Report Overview

Friction Modifier Market - Highlights

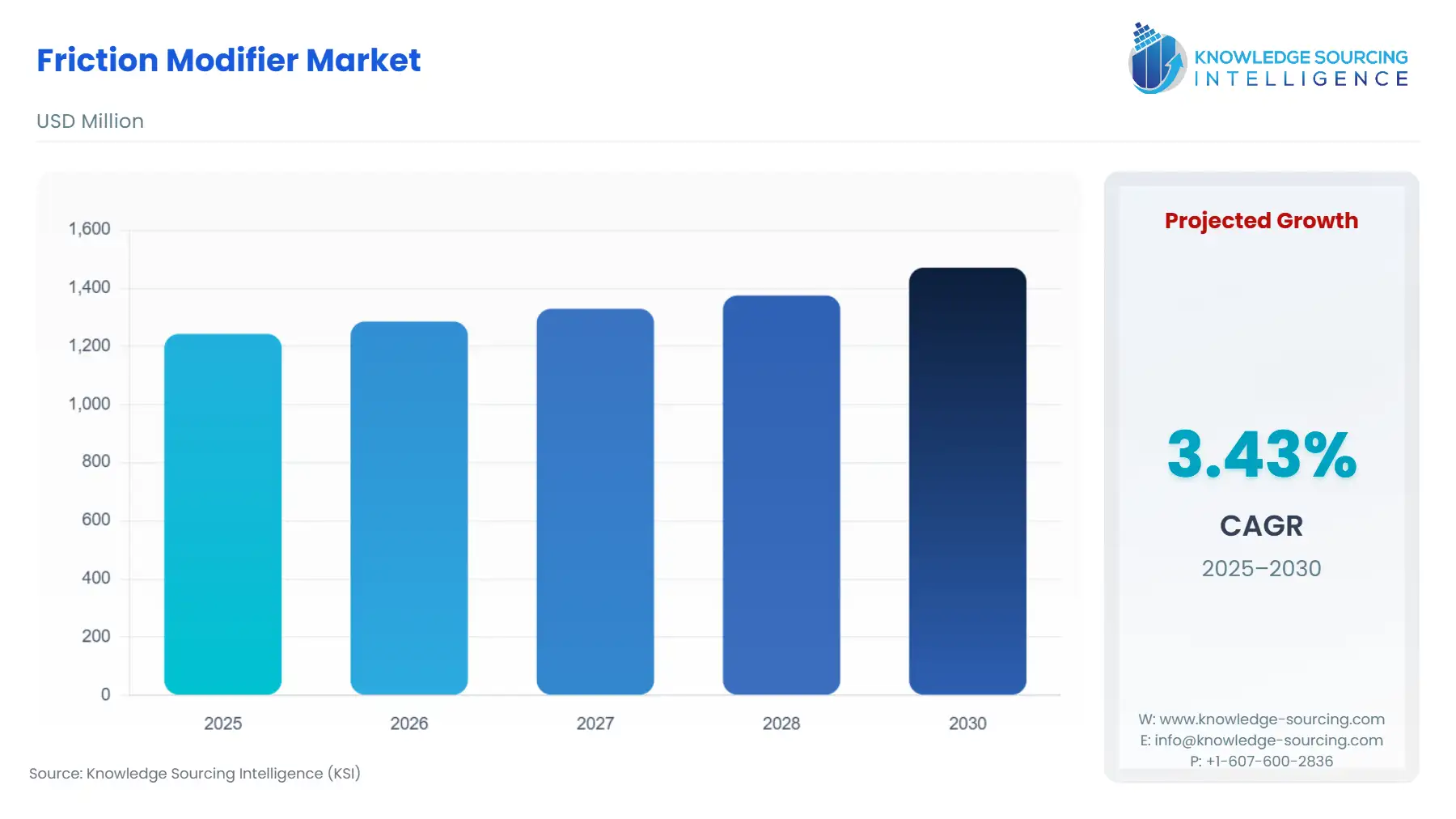

Friction Modifier Market Size:

Friction Modifier Market, with a 3.33% CAGR, is anticipated to reach USD 1.513 billion in 2031 from USD 1.243 billion in 2025.

Friction Modifier Market Key Highlights:

A friction modifier refers to a chemical additive used in lubricants and various other substances to modify the frictional properties between two surfaces in contact. It is specifically designed to reduce friction, minimize wear and tear, and improve the overall efficiency and performance of mechanical systems. The different types of friction modifiers include organic friction modifiers, functionalized polymer, and oil-soluble organomolybdenum friction modifiers, which finds applicability in the automotive, industrial, aerospace & defense, and manufacturing sector to reduce friction, minimize wear and tear, and enhance the overall performance and reliability of mechanical systems. The increasing investments in aerospace & defense manufacturing and the growing automotive production will boost the demand for friction modifiers, propelling their market growth.

Friction Modifier Market Growth Drivers:

The surge in aerospace & defense manufacturing is expected to drive the friction modifier market growth.

The aerospace and defense industry demands high-performance lubrication solutions to ensure the efficient and reliable operation of various components and systems. In the aerospace sector, friction modifiers are used in engines, landing gears, actuation systems, and other moving parts to improve their efficiency and reliability. These additives help reduce friction between components, which is particularly crucial in high-speed applications where the minimization of energy loss and heat generation is vital. Aerospace manufacturers can enhance fuel efficiency, reduce maintenance costs, and extend the service life of components, contributing to the overall performance and safety of aircraft. The rise in air traffic demands an increase in aerospace production and parallelly boosts the demand for friction modifiers. According to the Coalition of Airline Pilots Associations (CAPA) in 2022, Boeing and Airbus delivered 766 commercial aircraft over the first three quarters of 2022. According to the International Air Transport Association (IATA) in 2023, total global air traffic in February 2023 increased by 55.5% compared to February 2022.

In the defense industry, friction modifiers are employed in military vehicles, weaponry, and other defense systems. These additives help optimize the performance of critical mechanical components, such as engines, transmissions, and hydraulics, under demanding operating conditions.

The rise in the production of automobiles is expected to accelerate the demand for friction modifiers.

Friction modifiers are widely used in the automotive industry for lubricating various mechanical systems, including engines, transmissions, differentials, and wheel bearings. These additives work by reducing friction and wear between moving parts, improving energy efficiency, and minimizing heat generation. Incorporating friction modifiers into lubricants can help automotive manufacturers to optimize the performance of their vehicles, reduce maintenance costs, and enhance overall reliability. The increase in automotive production due to a rise in consumer demand for fuel-efficient vehicles will boost the demand for friction modifiers. According to the European Automobile Manufacturers Association 2021, global motor vehicle production was 79.1 million in 2021, which was an increase of 1.3% compared to the previous year. According to the Society of Motor Manufacturers and Traders, in 2021, over 859,000 cars, 72,913 commercial vehicles, and 1.6 million engines were built in the UK.

Friction Modifier Market Geographical Outlook:

The Asia Pacific region is expected to hold a significant market share during the forecast period.

The Asia-Pacific region holds a major market share due to an increase in incomes, growing automotive production and consumption, and rising aerospace and defense activities. In 2021, the Chinese government removed the limits on foreign investment in passenger car manufacturing in China, and the authorities allowed full foreign ownership of passenger car manufacturing in the country. In 2022, the Prime Minister of India laid the foundation stone for a C295 aircraft manufacturing plant in Vadodara, Gujarat, of the Tata-Airbus consortium that will manufacture the transport aircraft for the Indian Air Force (IAF). Such progressive developments will accelerate the demand for friction modifiers and boost their regional market growth.

Segmentation:

By Type

Organic Friction Modifier

Functionalized Polymer

Oil Soluble Organomolybdenum Friction Modifier

By Application

Engine Oil

Industrial Gears

Metal Working Application

Transmission Fluids

Others

By End-User

Aerospace & Defense

Automotive

Manufacturing

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others