Report Overview

Fluid Bearing Market - Highlights

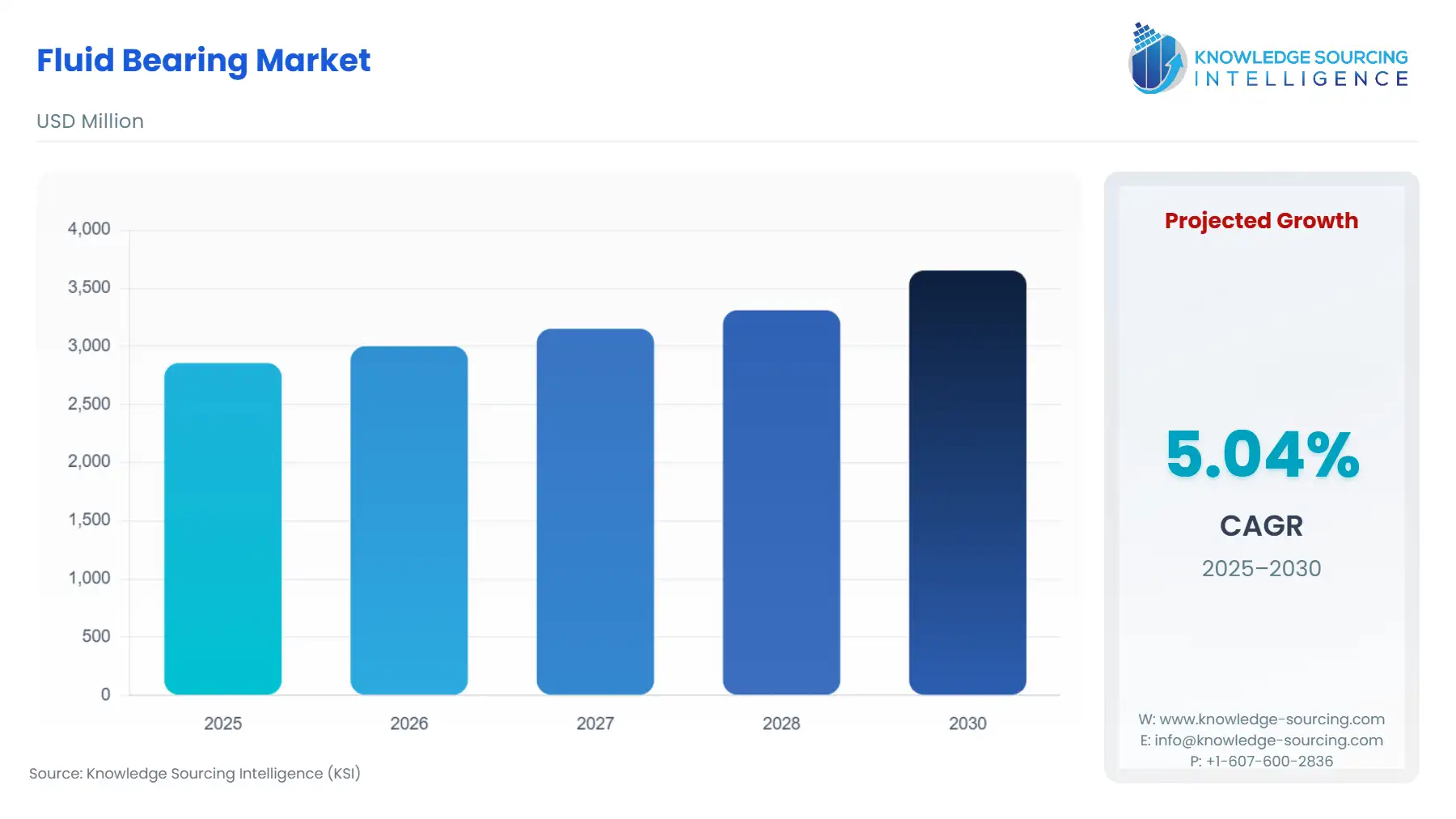

Fluid Bearing Market Size:

The fluid bearing market, at a 4.89% CAGR, is expected to reach USD 3.804 billion in 2031, starting from USD 2.857 billion in 2025.

Fluid bearings utilize a thin layer of pressurized liquid or gas to support and sustain the load between the surfaces of the bearing, enabling smooth and efficient operation. Fluid bearings are utilized by various end users such as oil & gas, chemical, power & energy, mining, and other industries, highlighting their wide-ranging applications and demand. Bolstering growth in its major end-users like oil & gas and mining is driving the growth of the fluid-bearing market, contributing to its increased size and demand.

Fluid Bearing Market Growth Drivers:

Booming oil and gas production bolsters the fluid-bearing market growth.

In the oil & gas sector, fluid bearings are crucial components used in various applications, including pumps, compressors, turbines, and drilling equipment. The demanding operating conditions, high speeds, and heavy loads in oil & gas operations require reliable and efficient bearing solutions, making fluid bearings an ideal choice. As an increase in demand for energy increases, there is a growth in the oil & gas industries. According to the Energy Information Administration, in 2020, the United States consumed approximately 18,186 thousand barrels per day of petroleum and other liquids. This consumption saw an increase to 19,890 thousand barrels per day in 2021.

Growing chemical industry drives the fluid-bearing market expansion.

In chemical manufacturing processes, fluid bearings are extensively used in pumps, mixers, agitators, and other equipment. The sector's growth, driven by increasing demand for chemicals across industries such as pharmaceuticals, plastics, and specialty chemicals, has accelerated the demand for reliable bearing solutions simultaneously. According to the European Chemical Industry Council, global sales witnessed a substantial growth of 15.2%, reaching €4,026 billion in 2021 from €3,494 billion in 2020. Among the top-ranking regions, the EU27 chemical industry secured the second position with a 14.7% increase in total sales, while the United States stood third with a 10.9% rise.

Rising mining activities drive the fluid-bearing market growth.

Mining operations use fluid bearings in various equipment, including crushers, conveyors, pumps, and drilling machinery. The rise in investment and government initiatives to boost the mining sector has boosted the demand for fluid bearings. For instance, Hindustan Copper Limited, India, targets significant mining capacity growth - from 4.0 to 12.2 million tons per annum in phase-I, and to 20.2 million tons per annum in phase-II. The expansion plan includes reopening closed mines, expanding existing ones, and opening new mines, all set to commence in the financial year 2021-22. Additionally, according to the Government of Canada, Canada's coal mineral production witnessed significant growth, rising from $4.0 billion in 2020 to a substantial $8.0 billion in 2021.

Fluid Bearing Market Geographical Outlook:

Asia-Pacific is predicted to dominate the fluid-bearing market.

The Asia Pacific region is the leading region in the fluid-bearing market owing to the rapid industrial developments in oil & gas, chemical, power & energy, and mining in major APAC economies namely China, India, Japan, and South Korea has boosted the need for reliable and high-performance fluid bearings for various operations. According to the Energy Information System, China's petroleum and other liquid consumption witnessed a growth of 5.6% from 14,433 thousand barrels per day in 2020 to 15,266 thousand barrels per day in 2021. Also, Indian Oil Corporation (IOCL)in November 2021 invested Rs. 3,681 crores in the establishment of India's inaugural mega-scale maleic anhydride unit. This facility primarily focuses on producing high-value specialty chemicals.

High-Initial costs restrain the fluid-bearing market growth.

The implementation of fluid bearings can present a higher cost burden compared to traditional mechanical bearings. This increased cost encompasses various aspects, including the expenses associated with designing, manufacturing, and installing fluid bearings. As a result, these higher costs can pose a significant barrier for industries, particularly smaller businesses or those operating with limited budgets. The upfront investment required for fluid bearings may deter their adoption, limiting their accessibility and potential market growth within these economic constraints.

Fluid Bearing Market Key Developments:

February 2023: Mac Marketing Corporation, a leading company, announced the introduction of HYPROSTATIK's innovative hydrostatic spindle bearings to the Indian market. This strategic move aims to bring the benefits of hydrostatic spindle bearings, known for their exceptional performance and precision, to various industries in India.

October 2022: Jenkins Electric acquired Wheeler Bearing, a sleeve and fluid film bearing manufacturer. This strategic move represents a significant expansion of Jenkins' distribution business, now encompassing a comprehensive range of offerings, including sleeve and fluid film bearings, motor cooling fans, winding protection, and motor parts. This acquisition strengthens Jenkins' position in the market and reinforces its commitment to providing customers with a diverse portfolio of high-quality products.

August 2022: Waukesha Bearings, a subsidiary of Dover Corporation, completed the acquisition of Federal-Mogul RPB. This strategic acquisition aligns perfectly with Waukesha Bearings' overarching strategy to establish itself as the foremost leader in the industry for designing, manufacturing, and selling precision hydrodynamic fluid film bearings. By incorporating Federal-Mogul RPB's expertise and resources, Waukesha Bearings strengthens its position and reinforces its commitment to delivering cutting-edge solutions in the field of fluid film bearings.

Fluid Bearing Market Company Products:

Hydrodynamic Thrust Bearings: The Hydrodynamic Thrust Bearings are offered by 3M. These bearings are designed to minimize frictional losses, resulting in improved motor efficiency. By reducing friction, these bearings contribute to energy savings and enhanced overall performance. Additionally, the extended service life of these bearings ensures reliable operation over an extended period. With their high-temperature capability, exceeding 650°F, they are well-suited for demanding applications that involve elevated temperatures.

Flexure Pivot tilt pad thrust bearings: Waukesha Bearings offers the innovative Flexure Pivot Thrust Bearings, which deliver significant benefits in terms of power loss reduction and extended bearing life across a wide range of operating conditions. These bearings feature the unique Flexure Pivot tilt pad design, which utilizes the flexure of post support to form a converging wedge. This design eliminates pivot wear and mitigates high contact stresses that are typically associated with traditional point or line contact tilt pads.

List of Top Fluid Bearing Companies:

3M

Waukesha Bearings

Kingsbury, Inc.

Wheeler Bearing Company, LLC

Bearings Plus

Fluid Bearing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Fluid Bearing Market Size in 2025 | USD 2.857 billion |

Fluid Bearing Market Size in 2030 | USD 3.653 billion |

Growth Rate | CAGR of 5.04% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Fluid Bearing Market |

|

Customization Scope | Free report customization with purchase |

Fluid Bearing Market Segmentation

By Type

Hydrostatic Bearing

Hydrodynamic Bearing

Circumferential Groove Bearing

Pressure Bearing

Multiple Groove Bearing

By Fluid Type

Oil

Water

Process Fluid

By End-User

Oil & Gas

Chemical

Power & Energy

Mining

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others