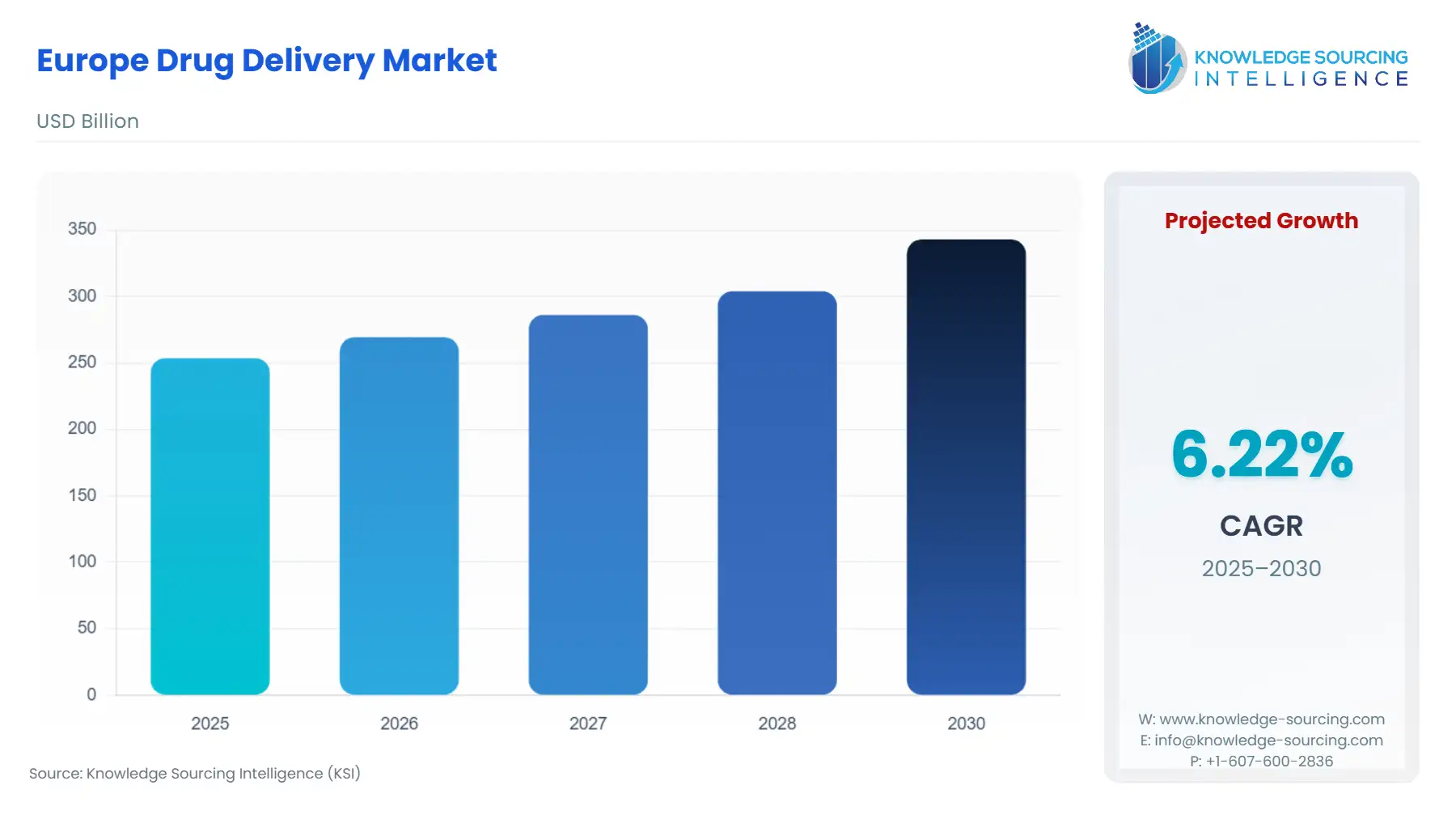

The Europe drug delivery market is estimated to attain a market size of US$342.982 billion by 2030, growing at a 6.22% CAGR from a valuation of US$253.649 billion in 2025.

Europe Drug Delivery Market Trends:

The drug delivery market in Europe is growing strongly, mainly influenced by the rising incidence of infectious and chronic diseases. Diseases like cancer, diabetes, cardiovascular disorders, and respiratory conditions are on the rise across the continent, notably among the elderly. This is triggering the need for sophisticated, effective, and targeted drug delivery systems that enhance the efficacy of treatment and minimize side effects. Increases in outpatient treatment and home-based therapies also favor the use of self-help drug delivery systems such as inhalers, injectables, and transdermal patches.

Europe Drug Delivery Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The Europe drug delivery market is segmented by:

- Type: The European drug delivery market is segmented into Inhalation drug delivery, injectable drug delivery, nasal drug delivery, oral drug delivery, transdermal drug delivery, and others. Inhalation drug delivery holds a considerable share in the market. The market is anticipated to grow at a robust rate, fueled by a rising burden of respiratory diseases such as asthma and COPD, growing technological innovation, and a fundamental shift in demand towards patient-centric healthcare solutions.

Respiratory diseases are the third most common cause of death in European Environment Agency (EEA) member countries. Nearly 420,000 people die from respiratory diseases annually, with over 60% of those deaths due to chronic respiratory diseases (CRDs) such as COPD, asthma, bronchitis, and emphysema. (Eurostat, 2024a; WHO, 2024; IHME, 2024).

As per the data from the European Union statistics, in 2021, there were 324,300 deaths in the EU resulting from diseases of the respiratory system, equivalent to 6.1% of all deaths among residents. Around 4.2 million in-patients with diseases of the respiratory system were discharged from EU hospitals in 2021. Discharges of in-patients treated for respiratory diseases accounted for 14.2% of the total number of hospital in-patient discharges in Romania, 12.7% in Cyprus, 11.6% in Lithuania, and 11.2% in Estonia, France (4.7%), Latvia (4.7%), and Hungary (4.8%). These data strongly support a growing and urgent demand for inhalation drug delivery systems in Europe.

- Application: The market is segmented into the treatment of diseases and Research/academic purposes.

- Region: The European drug delivery market is segmented into the U.K., Germany, Switzerland, France, Spain, Italy, and other countries. The UK is anticipated to be a dominant region during the forecast period.

Top Trends Shaping the Europe Drug Delivery Market:

1. Shift Toward Non-Invasive Delivery Methods

- One of the most significant European drug delivery industry trends has been the increased need for non-invasive delivery systems. Physicians and patients alike are preferring comfort, simplicity of administration, and a lower risk of complications, which has brought about a boom in the use of transdermal patches, oral dissolvable films, nasal sprays, and inhalers. These delivery modalities obviate injections, thus making them more attractive, especially for pediatric, geriatric, and chronically ill patients needing frequent dosing. Furthermore, non-invasive routes can frequently be done as self-administration, minimizing the necessity of clinic visits and decreasing healthcare expenditures.

2. Rise in Biologic Drug Deliveries

- Biologic therapeutics such as monoclonal antibodies, vaccines, and hormone therapy frequently need unique delivery systems to ensure stability and bioavailability. Consequently, the pharma industry is spending on sophisticated delivery forms such as pre-filled syringes, auto-injectors, and infusion pumps specifically designed for high-molecular-weight drugs. These devices improve precision, minimize contamination risk, and enhance patient convenience, particularly for home-based treatment.

Europe Drug Delivery Market Growth Drivers vs. Challenges:

- Rising Prevalence of Chronic Diseases: The increasingly high incidence of chronic illnesses in Europe is a major motivator for the drug delivery market. Sedentary lifestyles, aging population, and diets are all factors causing increased occurrences of diseases like diabetes, cancer, cardiovascular diseases, and respiratory diseases. The share of those aged 80 years or above in the EU's population is projected to have a 2.5-fold increase between 2024 and 2100, from 6.1% to 15.3%. Chronic health issues necessitate ongoing and often complicated treatment protocols that drive demand for better drug delivery systems.

Moreover, as per the IDF Diabetes Atlas, in 2021, people with diabetes were 5,141.3 thousand in Spain 2021, which is anticipated to increase to 5,576.0 thousand in 2030. Amongst this, Type 1 diabetes in children and adolescents was 9.7 thousand in 2021. Patients with diabetes mellitus (type 1 or 2) have a total lifetime risk of a diabetic foot ulcer complication as high as 25%.

Additionally, as chronic diseases are increasingly treated with personalized and combination therapies, pressure is growing for drug delivery technologies that enable precision medicine. This involves delivery systems designed to meet particular patient requirements with enhanced bioavailability and safety profiles. The growing burden of chronic disease will continue to be one of the principal drivers of innovation and market growth in Europe's drug delivery industry.

- Technological Innovations: Technological innovations are significantly influencing the market. Advances in nanotechnology, sustained-release formulations, and intelligent drug delivery devices are enabling more accurate dosing, extended action, and enhanced patient compliance. The increasing importance of biologics and biosimilars, many of which demand complex delivery systems like auto-injectors or implantable systems, is also driving technology development.

In this regard, pharmaceutical firms and research centers in Europe are investing significantly in R&D to develop more patient-friendly, cost-efficient drug delivery systems. PCI Pharma Services, one of the world's leading global contract development and manufacturing organization (CDMO) specializing in biopharma's most challenging therapies, is committing over $365 million to infrastructure enabling clinical and commercial-scale ultimate assembly and packaging of drug-device combination products based on advanced drug delivery systems with a focus on injectable forms. Comprising new and expanded facilities in both Europe and North America, the effort is part of PCI’s global investment plan, is anchored and funded by recent new business, and is designed to augment and accommodate future growth.

Europe Drug Delivery Market Restraints:

- High Development and Production Costs: One of the biggest constraints in the European drug delivery market is the expensive nature of developing and producing innovative drug delivery systems. Innovations like prolonged release formulations, targeted nanoparticles, or intelligent delivery devices need a lot of investment in development, research, testing, and compliance. The high initial costs involved may act as a barrier, particularly for small and mid-size pharma firms.

Europe Drug Delivery Market Regional Analysis:

- Germany: Germany's drug delivery systems market is ushered in growth by the increasing cases of diabetes and cardiovascular diseases, along with cancer and an aging population that fuel demand for advanced, targeted drug delivery systems meant for effective treatment. In World Health Organization (WHO) data, in 2023, in Germany, the population above 65 years accounted for 24.9 percent.

Moreover, IDF data reported Germany accounted for a prevalence of diabetes in adults of 10 percent, which was 6,199,900 cases in 2021. Besides, a total of 529,955 new cases of cancer were expected in 2022 by the European Cancer Information System (ECIS) of the Joint Research Centre. Meanwhile, ECIS expected a 15 % increase in cancer cases in Germany from 2022 to 2040.

Additionally, as per ECIS estimated cancer incidence rate in the country was 648 per 100,000 in men and 486 per 100,000 in women as of 2022. In addition, the rise in the cases of chronic respiratory conditions in Germany is also expected to drive the demand for the drug delivery system in the coming years. According to the WHO and European Health Information Gateway data of October 2024, the prevalence of COPD in Germany was 0.3% in 2022.

Europe Drug Delivery Market Key Developments:

- Product Launch: In April 2025, Argenx SE, a Netherlands-based company, announced that it received U.S. FDA approval for a new prefilled syringe format of its drug VYVGART® Hytrulo (efgartigimod alfa and hyaluronidase-qvfc), enabling self-injection for adult patients with generalized myasthenia gravis (gMG) and chronic inflammatory demyelinating polyneuropathy (CIDP).

- Company Collaboration: In November 2024, Ypsomed agreed with Novo Nordisk to manufacture autoinjectors for Novo’s next-generation GLP-1-based obesity drug, CagriSema, which is expected to offer significantly improved weight-loss results. It is believed that the weekly injection will lead to an average weight loss of 25% within a year.

Europe Drug Delivery Companies:

- Ascendis Pharma A/S

- Pfizer Inc.

- Becton, Dickinson Company

- Baxter International Inc.

- Novartis

Europe Drug Delivery Market Scope:

| Report Metric | Details |

| Europe Drug Delivery Market Size in 2025 | US$253.649 billion |

| Europe Drug Delivery Market Size in 2030 | US$342.982 billion |

| Growth Rate | CAGR of 6.22% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | U.K., Germany, Switzerland, France, Spain, Italy, Others |

| List of Major Companies in the Europe Drug Delivery Market |

|

| Customization Scope | Free report customization with purchase |

Europe Drug Delivery Market Segmentation:

By Type

- Inhalation Drug Delivery

- Injectable Drug Delivery

- Nasal Drug Delivery

- Oral Drug Delivery

- Transdermal Drug Delivery

By Application

- Treatment of diseases

- Research/Academic purposes

By Region

- U.K.

- Germany

- Switzerland

- France

- Spain

- Italy

- Others