Report Overview

Facial Implants Market - Highlights

Facial Implants Market Size:

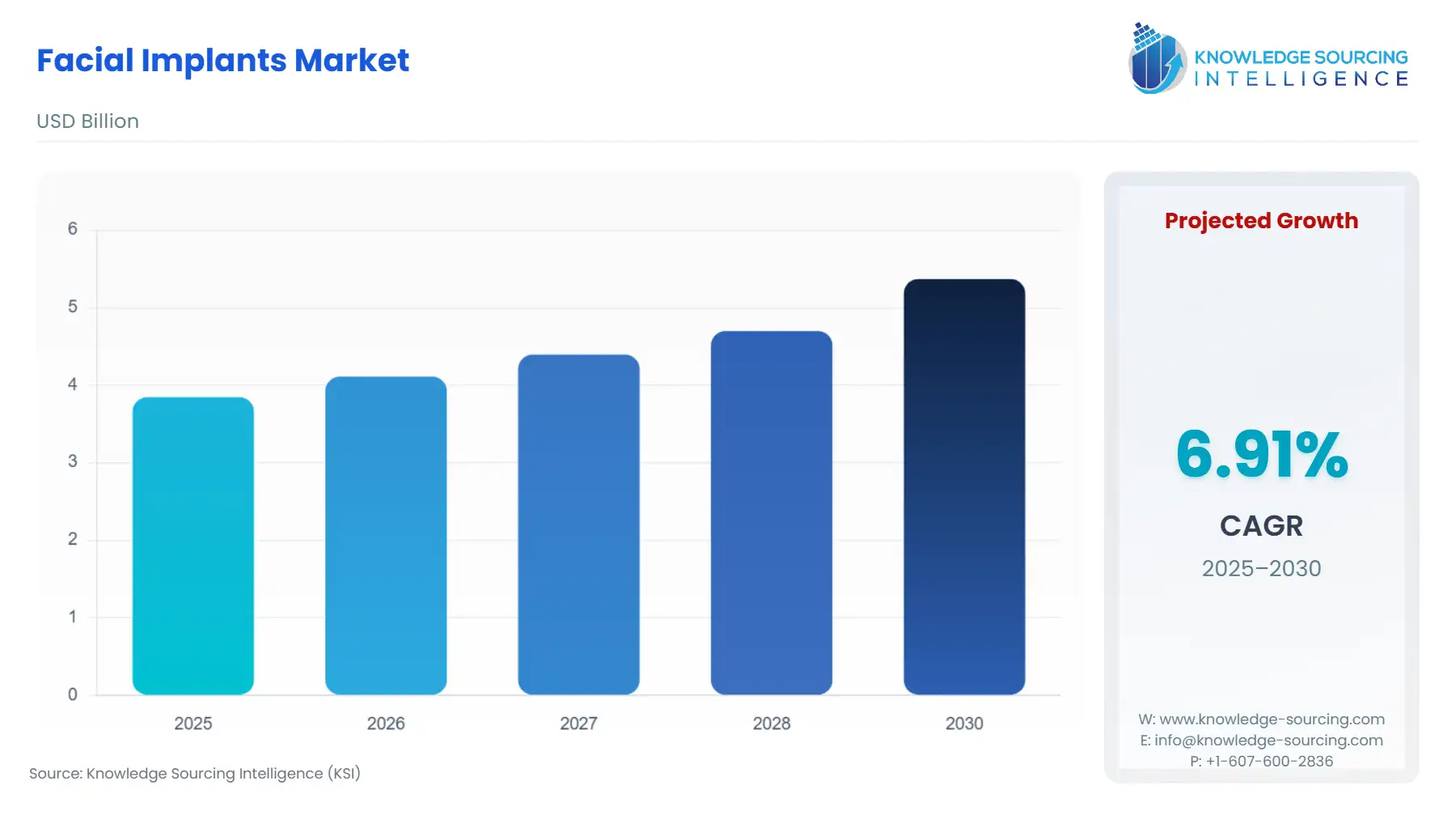

The facial implants market is expected to expand at a 6.7% CAGR, reaching USD 5.675 billion in 2031 from USD 3.845 billion in 2025.

Facial implants are medical devices used to enhance certain facial features or improve facial symmetry. They are commonly made of silicone or other biocompatible materials. The growing number of road accidents resulting in face deformities along with the huge prevalence of congenital or acquired face deformities is a major growth driver of the facial implants market. Moreover, the rising aging population coupled with the growing popularity of cosmetic procedures and enhanced productive launches are further contemplated to boost the facial implants market size.

Facial Implants Market Growth Drivers:

Growing Road Accident Cases

Road accidents can cause severe facial injuries such as fractures, disfigurement, and soft tissue damage. In some cases, facial implants may be utilized as part of reconstructive surgery to repair and restore the affected areas of the face. Therefore, the rising cases of road accidents are expected to propel the facial implant market. For instance, non-fatal injuries affect between 20 and 50 million individuals each year, many of whom develop disabilities as a result of their injuries according to the WHO report. Moreover, road traffic accidents incur a cost equivalent to approximately 3% of the gross domestic product (GDP) in many countries as per the WHO report.

Rising Prevalence of Congenital or Acquired Face Deformities

Facial implants can be used in the treatment of both congenital and acquired facial deformities. The huge prevalence of face deformities such as cleft lip, micrognathia, facial asymmetry, facial fractures, facial paralysis, and loss of facial tissue are contemplated to augment the facial implant market. For instance, micrognathia affects around 1 in 1500 children from birth as per the Fetal Medicine Foundation. According to the Rare Disease Organization, an estimated 40,000 Americans are diagnosed with Bell’s palsy (a neurological disorder of the facial nerve) every year. It affects males and females equally and it may be inherited.

Rising Popularity of Cosmetic Procedures

The growing popularity of cosmetic surgeries and aesthetic treatments has been a significant driver of the facial implants market. People's desire to improve their appearance and achieve facial symmetry has led to an increased demand for facial implants. For instance, according to The International Society of Aesthetic Plastic Surgery (ISAPS), there was a significant 19.3% overall rise in surgical procedures performed by plastic surgeons globally in 2021, with a total of over 12.8 million surgical procedures conducted worldwide. Moreover, liposuction emerged as the most prevalent cosmetic surgical procedure, with over 1.9 million cases performed globally, experiencing a substantial increase of 24.8% in 2021, and face and head surgery procedures increased by 14.8% as per the ISAPS global survey report.

Aging Population

There is a rising demand for facial rejuvenation procedures as a result of the aging population. Facial implants can help address volume loss and restore youthful facial contours, making them an appealing option for older individuals seeking cosmetic enhancement. The rising ageing population is, therefore, a significant growth driver of the facial implant market. For instance, there were 3.9 million cosmetic procedures conducted in the age group of 55-69 years American people in 2020 as per the American Society of Plastic Surgeons (ASPS). Moreover, the number of people aged 60 years or above are estimated to increase from 1 billion in 2020 to 1.4 billion by 2030 and the total contribution of this age group is expected to almost double from 12% in 2020 to 22% in 2030 as per the WHO reports.

Facial Implants Market Restraints:

The facial implants market has experienced growth and development however some restraints or challenges can impact its expansion. For example, facial implant procedures can be expensive, which may deter some potential patients from opting for these treatments. For example, the average cost of a facial implant may range from $3500 for a single implant site to up to $7500 for two or more implant sites as per the ASPS. Moreover, potential complications, such as infection, implant displacement, or adverse reactions to the implant material, may lead some individuals to hesitate in undergoing the procedure thereby limiting the facial implants market expansion.

Facial Implants Market Geographical Outlook:

North America is Expected to Grow Considerably

North America is expected to hold a significant share of the facial implants market during the forecast period. The factors attributed to such a share are the increasing cosmetic procedures, advanced technology, earlier adoption of medical technology, and rising car accidents. For instance, the United States accounted for the highest number of cosmetic procedures performed globally in 2021, representing 24.1% of the total procedures. Specifically, the US accounted for 30.4% of all non-surgical procedures and 15.5% of all surgical procedures conducted worldwide, as reported by the ISAPS. Moreover, the presence of major market players such as Implantech and Surgiform Technology further augment the facial implant market through enhanced accessibility and technological advancements.

Facial Implants Market Major Players:

Implantech is a US-based company specializing in the design, manufacturing, and distribution of facial implants and body contouring implants. It offers silicon-based ePTFE-based chin, mandibular, midfacial, temporal, and nasal implants.

Surgiform offers a range of facial implants made from biocompatible materials, such as silicone, designed to enhance various facial features and correct facial deformities. It offers chin implants in extended, standard, and extended anatomical forms. It also offers Asian nasal standard silicone implants.

Eurosurgical is a UK-based company specializing in the distribution of medical and surgical products, including facial implants. It offers silicone elastomer and PTFE-coated facial implants for the chin, mandibular and midfacial range.

List of Top Facial Implants Companies:

Implantech

Hanson Medical

Surgiform

Technomed Private Limited

GWS Surgical LLP

Facial Implants Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Facial Implants Market Size in 2025 | USD 3.845 billion |

Facial Implants Market Size in 2030 | USD 5.370 billion |

Growth Rate | CAGR of 6.91% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Facial Implants Market |

|

Customization Scope | Free report customization with purchase |

Facial Implants Market Segmentation

By Product

Chin

Cheek

Nasal

Injectables

By Material

Metal

Biologics

Polymers

Ceramic

By Procedure

Eyelid Surgery

Facelift

Rhinoplasty

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others