Report Overview

Global Automotive Electro-Hydraulic Steering Highlights

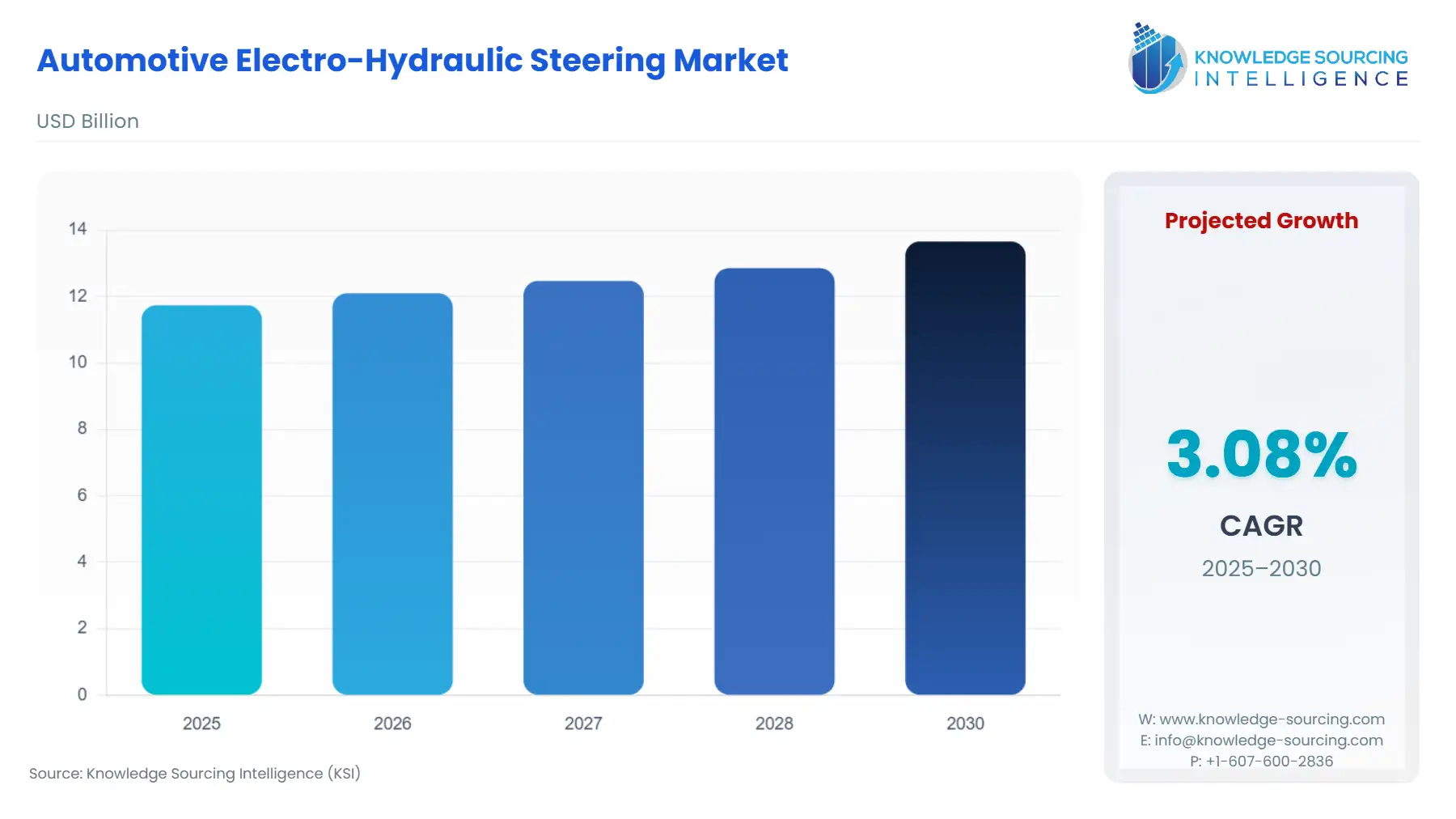

Automotive Electro-Hydraulic Steering Market Size:

The Global Automotive Electro-Hydraulic Steering Market is expected to grow from USD 11.738 billion in 2025 to USD 13.659 billion in 2030, at a CAGR of 3.08%.

Automotive Electro-Hydraulic Steering Market Trends:

This growth is attributed to the growing demand for better and more convenient steering systems which make the driving experience safer and more efficient.

Power steering systems are systems that provide assistance in steering to the driver, making it easier. The Electro-hydraulic power steering system is abbreviated as EHPS and is also known as a hybrid system because they use the same mechanism as the hydraulic power steering system but instead of the power coming from a pump which is driven by the engine, the pump is driven by the electric motor whose speed varies the amount of hydraulic pressure and is controlled by the ECU. The system uses valves to control the flow to the cylinder. The force the driver applies to the steering column is equal to the amount of force exerted by the fluid through the valves on the steered wheels. To measure the torque applied to the wheels, a torque sensor is used which is fixed on the steering column. When the steering wheel starts to rotate, in turn, the steering column also rotates, thus rotating the torsion bar, which then twists according to the torque provided to it, this torque sensor sends the information to the ECU which then according to the steering angles, vehicle speed, and steering force, controls and operates the electric motor, which provides the hydraulic power thus assisting in steering.

At low speeds, the power supplied by the hydraulic pump is increased to assist in turning and steering operations, whereas at high speeds it is reduced as much assistance is not required. There are key players who are involved in making investments and improvements in electro-hydraulic steering to make them more efficient. For example, Nikola Motor unveiled two hydrogen-electric tractors in April 2019, with electric and hydraulic power steering and high-performance LED lighting. The company's goal is to achieve a zero-emission future.

Due to exertion while driving, the need for more advanced and safer driving and steering systems is increasing, as technological advancements are happening the industry is moving towards making driving less tedious. These factors are driving the market for electro-hydraulic steering.

Automotive Electro-Hydraulic Steering Market Segment Analysis:

- By Vehicle Type

On the basis of vehicle type, the global automotive electro-hydraulic steering market is segmented into passenger vehicles, light commercial vehicles, heavy commercial vehicles, and others. Passenger vehicles hold a significant share of the market owing to the fact that their production and demand are greater than other vehicles.

- By Sales Channel

On the basis of the sales channel, the global automotive electro-hydraulic steering market can be segmented as OEMs and aftermarkets. OEMs hold a notable amount of market share due to the fact that many cars that are produced these days come with electro-hydraulic power steering.

- By Geography

By geography, the global automotive electro-hydraulic steering market is segmented into North America, Europe, Middle East & Africa, Asia-Pacific, and South America. Asia-Pacific is estimated to hold a good amount of market share. As regions like China and India are good producers of automobiles, and as the demand for more automobiles is rising, the demand for electro-hydraulic power steering is also increasing due to the need for better steering systems.

Automotive Electro-Hydraulic Steering Market Competitive Landscape:

The global automotive electro-hydraulic steering market is competitive owing to the presence of well-diversified international, regional, and local players. The competitive landscape details strategies, products, and investments being made by key players in different technologies and companies to boost their market presence.

Automotive Electro-Hydraulic Steering Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Automotive Electro-hydraulic Steering Market Size in 2025 | US$11.738 billion |

| Automotive Electro-hydraulic Steering Market Size in 2030 | US$13.659 billion |

| Growth Rate | CAGR of 3.08% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Automotive Electro-hydraulic Steering Market |

|

| Customization Scope | Free report customization with purchase |

Automotive Electro-Hydraulic Steering Market Segmentations:

- By Component

- Steering Gear

- Pump

- Hoses

- Reservoir Tank

- By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By Sales Channel

- OEMs

- Aftermarket

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America