Report Overview

Construction Chemicals Market - Highlights

Construction Chemicals Market Size:

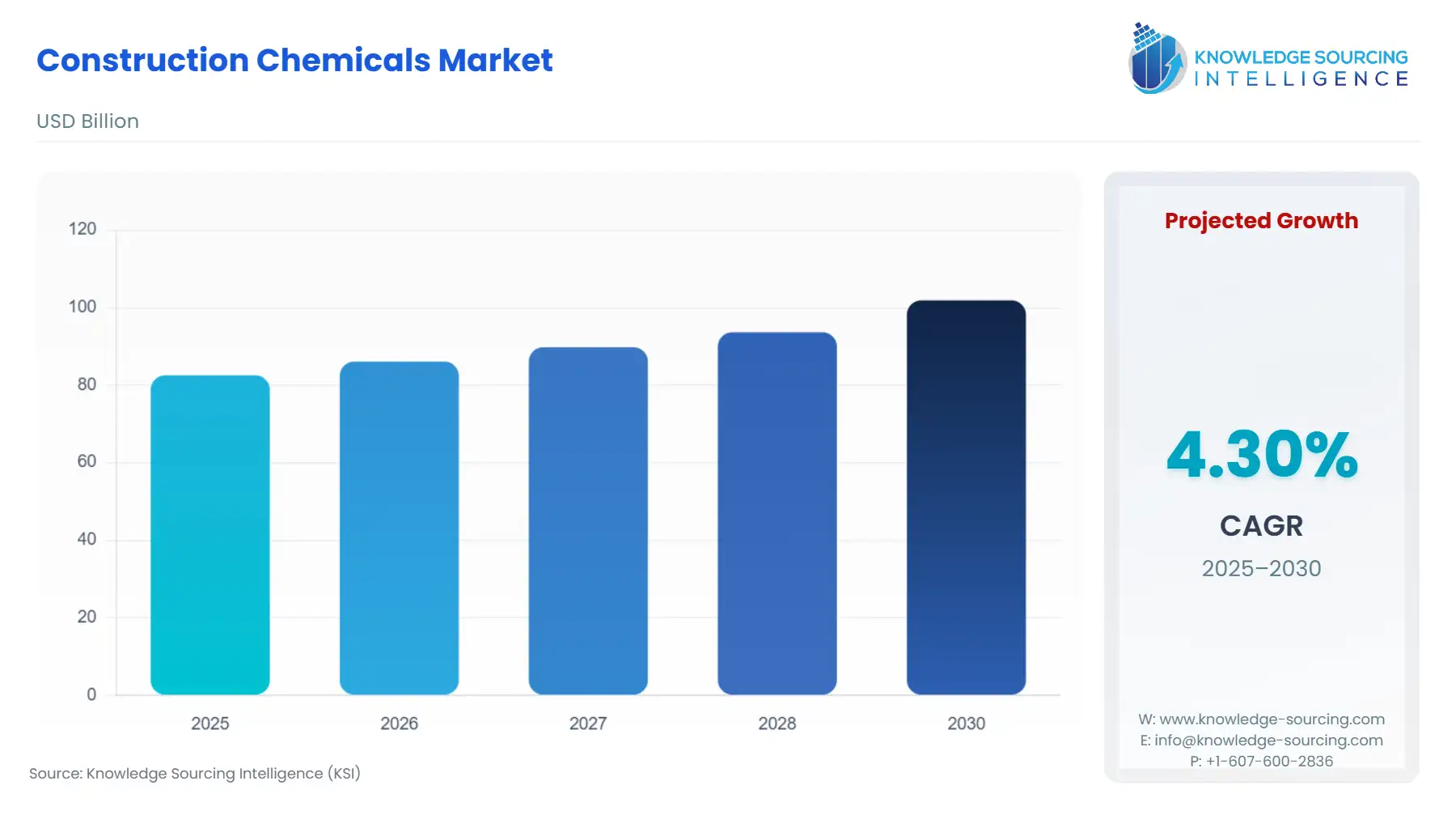

The Construction Chemicals Market is expected to grow from USD 82.548 billion in 2025 to USD 101.889 billion in 2030, at a CAGR of 4.30%.

The Construction Chemicals market provides a critical portfolio of chemical products—including additives, sealants, coatings, and repair materials—that enhance the strength, durability, and functionality of constructed assets. These products are not merely supplements but are indispensable tools used to overcome the inherent limitations of traditional building materials like concrete, steel, and masonry.

The market encompasses diverse product lines, from high-volume Concrete Admixtures used in ready-mix concrete to specialised Waterproofing and Roofing solutions vital for structural integrity and building envelope performance. Demand for construction chemicals is a derived demand, intrinsically linked to the global Non-residential and Residential Buildings construction sector’s volume, but increasingly decoupled from simple volume growth by the quality and complexity of projects. The imperative to build structures that are taller, more resilient, energy-efficient, and sustainable serves as the primary technical catalyst for product innovation and the persistent expansion of market value.

Construction Chemicals Market Analysis:

- Growth Drivers

The key driver is the escalating stringency of green building standards and codes worldwide. Certifications like LEED mandate low VOC and sustainable material use, directly compelling contractors to increase their demand for advanced Concrete Admixtures and Sealants and Adhesives formulated with reduced environmental footprints, moving from commodity-grade to premium-speciality chemicals. A concurrent driver is the global investment surge in long-life infrastructure projects, such as bridges, tunnels, and mass transit systems. These projects require non-negotiable material performance to meet 50-to-100-year design life specifications, which explicitly drives demand for high-performance, chemical-based solutions for corrosion control, superior water tightness, and concrete durability. The impact of US tariffs, while primarily affecting raw material import pricing, also subtly accelerates demand for locally-produced final formulations, as regional manufacturing mitigates the direct price shock of tariffs on global supply.

- Challenges and Opportunities

A major challenge facing the market is the significant price volatility of petrochemical feedstock, which directly impacts the cost structure of key segments like epoxy-based Flooring and acrylic Waterproofing. This cost uncertainty compresses margins for formulators and creates headwinds against stable project budgeting. A core opportunity lies in the digitalisation of construction site applications and process efficiency. Developing smart admixtures that allow for real-time monitoring of concrete setting times or moisture content during curing creates a high-value demand segment for integrated chemical-sensor solutions, improving jobsite productivity and reliability. Furthermore, the massive global inventory of ageing infrastructure creates a substantial, secular demand opportunity for sophisticated Repair and rehabilitation chemicals, as governments prioritise maintenance and extension of existing assets over new construction.

- Raw Material and Pricing Analysis

The Construction Chemicals market is a physical product market where raw material costs constitute the largest proportion of total production cost. Key materials include petrochemical derivatives such as acrylic monomers (for coatings and sealants), epoxy resins (for high-performance flooring and adhesives), and polyols/isocyanates (for polyurethane-based waterproofing). Pricing is inherently volatile, as these materials are downstream derivatives of crude oil and natural gas, tying the market's cost base to global energy price swings. For instance, fluctuations in Brent crude price directly influence the cost of propylene and ethylene, which are precursors for many admixtures and sealants. Manufacturers must therefore operate complex, integrated supply chains (e.g., BASF's Verbund model) to maintain cost control, creating a competitive advantage. This raw material volatility drives demand for continuous product reformulation towards high-solids, water-based, or bio-based chemical alternatives to stabilise input costs and meet sustainability targets.

- Supply Chain Analysis

The global supply chain for construction chemicals is characterised by two distinct tiers: centralised production of speciality chemical intermediates and regionalised final product formulation. Major production hubs for base chemicals (e.g., acrylics, PCE polymers) are concentrated in Asia-Pacific (especially China) and certain parts of Europe (Germany, Switzerland). The final products, such as Concrete Admixtures and Mortars, are often manufactured closer to the point of consumption due to logistics costs (high water content/bulk), short shelf lives, and the need for customised local standards compliance. This structure leads to a critical dependency: regional formulators rely heavily on the stable, high-quality import of performance-critical chemical intermediates. Logistical complexities arise from the transportation of hazardous or temperature-sensitive chemical precursors. This dependency and complexity increase the demand for globally integrated manufacturers like Sika and BASF, who can leverage global sourcing and local production to offer a resilient supply to contractors.

- Government Regulations:

Governmental and regulatory bodies impose strict standards aimed at improving building safety, performance, and environmental impact, thereby directly influencing product demand.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

Construction Products Regulation (CPR) & REACH Regulation |

CPR mandates that construction products (including chemical products) must meet essential performance characteristics, ensuring quality and structural reliability. REACH imposes stringent requirements for the registration and use of chemical substances. These rules increase compliance costs but drive demand for high-specification, pre-certified, and low-toxicity Construction Chemicals that guarantee access to the large EU building market and ensure long-term structural integrity. |

|

United States |

State-Level VOC Regulations (e.g., CARB, OTC) |

While federal regulation exists, specific state bodies impose strict limits on Volatile Organic Compound (VOC) emissions from consumer and institutional products, including Sealants and Adhesives and Flooring coatings. These local regulations shift demand away from solvent-based formulations toward waterborne and 100% solids chemical systems to achieve compliance, creating a strong market segment for low-VOC products. |

|

India |

Bureau of Indian Standards (BIS) & National Building Code (NBC) |

The BIS sets mandatory quality and performance standards for materials like Concrete Admixtures and Waterproofing systems, particularly in large infrastructure projects funded by the government (e.g., National Infrastructure Pipeline). Stricter codes focusing on climate resilience in high-rainfall zones mandate the use of advanced Waterproofing membranes and liquid-applied systems, directly boosting demand for BIS-compliant, durable solutions. |

Construction Chemicals Market Segment Analysis:

- By Type: Concrete Admixtures

The Concrete Admixtures segment, encompassing plasticisers, superplasticisers, air entraining agents, and accelerators, constitutes the largest volume portion of the construction chemicals market. Its demand is fundamentally driven by the increasing complexity of concrete mix designs required for modern construction. Specifically, the necessity to produce high-performance, high-strength concrete (HPC) with extended workability, especially in Commercial Buildings and large infrastructure projects, dictates the use of high-range water reducers, known as polycarboxylate ether (PCE) superplasticisers. These admixtures allow concrete producers to significantly lower the water-to-cement ratio, thereby boosting strength and durability without sacrificing flowability, which is essential for pouring complex structural forms. This is a non-negotiable demand driver: structural engineering specifications for modern skyscrapers, bridges, and tunnels cannot be met without these chemical enhancers, creating a continuous, high-volume requirement that scales with new construction starts. The trend toward using recycled aggregates also fuels demand for specialised admixtures that counteract the variable water absorption and consistency of these alternative materials.

- By End-User: Industrial Buildings

The Industrial Buildings segment, which includes manufacturing plants, warehouses, logistics centres, and power generation facilities, drives highly specific and performance-critical demand for construction chemicals. The primary driver is the need for extreme durability, chemical resistance, and operational safety in these high-traffic environments. Flooring chemicals, particularly high-build epoxy and polyurethane coatings, see immense demand here because the floors must withstand heavy point loads, forklift traffic, abrasion, and exposure to oils, solvents, and chemical spills without degradation. Furthermore, specialised chemical Sealants and Adhesives are critical for securing equipment and maintaining strict hygienic standards in facilities like food processing plants. The shift towards automated logistics and warehousing further amplifies the demand for specialised lithium-silicate hardeners that reduce dusting and enhance the life of concrete floors. Compliance with environmental, health, and safety (EHS) regulations in these facilities also necessitates the use of low-VOC, non-toxic products, further channelling demand toward premium chemical solutions.

Construction Chemicals Market Geographical Analysis:

- US Market Analysis (North America)

The US market for construction chemicals is characterised by stringent building codes, a high preference for innovative, sustainable products, and significant public infrastructure investment. The primary factor impacting demand is the modernisation and rehabilitation of ageing transportation networks (bridges, highways, ports), which generates massive, sustained demand for Repair mortars, corrosion inhibitors, and high-performance Waterproofing systems designed for multi-decade service life. Furthermore, a strong push for green buildings, often driven by local municipal requirements and tax incentives, compels builders to specify low-VOC coatings and materials for Residential Buildings, directly propelling the demand for premium, health-conscious Sealants and Adhesives that comply with the latest state-level regulations.

- Brazil Market Analysis (South America)

The Brazilian construction chemicals market is predominantly driven by large-scale residential and commercial development in major urban centres, coupled with significant, yet often volatile, public infrastructure spending. The core demand factor is the need for cost-effective performance and rapid construction times in warm, humid climates. This creates high-volume demand for general-purpose Concrete Admixtures to manage concrete setting in high temperatures, and robust Waterproofing chemicals to combat pervasive moisture intrusion in new Residential developments. Market growth remains highly sensitive to local economic conditions and commodity price fluctuations, which can temporarily constrain the demand for high-end, imported speciality chemicals.

- Germany Market Analysis (Europe)

Germany is a mature, technology-driven construction chemicals market where demand is heavily influenced by strict energy efficiency standards (EnEV) and the refurbishment of existing building stock. Local factors centre on the imperative for long-term energy savings and structural preservation. This structural focus creates sustained demand for advanced thermal insulation systems, which in turn drives demand for specialised Adhesives and Sealants and high-performance Waterproofing for foundation and roof structures to eliminate thermal bridging and moisture defects. Furthermore, the strong emphasis on engineering precision and durability in civil works ensures consistent demand for the highest quality Repair and protection products.

- United Arab Emirates Market Analysis (Middle East & Africa)

The UAE market is defined by mega-project development and extreme climate conditions. The primary demand driver is the construction of world-class commercial, industrial, and infrastructure assets (e.g., Expo sites, high-rise towers, metro systems). The need to combat the high-salinity environment, extreme heat, and humidity creates non-negotiable demand for specialised corrosion inhibitors, high-range Concrete Admixtures for heat management during pouring, and high-performance Waterproofing and protective coatings to ensure long-term concrete durability and thermal performance. Demand is concentrated and directly linked to the massive capital spend on these specific, iconic projects.

- China Market Analysis (Asia-Pacific)

China is the world's largest consumer and producer of construction chemicals, with demand governed by massive urbanisation, government-led infrastructure investment, and national self-sufficiency goals. The key factor is the sheer volume of construction activity across all segments (Residential, Non-residential, and infrastructure), which creates huge, base-level demand for commodity Concrete Admixtures and Waterproofing products. A secondary, but crucial, factor is the government’s push for local substitution of foreign chemical brands, which directly drives domestic production capacity additions and R&D for high-end Flooring and Repair chemicals to compete with international quality standards.

Construction Chemicals Market Competitive Environment and Analysis:

The Construction Chemicals market is highly competitive and moderately fragmented, with a global tier of integrated, multinational chemical companies competing against numerous regional and local specialists. The competitive strategy focuses on technical service, product customisation, and M&A-driven geographical expansion.

- Sika

Sika is a globally leading speciality chemicals company whose strategic positioning is defined by its aggressive M&A strategy and its comprehensive Target Market approach, which covers waterproofing, sealing, bonding, damping, and reinforcing. Sika's competitive advantage lies in its extensive portfolio across almost all Type segments, allowing it to offer end-to-end solutions for major projects. Its continued geographical expansion, including recent targeted acquisitions in high-growth regions, directly secures new demand channels and local manufacturing capability. For instance, Sika's focus on Waterproofing roofing and Concrete Admixtures makes it a mandatory supplier for large infrastructure and commercial projects globally. The integration of acquired companies allows Sika to immediately leverage established local distribution networks to meet specific local building code demands.

- BASF SE

BASF SE, through its Construction Chemicals business, utilises its deep-seated Verbund system—an integrated materials science platform—to maintain a cost-competitive and innovation-rich position. Its strategic advantage is the backward integration into key raw material supply chains (e.g., dispersions for coatings and concrete admixtures), which offers supply reliability and cost optimisation critical in volatile raw material environments. BASF's product strategy emphasises sustainability and high-performance solutions, such as low-VOC flooring and high-end Concrete Admixtures (superplasticisers) developed from its proprietary chemical platforms. This focus on verifiable sustainability captures the demand from large, institutional clients and public projects that mandate environmentally compliant materials. The company's capacity expansions in strategic emerging markets further underline its commitment to regionalised supply.

- Dow Inc.

Dow Inc.'s position in the construction chemicals market is anchored in its extensive portfolio of advanced polymers and speciality silicones, primarily driving the Sealants and Adhesives and Waterproofing segments. Dow leverages its fundamental materials science expertise to deliver high-performance solutions, such as its DOWSIL™ silicones, which provide superior weather resistance and durability for façade and structural glazing applications in Commercial Buildings. The company’s focus on the upper-tier of high-performance Sealants allows it to capture demand in projects where long-term material performance and compliance with stringent environmental standards are paramount. While not as diversified across all construction chemical segments as Sika or BASF, Dow maintains a critical leadership role in the high-margin, technically demanding silicones and acrylic-based solutions market.

Construction Chemicals Market Developments:

- November 2025: Sika Acquires Gulf Seal to Drive Growth Across the Middle East

Sika acquired Gulf Seal, a major manufacturer of waterproofing membranes and systems in the Middle East. This strategic acquisition is directly tied to the massive construction pipeline in Saudi Arabia and the GCC region, specifically targeting projects linked to Saudi Arabia’s Vision 2030 and the FIFA World Cup 2034. The acquisition provides Sika with immediate local production capacity and a well-established market position. This move immediately increases Sika’s capacity to meet the surge demand for Waterproofing and Roofing systems required by large-scale commercial and infrastructure mega-projects in the region, leveraging Gulf Seal's local expertise and Sika's global product portfolio.

- October 2025: BASF Expands Production Capacity for Dispersions in Türkiye

BASF started up a new production line for dispersions at its facility in Dilovas?, Türkiye, specifically aimed at the architectural coatings and construction industries. This expansion significantly enhances production capacity for low-VOC (volatile organic compound) and low-CO2 dispersions. This capacity addition directly addresses the rising demand for high-quality, sustainable chemical products in Türkiye, the Middle East, and Northwest Africa. By producing low-VOC products regionally, BASF is positioned to capture the demand driven by stricter local environmental standards and the broader customer shift towards green building materials.

- May 2024: BASF Inaugurates Second Polymer Dispersions Line at Daya Bay Site in China

BASF inaugurated a second polymer dispersions production line at its Daya Bay site in Huizhou, China. This expansion focuses on enhancing responsiveness to customer requirements across various sectors, including the coatings, construction, adhesives, and packaging industries. This targeted capacity investment reinforces BASF's regional market leadership and directly improves its ability to reliably supply high-volume chemical intermediates. This move directly facilitates increased supply and captures the surging volume demand for Adhesives, Sealants, and Concrete Admixture components, fueled by the ongoing, massive Residential and Commercial Buildings construction activity in the Greater China market.

Construction Chemicals Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 82.548 billion |

| Total Market Size in 2030 | USD 101.889 billion |

| Forecast Unit | Billion |

| Growth Rate | 4.30% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, End-User, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Construction Chemicals Market Segmentation

- By Type

- Concrete Admixtures

- Waterproofing and Roofing

- Repair

- Flooring

- Sealants and Adhesives

- Others

- By End-User

- Residential Buildings

- Industrial Buildings

- Commercial Buildings

- By Application

- Residential

- Non-residential

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America