Report Overview

Global ESG Reporting Software Highlights

Global ESG Reporting Software Market Size:

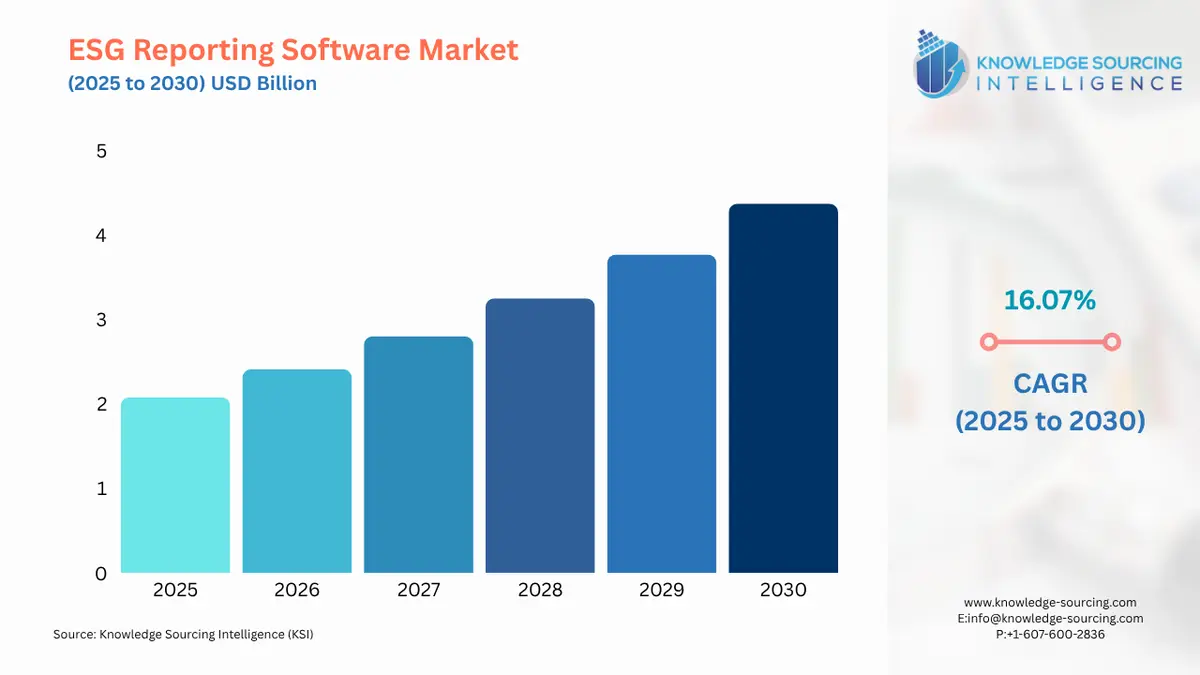

The Global ESG Reporting Software Market is expected to climb at a CAGR of 16.07%, growing to USD 4.374 billion in 2030 from USD 2.077 billion in 2025.

The market is experiencing significant growth due to increasing governmental and financial regulators' mandates and standards imposing mandatory ESG disclosures, such as the EU’s CSRD and SFDS. Various governments' regulations, such as the IFRS International Sustainability Standards Board (ISSB), the European Union’s Corporate Sustainability Reporting Directive (CSRD), and the U.S. SEC’s climate disclosure rules, are actively working to harmonize ESG reporting standards globally. These growing mandates and steps towards standardisation are forcing firms to adopt specialized reporting software to ensure compliance and avoid hefty penalties, leading the market growth. In addition, the change in investors' and stakeholders preference towards sustainable assets is propelling the market growth.

As a result, many companies are moving towards strategic ESG alignment, driving demand for ESG reporting software to track and report across E, S, and G pillars. Further, market players are working towards production innovation and are also integrating ESG software with existing business intelligence systems, such as SAP ESG tools integration with ERP, propelling the adoption. During the forecast period, the market is expected to experience a growing shift from basic compliance tools to insight-driven platforms such as predictive ESG analytics, automated assurance, and audit-ready reports. Technological evolution in AI, ML, blockchain and others will be significantly shaping the market.

Global ESG Reporting Software Market Overview & Scope:

The Global ESG Reporting Software Market is segmented by:

- Component: By component, the market is segmented into software and services. Software includes a standalone ESG platform, integrated ESG modules within Enterprise systems and cloud-based ESG analytics platforms. The software segment is the largest contributor, while services cover implementation, integration, consulting and training. It has a lower share in the market, though often bundled with software only.

- Deployment Mode: Based on deployment mode, the market is segmented into cloud-based and on-premise. Cloud-based deployment represents the dominant share, driven by demand for flexibility, scalability and accessibility. Financial institutions and government for data privacy and security generally prefer on-premise, though the adoption is declining in favour of cloud offerings.

- Organization Size: Large enterprises represent the majority share, due to mandates from securities exchange boards for public companies and large corporations to disclose ESG reports. SMEs are gaining demand, driving demand for freemium models, light-weight SaaS platforms, or outsourced ESG consultants.

- End-User: Based on end-user industry, the market caters to financial institutions, industrial nd energy, technology and services, consumer goods and retail, public sector and government and others, including construction and healthcare.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific. North America and Europe have a significant share in the market, driven by mandates from governments for ESG disclosure along with high presence of ESG consultants and SaaS providers. Asia-Pacific is rapidly growing, driven by increasing government ESG mandates and investors' demand for ESG-disclosed companies.

Top Trends Shaping the Global ESG Reporting Software Market:

- Integration of AI/ML, Blockchain and Advanced Analytics in ESG Platforms

One of key trends shaping the market is the increasing integration of AI/ML, blockchain and advanced analytics in ESG reporting software. They are offering automated, transparent, and predictive ESG reporting.

For example, in April 2025, Zevero launched AI-powered ESG reporting tool to streamline sustainability reporting across major global frameworks, including B Corp, CDP, and CSRD. This highlights the integration of AI in ESG reporting software.

Another example, Kaleido, which integrates blockchain into its solutions is a key example that highlights how companies are leveraging blockchain for increasing consumer trust, meeting ESG compliance requirements, adding traceability to supply chains. - Shift Towards Cloud-based SaaS Models

One other key trend is organizations growing shift towards cloud-based Software-as-a-Service (SaaS) models as these software or platforms offer flexibility, scalability as well as they are cost-effective solutions. These platforms can also easily scale across multi-country operations, thus fast-growing companies increasingly prefer them.

For instance, the Workiva platform is a cloud-based SaaS (software as a service) application that makes creating and managing complex business reports easy. It is used by more than 6.300 organizations globally.

Global ESG Reporting Software Market Growth Drivers vs. Challenges:

Opportunities:

- Increasing Regulatory Pressure for ESG Compliance: One of the key factors driving the market is the growing regulatory pressure from government bodies for aligning with ESG norms. They are making ESG disclosures mandatory, pressurizing companies to comply with these, and driving the demand for these ESG platforms. For instance, the EU’s Corporate Sustainability Reporting Directive mandates that companies above a certain size (those with more than 1000 employees) disclose information on what they see as the risks and opportunities arising from social and environmental issues, and on the impact of their activities on people and the environment. Similarly, the USA’s SEC Climate Disclosure Rule and India’s BRSR are forcing firms to adapt to these norms, driving the market growth for ESG and green finance platforms. A report by OneStream, “Our Recent Finance 2035”, 73% of investors believe strong ESG credentials are key to global competitiveness.

- Product Innovation and Offering Scalable ESG Reporting Solutions: A major factor contributing to the growth is the continuous product innovation in the market. Players are working on offering more scalable, modular and configurable platforms that can adapt to diverse industry needs and evolving global regulations. For instance, companies are offering only the ESG modules that they need, such as carbon accounting, DEI tracking, or supply chain ESG risk. Products are integrated with the existing ERP systems, allowing more adoption for easy integration.

Challenges:

- Lack of Unified Global ESG Standards: One of the key challenges that is limiting the market growth and potential is the absence of any universal standard for ESG reporting. As it has become an essential part of corporate disclosures, it lacks a single global unified standard like the financial reporting’s GAAP or IFRS. The absence of a unified single ESG reporting creates challenges for these reporting software to build tools that support multiple taxonomies, metrics, and disclosure timelines. This leads to data inconsistencies and comparability issues, slowing down adoption especially among SMEs and emerging markets.

Global ESG Reporting Software Market Regional Analysis:

- North America: The North American region is the leading market in the global ESG reporting software market, driven by government’s ongoing regulations, string institutional investor pressure and high concentration of ESG tech startups. The regulations by the governments, such as the USA’s SEC Climate Disclosure Rules or Canadian ESG mandates, along with federal and state-level ESG-linked incentives, are driving the compliance urgency and leading the adoption of reporting software. At the same time, the firms’ readiness to adopt ESG reporting software due to high penetration of ESG platforms and ESG-conscious key investors, is significantly boosting the market demand. It is the fastest-growing market segment for carbon accounting and investor-grade ESG platforms.

- Europe: Europe is a pioneer in transitioning towards sustainability and ESG compliance. It has the most advanced regulatory framework with strict laws such as CSRD, SFDR, EU Taxonomy for sustainable activities and others that apply to thousands of firms. Therefore, the strong government regulations along with support are the key factors driving the adoption of ESG reporting software by various mid-size or large firms.

- Germany: Germany is a key market for the ESH reporting software market. The presence of a large number of multinational corporations such as Bosch, BASF SE and others who require following ESG disclosures subject to CSRD and EY taxonomy and various other regulations or initiatives drives the market. The early adoption of ESG tools and high demand for carbon accounting and supply chain ESG tools, especially due to Germany’s Supply Chain Due Diligence Act (LkSG), drives the market.

Global ESG Reporting Software Market Competitive Landscape:

The market is moderately consolidated with the presence of few global players such as Workiva, Diligent, Sphera, Enablon, and EcoVadis, as many large enterprises prefer integrated, global platforms that comply with multiple frameworks and offer scalable cloud-based solutions. Also, as mergers and acquisitions activities are growing, the market is growing towards consolidation. However, the presence of regional and niche players, especially in APAC and the Middle East, the market does not represent full consolidation.

- Product Launch: In June 2025, Datamaran introduced a Core ESG Compliance platform. It is an AI-driven platform that enables companies to manage ESG risks, conduct materiality assessments, and ensure compliance with global ESG disclosure regulations. It supports cross-functional teams, and aligns with EU CSRD and ESRS. It also includes DMA evaluation.

- Product Innovation: In April 2025, OneStream launched a new ESG Reporting & Planning solution that collects, analyses, reports and plans for ESG requirements – including Scope 1, 2 and 3 emissions- within OneStream's unified platform. The product includes features such as governing end-to-end user workflows, forecasting ESG KPIs and managing renewable energy contracts.

- Acquisition: In 2023, apexanalytix, a leading company in global supply chain risk management data, software, and services, acquired ESG Enterprise, a provider of environmental, social, and governance (ESG) management solutions. Through this acquisition, apexanalytix strengthened its ESG and climate data capabilities by integrating ESG Enterprise’s robust AI-powered platform. This acquisition positions apexanalytix to offer integrated ESG + supply chain risk solutions, which are highly demanded in global ESG strategies.

Global ESG Reporting Software Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.077 billion |

| Total Market Size in 2031 | USD 4.374 billion |

| Growth Rate | 16.07% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Deployment Mode, Organization Size, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Global ESG Reporting Software Market Segmentation:

- By Component

- Software

- End-to-End ESG Reporting Platforms

- Standalone ESG Report Builders

- Services

- Software

- By Deployment Mode

- Cloud-Based

- On-Premise

- By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

- By End-User

- Financial Institutions

- Industrial and Energy Sectors

- Technology and Services

- Consumer Goods & Retail

- Public Sector and Government

- Others

- By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others

- North America