Report Overview

Global Chain Drives Market Highlights

Chain Drives Market Size:

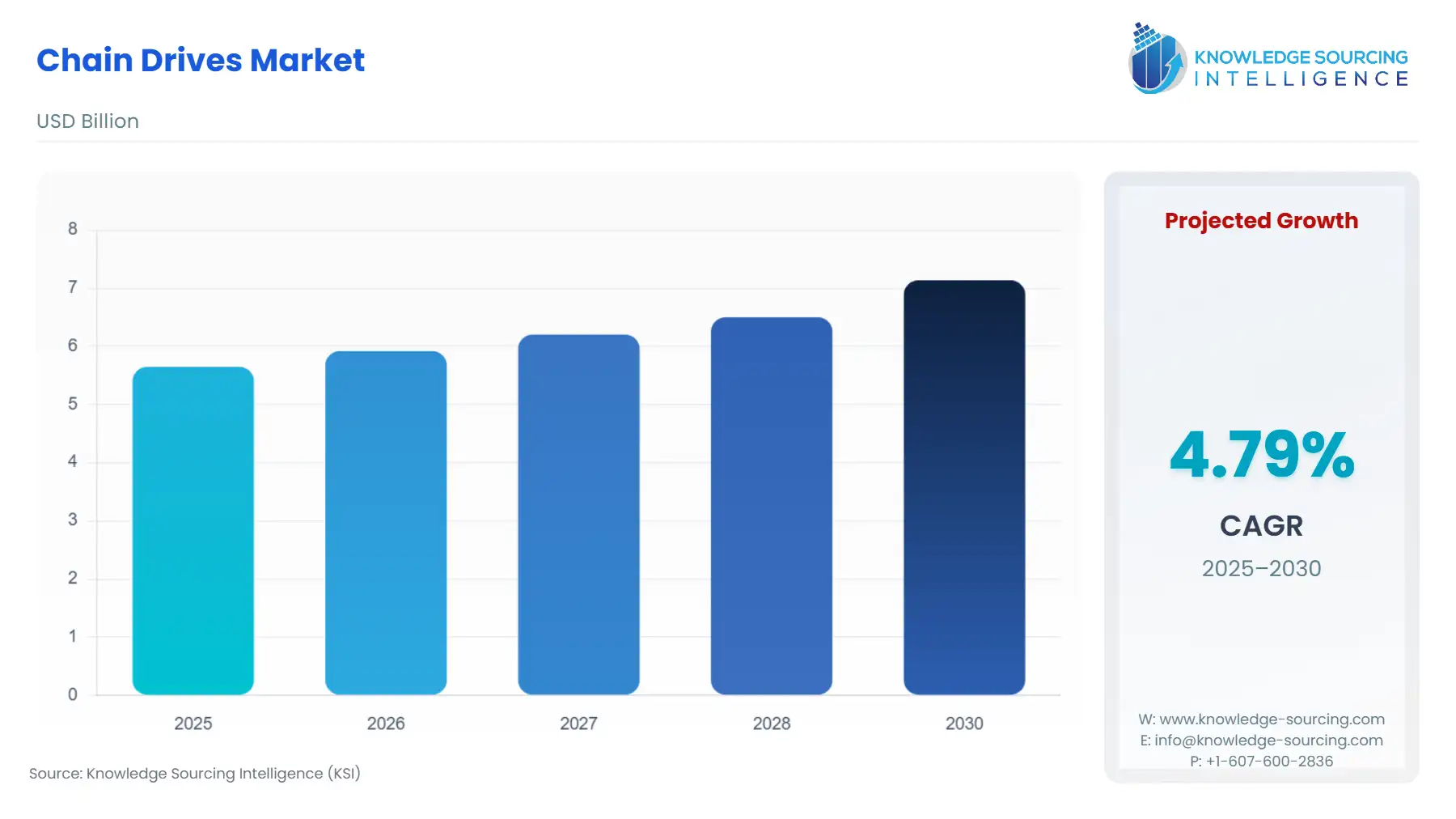

The global chain drives market will grow from US$5.650 billion in 2025 to US$7.138 billion in 2030 at a CAGR of 4.79%.

Real-time monitoring and analysis of complex environments are made possible by global chain drives, which facilitate proactive decision-making and threat identification in a variety of industries, including critical infrastructure, defense, and security. By employing cutting-edge sensor technologies, artificial intelligence, and data analytics, these systems improve situation awareness and reaction times, guaranteeing efficient handling of unpredictable and dangerous situations. Their acceptance and evolution to solve changing security concerns are driven by their continuous innovation and integration with existing infrastructures.

Global chain drives are used to monitor and control an organization's environment. Further, security and surveillance systems are used to reduce the risk of unwanted activities and human negligence which have the potential to cause hazards or disaster. Moreover, surging cybercrime and terrorism have increased the need for global chain drives to curb and remove terror activities. Hence the prime reasons driving the growth of the global chain drives market are growing human negligence and human-made disaster. However high implementation costs may constrain the market growth during the forecasted period.

Chain Drives Market Trends:

The market is expected to surge in the coming years, because of the rise and growth in the automotive sector, construction and manufacturing sector, agriculture sector, and others, worldwide. In an industry, chain drives are used to perform three functions such as conveying materials, transmitting power, and several timing purposes.

Some of the chain drive’s industrial applications are hydraulic lift truck fork operation, rigging and moving heavy materials, overhead hoists, and others. With the increasing investments and advancements in the development of the Internet of Things and artificial intelligence for the industrial and manufacturing sectors, the market is expected to surge at an exponential rate, during the forecast period. Growth in the agriculture sector is also expected to be a positive development for the market, because of the increase in food production and the demand for high-quality products.

Chain Drives Market Growth Drivers:

- Growth in the automotive industry is expected to influence the global chain drive market growth.

The global chain drives market is expected to be greatly impacted by the automobile industry's predicted expansion. Advances in the automobile industry, including the development of electric vehicles (EVs), hybrid cars, and autonomous driving technologies, have increased demand for long-lasting and dependable chain drives in a variety of vehicle components, including timing systems, engines, and gearboxes.

The need for replacement chain drives is also fueled by the growth of the automotive aftermarket sector, which is fueled by maintenance and repair operations. Furthermore, the usage of premium chain drives that provide accurate power transfer and low energy loss is required due to the increased emphasis on fuel economy, lower emissions, and improved performance in automobiles.

Moreover, the global chain drives market is growing overall as a result of rising car production and sales, especially in emerging nations. Consequently, the automotive industry's manufacturers are depending more and more on chain drives to guarantee maximum efficiency and dependability, which is propelling the growth of the global chain drives market.

- A rise in the construction sector is predicted to positively impact the global chain drive market growth.

The global chain drives market is anticipated to benefit from the anticipated expansion in the construction industry. The need for heavy gear and equipment, such as cranes, excavators, and conveyor systems, which depend on chain drives for effective power transmission, is rising as building activities across the world expand. In these applications, chain drives are vital because they provide the robustness, dependability, and accurate motion control required to operate different construction machinery parts.

The need for chain drives is also fueled by expenditures in residential and commercial buildings, urbanization initiatives, and infrastructure upgrading. Furthermore, as cost-effectiveness, safety, and productivity become more important to construction enterprises, they are choosing higher-quality chain drives that can handle big loads and challenging working environments. In addition, the construction industry's aftermarket sector stimulates demand for replacement chain drives, hence bolstering market expansion. Given that these crucial parts are still a fundamental part of the gear and equipment used in building projects all over the world, the expanding construction industry offers the global chain drives market several profitable chances.

- Innovation and advancement in technology are predicted to positively impact global chain drives market growth.

The market is expected to surge in the coming years because of innovation and advancement in the chain drive. There has been an evolvement in manufacturing technologies, which includes advanced robotics, artificial intelligence, and the Internet of Things, which are often referred to as Industry 4.0. Major companies have been making significant developments in the market, in the past few years. Iwis has become one of the leading players in the market. The company has been providing advanced and high-performance chain drive products to innovative drive chain systems.

Furthermore, the company has been making and providing products for subway trains to power stations, cement making, chocolate manufacturing, and other industries. The company’s conveyor chain contains a series of journal bearings, which consist of a bush and a bearing pin on which the chain roller revolves. Other companies are also making significant developments in the market, which is expected to drive market growth, during the forecast period.

Chain Drives Market Restraints:

There are several obstacles the chain drives industry must overcome to continue expanding and growing. For instance, other technologies for power transmission applications, such as gear and belt drives, are becoming more widely available. This might reduce the market share of chain drives. Additionally, end users may choose low-maintenance options due to worries about the maintenance and lubrication demands associated with chain drives, which can raise operating costs and complexity. Chain drive-generated noise and vibration can sometimes be problematic, especially in situations where noise abatement is essential, such as in industrial or automotive contexts.

The desire for eco-friendly substitutes may also be influenced by environmental factors, such as concerns about sustainability and the disposal of lubricants, which might hinder the uptake of conventional chain drives. Moreover, wear and tear-related requirements for regular inspections and replacements can cause downtime and production losses, which can negatively affect overall effectiveness and cost-effectiveness. To overcome these limitations, chain-drive technology advancements are needed to increase productivity, lower maintenance costs, and lessen environmental effects.

Chain Drives Market Geographical Outlook:

- The North American region is anticipated to hold a significant share of the market.

The powerful industrial sector in North America, which includes the automotive, manufacturing, and mining industries, is the reason for the market's success. Technological developments in chain drive designs improve performance, dependability, and efficiency, satisfying industrial productivity requirements. Market confidence is fostered by the availability of high-quality chain drives, which are guaranteed by top manufacturers and strict quality requirements. The demand for long-lasting power transmission systems is driven by infrastructure development projects in the transportation, construction, and energy sectors.

The adoption of sophisticated chain drives with integrated sensors is fueled by developments in automation and smart manufacturing, which maximize operational efficiency. Because of its emphasis on quality and innovation, the area is positioned to expand significantly in the global chain drives market. Overall, consistent demand from a variety of industrial sectors fuels market growth and encourages more innovation in the North American supply chain.

Chain Drives Market Key Developments:

- In November 2023, Amazon Web Services, Inc., a subsidiary of Amazon.com, Inc. unveiled four new features for the AWS Supply Chain at AWS re: Invent. These features combine Amazon's nearly three decades of supply chain expertise with the resilience, security, and business continuity of an AWS-managed service to assist clients in streamlining their supply chains.

- In September 2023, Coupa Software, a pioneer in business spend management (BSM), unveiled a new solution to enhance supply assurance and business continuity as organizations struggle with supply chain risks endangering their vital revenue streams.

Chain Drives Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Chain Drives Market Size in 2025 | US$5.650 billion |

| Chain Drives Market Size in 2030 | US$7.138 billion |

| Growth Rate | CAGR of 4.79% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Chain Drives Market |

|

| Customization Scope | Free report customization with purchase |

Chain Drives Market Segmentation:

- By Type

- Hoisting Chains

- Power Transmission Chains

- Conveyer Chains

- By Application

- Agriculture Machinery

- Automotive

- Building Construction

- Material Handling Equipment

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others