Report Overview

Gas Level Indicators Market Highlights

Gas Level Indicators Market Size:

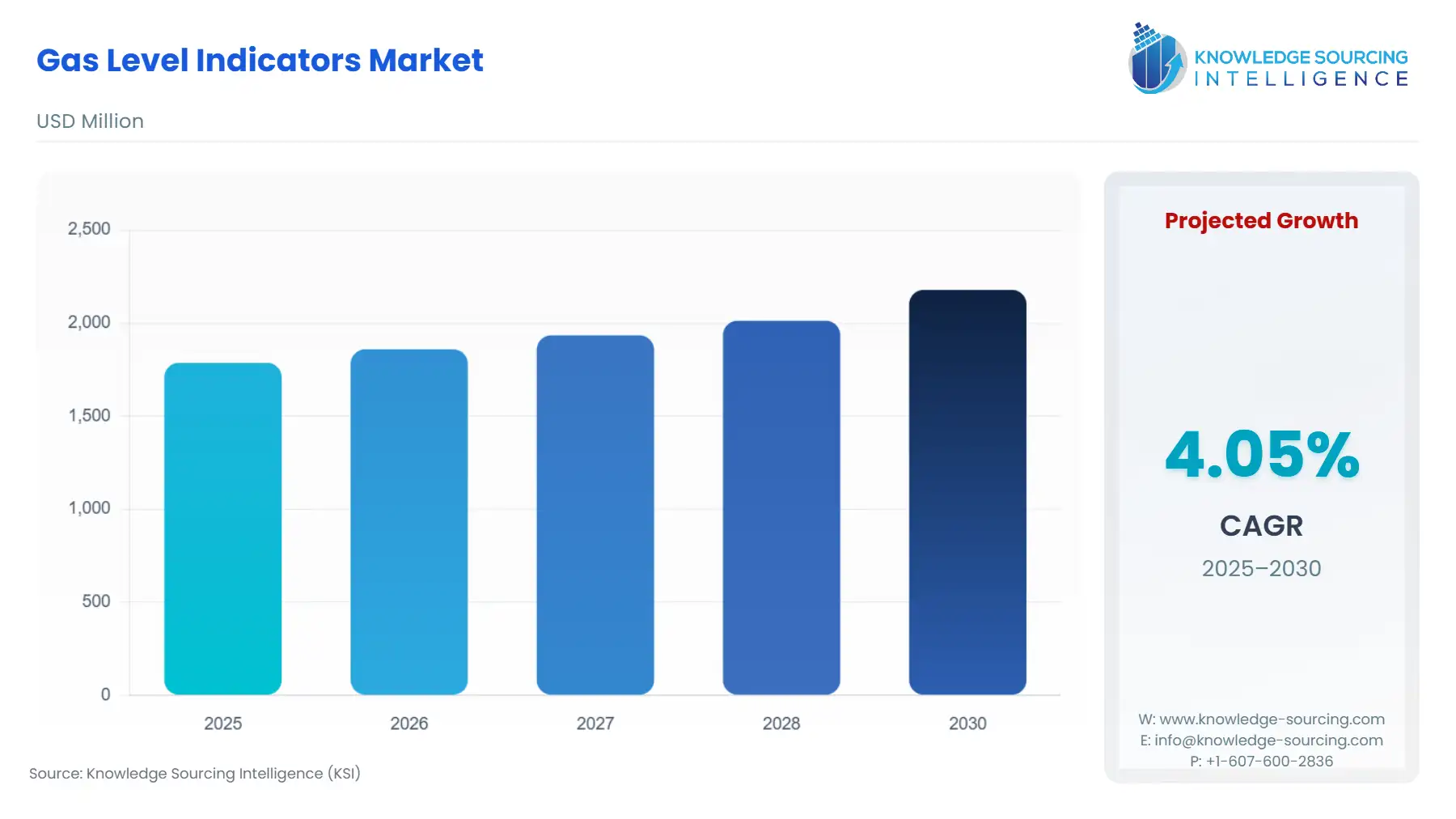

The Gas Level Indicators Market is estimated at USD 1.7875 billion in 2025 to USD 2.179 billion in 2030, and will witness a modest CAGR of 4.04% during the forecast period.

Gas Level Indicators Market Introduction:

The gas level indicators market is a critical segment within industrial and consumer safety, providing essential tools for monitoring and managing gas levels in storage tanks and cylinders. These devices, encompassing gas level sensors, gas level meters, tank level indicators, and cylinder level indicators, ensure accurate gas level monitoring across applications such as industrial processes, healthcare, food and beverage, and domestic use, like grilling and RV camping. By preventing gas shortages, overfills, or hazardous leaks, gas detection equipment enhances safety and operational efficiency. Technologies like ultrasonic, magnetic, pressure-based, and optical sensors cater to diverse needs, from non-invasive measurements in propane cylinders to precise monitoring in industrial LPG tanks.

The market is driven by increasing safety regulations, technological advancements, and growing demand for portable energy solutions, positioning gas level indicators as vital for both industrial and consumer applications. Market players recognize their role in optimizing resource management, ensuring compliance, and supporting sustainability in gas-dependent operations.

How Gas Level Indicators Work:

Gas level indicators operate using various technologies to measure and display the remaining gas in tanks or cylinders, ensuring accurate and safe gas level monitoring. Common methods include:

Float-Based Indicators: A buoyant float rises or falls with the liquid gas level, mechanically or magnetically linked to a gauge or dial. For example, magnetic float gauges, like those from Good Life Innovations, visually indicate levels using thermochromic technology.

Ultrasonic Sensors: These non-invasive gas level sensors emit high-frequency sound waves that reflect off the liquid surface, calculating the level based on wave return time. Thincke’s ultrasonic cylinder level indicator for propane tanks exemplifies this, offering precise, non-contact measurement.

Pressure-Based Gauges: These measure gas pressure, which correlates to the liquid level, using a diaphragm or transducer. Kaidi Sensors’ pressure gauges provide digital displays for industrial precision.

Optical and Capacitance Sensors: Optical sensors detect level changes via light reflection, while capacitance gauges measure dielectric changes. These are suited for extreme conditions, as noted in Alibaba’s overview of tank level indicators.

IoT-enabled actuators enhance functionality, enabling real-time data transmission to mobile apps or control systems, as seen in Mopeka’s WiFi-enabled sensors. These technologies ensure reliable, safe monitoring tailored to specific applications.

Choosing the Best Gas Level Indicator for Your Grill, RV, or Camping Stove:

Selecting the optimal gas level indicator for a grill, RV, or camping stove depends on portability, ease of use, and environmental conditions:

Portability and Compatibility: For RV camping or grilling, compact, reusable indicators are ideal. Magnetic cylinder level indicators, like ALVA’s latest model, attach easily to 3-9 kg propane cylinders and use thermochromic strips for clear readings.

Accuracy and Technology: Ultrasonic gas level sensors offer non-invasive precision, ideal for frequent travelers. Thincke’s sensor, compatible with standard propane bottles, ensures accurate readings without tank modifications.

Ease of Installation: Magnetic or adhesive indicators, like Gaslow’s model, require no tools and suit temporary setups.

Durability and Environment: For outdoor use, choose indicators with thermal compensation for temperature fluctuations, as recommended by Alibaba’s recent guide.

For most grill, RV, or camping stove users, a magnetic or ultrasonic cylinder level indicator, such as Thincke’s or ALVA’s, offers a balance of accuracy, portability, and ease, ensuring reliable gas level monitoring without complex installation.

Several factors drive the market:

Stringent Safety Regulations: Global standards, like EPA’s leak detection mandates, drive demand for gas detection equipment to ensure safety.

Technological Advancements: IoT-enabled actuators and ultrasonic sensors enhance precision and connectivity, as seen in Mopeka’s WiFi sensors.

Portable Energy Demand: Growing RV and camping activities boost the need for tank level indicators.

The market faces challenges:

High Costs: Advanced gas level meters with IoT or ultrasonic technology are expensive, limiting adoption by smaller users.

Regulatory Complexity: Varying global standards for gas detection equipment increase compliance costs.

The gas level indicators market is pivotal for safe and efficient gas management, driven by technological innovation and regulatory demands. Gas level sensors, tank level indicators, and cylinder level indicators cater to diverse needs, from industrial safety to consumer convenience. While costs and regulatory challenges persist, advancements in gas level monitoring technologies ensure continued growth, supporting industries and outdoor enthusiasts alike with reliable, precise solutions.

Gas Level Indicators Market Trends:

The gas level indicators market is evolving rapidly, driven by technological advancements and the need for enhanced safety and efficiency. IoT gas sensors are transforming gas level monitoring by enabling real-time data transmission to cloud platforms, improving operational oversight. For instance, Mopeka’s Pro Check sensor integrates Bluetooth gas gauge functionality, allowing users to monitor propane levels via smartphone apps. Ultrasonic level sensors, like Thincke’s model, offer non-invasive gas level indicator solutions, using sound waves for precise measurements without tank modifications. Magnetic level indicators, such as ALVA’s model, provide simple, cost-effective monitoring for consumer applications like grilling. LoRaWAN for gas monitoring supports long-range, low-power connectivity, as seen in Milesight’s EM500-SGL sensor for fuel tanks, enabling remote monitoring in industrial settings. Wireless gas level indicators enhance flexibility, with IoT gas sensors driving adoption in smart homes and industries, aligning with safety and sustainability goals.

Gas Level Indicators Market Dynamics:

Market Drivers

Increasing Safety and Regulatory Compliance

The gas level indicators market is driven by stringent safety regulations mandating precise gas level monitoring to prevent leaks, overfills, and accidents. Regulatory bodies like the U.S. Environmental Protection Agency (EPA) enforce standards for gas storage, particularly in industries handling LPG, propane, and fuel gases, necessitating reliable gas detection equipment. Magnetic level indicators and ultrasonic level sensors ensure compliance by providing accurate measurements, reducing risks in industrial and consumer applications. Recently, Emerson’s AVENTICS SPRA series integrated IO-Link connectivity to enhance safety in fuel tank monitoring, aligning with global standards. The growing emphasis on workplace and environmental safety, especially in the oil and gas and healthcare sectors, drives demand for tank level indicators. This regulatory push ensures sustained market growth as industries prioritize compliance and safety.

Technological Advancements in Connectivity

Advancements in IoT gas sensors and wireless gas level indicators are propelling the gas level indicators market by enabling real-time monitoring and data integration. LoRaWAN for gas monitoring supports long-range, low-power connectivity, ideal for remote industrial applications. Milesight’s EM500-SGL sensor, for instance, uses LoRaWAN to monitor fuel tanks across large facilities. Bluetooth gas gauges, like Mopeka’s Pro Check, allow consumers to track propane levels via smartphones, enhancing convenience for RV camping and grilling. These technologies improve operational efficiency and enable predictive maintenance, reducing downtime in industrial settings. A 2025 automation report noted the rise of smart factory integration, driving adoption of connected gas level meters. This connectivity trend supports market expansion by meeting the demand for smart, efficient gas management solutions.

Growing Demand for Portable Energy Solutions

The increasing popularity of portable energy solutions, such as propane for RV camping, grilling, and portable stoves, fuels the gas level indicators market. Cylinder level indicators cater to outdoor enthusiasts needing reliable gas level monitoring for safety and convenience. ALVA’s magnetic gas level indicator gained traction for its ease of use with 3-9 kg propane cylinders, ideal for consumer applications. The rise in outdoor recreational activities drives demand for non-invasive gas level indicators like Thincke’s ultrasonic sensors, which simplify monitoring without tank modifications. This trend, coupled with the growth of off-grid energy solutions, boosts the need for portable, user-friendly tank level indicators, expanding the market in consumer and small-scale industrial segments.

Market Restraints

High Costs of Advanced Technologies

The high cost of advanced gas level sensors, such as ultrasonic level sensors and IoT gas sensors, restricts widespread adoption in the gas level indicators market, particularly for small businesses and individual consumers. Implementing LoRaWAN for gas monitoring or Bluetooth gas gauges requires significant investment in hardware, software, and integration. For example, IoT-enabled gas level meters involve additional expenses for connectivity and maintenance, deterring cost-sensitive markets like small-scale RV users or developing regions. While magnetic level indicators offer a lower-cost alternative, their limited precision restricts their use in industrial applications. This cost barrier slows market growth by limiting accessibility, particularly in price-sensitive sectors, pushing users toward traditional gauges despite the benefits of advanced technologies.

Regulatory and Standardization Challenges

Varying global standards for gas detection equipment create significant challenges for the gas level indicators market, increasing compliance costs and complexity. Regulations differ across regions, with Europe’s ATEX directives and the U.S. OSHA standards imposing strict requirements on tank level indicators for hazardous environments. For instance, IoT gas sensors must comply with data privacy and safety protocols, complicating development. Manufacturers like Kaidi Sensors face challenges adapting gas level meters to meet diverse regional standards, delaying market entry and increasing costs. This lack of global standardization hinders scalability, particularly for non-invasive gas level indicators targeting multiple markets, slowing adoption and limiting market expansion in regions with stringent or inconsistent regulatory frameworks.

Gas Level Indicators Market Segmentation Analysis:

By Type: Ultrasonic Gas Level Indicator

Ultrasonic Gas Level Indicators lead the gas level indicators market due to their non-invasive, highly accurate measurement capabilities, making them ideal for both industrial and consumer applications. These gas level sensors use high-frequency sound waves to detect liquid gas levels without physical contact, ensuring safety and compatibility with various tank materials. For example, Thincke’s ultrasonic cylinder level indicator enhanced propane tank monitoring for RV camping, offering precise readings via smartphone integration. Their versatility supports applications in LPG, propane, and fuel tanks. Ultrasonic Gas Level Indicators dominate due to their integration with IoT gas sensors and Bluetooth gas gauges, enabling real-time gas level monitoring, as seen in Milesight’s EM500-SGL sensor. This segment drives market growth by offering reliable, user-friendly solutions for diverse environments.

By End-User: Oil & Gas

The Oil & Gas sector is the dominant end-user segment in the gas level indicators market, driven by the critical need for precise gas level monitoring to ensure safety and operational efficiency in exploration, refining, and storage. Tank level indicators and gas level meters are essential for monitoring LNG, propane, and fuel gases, preventing leaks, and ensuring compliance with stringent regulations like those from the U.S. EPA. For instance, Emerson’s AVENTICS SPRA series integrated IO-Link connectivity for real-time monitoring of fuel tanks, enhancing safety in offshore operations. The segment’s growth is fueled by global energy demand, with Saudi Arabia’s Vision 2030 initiatives driving the adoption of ultrasonic level sensors in oil facilities. Oil & Gas leads due to its reliance on advanced gas detection equipment to mitigate risks and optimize resource management, solidifying its market dominance.

Gas Level Indicators Market Geographical Outlook:

By Geography: North America

North America dominates the gas level indicators market due to its advanced industrial infrastructure, stringent safety regulations, and high adoption of smart factory technologies. The U.S. leads with significant investments in Oil & Gas and chemical industries, where gas level sensors ensure compliance with OSHA and EPA standards. Mopeka’s Pro Check sensor, featuring Bluetooth gas gauges, gained popularity for consumer and industrial propane monitoring. Canada’s energy sector also drives demand, with ultrasonic gas level indicators supporting LNG storage. The region’s focus on LoRaWAN for gas monitoring, as seen in Milesight’s recent deployments, enhances remote monitoring capabilities. North America’s leadership stems from its technological advancements and regulatory support, driving widespread adoption of gas level indicators across industries.

List of key companies profiled:

Mopeka Products, LLC

Thincke Electronic Technology Co., Ltd.

Kaidi Sensors

Emerson Electric Co.

ALVA (Pty) Ltd

Gas Level Indicators Market Key Developments:

In July 2025, Wabtec, a global provider of rail technology, announced its acquisition of Frauscher Sensor Technology Group for €675 million. While Frauscher is primarily known for its train detection and axle counting systems, this strategic acquisition is aimed at strengthening Wabtec's Digital Intelligence business. The integration of Frauscher's railway signaling technologies, which are based on sensors, is expected to enhance Wabtec's ability to provide safety-critical insights through combined sensor, software, and analytics solutions for the global rail network.

In July 2025, in a significant move to bolster its sensor capabilities, STMicroelectronics announced its agreement to acquire NXP Semiconductors' MEMS sensors business. The deal, valued at up to $950 million, focuses on strengthening STMicroelectronics' position in the automotive safety and industrial sectors. The acquired product line, which includes pressure sensors and accelerometers, complements STMicroelectronics' existing portfolio and is expected to unlock new opportunities for development in various applications.

In January 2024, Teledyne FLIR, a subsidiary of Teledyne Technologies, launched the Neutrino LC OGI, a camera module specifically designed for UAV-based optical gas imaging. This lightweight and low-power infrared imaging module is optimized for detecting, quantifying, and visualizing methane and other hydrocarbon gas emissions. It is aimed at developers creating cameras for aerial platforms, offering a solution for monitoring gas leaks from a distance.

Gas Level Indicators Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.7875 billion |

| Total Market Size in 2031 | USD 2.179 billion |

| Growth Rate | 4.04% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Gas Type, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Gas Level Indicators Market Segmentation:

By Type

Ultrasonic Gas Level Indicator

Magnetic Gas Level Indicator

By Gas Type

Propane

Butane

Others

By End-User

Oil & Gas

Chemicals

Power & Energy

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

Japan

South Korea

India

Indonesia

Thailand

Others