Report Overview

Global Cold Chain Equipment Highlights

Cold Chain Equipment Market Size:

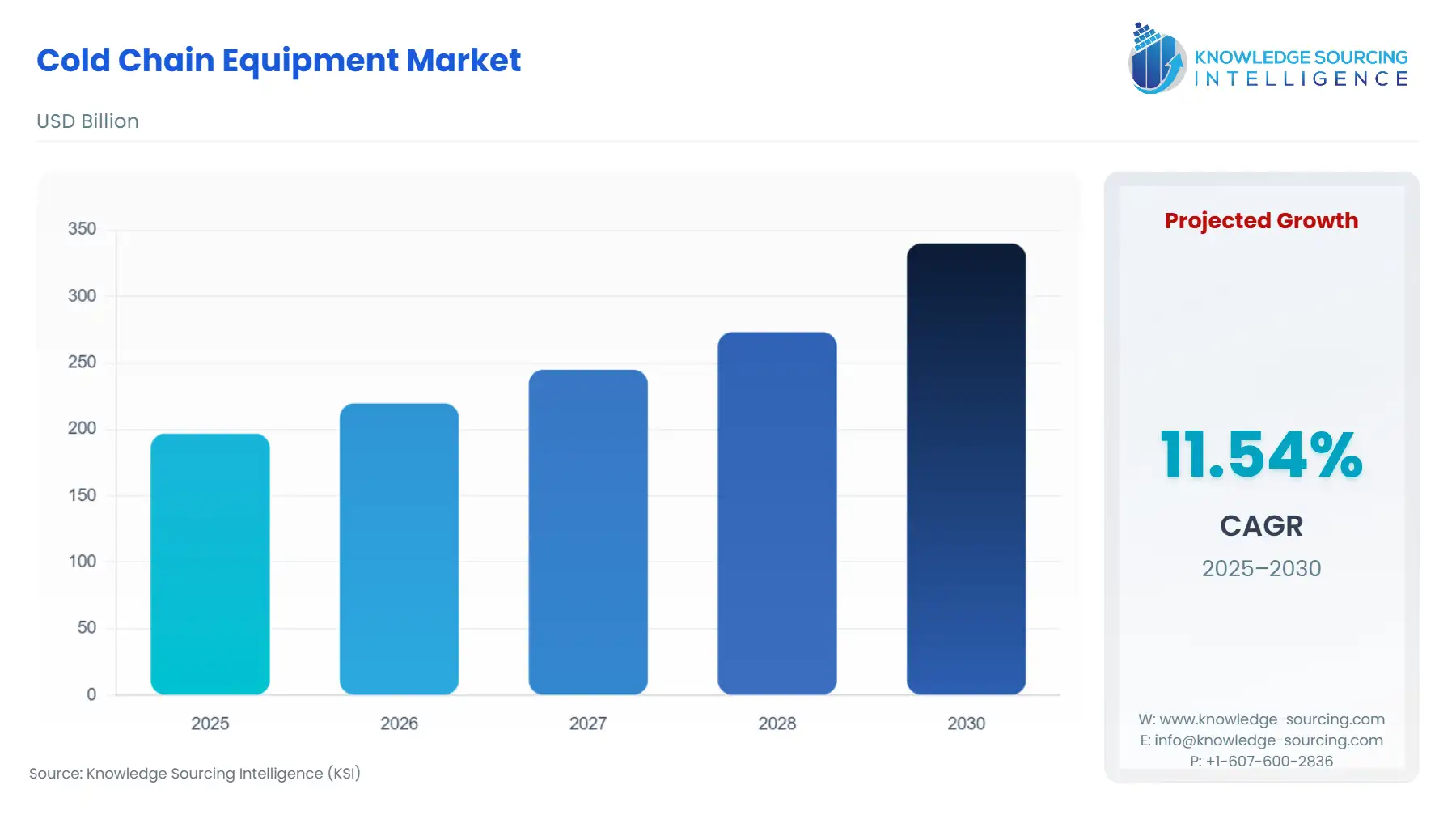

The Global Cold Chain Equipment market is expected to grow at a CAGR of 11.54%, reaching a market size of US$339.900 billion in 2030 from US$196.873 billion in 2025.

Cold chain is a type of temperature-controlled supply chain that includes storage, transportation, and distribution of various types of perishable goods, such as vaccines, chemicals, and various food & beverage products, like dairy and seafood. It includes various rules and procedures that ensure proper storage and distribution of such perishable products. The cold chain equipment includes cold boxes, cold storage, and insulated boxes.

Rising globalization and expanding trade activities, such as exports and imports, will push the demand for cold chain equipment during the forecasted timeline. The global demand for cold chain equipment increase can be attributed to multiple factors, including growing demand for frozen or processed food and increasing need for vaccines and pharmaceutical products.

Similarly, global vaccine demand and trade growth are also expected to boost the cold chain market in the coming years. Vaccines require temperature-controlled storage and transportation to maintain their integrity and effectiveness. The growth of the global vaccine trade will positively affect the cold chain equipment market worldwide.

The higher operating cost of cold chain equipment in the global market is estimated to act as a major barrier during the forecasted year. The cost of cold chain equipment is generally higher than that of normal transportation.

Cold Chain Equipment Market Growth Drivers:

- Increasing demand for processed food and meats.

One of the major driving factors that is estimated to propel the market size of the global cold chain equipment market is forecasted to be the growing consumption of meats and processed foods in the global market. With the global increase in the market demand for processed foods and meat products, the need for safe and temperature-controlled transportation and storage will expand. In the processed food and meat products market, cold chain equipment offers a critical role in transporting and storing such products, as it maintains its shelf life. The demand for processed food in the global market has witnessed a major boost, which can be credited to the expanding global population and increasing disposable income worldwide.

Similarly, the per capita consumption of meat in multiple countries around the globe has witnessed a significant increase, raising the demand for meat in such nations. For instance, the Organization for Economic Co-Operation and Development (OECD) stated that in 2022, the USA’s per capita poultry meat consumption was recorded at 35 kgs, which increased to about 35.7 kgs in 2023. Similarly, poultry meat consumption in Peru increased from 32.7 kg/capita in 2022 to 33kg/capita in 2023.

- Growing demand for vaccine supply

The growing demand for medicinal vaccines among the global population is also expected to significantly boost the global cold chain equipment market share. Especially with the introduction of new and deadly global diseases like COVID-19, the demand for vaccines has skyrocketed. There are various types of vaccines, like inactivated, live-attenuated, mRNA, and toxoid vaccines, which require cold or temperature-controlled equipment to transport and store them. Various types of cold chain equipment are used to safely transport such vaccines, like cold boxes, ice packs, foam pads, and refrigerators.

The global trade of vaccines has witnessed significant growth in recent years. The World Integrated Trade Solution (WITS), a partner of UNCS, UNCTAD, and WTO, among others, stated that in 2023, Belgium became the biggest importer of vaccines, which estimated that about US$12.43 billion worth of vaccines for human medicines, followed by the USA, which imported about US$9.27 billion of vaccines in the same year. The agency further stated that Belgium imported a total of 36.575 billion kgs of vaccines, and about 2.471 billion kgs of vaccines were imported by the USA.

Cold Chain Equipment Market Restraints:

- Higher transportation and operating costs.

One of the major challenges for the global cold chain equipment market is forecasted to be the higher operating and transportation costs of materials in the industry. Cold chain equipment, like refrigerators and cold boxes, requires safe and dedicated storage space to store various products, like vaccines, chemicals, and food products. Furthermore, operating such refrigerators or refrigerated vehicles also consumes more energy than general transportation units.

Cold Chain Equipment Market Geographical Outlook:

- Asia Pacific is anticipated to hold a significant share of the Global Cold Chain Equipment Market.

The Asia Pacific region is expected to attain a greater global cold chain equipment market share in the forecasted timeline. Various factors contribute to the growth of the cold chain equipment market in the region, like expanding the production of products that require cold chain transportation, such as vaccines, chemicals, processed foods, meat products, and beverages.

The region has one of the biggest meat product markets in the globe. The constant expansion of meat production and supply globally is estimated to boost the cold chain equipment market in the region, as meat products require special temperature-controlled storage and transportation solutions to maintain their shelf life.

The region is also among the biggest producers and global suppliers of vaccines and other medicinal products. Countries like India, China, and Singapore are among the biggest producers of vaccines in the global market. In its press release, the Government of India stated that the nation accounts for about 60% of the total vaccine produced globally. The government further stated that the nation's pharma exports grew by 125% in the past 9 years. The export of vaccines and pharma products requires special cold boxes, which further boosts the cold chain equipment market in the region.

Cold Chain Equipment Market Products Offered by Key Companies:

Cold Chain Equipment Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cold Chain Equipment Market Size in 2025 | US$196.873 billion |

| Cold Chain Equipment Market Size in 2030 | US$339.900 billion |

| Growth Rate | CAGR of 9.17% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Cold Chain Equipment Market |

|

| Customization Scope | Free report customization with purchase |

The Global Cold Chain Equipment Market is analyzed into the following segments:

- By Type

- Storage Equipment

- Transportation Equipment

- By End-User

- Pharmaceutical

- Food And Beverage

- Chemicals

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East And Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- Indonesia

- Taiwan

- Thailand

- Others

- North America