Report Overview

Global Automotive LED Taillight Highlights

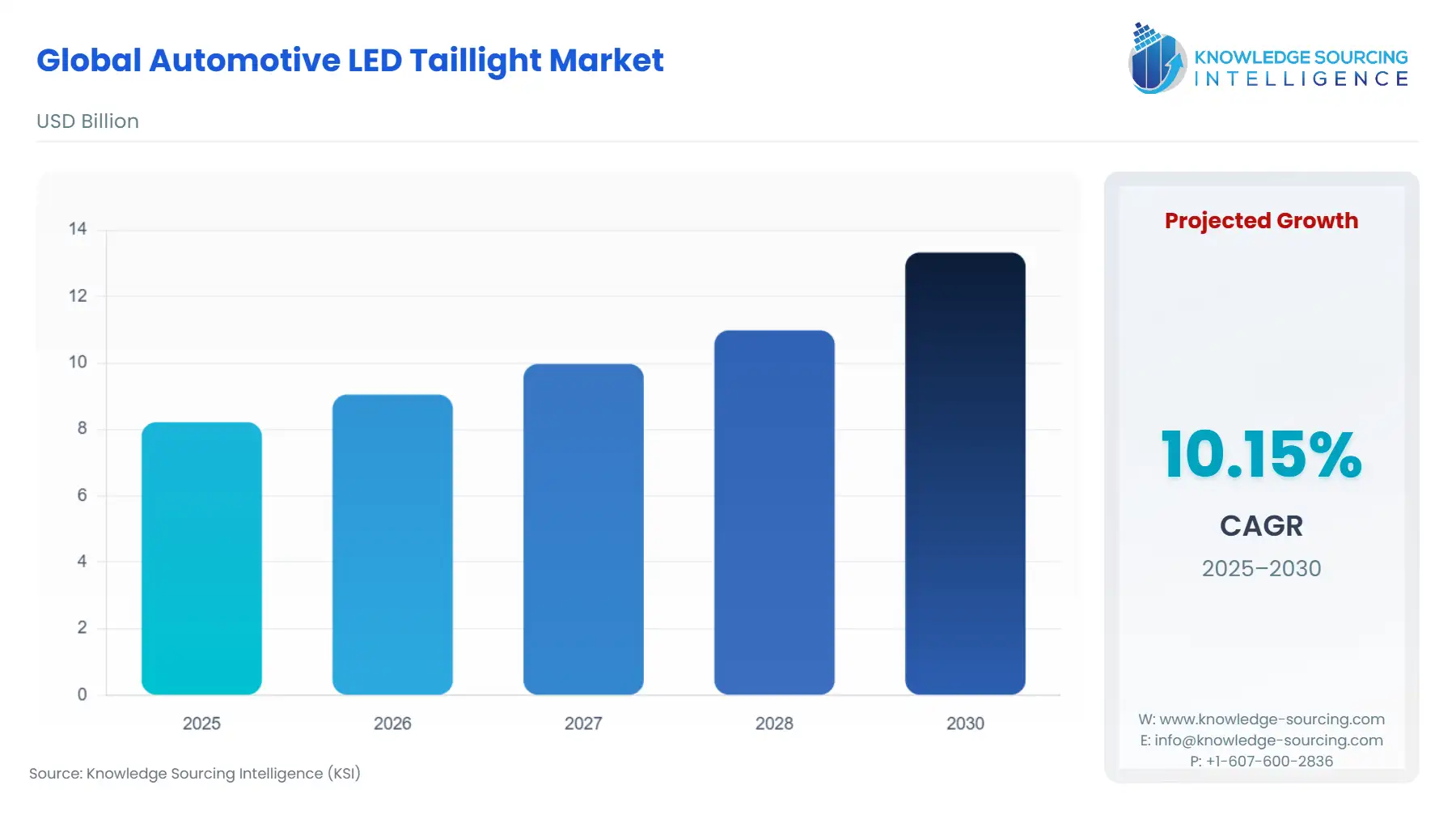

Automotive LED Taillight Market Size:

The Global Automotive LED Taillight Market is expected to grow from USD 8.217 billion in 2025 to USD 13.327 billion in 2030, at a CAGR of 10.16%.

The global automotive LED taillight market is experiencing an irreversible transformation driven by an interwoven set of regulatory, technological, and consumer-preference catalysts. LED technology has moved past being an optional feature, establishing itself as the de facto standard for rear vehicle illumination across the luxury, mid-range, and increasingly, the entry-level segments. This shift is not merely cosmetic; it is fundamentally rooted in engineering necessity—LEDs offer a faster response time, greater lumen efficacy, and a substantially longer lifespan compared to traditional incandescent or halogen systems. This analytical report delves into the core dynamics propelling and constraining the market, providing a precise, demand-centric perspective for industry stakeholders.

Global Automotive LED Taillight Market Analysis

- Growth Drivers

The market's expansion is fundamentally propelled by a critical intersection of regulatory enforcement and technological maturity, which together create non-negotiable demand for LED taillights.

Regulatory Mandates for Enhanced Road Safety and Visibility: International and regional governing bodies consistently raise the performance requirements for vehicle lighting, directly translating into increased demand for LED technology. The European Union's ECE Regulation No. 48, which dictates the installation and functioning of lighting, alongside the US National Highway Traffic Safety Administration's (NHTSA) FMVSS 108, emphasizes minimal failure rates, specific photometric characteristics, and conspicuity. LEDs intrinsically offer superior brightness, color consistency, and a significantly faster on/off response time (in the order of nanoseconds compared to milliseconds for incandescent bulbs). This rapid illumination is crucial for brake lights, giving following drivers a critical fraction of a second more reaction time. Consequently, Original Equipment Manufacturers (OEMs) are compelled to adopt LED systems to secure type approval in major markets, ensuring a baseline demand across all new vehicle platforms.

The Electrification Imperative and Energy Efficiency: The global pivot toward Electric Vehicles (EVs) establishes LED taillights as a fundamental necessity, not a premium upgrade. Unlike internal combustion engine vehicles, every electrical component in an EV directly impacts the vehicle's driving range, a core metric of consumer utility. LED systems consume substantially less power than traditional lighting, minimizing the drain on the high-voltage battery pack. For a major OEM, selecting energy-saving LED lighting across all exterior and interior applications is a vital decision in the trade-off between vehicle performance and battery size. This technological selection process directly creates sustained, high-volume demand from the burgeoning EV segment, which includes passenger vehicles and light commercial delivery vans operating under zero-emission mandates. Furthermore, as EV platforms often adopt unique, stylized lighting signatures to establish brand identity, the inherent design flexibility of LED modules—allowing for ultra-thin profiles, dynamic patterns, and intricate shapes—compounds this demand.

- Challenges and Opportunities

The primary challenge facing the market is the volatile supply chain for critical semiconductor components and rare-earth elements used in LED driver ICs and phosphors. This volatility introduces cost fluctuation and supply lead-time uncertainty for manufacturers, potentially leading to upward pricing pressure on the final product and dampening immediate demand growth. Another constraint is the higher initial unit cost of certified LED assemblies compared to conventional bulbs, which can impede mass-market penetration in price-sensitive developing economies.

Conversely, significant opportunities exist in the proliferation of advanced digital lighting functions, such as dynamic brake light sequencing and unique vehicle-to-everything (V2X) communication indicators. This allows manufacturers to develop highly differentiated, premium-priced offerings that enhance safety and vehicle value. Furthermore, the increasing focus on thermal management innovations in LED assemblies presents an opportunity to extend the lifespan and maintain the luminous flux of LED products, which boosts their value proposition in the long-term cost-of-ownership analysis. The implementation of reciprocal tariffs between major trading blocs introduces logistical complexity and can necessitate localized production, presenting a capital expenditure challenge but also an opportunity for regional manufacturers to secure local supply contracts.

- Raw Material and Pricing Analysis

The Global Automotive LED Taillight is a physical product that depends on a complex array of electronic and material inputs. Key raw materials include gallium nitride (GaN), typically grown on sapphire, silicon carbide (SiC), or silicon substrates for the LED chip, and specialized rare-earth phosphors (e.g., yttrium aluminum garnet doped with cerium) essential for color conversion and white light generation. The pricing dynamics for these materials are strongly influenced by the global semiconductor supply chain and the geopolitical stability of rare-earth mining operations, predominantly located in the Asia-Pacific. Fluctuations in the cost of these inputs directly impact the final module price, as the LED driver ICs (which require specialized semiconductor fabrication) are also a high-value component.

- Supply Chain Analysis

The global supply chain for automotive LED taillights is highly concentrated and vertically integrated. The supply chain begins with the manufacturing of foundational materials—primarily LED chips and driver ICs, with a dominant production hub in the Asia-Pacific region, specifically in Taiwan, South Korea, and China. These components are then integrated by Tier-2 suppliers into LED modules, and subsequently assembled by Tier-1 automotive lighting specialists into the final taillight assembly. Logistical complexities stem from the necessary just-in-time (JIT) delivery model required by OEMs globally, making the supply chain highly vulnerable to regional production shutdowns or international shipping disruptions. The dependency on Asia-Pacific for specialized semiconductor components represents a significant strategic risk, compelling Tier-1 suppliers to pursue dual-sourcing strategies and consider regionalized manufacturing capacity expansion, particularly in North America and Europe.

The impact of tariffs, such as those imposed between the U.S. and China, is felt within the supply chain by increasing the landed cost of key electronic sub-components, primarily LED chips and driver ICs, which are often sourced from Asia-Pacific facilities. This elevated cost acts as an inflationary headwind, compressing the margins of global Tier-1 and Tier-2 suppliers and potentially increasing the final vehicle cost.

Automotive LED Taillight Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Europe |

UNECE Regulation No. 48 / ECE R07 |

The regulations mandate specific photometric performance and installation requirements for rear lighting. ECE R07 compliance directly drives demand for certified LED assemblies over traditional bulbs, as LEDs more reliably meet the strict intensity and uniformity standards, particularly for brake and position lamps. |

|

United States |

Federal Motor Vehicle Safety Standard (FMVSS) 108 (Lamps, Reflective Devices, and Associated Equipment) / NHTSA |

FMVSS 108 sets minimum performance requirements for visibility and safety. Its stringent requirements for light intensity and durability compel OEMs to utilize high-quality, non-obstructive LED components, especially favoring integrated LED units that ensure long-term compliance, which bolsters OEM demand. |

|

India |

Central Motor Vehicles Rules (CMVR) / Automatic Headlamp On (AHO) Mandate |

The AHO mandate on two-wheelers creates high, sustained demand for energy-efficient, durable lighting systems. Incandescent filaments cannot withstand the continuous illumination duty cycle, functionally forcing a rapid transition to LED lighting for both front and rear applications in the world's largest two-wheeler market. |

Global Automotive LED Taillight Market Segment Analysis

- By Vehicle Type: Passenger Vehicle Analysis

The passenger vehicle segment represents the largest and most dynamic consumer of automotive LED taillights, and its demand is fundamentally driven by a convergence of consumer-led aesthetic choice and aggressive OEM standardization. The segment’s high volume, spanning from luxury sedans to high-selling SUVs, provides the necessary economies of scale to justify the Research and Development (R&D) investment in LED technology. OEMs actively use sophisticated LED taillight designs—such as full-width light bars, signature illuminated elements, and dynamic turn signals—as a core differentiator to establish brand identity and premium perception. This strategic use of lighting in styling directly propels demand, especially in the growing SUV and crossover sub-segments. Furthermore, the rapid transition to electric vehicle (EV) platforms, which are overwhelmingly passenger-type vehicles, cements LED as the mandatory lighting technology to maximize crucial battery range due to its inherent power efficiency. The replacement cycle and crash repair market for this high-volume segment also sustains a robust aftermarket demand for certified LED units.

- By Sales Channel: OEMs Analysis

The Original Equipment Manufacturers (OEMs) channel dictates the primary volume and technological trajectory of the Global Automotive LED Taillight Market. Demand within this channel is non-discretionary, driven entirely by new vehicle production volumes and regulatory requirements for model-year compliance. OEMs select LED assemblies because they meet stringent performance specifications (such as the rapid response time required by safety standards) and offer the integration potential necessary for ADAS functionality and vehicle network communication (e.g., CAN bus). The shift toward a platform-based architecture in automotive production, where a single LED taillight module design can be shared across multiple vehicle models, allows Tier-1 suppliers to secure high-volume, long-term contracts. This inherent efficiency and the imperative for safety compliance ensure that the OEM channel remains the critical demand catalyst, far outpacing the aftermarket in terms of technological adoption and volume scale.

Global Automotive LED Taillight Market Geographical Analysis

- United States Market Analysis (North America)

Demand in the U.S. market is uniquely driven by a dual emphasis on stringent safety compliance under FMVSS 108 and a strong consumer preference for feature-rich, large-format vehicles, particularly trucks and SUVs. The increasing proliferation of truck platforms with unique, high-definition LED taillight signatures (e.g., sequential amber turn signals) acts as a powerful demand catalyst in this region. State-level adoption of advanced lighting technologies and the enforcement of certified repair standards also formalize the aftermarket. Additionally, the presence of significant domestic OEM manufacturing facilities in the South and Midwest compels the co-location of Tier-1 and Tier-2 LED assembly plants to facilitate the required Just-In-Time (JIT) delivery, anchoring a significant regional segment of the supply chain.

- Brazil Market Analysis (South America)

The Brazilian market’s demand profile is dominated by the need for cost-effective, durable LED solutions for high-volume entry-level and flex-fuel passenger vehicles. Regulatory compliance, while less stringent than in Europe, still prioritizes basic safety features, creating sustained demand for foundational LED brake and position lamps over older technologies. The key demand driver is the low total cost of ownership (TCO) appeal of LEDs—their extended lifespan and durability against road vibration and heat are highly valued in Brazil’s diverse operating conditions, reducing the long-term maintenance burden for both fleet operators and private owners.

- Germany Market Analysis (Europe)

German demand is the epicenter of technological leadership within the European market, driven by the presence of global luxury OEMs who actively leverage LED and emerging OLED technologies for brand differentiation. The strict, complex regulatory framework, including UNECE regulations and the push for pedestrian safety, necessitates cutting-edge LED solutions. The demand catalyst here is the integration of advanced digital and adaptive lighting features, where the taillight not only illuminates but also communicates. German OEMs are at the forefront of implementing segmented, customizable OLED rear lights for dynamic signaling, thereby creating high-value demand for Tier-1 suppliers capable of meeting stringent quality and aesthetic requirements.

- Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market exhibits strong demand for high-end, premium LED taillights, mirroring the consumer preference for luxury and large-format vehicles imported from Europe, the US, and Asia. Demand is primarily driven by consumer aesthetics and high-volume sales of luxury SUVs and sedans. The harsh, high-temperature operating environment in the region makes the thermal management capabilities of high-quality LED assemblies a critical, non-negotiable feature for durability and long-term performance. While local manufacturing is limited, the high per-capita demand for premium vehicles ensures a consistently strong pull for the most technologically advanced and aesthetically sophisticated LED and OLED taillight modules available globally.

- China Market Analysis (Asia-Pacific)

China drives global volume and capacity expansion, with demand fueled by the world's largest automotive production base and rapid electrification. The government's industrial policy, coupled with an intensely competitive domestic OEM landscape, compels rapid adoption of new features. The primary demand catalysts are the sheer volume of vehicle production and the consumer trend toward adopting in-car technology, where sophisticated, connected taillight designs are seen as essential for vehicle value. Chinese OEMs are rapidly innovating in dynamic lighting patterns and personalized rear light signatures, creating immense, localized demand.

Global Automotive LED Taillight Market Competitive Environment and Analysis

The Global Automotive LED Taillight Market is characterized by intense competition among a small number of globally dominant Tier-1 suppliers who have secured deep, long-standing relationships with OEMs. The competition is centered on technological innovation, specifically in advanced photometric performance, aesthetic design flexibility (e.g., minimal light gaps, uniform illumination), and the ability to seamlessly integrate lighting control electronics with the vehicle's electrical architecture. Success is defined by the capacity for mass-market, high-quality production and the ability to co-develop new lighting systems with OEMs during the initial platform design phase.

- Koito Manufacturing Co., Ltd.

Koito Manufacturing, headquartered in Japan, maintains a robust strategic position as a global leader in automotive lighting, serving both Japanese and international OEMs. The company's positioning is rooted in its extensive intellectual property portfolio and a focus on high-quality, high-reliability products that meet the stringent requirements of major global vehicle manufacturers. Koito consistently prioritizes the development of advanced lighting technologies, including next-generation LED assemblies and associated control electronics.

- FORVIA HELLA (Hella GmbH & Co. KGaA)

FORVIA HELLA, a major German-based Tier-1 supplier, distinguishes itself by emphasizing innovative, modular lighting systems and advanced electronics integration. The company's core strategy focuses on utilizing LED technology to facilitate complex light functions and integrate them with vehicle sensing technologies for ADAS applications.

Global Automotive LED Taillight Market Key Development

- November 2025: ORACLE Lighting announced a new Classic Vehicle LED Tail Light Conversion kit for 1987–1993 Ford Mustang LX that replaces the internals while keeping the original housing and lens; the plug-and-play kit features sequential, individually addressable LEDs, high-output reverse lights, a reversible no-splice installation, an MSRP of $389.95, U.S. engineering and assembly, a 2-year limited warranty, and a debut at SEMA in December 2025.

- April 2025: Marelli showcased at Auto Shanghai 2025, a trio of forward-looking lighting technologies: the Pixel Rear Lamp — billed as the world’s first exterior OLED-TFT application for high-resolution, dynamic taillight displays that support vehicle status/V2X messaging and personalization.

Global Automotive LED Taillight Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Automotive LED Taillight Market Size in 2025 | US$8.217 billion |

| Automotive LED Taillight Market Size in 2030 | US$13.327 billion |

| Growth Rate | CAGR of 10.16% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Automotive LED Taillight Market |

|

| Customization Scope | Free report customization with purchase |

Automotive LED Taillight Market Segmentations:

- By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By Sales Channel

- OEMs

- Aftermarket

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America