Report Overview

Cancer Biomarkers Market - Highlights

Cancer Biomarkers Market Size:

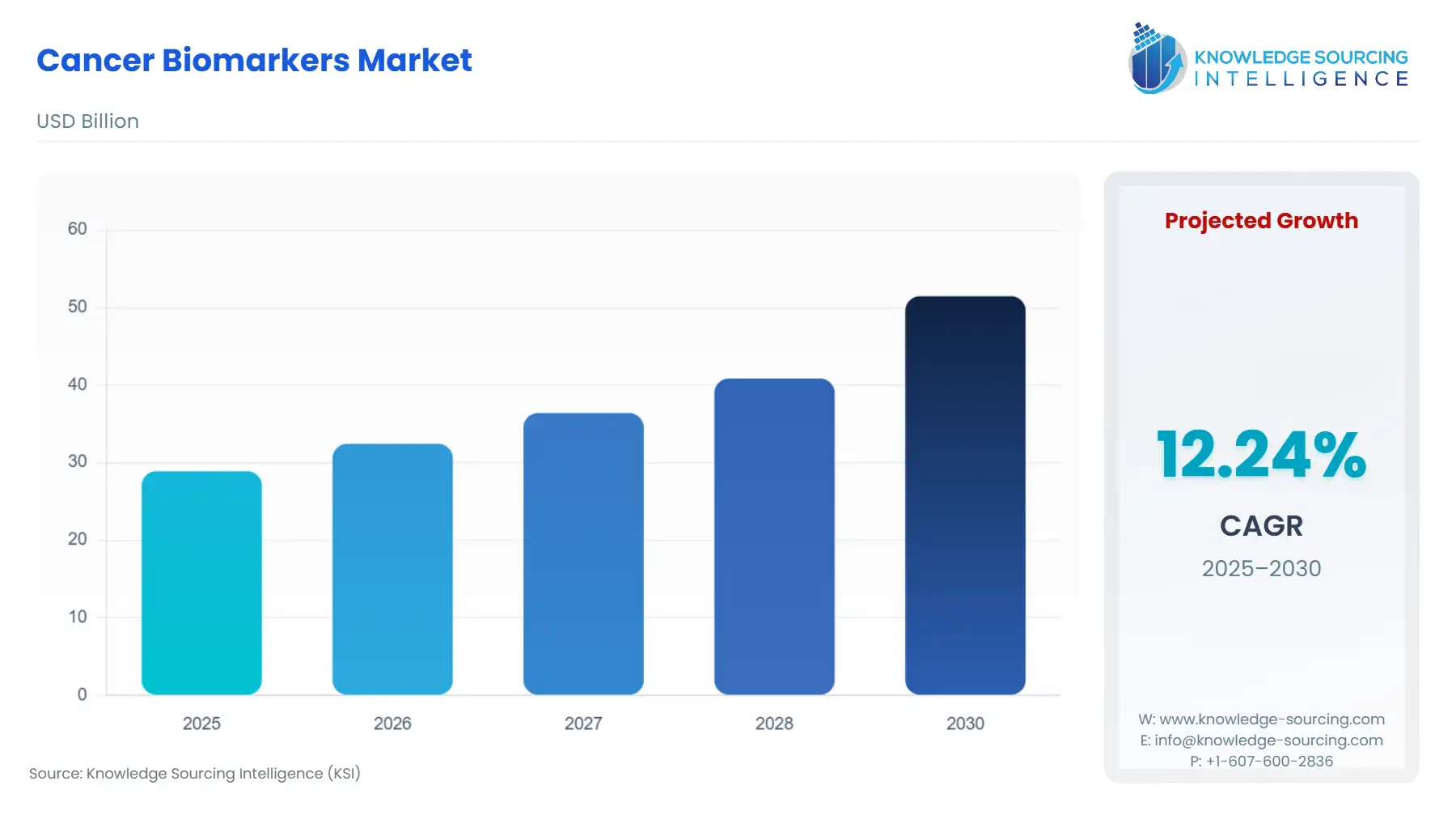

The Cancer Biomarkers Market is expected to grow from US$28.897 billion in 2025 to US$51.474 billion in 2030, at a CAGR of 12.24%.

The market for global cancer biomarkers is an essential component of the precision oncology paradigm, moving beyond traditional diagnostics to offer actionable molecular intelligence for disease management. This sector encompasses a broad range of biological indicators—from proteins and genes to metabolites—used to detect cancer presence, predict therapeutic response, and monitor recurrence. The market's foundational growth is structurally linked to the global public health imperative of improving cancer survival rates. Biomarkers are no longer merely research tools; they represent critical decision-making assets that guide multi-billion dollar drug development pipelines and increasingly shape routine clinical practice in specialized oncology centers worldwide.

Global Cancer Biomarkers Market Analysis

Growth Drivers

The market expansion for cancer biomarkers is propelled by three primary, intertwined drivers, each creating quantifiable increases in product demand.

The escalating global cancer burden represents the most fundamental catalyst for market demand. In 2022, the International Agency for Research on Cancer (IARC) reported nearly 20 million new cancer cases globally, with lung, breast, and colorectal cancers being the most common. This sheer volume of disease dictates an unrelenting demand for effective screening, diagnosis, and staging tools. Specifically, the high prevalence of these major cancer types directly drives demand for established biomarkers like the detection of specific mutations in Genetic Biomarkers for lung cancer or the analysis of hormone receptors in Protein Biomarkers for breast cancer. The clinical imperative to diagnose these vast patient populations accurately before initiating treatment ensures a sustained, high-volume requirement for biomarker assays across all geographical markets.

Secondly, the accelerated regulatory approval of targeted and personalized oncology therapeutics has functionally transformed biomarkers from supplemental tools into indispensable companion diagnostics. Regulatory bodies, including the US FDA, are increasingly conditioning the use of novel drug therapies—such as tyrosine kinase inhibitors or checkpoint inhibitors—on the detection of a specific molecular target. This process mandates the development and clinical adoption of an FDA-approved diagnostic test alongside the drug. Pharmaceutical companies driving the development of these precision medicines become the primary engine of demand for companion diagnostic development and commercialization, ensuring that biomarker test volumes track directly with drug uptake.

Thirdly, technological advancements in liquid biopsy are generating a disruptive shift in demand by addressing a significant constraint of traditional tissue-based testing: invasiveness and sample availability. Liquid biopsy platforms, which detect circulating tumor cells (CTCs) or cell-free DNA (cfDNA) and circulating tumor DNA (ctDNA) from a simple blood draw, expand the addressable market for cancer biomarker testing, particularly in contexts where a surgical tissue biopsy is challenging, risky, or impractical (e.g., recurrence monitoring or initial diagnosis of advanced-stage lung cancer). This non-invasive approach lowers the barrier to repeat testing, increasing the demand for post-treatment monitoring biomarkers.

The improved sensitivity and specificity of next-generation sequencing (NGS) and digital PCR (dPCR) technologies have validated the liquid biopsy's clinical utility, creating a new, substantial segment of demand centered on Genetic Biomarkers that track disease progression or minimal residual disease (MRD) status. The convenience and clinical versatility of liquid biopsy technologies act as an adoption catalyst, moving biomarker testing earlier and more frequently into the patient care pathway. The rise of liquid biopsy also addresses the challenge of tumor heterogeneity, as a blood sample may better represent the overall genetic landscape of metastatic disease compared to a single tissue biopsy, further consolidating the demand for these advanced molecular assays.

Challenges and Opportunities

The primary constraint facing the cancer biomarkers market is the persistent challenge of reimbursement and clinical validation, which directly impacts demand by limiting patient access. Obtaining coverage from payers requires extensive, high-cost clinical utility data, slowing the translation of novel discovery into routine clinical use. Conversely, a substantial opportunity lies in the standardization of multi-omic data integration. Developing validated bioinformatics pipelines that effectively combine genetic, proteomic, and epigenetic biomarker data into an integrated, actionable report for clinicians will significantly increase the value proposition and, consequently, the clinical demand for comprehensive biomarker profiling services. This integration addresses the complexity of cancer biology, pushing demand from single-target tests toward broader panel testing.

Supply Chain Analysis

The cancer biomarkers supply chain is complex, primarily characterized by high-value, low-volume components. Key production hubs for high-complexity components, such as next-generation sequencing (NGS) instruments, proprietary microfluidics, and specialized reagents (e.g., high-quality antibodies and proprietary enzymes), are heavily concentrated in North America (US) and Europe (Germany, Switzerland). Logistical complexity is centered on maintaining the integrity of these specialized reagents, which often require stringent cold-chain management, and the movement of clinical samples across borders to centralized testing laboratories. The supply chain dependency on a limited number of specialized manufacturers for capital equipment (sequencers, mass spectrometers) introduces vulnerability to geopolitical friction.

The impact of tariffs, particularly on high-value, imported scientific instrumentation and certain specialized reagents, translates directly into increased manufacturing costs and ultimately, higher final pricing for advanced diagnostic tests. For example, if tariffs are applied to precision components sourced from a major Asian manufacturing hub and intended for integration into US- or EU-made testing platforms, the increased import duty is passed through. This cost inflation acts as a headwind on demand, particularly in price-sensitive emerging markets and within academic research settings with fixed budgets, potentially decelerating the adoption of high-throughput molecular diagnostics.

Cancer Biomarkers Market Government Regulations

Regulatory oversight is a primary factor shaping the demand structure, particularly through its role in establishing clinical necessity and mandating quality. Agencies define the necessary evidence for clinical utility, which directly governs payer reimbursement and clinical adoption rates.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

USA | FDA (Food and Drug Administration) Approval/Clearance | FDA approval of a test as a companion diagnostic locks the biomarker into the treatment pathway for a corresponding drug, creating a definitive, mandatory demand. The increasing focus on Laboratory Developed Tests (LDTs) regulation, should it materialize, would heighten validation costs, acting as a constraint on small laboratories but increasing the commercial stability and quality of the market's major players. |

Europe | In Vitro Diagnostic Regulation (IVDR) | The IVDR, with its significantly stricter requirements for technical documentation, quality management systems, and clinical evidence, requires manufacturers to re-certify products. This elevates the cost of market entry and post-market surveillance, creating a short-term constraint on product availability but ensuring long-term product quality, thus increasing physician confidence and demand stability. |

China | National Medical Products Administration (NMPA) Regulation | The NMPA's processes for foreign IVDs often require local clinical trials, which presents a significant barrier to entry. However, NMPA approval opens access to the vast domestic patient population, representing a massive, concentrated demand opportunity once regulatory hurdles are cleared. |

Global Cancer Biomarkers Market Segment Analysis

By Application: Diagnosis

The Diagnosis segment maintains market leadership as cancer biomarkers are inherently critical to the initial identification, classification, and staging of the disease. Demand in this segment is directly proportional to global cancer incidence. The analytical imperative is that the biomarker must be highly sensitive and specific to reliably distinguish malignant from benign or normal tissue. The use of immunohistochemistry (IHC)-based Protein Biomarkers (e.g., HER2, ER, PR) remains the gold standard in many solid tumor diagnostics, driving persistent demand for validated antibodies and automated staining platforms in pathology labs. Simultaneously, the application of broad Genetic Biomarker panels, particularly in lung and colorectal cancer, is becoming standard-of-care, as identifying actionable mutations at diagnosis informs the first line of treatment. The demand for diagnostic biomarkers is structurally inelastic, driven by medical necessity rather than discretionary spending.

By Type: Genetic Biomarkers

Genetic Biomarkers, encompassing DNA mutations, gene fusions, and RNA expression profiles, are experiencing the fastest demand growth due to their essential role in precision medicine. The primary driver is the demonstrable clinical utility of sequencing technologies (NGS) to simultaneously interrogate multiple gene targets, which is required for effective patient stratification into targeted therapy groups. For example, a single NGS panel can screen a patient for over 500 genes, replacing multiple sequential, single-gene tests. This operational efficiency creates a strong incentive for end-users like hospitals and diagnostic centers to adopt NGS-based Genetic Biomarkers as a unified solution, increasing per-patient test volume and driving high-value demand for bioinformatics software and sequencing consumables. The rising adoption of liquid biopsy further consolidates demand for this segment, as cfDNA and ctDNA analyses are fundamentally genetic biomarker applications.

Global Cancer Biomarkers Market Geographical Analysis

US Market Analysis

The US market exhibits the highest adoption rate, propelled by a robust, well-funded ecosystem of pharmaceutical R&D, advanced diagnostic labs, and a favorable, albeit complex, reimbursement landscape. The demand for Genetic Biomarkers is exceptionally strong, driven by clinical guidelines from bodies like the National Comprehensive Cancer Network (NCCN) that recommend extensive molecular profiling for most advanced cancers. Local factors, such as the high density of specialized cancer centers and the FDA's accelerated approval pathways for both drugs and companion diagnostics, rapidly translate new biomarker discoveries into clinical standard-of-care, ensuring an early and high-volume demand curve.

Brazil Market Analysis

Brazil’s market dynamics are fundamentally shaped by the interplay between public and private healthcare systems. The demand for advanced cancer biomarkers is robust but concentrated within the private sector and major metropolitan oncology centers. While the incidence of major cancers drives an underlying need, demand is constrained by price sensitivity and the protracted processes for public health system (SUS) incorporation and reimbursement. Consequently, there is a higher proportional demand for cost-effective, established Protein Biomarkers (e.g., immunoassay-based tests) and a growing, but smaller-scale, demand for next-generation Genetic Biomarkers primarily funded by private insurance.

UK Market Analysis

The UK market is governed by centralized decision-making through the National Health Service (NHS) and the National Institute for Health and Care Excellence (NICE). NICE appraisals, which require a high level of cost-effectiveness evidence, serve as a critical filter for market access. Once approved, however, the test is rapidly and uniformly implemented across the public system, creating a large, centralized, and predictable demand. The current focus is on standardizing molecular testing pathways for cancers like lung and colorectal, driving stable, high-volume demand for nationally procured, validated Genetic Biomarker assays.

Saudi Arabia Market Analysis

The Saudi Arabian market is characterized by significant government investment in healthcare infrastructure as part of its Vision 2030, directly funding the establishment of high-quality oncology centers. This top-down investment creates an accelerated demand for state-of-the-art diagnostic platforms, driving procurement of high-throughput instruments and advanced Genetic Biomarker panels. Demand is high for comprehensive solutions, often involving partnerships with major global vendors to establish local capabilities and expertise, rather than a gradual, organic adoption process.

Japan Market Analysis

Japan’s market is defined by a conservative but methodical approach to reimbursement via the National Health Insurance (NHI) system. New cancer biomarkers must demonstrate clear clinical utility to secure NHI coverage, a process that can be slow. However, once approved, adoption is widespread. The market shows a high preference for quality and technological precision, driving demand for locally validated, high-accuracy diagnostics. A notable driver is the aging population, which contributes to a high absolute number of cancer cases, maintaining steady demand across both Protein and Genetic Biomarkers for early detection and treatment monitoring.

Global Cancer Biomarkers Market Competitive Environment and Analysis

The global cancer biomarkers market features an intensely competitive landscape dominated by major multinational corporations that leverage integrated diagnostic and pharmaceutical portfolios. Competition is primarily focused on achieving regulatory clearance as a companion diagnostic, securing favorable reimbursement rates, and advancing liquid biopsy capabilities.

F. Hoffmann-La Roche Ltd. stands as a competitive anchor, strategically positioning its Diagnostics division to complement its Pharmaceutical division's leading oncology pipeline. The company’s core strategy revolves around integrated personalized healthcare. A key offering is the VENTANA PD-L1 (SP263) Assay, a Protein Biomarker companion diagnostic for use with multiple immunotherapies across various cancer types, including non-small cell lung cancer.

Illumina, Inc. dominates the market for next-generation sequencing (NGS) instrumentation and reagents, placing it as a critical enabler rather than a direct diagnostic provider for many high-complexity biomarker tests. The company's strategic positioning is focused on expanding the utility and accessibility of its platforms, such as the NovaSeq and MiSeq systems.

Global Cancer Biomarkers Market Key Development:

May 2025: University of Houston awarded a US$3 million grant from Cancer Prevention and Research Institute of Texas (CPRIT) to establish the first-in-Texas Cancer Immunotherapy Biomarker Core facility, which will provide advanced proteomic platforms—able to screen 11,000 proteins per sample and assess autoantibodies against 21,000 human proteins—to accelerate biomarker discovery and improve immunotherapy outcomes.

August 2024: Illumina, Inc. announced that its TruSight Oncology Comprehensive kit for cancer biomarker testing received US FDA approval as a companion diagnostic for solid tumours, allowing over 500 genes to be profiled in one test and enabling identification of patients with NTRK fusions or RET fusions who may benefit from targeted therapies like VITRAKVI or RETEVMO.

Cancer Biomarkers Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 28.897 billion |

| Total Market Size in 2030 | USD 51.474 billion |

| Forecast Unit | Billion |

| Growth Rate | 12.24% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Cancer Type, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Cancer Biomarkers Market Segmentation:

By Type

Protein Biomarkers

Genetic Biomarkers

Others

By Cancer Type

Melanoma

Lung cancer

Thyroid cancer

Kidney cancer

Breast Cancer

Others

By Application

Diagnosis

Drug Discovery and Development

Prognosis

Risk Assessment

By End User

Hospitals and Clinics

Diagnostic Centers

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

Israel

Others

Asia Pacific

China

Japan

South Korea

India

Others