Report Overview

Global Circuit Breaker Market Highlights

Circuit Breaker Market Size:

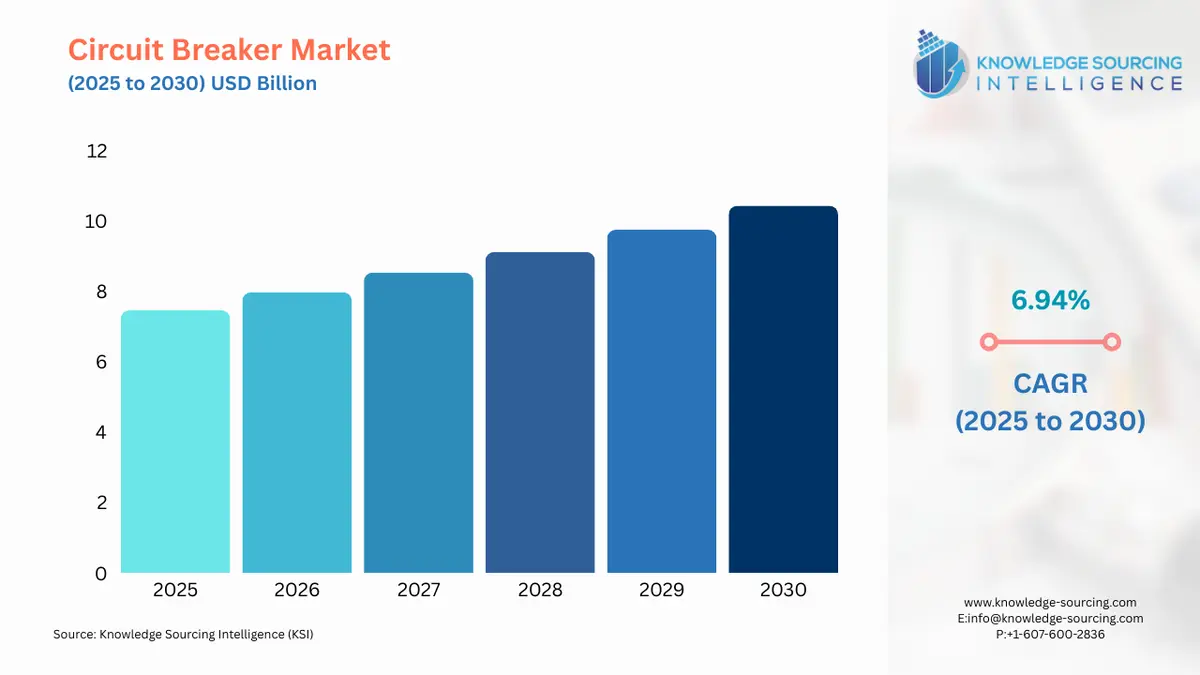

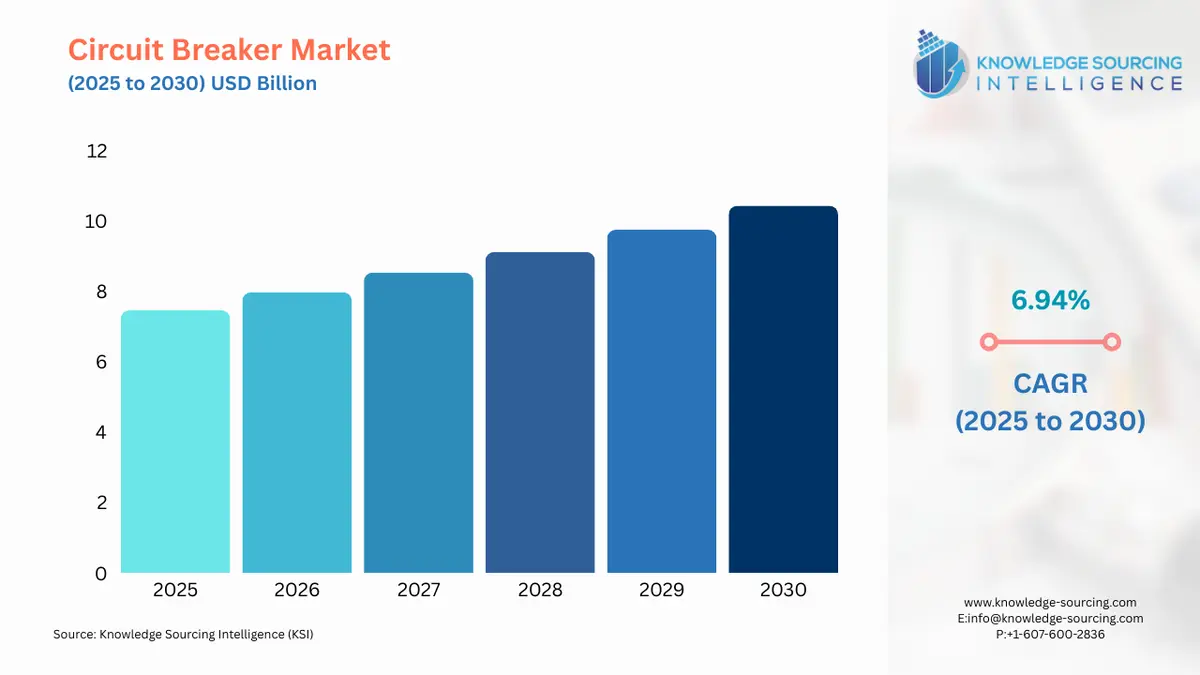

The global circuit breaker market is projected to grow at a CAGR of 6.94% over the forecast period, increasing from US$7.457 billion in 2025 to US$10.428 billion by 2030.

Circuit Breaker Market Trends:

A circuit breaker is an electrical safety device that interrupts a current flow to prevent overloading, thereby preserving the overall electrical system. Unlike a fuse, which works only once, a circuit breaker allows normal operations to be continuous. The ability of such devices to detect faults in current flow makes them an integral part of vital electrical infrastructure, thereby driving their applicability in power grids, and residential, industrial, and commercial establishments.

The market is also witnessing an increasing trend towards sustainable manufacturing, leading to the integration of eco-friendly materials into industrial electrical components, including circuit breakers. For instance, Siemens AG and BASF have introduced the SIRIUS 3RV2 circuit breaker with biomass-balanced plastics, reducing the emission of carbon dioxide equivalents by ~270 tons per year, aligning with the circular economy trend.

Global Circuit Breaker Market Overview & Scope:

The global circuit breaker market is segmented by:

- Insulation Type: The global circuit breaker market, by type, is divided into Air circuit breakers, oil circuit breakers, gas circuit breakers, and others. The global growth of the air circuit breaker market is mainly fueled by increased industrialization and urban infrastructure development, which is impacted by the growth in personal income. According to the Bureau of Economic Analysis, the United States in the year 2025 witnessed a growth in personal income, disposable personal income as well as in personal consumption expenditures rising from USD92 billion to USD194.7 billion.

- Voltage: The global circuit breaker market, by voltage, is divided into Up To 5KV, 5KV – 15KV, 15KV – 60KV, and above 60KV. A large portion of the market will be occupied by 15–50kV because of the growing demand from commercial and industrial applications.

- End-User: The global circuit breaker market, by end-user, is divided into residential, commercial, and industrial. Residential applications will have a growing market. Manufacturing plants, factories, warehouses, and other such large industries require a large amount of electricity, thus requiring a more advanced circuit breaker as compared to residential circuit breakers. There are various types of industrial circuit breakers for different purposes. For instance, low-voltage industrial circuit breakers, magnetic industrial circuit breakers, thermal magnetic industrial circuit breakers, medium-voltage circuit breakers, high-voltage industrial circuit breakers, and sulfur hexafluoride high-voltage industrial circuit breakers are some examples.

- Region: North America is poised to hold a prominent position in the global circuit breaker market, particularly due to its increasing R&D activities.

Top Trends Shaping the Global Circuit Breaker Market:

1. Rise of Smart Circuit Breakers

- The increasing use of smart circuit breakers is revolutionizing the monitoring and management of power systems. Smart circuit breakers are infused with IoT functionality, sensors, and communication modules that enable real-time diagnostics, remote operation, and predictive maintenance. As power systems get increasingly digitized, utilities and industries are moving toward smarter protection devices that can maximize energy consumption, minimize downtime, and enable automation. This trend is especially prevalent in applications such as data centers, industrial automation, and commercial infrastructure, where reliability and efficiency are mission-critical.

2. Advancements in 3D Bioprinting and Nanotechnology

- Concern over the environment and the tightening of environmental regulations are creating a profound shift away from conventional SF? (sulfur hexafluoride)-type circuit breakers toward more environmentally friendly alternatives. SF?, while excellent as an insulating medium, is a strong greenhouse gas, so the industry has been searching for alternatives in the form of air-insulated and vacuum circuit breakers. Industry manufacturers are introducing greener models that reduce the environmental footprint without sacrificing performance, enabling the utility and industrial markets to meet sustainability targets and conform to increased environmental regulations.

Global Circuit Breaker Market Growth Drivers vs. Challenges

Drivers:

- Growing Electricity Demand: The key market growth factors include electricity demand and reliable power delivery along with the booming electricity consumption fuelled by fast economic development and investment to bolster power distribution followed by technological development. For instance, according to the IEA, the percentage of electricity in total energy consumption increased from 18% in 2015 to 20% in 2023. Global electricity demand rose by 4.3% in 2024 and is forecast to continue to grow at close to 4% out to 2027. Over the next three years, global electricity consumption is forecast to rise by an unprecedented 3,500 TWh, as per the IEA Electricity Report 2025.

- Rising Demand for Energy-Efficient Infrastructure and Power Supply: One of the prominent causes of the circuit breaker market growth is the growing demand for energy-efficient infrastructure and renewable energy sources to optimize the overall process of power distribution, which has led to various strategic collaborations and government investment in this direction. Post such investments in necessary infrastructure development, the demand for circuit breakers, which are vital in transmission and distribution, is also anticipated to increase.

As per the Renewable Energy Capacity Statistics 2025 released by the International Renewable Energy Agency (IRENA), there is a massive increase in renewable power capacity during 2024, reaching 4,448 gigawatts (GW).

Additionally, smart power grid developments are also anticipated to propel market expansion. For example, until 2023, anticipated energy investments totaled about USD 2.8 trillion, which showcased significant growth over the past four years. Clean energy, which includes nuclear power, storage, grids, low-emission fuels, renewable energy, efficiency enhancements, end-use renewables, and electrification, has been allocated more than USD 1.7 trillion.

Challenges:

- High Initial Costs for Advanced Systems: One of the major factor restraining the global circuit breaker market is the high upfront cost of advanced systems, especially smart and digital circuit breakers. These new solutions tend to be fitted with functionalities such as remote monitoring, real-time diagnostics, and compatibility with smart grids, which raise their manufacturing and installation costs by a wide margin compared to conventional models.

Global Circuit Breaker Market Regional Analysis:

- North America: The North American circuit breaker market, country-wise, is segmented into the United States, Canada, and Mexico. As one of the most developed economies in the world, the United States stands at the forefront of industrial progression, power generation and supply, and rapid urbanization. The ongoing investments in new commercial establishments, including offices, data centers, and business premises, have escalated the volume of electricity demand in the county, which is expected to stimulate the circuit breaker’s demand simultaneously. Furthermore, the constant growth in transportation and residential end-users has also added more to the overall electricity consumption.

According to the International Energy Agency’s “Electricity Mid-Year July 2024” report in 1H 2024, the electricity demand in the United States experienced 3.8% growth. Moreover, the same source states that in 2023, the electricity demand in the United States stood at 4,262 TWh, which is expected to reach 4,392 TWh in 2024 and 4,475 TWh in 2025. Thus, the report showcases 3% year-on-year growth for 2023/2024 and 19.% for 2024-2025.

Global Circuit Breaker Market Regional Analysis:

- Product Innovation: In April 2025, ABB launched an end-to-end switchgear solution for wind turbines to enable the installation of bigger wind turbines with greater yields. The solution has the industry's highest power rating for an end-to-end switchgear solution, which includes a 7200A Emax 2 air circuit breaker and a 3200A AF Contactor, to deliver best-in-class reliability and switching performance.

Circuit Breaker Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Circuit Breaker Market Size in 2025 | US$7.457 billion |

| Circuit Breaker Market Size in 2030 | US$10.428 billion |

| Growth Rate | CAGR of 6.94% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Circuit Breaker Market |

|

| Customization Scope | Free report customization with purchase |

Global Circuit Breaker Market Segmentation:

By Installation

- Indoor

- Outdoor

By Insulation type

- Air Circuit Breaker

- Oil Circuit Breaker

- Gas Circuit Breaker

- Others

By Rated Voltage

- Up to 5V

- 5V – 15kV

- 15kV – 60kV

- Above 60kV

By End-users

- Industrial

- Commercial

- Residential

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

Our Best-Performing Industry Reports:

Navigation:

- Circuit Breaker Market Size:

- Circuit Breaker Market Trends:

- Circuit Breaker Market Key Highlights:

- Global Circuit Breaker Market Overview & Scope:

- Top Trends Shaping the Global Circuit Breaker Market:

- Global Circuit Breaker Market Growth Drivers vs. Challenges

- Global Circuit Breaker Market Regional Analysis:

- Global Circuit Breaker Market Regional Analysis:

- Circuit Breaker Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 23, 2025