Report Overview

Global Aspirin Market - Highlights

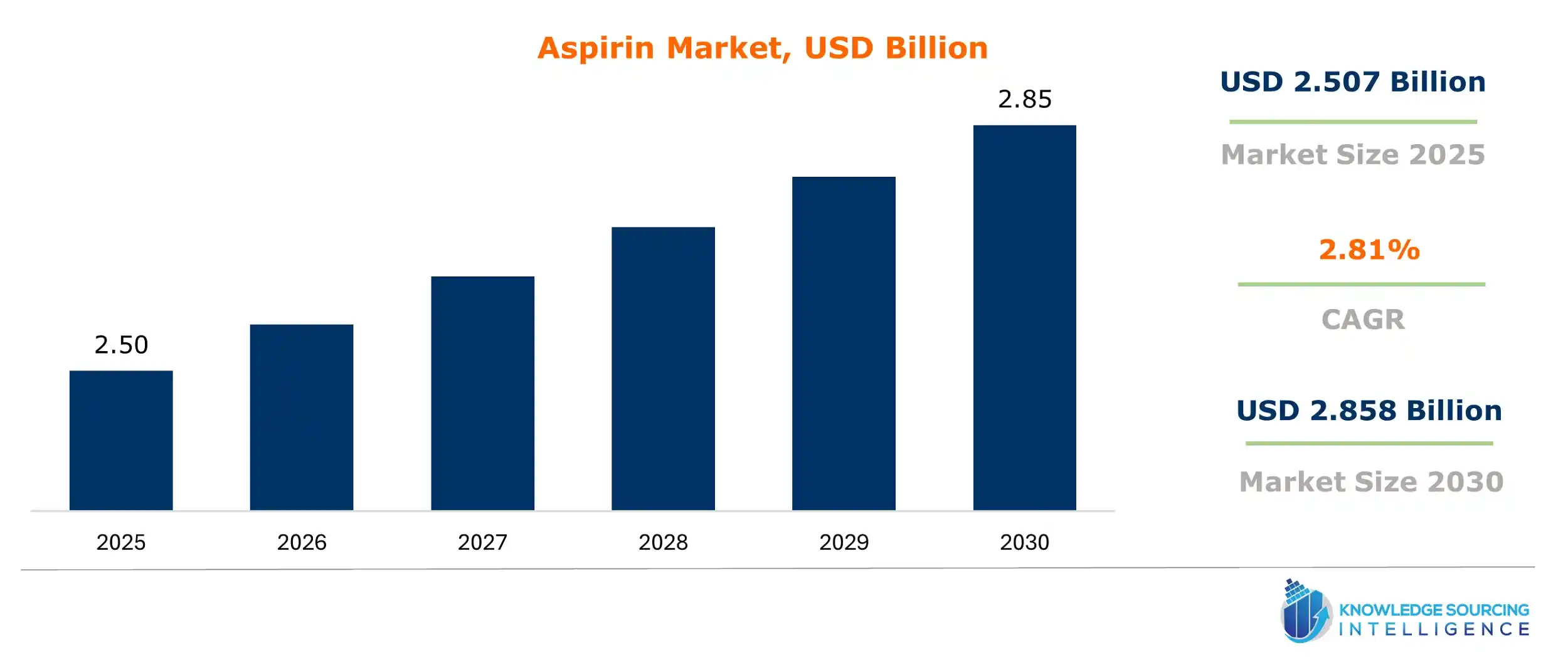

Aspirin Market Size:

The global aspirin market size is estimated to grow at a CAGR of 2.81%, increasing from USD 2.507 billion in 2025 to USD 2.858 billion by 2030.

Aspirin, also known as acetylsalicylic acid (ASA), is a versatile medication driving market growth due to its wide-ranging applications. It is used to reduce fever, relieve pain, act as an anti-inflammatory, and serve as a blood thinner for cardiovascular health. Available globally as prescription and over-the-counter (OTC) aspirin, its affordability and efficacy ensure sustained demand. Recent studies exploring aspirin's potential in cancer prevention and dementia management are further boosting interest, with pharmaceutical companies investing in innovative formulations to expand its therapeutic scope.

However, side effects such as gastrointestinal bleeding and ulcers have raised concerns, prompting some consumers to reconsider non-prescription use. This could restrain market growth, as patients and healthcare providers explore alternatives like ibuprofen or acetaminophen, which may offer safer profiles for certain populations. Despite this, aspirin’s integration into advanced healthcare products, such as hydrogels by Cardinal Health, supports market expansion. These products leverage aspirin’s properties to enhance treatment outcomes, contributing to growth during the forecast period.

Cardinal Health, a global leader in healthcare services, manufactures hydrogels for diverse applications, including ECG signaling, wound care, electrosurgery, and cosmetics. These hydrogels incorporate additives like aloe, vitamins A, C, and E, menthol, aspirin, camphor, lidocaine, green tea extract, and fragrances such as cinnamon and essential oils, improving functionality and patient comfort. Recent innovations in hydrogel technology have further strengthened aspirin’s role in specialized medical applications.

The growing active pharmaceutical ingredient (API) industry, particularly in the Asia-Pacific (APAC) region, propels acetylsalicylic acid’s market growth. China, a key player, holds a significant share of the global API market, producing around 20% of the world’s APIs. In 2025, U.S. tariffs on imported APIs have driven some manufacturers to invest in domestic production, impacting pricing but fostering supply chain resilience. Additionally, the booming retail sector and rising e-commerce sales, especially in APAC, enhance aspirin accessibility, fueling market demand through 2030. The expansion of online pharmacies and increased healthcare awareness further support this trend, ensuring aspirin’s continued relevance in global healthcare.

Aspirin Market Growth Drivers:

- The presence of companies offering acetylsalicylic acid products is propelling market growth during the forecast period

Bayer Aspirin has been an essential medicine for over 100 years. It helps alleviate pain and prevent cardiovascular events and has stood the test of time. In the form of a brand, Aspirin™ is among the highly trusted products by a range of customers worldwide compared to any other over-the-counter medicine for reducing pain. The World Health Organization lists aspirin as an essential medication based on its pain relief and antiplatelet effects.

The company's product portfolio includes Aspirin and Aspirin Cardio as its products. Aspirin™ falls under the category of consumer health and pharmaceuticals. Aspirin Cardio is designed explicitly for cardiology applications. With the growing number of cardiovascular diseases, aspirin is prescribed for blood-thinning applications. A physician may prescribe a low-dose aspirin for the prevention of blood clots. This further aids in the reduction of stroke and heart attack risks. A patient who underwent surgery to treat clogged arteries, including a bypass surgery or a stenting procedure, is mostly prescribed aspirin in the form of blood thinners for preventing blood clots. On the other hand, aspirin for consumer health includes the following applications: headache, body pain, muscle pain, and fever.

Par Pharmaceutical, a generic pharmaceutical company, offers quality medicines to a range of customers. These drug products are of high quality and cost-effective, achieved through excellence in innovation, development, manufacturing, and commercialization. The company manufactures aspirin & extended-release dipyridamole capsules as one of the crucial products in its generic product portfolio.

Allegiant Health manufactures and markets over-the-counter drugs and nutritional supplements. The company was formed due to a spin-off from a division of A&Z Pharmaceutical Inc., a leading US manufacturer and marketer of OTC drugs.

Under its analgesics section, the company uses aspirin as an active ingredient in various product variants. The company's aspirin products include chewable aspirin (orange flavor), chewable aspirin (cherry flavor), enteric-coated aspirin, and regular-strength aspirin therapy.

Nanjing Pharmaceutical Factory Co., Ltd. is an extensive and integrated API, finished dosage, and fine chemicals manufacturer with robust research and development capabilities. From the finished dosages section, the company manufactures aspirin enteric-coated tablets. From the APIs section, the company manufactures aspirin for the non-steroidal anti-inflammatory drugs and antiplatelet aggregation drugs category. The company’s API manufacturing site spans an area of 120,000 square meters, consisting of six dedicated and multi-purpose workshops coupled with abundant land for expansion. The production and quality systems are operated as per the cGMP requirements. The API commodities supplied worldwide include highly regulated markets, the United States and the European Union. The company’s finished dosages plant spans an area of 70,000 square meters and deals in the production of tablets, capsules, and granules, in addition to the production of small-volume injections and lyophilized powder for injections. All the products are available at a competitive price for the customers.

- The growing demand for branded generics will continue to boost market growth during the forecast period

The global branded generics market is projected to grow in the forecast period, with the marketing approval by the FDA for several generic drug products in 2024.

Hence, this will continue to strengthen market growth during the forecast period. Generic drugs are comparatively cheaper than branded products. Hence, poorer countries where people cannot afford costly medical treatments cannot buy branded medicines that come under the treatment costs post-treatment.

Thus, the generic versions of aspirin will continue to drive the market growth in the forecast period. As per the USFDA, generic medicines are around 80 to 85% cheaper than branded versions. Therefore, these medicines play an important role in offering cost-effective health care, further contributing to their surging use with time worldwide.

As per the prescription audit statistics, generic medicines account for more than 80% of the total medicines prescribed in the United States, the United Kingdom, China, and Australia. In India, although generic medicines are exported in large volumes to other countries, doctors prescribe less than 50% of these medicines. One of the primary reasons is the lack of confidence in the quality of unbranded generic medicine. Hence, branded generics are gaining momentum, further fueling the market for branded aspirin in the forecast period. Additionally, generic consumption in India is mostly available in branded generics only.

- The prevalence of headaches worldwide will fuel the demand for analgesics, augmenting the market growth during the forecast period

According to the World Health Organization, headaches are the most common nervous system disorders. Most adults suffer from headaches frequently. One of the major reasons can be attributed to the changing living conditions where there is high competition among people in every part of their lives, be it child upbringing, choosing a career, and efforts to excel in every field they choose. Hence, this has created more tension, thus raising the stress level. The demand for analgesics is gaining momentum with the evolving consumer lifestyle, further offering strong market growth prospects during the forecast period for immediate pain relief. One of the most consumed drugs containing aspirin as an active ingredient is Disprin.

The product is now available in different new variants, including Disprin Direct. Different types of headaches, as listed by the WHO, include migraine, tension-type headaches, cluster headaches, and medication overuse headaches. Additionally, as per NIH information, around 1 to 2% of individuals worldwide suffer from chronic migraine. Around 2.5% of people suffering from episodic migraine progress to chronic migraine. Hence, such events will contribute to the surging market growth with the soaring demand for pain relievers in the forecast period. One can find aspirin in three different formats: standard tablets to swallow with water, soluble tablets that can be dissolved in a glass of water, and enteric-coated tablets; consumption is done by swallowing them whole with water.

List of Top Aspirin Companies:

- Bayer AG

- Hebei Jingye Chemical Co., Ltd.

- JQC (Huayin) Pharmaceutical Co., Ltd.

- Perrigo Company plc

- L.N.K. International Inc.

Aspirin Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Global Aspirin Market Size in 2025 | USD 2.507 billion |

| Global Aspirin Market Size in 2030 | USD 2.858 billion |

| Growth Rate | CAGR of 2.81% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

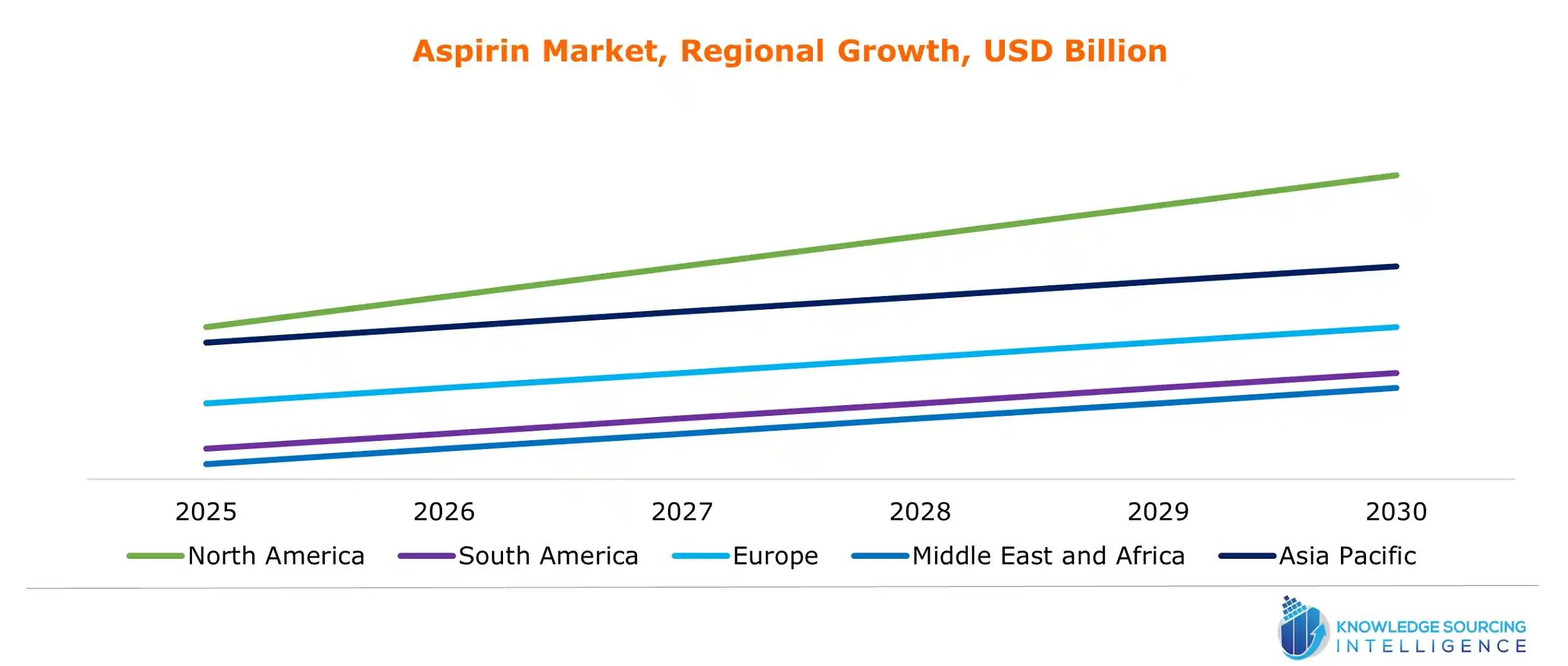

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Global Aspirin Market |

|

| Customization Scope | Free report customization with purchase |

Aspirin Market Segmentation:

- By Product

- Prescription

- OTC

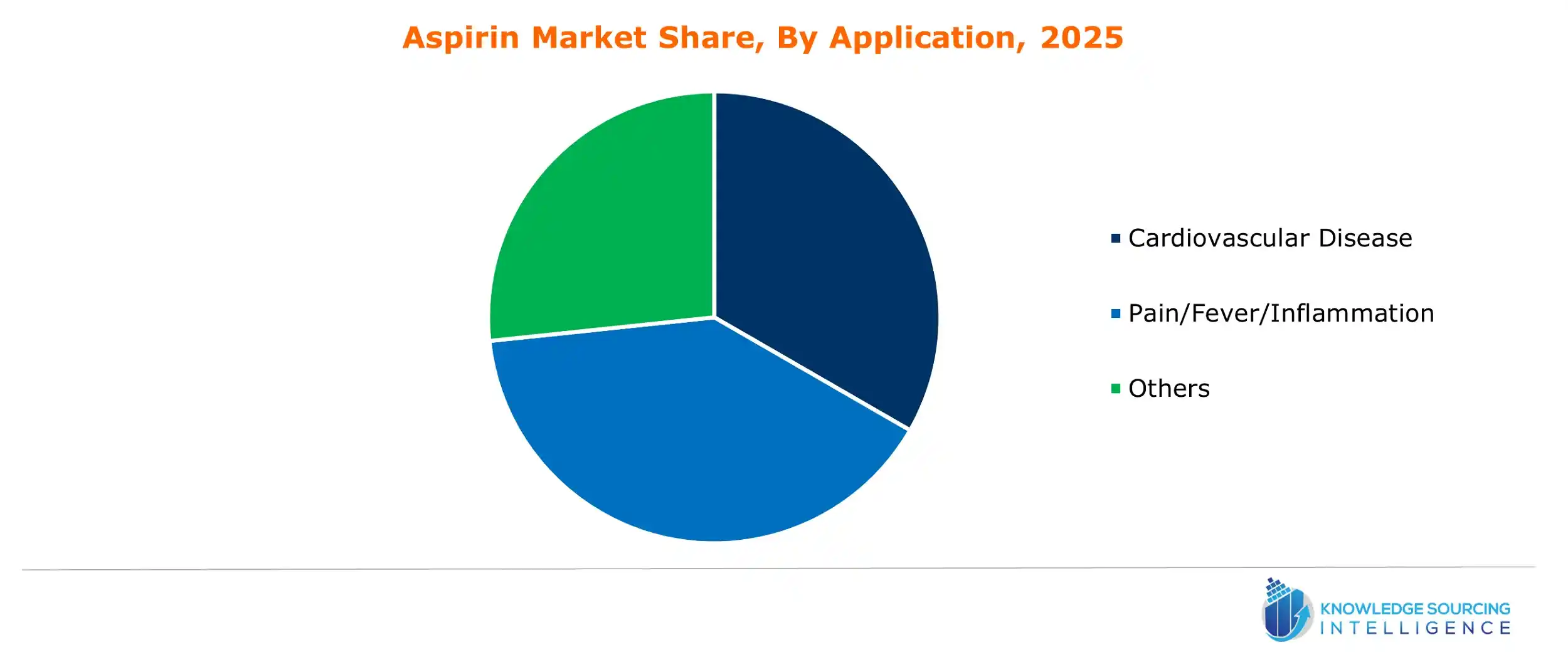

- By Application

- Cardiovascular Disease

- Pain/Fever/Inflammation

- Others

- By Distribution Channel

- Hospital and Retail Pharmacies

- Online Channels

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- Spain

- United Kingdom

- France

- Others

- Middle East and Africa

- UAE

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

- Blood Pressure Monitoring Devices Market

- Smart Medical Device Market

- Refurbished Medical Equipment Market