Report Overview

Global Automotive Engine Oil Highlights

Automotive Engine Oil Market Size:

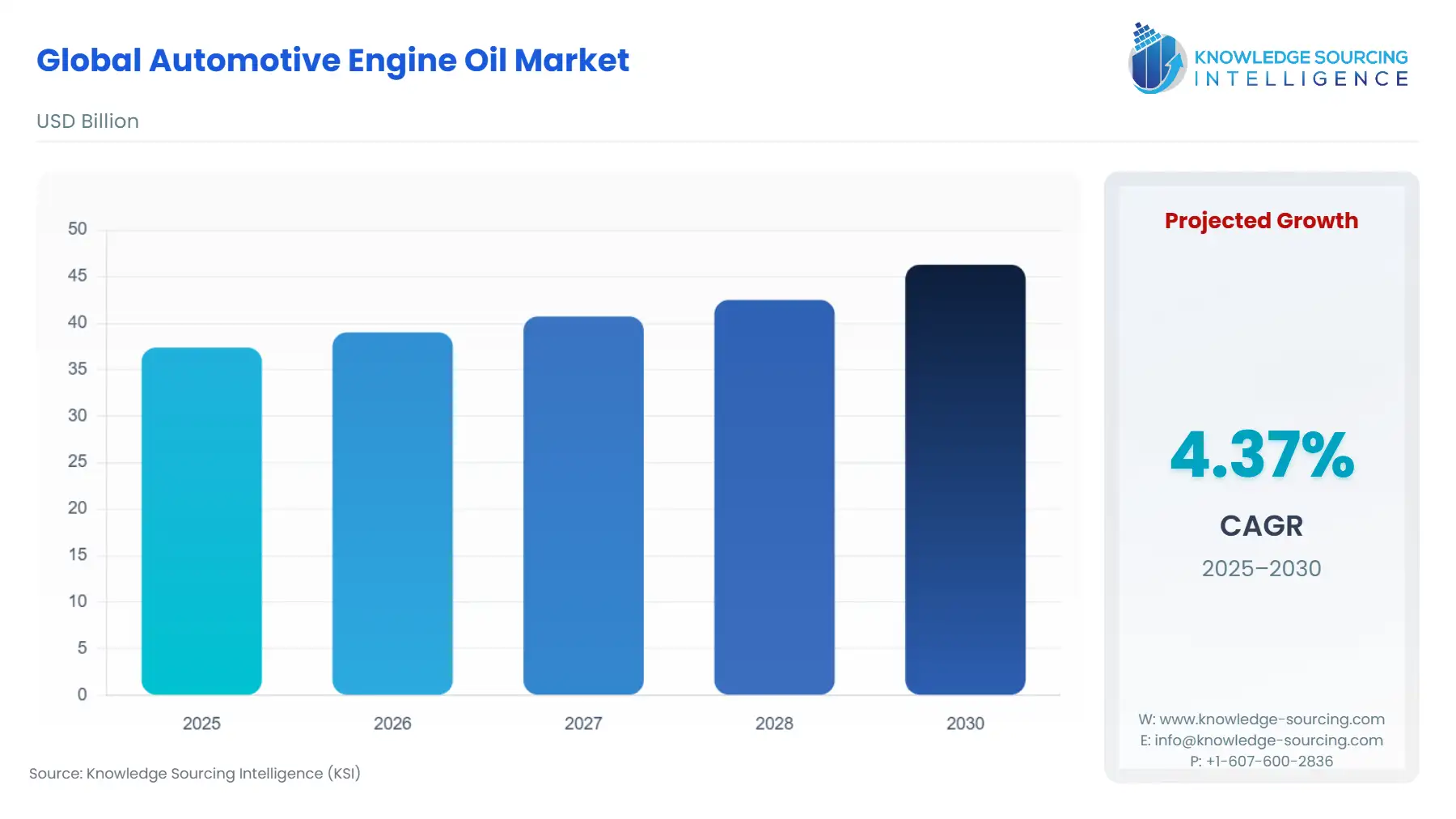

The Global Automotive Engine Oil Market is expected to grow from USD 37.379 billion in 2025 to USD 46.294 billion in 2030, at a CAGR of 4.37%.

Automotive Engine Oil Market Trends:

Engine oil is used to lubricate the internal combustion engine. Its basic function is to cool the engine, prevent wear and tear, reduce friction on the moving parts, and clean the engine of sludge. Three types of engine oils are commonly used for vehicles; synthetic, synthetic blend, and conventional. There are increasing concerns regarding the faster deterioration of engine components due to wear and tear, which leads to a significant decrease in their life due to the use of inferior quality lubricants and oils. This is encouraging people to use good quality engine oils to provide proper lubrication to limit wear and tear, which has led to an increased demand for these products and is a factor that will drive the growth of the engine oil market.

Furthermore, the increasing investments and participation of market players in order to improve the quality of engine oils and to launch products that are more advanced is also going to bolster market growth over the forecast period. For instance, recently on December 5th, 2019, Valvoline Inc. a leading supplier of premium lubricants, announced that they had developed engine oil called Valvoline Hybrid Vehicle Full Synthetic motor oil which was specifically designed for hybrid vehicles and would be launched in 2020. In September 2019, Pennzoil, a subsidiary of Shell, a leading oil and gas company, announced the launch of 4 new motor oils; Pennzoil Extended Care, Pennzoil Start Stop Protection, Pennzoil Maximum Power, and Pennzoil Hybrid. Pennzoil Start Stop Protection offers enhanced protection to the engine during start/stop driving, Pennzoil Hybrid caters to the needs of hybrid vehicles. Whereas Pennzoil Extended care increases the life of the component by increasing fuel economy and reducing wear and tear.

The automotive engine oil market has been segmented based on type, engine type, vehicle type, sales channel, and geography. By type, the market is segmented as a synthetic, synthetic blend, and conventional. By engine type, the market has been classified as petrol and diesel. By vehicle type, the market is segmented as passenger vehicles and commercial vehicles. The market has been segmented into online and offline sales channels by sales channel.

Automotive Engine Oil Market Segmentation Analysis:

- Synthetic oil is estimated to hold a significant market share

By type, synthetic oil is estimated to hold a significant share of the market. The right quality of engine oil is very important for the proper functioning of the engine, thus preventing any deterioration of the engine components and extending the life and fuel economy. Synthetic engine oils contain some additives that can aid in the effective management of the engine and prolong the life of components.

- Petrol dominates the by-engine type segment.

By engine type, petrol dominates the market owing to the fact that petrol cars are lighter, produce lower emissions, have lower maintenance costs, and are easier to drive as compared to diesel cars. Also, the cost of maintenance and acquisition of petrol cars is lower than diesel cars.

- Passenger vehicles are witnessing a surge in demand.

By vehicle type, passenger vehicles are projected to account for a significant share owing to the rising production of passenger vehicles coupled with rising demand for these vehicles due to the increasing purchasing power of people.

Online sales are responsible for generating high revenues owing to the rising internet penetration across the globe.

By sales channel, online is expected to hold a significant share in the market, which is attributable to the increasing penetration of the internet and people’s preference shifting towards ordering products online, which is associated with the high level of convenience it provides.

By geography, the Asia Pacific region holds a substantial market share owing to the increasing production of passenger vehicles and other vehicles in major economies such as China and India.

List of Top Automotive Engine Oil Companies:

- Shell plc

- BP plc.

- Motul S.A.

- TotalEnergies SE

- Petroliam Nasional Berhad (PETRONAS)

Automotive Engine Oil Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 37.379 billion |

| Total Market Size in 2031 | USD 46.294 billion |

| Growth Rate | 4.37% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Engine Type, Vehicle Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Engine Oil Market Segmentation:

- By Type

- Synthetic Oil

- Synthetic Blend Oil

- Conventional Oil

- High-Mileage Engine Oils

- By Engine Type

- Petrol

- Diesel

- CNG

- By Vehicle Type

- Passenger Cars

- Motorcycles

- Commercial Vehicles

- By Sales Channel

- OEM

- Aftermarket

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America