Report Overview

Material Handling Market Report, Highlights

Material Handling Market Size:

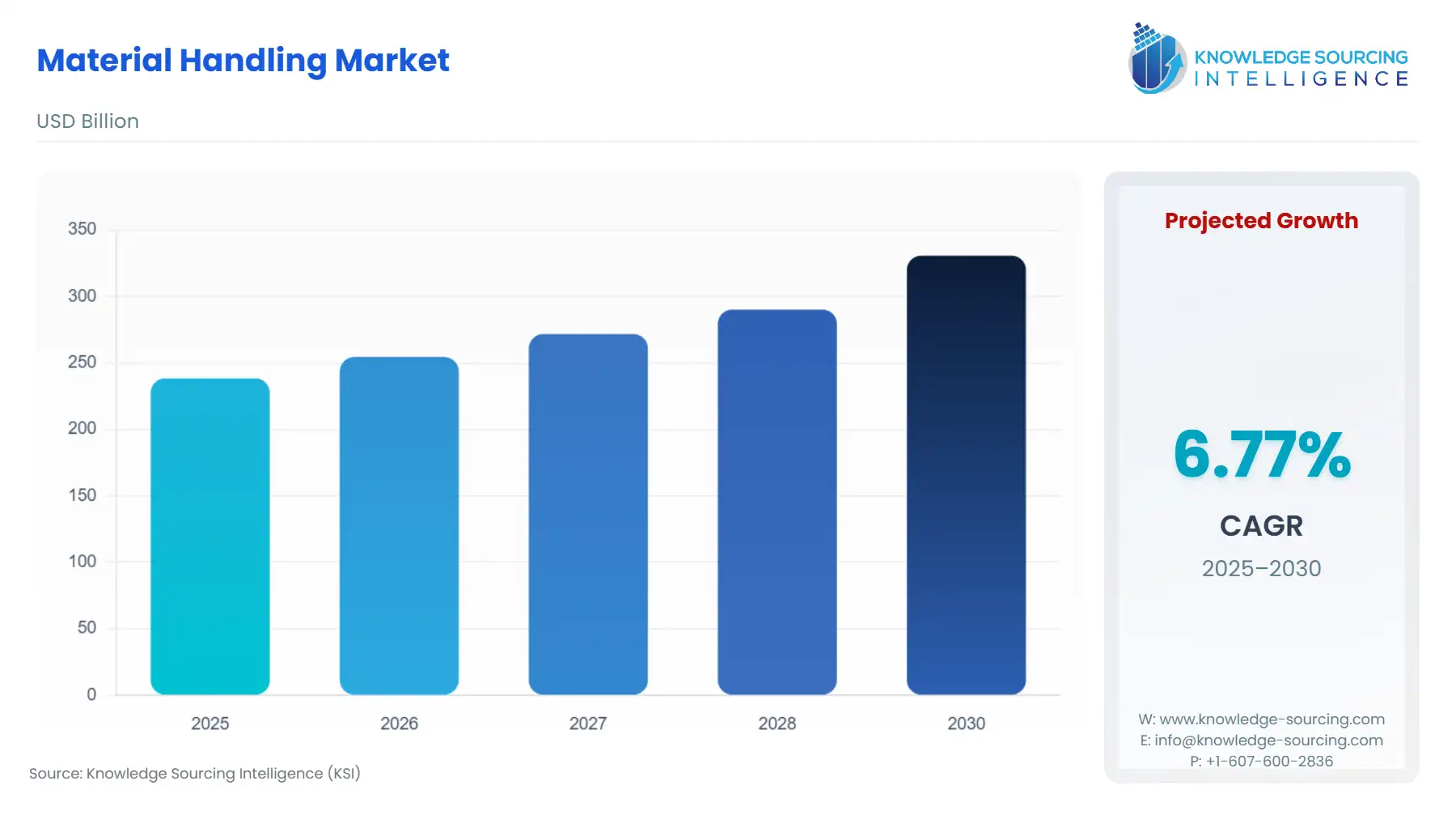

The material handling market is expected to grow at a CAGR of 6.77%, reaching a market size of US$330.828 billion in 2030 from US$238.457 billion in 2025.

Material Handling Market Trends:

The growing adoption of industrial automation solutions across various end-user industries is one of the key factors driving the global material handling market’s growth. The booming e-commerce industry and rising investments by manufacturers in installing various equipment at distribution centers and warehouses are also fueling the demand for material handling products and solutions worldwide.

In addition, stringent regulations on worker safety issues at workplaces have necessitated installing material handling solutions for perilous duties, compelling manufacturers to install these solutions. Thereby escalating the market for these types of products and services.

Material Handling Market Growth Drivers:

- Increasing demand for trucks and lifts

This growth is due to the replacement of people at warehouses with automated trucks and lifts, which is owing to high wage bills and the desire to enhance operational effectiveness in all supply chain activities. An increasing number of construction projects in developing countries is driving the demand for small trucks and specialized heavy-lifting equipment.

Moreover, the booming global logistics industry will further push the market’s growth over the next few years. Automated storage and retrieval systems (AS/RS) will witness the fastest growth during the forecast period, owing to the increasing demand for automated machines and equipment that reduce floor space, labour costs, and inventory levels to enhance productivity while reducing manufacturing cycle time.

- The rising need for warehousing and distribution

The growing global third-party logistics industry significantly drives the demand for material handling solutions. The entry of new startups in the growing global e-commerce industry is boosting the demand for 3PL solutions, as they rely on other logistics enterprises as part of the supply chain. Thus, there is a high demand for material handling solutions from the warehousing and distribution segment of the 3PL industry to smooth the entire supply chain.

Airport baggage handling applications are poised to experience significant market growth due to the growing global tourism industry. As the economies of the world's developing nations are becoming more prosperous, people are choosing air travel to a higher degree. This has caused the number of passengers in air transport to increase further, leading to a need for airport luggage handling solutions for the airport.

Material Handling Market Segment Analysis:

- The manufacturing sector is projected to grow considerably during the forecast period

The rising global manufacturing activities and infrastructural development, especially in developing countries, will spur the demand for material handling solutions for timely production requirements and increased productivity. Moreover, high labour costs coupled with stringent regulations for providing a safer workplace are pushing manufacturers to shift from labour-intensive to capital-intensive production methods, thereby positively impacting the global material handling market growth.

Additionally, the healthcare sector will witness the fastest market growth over the projected period due to the rising global geriatric population and the increasing cases of chronic diseases. The increase in demand for various medicines and medical devices will require the healthcare and pharmaceutical industries to opt for efficient material-handling solutions.

Material Handling Market Restraints:

- High initial investment

Automated handling equipment is a perfect fit for the fast-paced logistics and e-commerce industry of today, which demands automation. However, the market expansion is being hampered by the high initial cost of integrating material handling equipment across warehouses for procurement, installation, and packaging, which entails sophisticated accessories, programming, and other services. Companies, particularly small and medium-sized businesses, are limited by this. Most enterprises need assistance in raising large sums of money because they produce low volumes, with returns on investment coming late. Another challenge that hampers improving the worldwide market is maintenance costs, which are too high. High costs are associated with the software upgrades needed to test and train the automated system to achieve proficiency with few accidents on the shop floor.

Material Handling Market Geographical Outlook:

- Asia Pacific is projected to grow at a high rate during the forecast period

The growing e-commerce industry in India and China, due to the rising use of smartphones and the proliferation of internet connectivity, is fueling the demand for material handling solutions for warehousing and distribution applications. This is due to the rapid industrialization and escalating manufacturing activities in developing Asian economies like China, India, and South Korea, which are escalating demand for material handling solutions.

Over the forecast years, the Asia Pacific material handling market will be further accelerated by the boom in the construction industry and infrastructure development investments supported by friendly government policies and initiatives.

Material Handling Market Key Developments:

- In September 2025: Hyster Introduces Alternative Investment Models for Warehousing Automation. Hyster introduced alternative investment models for warehousing automation, allowing companies to adopt automation without massive upfront capital expenditures.

- In May 2025: DHL Group Signs MoU with Boston Dynamics for Additional Robots. DHL Group signed an MoU with Boston Dynamics for 1,000 additional robots, extending their 2018 partnership to boost material handling efficiency in logistics.

- In May 2023, Toyota Materials Handling, the industrial leader in innovative technological equipment in transporting loads, introduced three new electric models of forklift trucks, thus broadening its already extensive range of products and services in the transportation of goods. Among the new electric products, the following ones are being presented: side-entry end rider, centre rider stacker, and industrial tow tractor. This product has an ergonomic control handle with multiple functions that allow the operator to pick and place loads while facing forward and maintaining a clear line of sight. Best-in-class turning radius and speed reduction during turns will also be experienced by operators, making it simpler to transport loads when cornering and suitable for a variety of applications.

List of Top Material Handling Companies:

- Daifuku Co., Ltd.

- Schaefer Systems International Pvt Ltd

- Honeywell Intelligrated

- KION Group (Dematic)

- Toyota Industries Corporation

Material Handling Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Material Handling Market Size in 2025 | US$238.457 billion |

| Material Handling Market Size in 2030 | US$330.828 billion |

| Growth Rate | CAGR of 6.77% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Material Handling Market |

|

| Customization Scope | Free report customization with purchase |

Material Handling Market Segmentation:

- By Product

- Automated Guided Vehicles

- Automated Storage and Retrieval Systems

- Trucks and Lifts

- Cranes & Hoists

- Conveyor System

- Others

- By Application

- Warehousing and Distribution

- Airport Baggage Handling

- Bulk Handling

- Postal and Parcel Delivery

- Assembly

- Packaging

- By Industry Vertical

- Manufacturing

- Healthcare

- Chemical

- Paper

- Food and Beverage

- Warehousing

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Others

- Middle East and Africa

- UAE

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Indonesia

- Others

- North America