Report Overview

Global Bicycle Market Report, Highlights

Bicycle Market Size

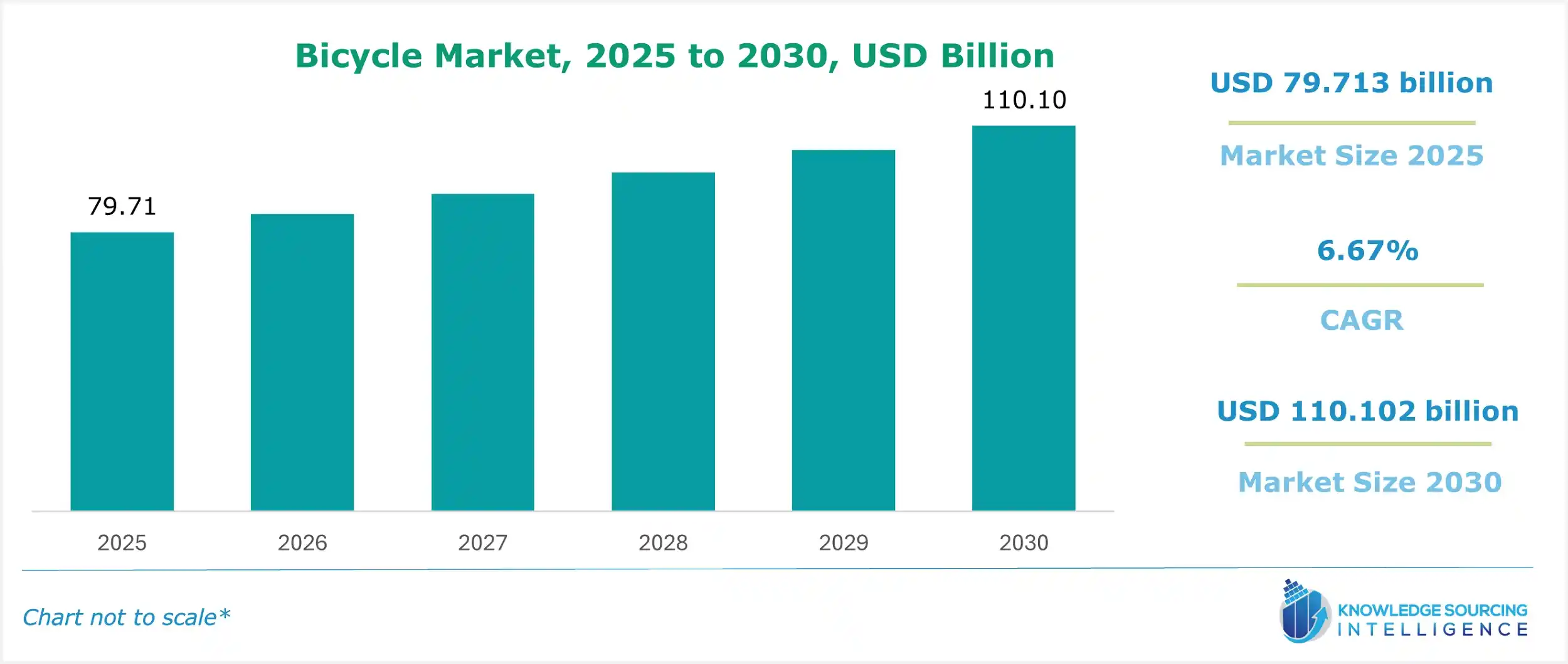

The Global Bicycle Market is expected to grow at a compound annual growth rate (CAGR) of 6.67% from US$79.713 billion in 2025 to US$110.102 billion in 2030.

Bicycle Market Trends

The global cycle market is projected to grow throughout the forecast years, primarily due to the increasing consumer preference for a healthy lifestyle.

Furthermore, there has been a rising adoption of bicycles in both developed and developing economies, as most people are opting to cycle for their daily routine activities and leisure. The demand for adventurous and sports bicycles will be growing in the forecast period.

Bicycle Market Growth Drivers:

- The Global Bicycle Market is witnessing significant growth driven by major factors

The growing prevalence of lifestyle-related diseases will boost the bicycle market: One of the key factors supplementing the demand for bicycles is the growing global prevalence of chronic diseases such as obesity, diabetes, and CVDs, among others. This has led to an upsurge in demand for bicycles worldwide because of growing concerns among people regarding a healthy lifestyle with easy exercise and physical activity. Furthermore, bicycling regularly at a medium pace helps mitigate the risk of several chronic diseases.

There has been a rapidly growing prevalence of diabetes at the global level. According to statistics from the International Diabetes Federation, by 2045, 783 million people will have diabetes. In 2021, one in 10 people lived with diabetes. Additionally, according to the statistics provided by the American Diabetes Association, in 2021, 38.4 million Americans had diabetes, out of which 38.4 million were diagnosed. 1.2 million Americans are diagnosed with diabetes every year. Cycling is directly associated with mitigating the risk of diabetes in adults as physical activities help people maintain blood sugar levels as it activates around 70% of the muscles in the body. Additionally, the prevalence of obesity has also grown remarkably in the past years. According to the World Health Organization, in 2022, one in 8 people were obese. Thus, cycling helps in maintaining physical activity and boosts the metabolism of individuals. This, in turn, is also anticipated to positively impact the demand for bicycles in both developed and developing economies of the world.

Global Bicycle Market Segmentation Analysis by Technology

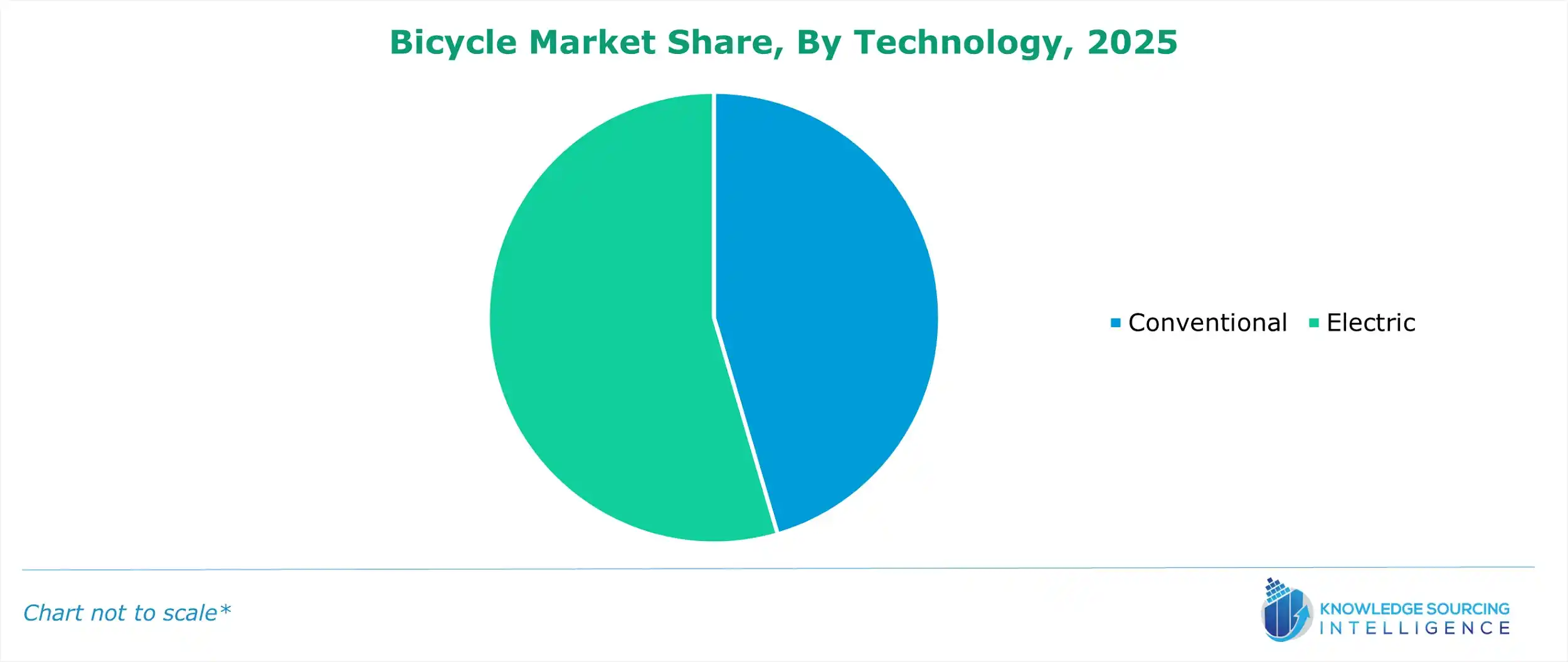

- Conventional: By technology, the conventional segment is projected to hold a considerable market share throughout the next five years. Bicycles are considered one of the most convenient means of short-distance transport, especially in developing economies. The presence of a considerable labor class population in emerging economies such as China, India, Brazil, and Indonesia, among others, is further supporting the growth of conventional cycles during the forecast period.

- Electric: The electric bicycle segment is anticipated to witness rapid growth during the forecast period, primarily because these cycles are often considered one of the most suitable means for leisure bicycling. However, the penetration of electric bicycles is still expected to be in the nascent stage in many parts of the world. Major market players are investing heavily in R&D for developing and launching new, high-tech electric bicycles, further boosting this segment’s growth.

Bicycle Market Geographical Outlook:

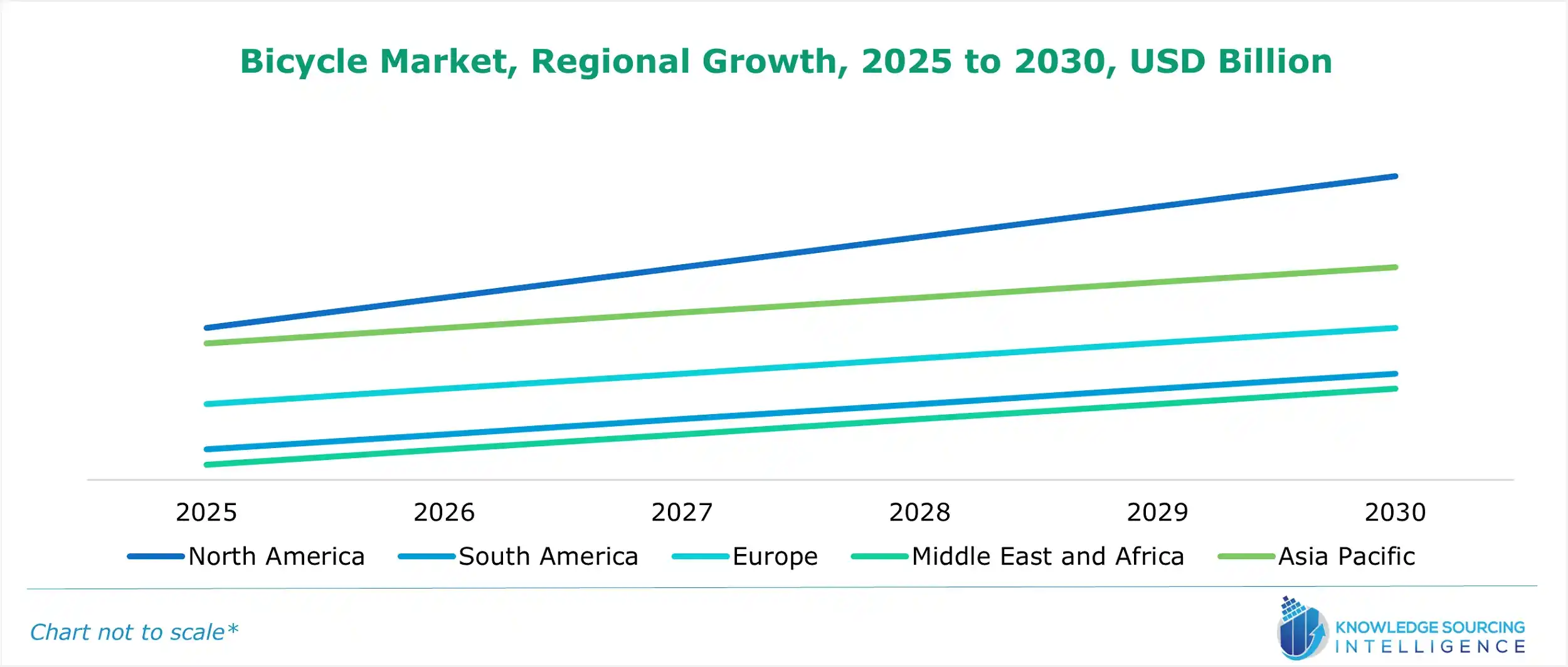

- Asia-Pacific is forecasted to hold a major market share.

Geographically, the Asia Pacific region is expected to hold a significant market share throughout the forecast period. The presence of a large low and middle-income population base in countries like India, China, Indonesia, and others is one of the major factors supplementing the dominance of this region in the global bicycle market. Furthermore, the presence of well-established domestic brands such as Atlas Cycles, Hero Cycles, and Giant Bicycles in countries like India and China further bolsters regional market growth.

Global Bicycle Market – Competitive Landscape

- Merida Industry Co., Ltd

- Giant Manufacturing Co. Ltd.

- Trek Bicycle Corporation

- Hero Cycles Limited

- Accell Group

These companies are the major market players in the global bicycle market. Some are well-established brands with good reputations, while others are leading innovators in technology, dominating the market of global bicycles.

Global Bicycle Market's Latest Developments

- In January 2025, KTM launched the KTM 125 ENDURO R and KTM 390 ENDURO R, having long travel suspension, 21/18-inch spoke wheels, and a minimal TFT dashboard. It will be in the market in early 2025.

Bicycle Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Bicycle Market Size in 2025 | US$79.713 billion |

| Bicycle Market Size in 2030 | US$110.102 billion |

| Growth Rate | CAGR of 6.67% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Bicycle Market |

|

| Customization Scope | Free report customization with purchase |

Bicycle Market Segmentation:

- By Type

- Mountain

- Road

- Hybrid

- Others

- By End-User

- Men

- Women

- Kids

- By Technology

- Conventional

- Electric

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America