Report Overview

France Material Handling Market Highlights

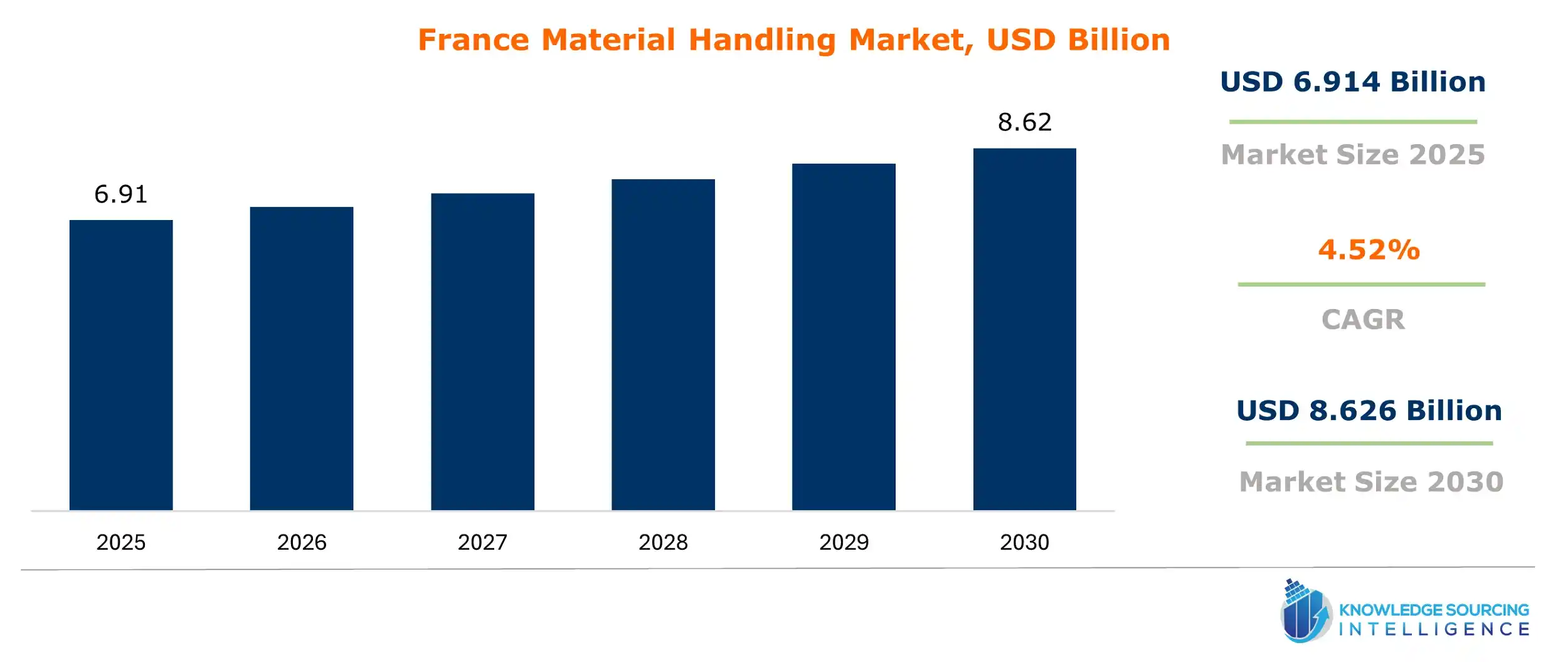

France Material Handling Market Size:

The French Material Handling market will grow at a CAGR of 4.52% from USD 6.914 billion in 2025 to USD 8.626 billion in 2030.

France Material Handling Market Key Highlights:

- France's material handling market is growing steadily due to rising manufacturing and logistics demands.

- E-commerce expansion is driving increased need for efficient material handling solutions nationwide.

- Automation and AI integration are boosting adoption of AGVs and ASRS technologies.

- Airport baggage handling demand is surging, fueled by rising air passenger numbers.

Material handling is the process of the movement of materials and goods across various locations. These include protection, control, and storage of materials from the manufacturing centers to the distribution locations. The increase in the nation's manufacturing and logistics industry is expected to boost the market for material handling in the nation. Furthermore, the introduction of artificial intelligence (AI) and automation has given rise to the market for automated guided vehicles (AGVs) and automated storage-and-retrieval systems (ASRS), both of which are expanding rapidly due to the presence of advanced material handling techniques.

One of the major drivers for the material handling market expansion in France is its increased demand for baggage handling at airports nationwide. Air passenger transport observed a significant increase. The INSEE of France stated that the number of passengers for domestic flights between the nation's airports was about 2.43 million in April of 2023, which increased to 2.583 million in May and 2.629 million in June 2023.

France Material Handling Market Drivers:

- The increasing market share of e-commerce retail in the nation is expected to propel the growth of France's material handling market.

E-commerce comprises the features of various industries, like warehouse, delivery, and parcel & packaging, that apply material handling. E-commerce material handling includes storing, receiving, and distributing various products and goods. The nation’s e-commerce industry growth is expected to boost the market share of material handling.

In France, the e-commerce industry has observed a constant rise in its market share. E-commerce Europe stated that the nation's e-commerce spending reached about US$170 billion (Euro 165 billion) in 2023, a 10.5% increase from 2022, when e-commerce spending was recorded at about US$155 billion (Euro 144.7 billion). The increase in the nation’s e-commerce spending will surely increase the flow of packages and parcels, propelling the demand for material handling.

France Material Handling Market Segment Analysis:

- The manufacturing segment is predicted to contribute at a significant pace to market growth

Manufacturers in France are progressively trying to integrate automation in the material handling sector as it will help them to reduce costs, enhance efficiency, and increase safety. The nation has several divisions where these material-handling types of equipment can be utilized. In industries such as automotive, aerospace, construction, and pharmaceutical businesses, the rising adoption of material handling hardware within these segments is anticipated to drive market development over the estimated period.

For instance, by the Grand Plan d’Investissement (Great Investment Plan), an investment plan for the civil engineering sector, the government planned to invest EUR 57.0 billion from 2018 to 2023. From this venture, EUR 9.0 billion will be invested in the thermal remodel of buildings, EUR 4.1 billion will be invested in infrastructure, renovation, and sustainable transportation, and EUR 7.0 billion will be invested in developing renewable energy. Moreover, the government plans to contribute EUR 13.7 billion by 2023 to progress the transport and mobility framework. Consequently, in the coming years, with the development of end-use businesses, the market for material handling is anticipated to boost.

This development is being driven by the expansion of the automotive, aviation, and pharmaceutical businesses. The development of manufacturing facilities creates demand for new material-handling equipment to assist producers in improving efficiency and productivity. In addition, the manufacturing division encompasses a huge share of France's GDP. According to the World Bank, 9% of France's GDP was contributed by the manufacturing sector, which expanded to 10% in 2023.

The automotive industry is one of the greatest consumers of material handling machinery, as there's a steady need to handle bulky material in that division. The rising automotive industry in France is expected to become one of the major material handling buyers in the years ahead. For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), several cars manufactured in 2021 in France were 9,17,907, which increased to 10,10,466 cars in 2022. In 2023, the number of cars manufactured increased to 10,26,690. With the developing end-use sector, the material-handling market is anticipated to have a positive impact in the forecasted period.

France Material Handling Market Key Players:

- Ameco Group- Ameco Group, founded in 1932, initially worked to provide maintenance services to potash mines in regions such as France, Switzerland, and Germany to deliver robust material handling equipment.

- Siemens company - Siemens company’s vision is to empower customers to transform industries that make up the backbone of economies, such as buildings, grids, and transportation. The company’s long-term strategy aligns with megatrends like urbanization, environmental change, glocalization, demographic change, and digitalization.

- Kardex Group- Kardex Group is a global industry partner for automated storage solutions, material handling solutions, and intralogistics solutions. The company has been in the business for more than 30 years and has more than 2,100 employees associated with it.

France Material Handling Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| France Material Handling Market Size in 2025 | US$6.914 billion |

| France Material Handling Market Size in 2030 | US$8.626 billion |

| Growth Rate | CAGR of 4.52% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Paris, Bretagne, Centre - Val de Loire, Bourgogne, Others |

| List of Major Companies in the France Material Handling Market |

|

| Customization Scope | Free report customization with purchase |

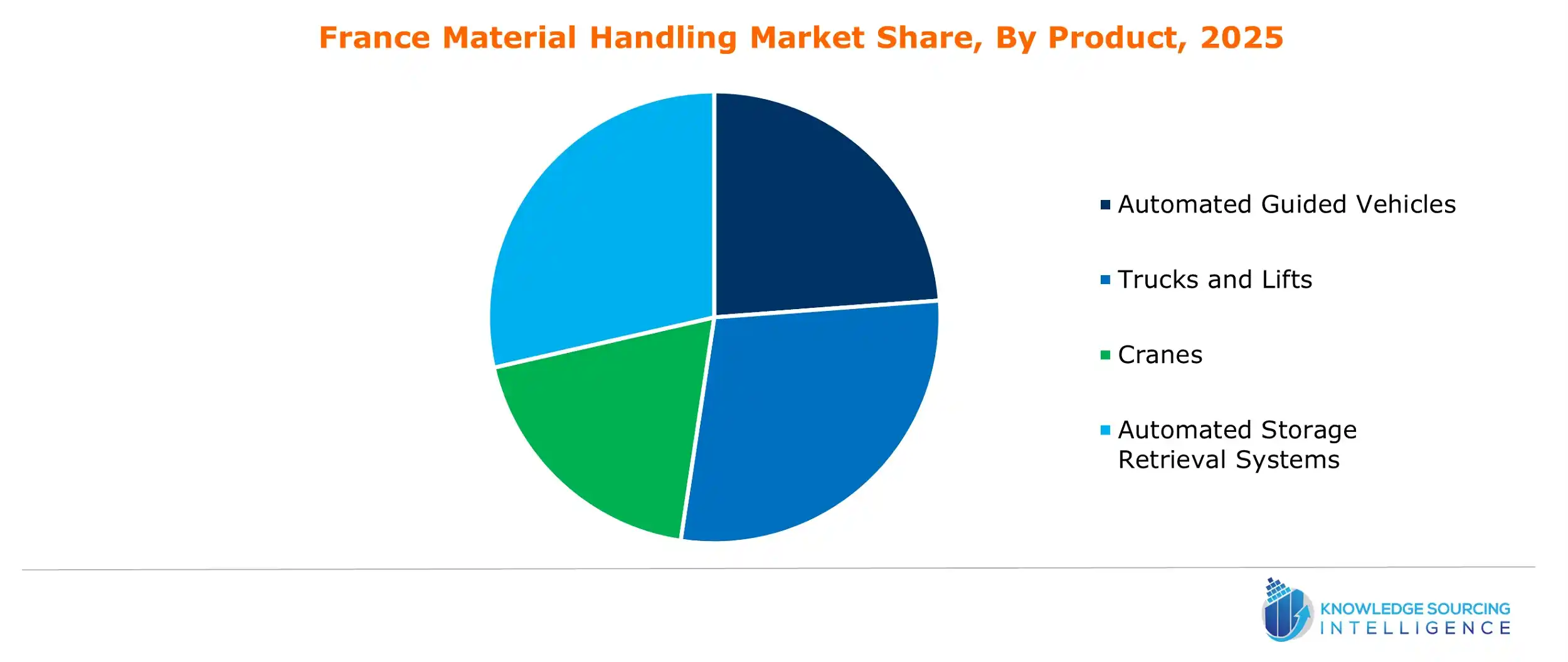

The France Material Handling Market is segmented and analyzed as below:

- By Product

- Automated Guided Vehicles

- Trucks and Lifts

- Cranes

- Automated Storage Retrieval Systems

- Conveyor Systems

- Others

- By Application

- Assembly

- Packaging

- Airport Baggage Handling

- Warehousing and Distribution

- Bulk Handling

- Postal and Parcel Delivery

- By Industry

-

- Healthcare

- Manufacturing

- Chemical

- Food and Beverage

- Warehousing

- Others

- By Province

- Paris

- Bretagne

- Centre - Val de Loire

- Bourgogne

- Others