Report Overview

Global Europium Market Size, Highlights

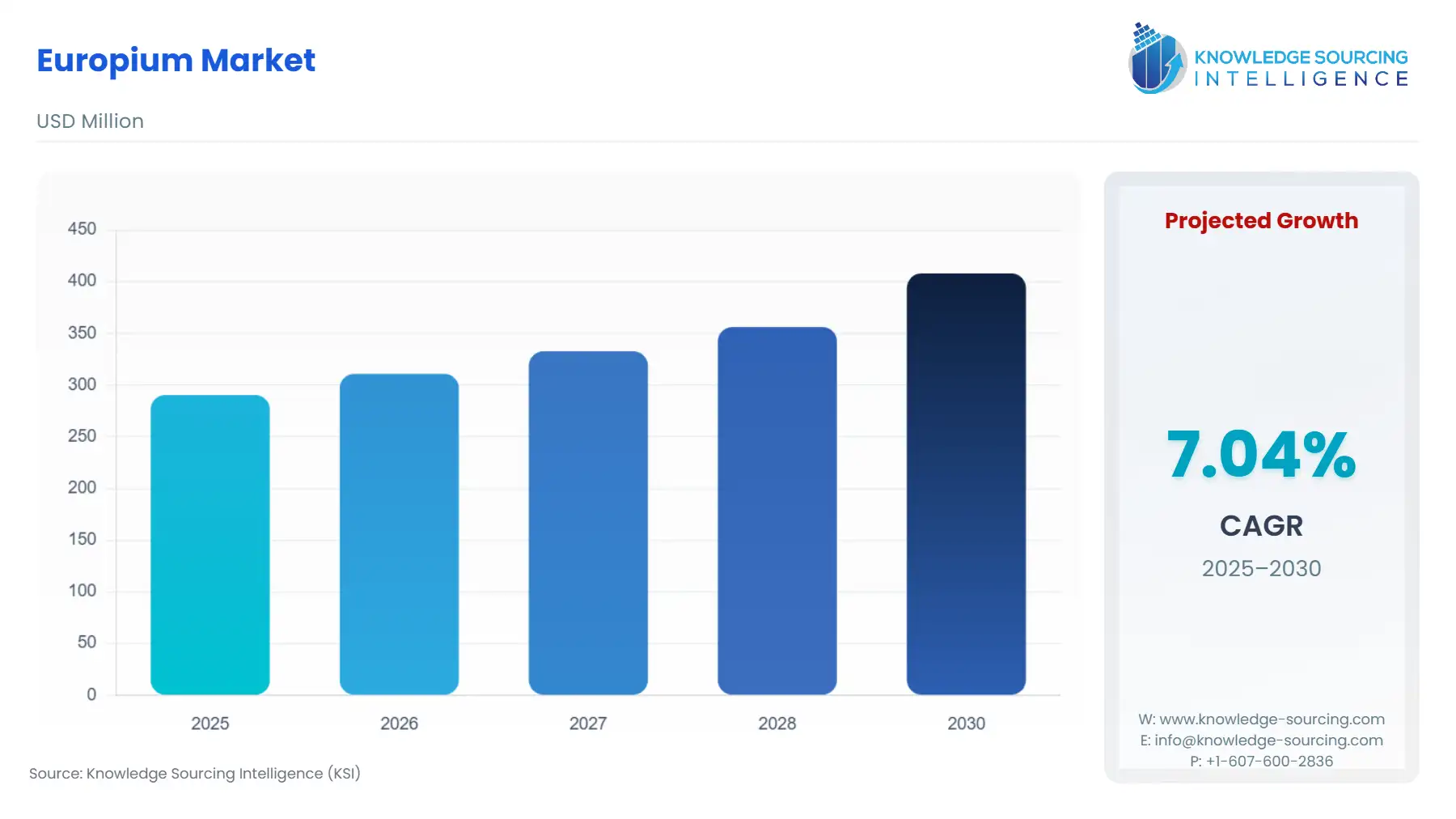

Europium Market Size:

The global europium market is expected to grow at a CAGR of 7.04%, reaching a market size of US$408.159 million in 2030 from US$290.470 million in 2025.

The lanthanide series of elements includes the rare earth metal europium, which is soft, silvery-white in appearance, and oxidizes in both air and water. It is the most flammable of the rare earth metals and ignites in the soil at temperatures ranging from 150°C to 180°C. It is typically found in oxide form and is used in fluorescent lights, consumer electronics, flat-panel displays, metallurgy, vehicles, and consumer electronics. It is also a glass dopant in lasers and other optoelectronic devices. The europium-based products are used for enhancing solar cells, which is one of the major drivers of the market.

Europium Market Growth Drivers:

- Expanding usage of europium in consumer electronics to drive the Global Europium market

The consumer electronics sector is predicted to be propelled by the rapidly expanding demand for smartphones, wearables, gadgets, and smart televisions in developing nations worldwide. This, in turn, is anticipated to increase demand for the global europium market. Due to reasons including better internet access, technological improvements, and rising consumer spending on high-end devices, the consumer electronics business is expanding quickly worldwide. It is predicted to substantially impact the growth of the entire industry.

Additionally, during the next eight years, the rising penetration in several applications, such as metal alloys, permanent magnets, glass additives, catalysts, and ceramics, will probably benefit product demand.

- Expanding the use of europium in various industry verticals to boost the market growth

To combat counterfeiting, europium oxide is also used as a watermark on Euro banknotes. Nuclear rods used in nuclear reactors for neutron absorption are made from europium. With the development of laser weapon systems, ceramic, glass, and their additives, as well as defense-related applications, the use of europium is growing. Due to its therapy and optical imaging usage, europium also finds utility in the healthcare sector. Therefore, the market is anticipated to grow as the use of europium in the healthcare sector increases.

- Growing semiconductor market-

Semiconductor technology is rapidly evolving as the industry develops more advanced products and process technologies for applications in end-use industries. In recent years, the largest segments of the worldwide semiconductor industry have been memory, logic, analog, and MPU.

These products have wider applications in simple household devices and space devices. Due to the rapid growth of consumer electronics, the semiconductor industry's growth leads to the increased demand for the europium application.

Europium Market Restraints:

- Environmental concerns regarding the extraction of the element as well as supply-chain disruption due to economic and geopolitical tensions.

Europium Market Key Developments:

- In July 2024, ETH (Eidgenössische Technische Hochschule) researchers were developing a process that efficiently recovers europium from old fluorescent lamps. In a proof of concept, the process extracts europium directly from fluorescent powder in used energy-saving lamps in much higher quantities than existing methods. This approach could lead to the recycling of rare earth metals. They were in the process of founding a start-up to put the recycling of these raw materials into practice.

- In August 2022, To further explore and develop the best method for extracting rare earth elements from phosphogypsum that contains europium, Rainbow Rare Earths entered into a Master Agreement with OCP SA, the leading producer of phosphate products in the world, and Mohammed VI Polytechnic University, a Moroccan university with a strong focus on science, technology, and innovation. As a byproduct of the manufacture of phosphoric acid, phosphogypsum contains rare earths. OCP has amassed large intellectual property (IP) assets, know-how, and competence in phosphogypsum processing because of the creative research done by UM6P.

Given Rainbow's knowledge and intellectual property regarding the extraction of rare earths, this presents a synergistic possibility for cooperative development. OCP and UM6P will share their specialized knowledge as well as modified complementary separation technologies. The Parties want to figure out how to extract rare earths from phosphogypsum in the most effective way and then separate those rare earths into their constituents. The Parties plan to collaborate on creating a pilot and large-scale rare earth extraction from phosphogypsum.

Europium Market Players and Products:

- Europium element: Neo Chemicals and Oxides companies offer europium (atomic number 63 and atomic mass 151.964) under the category of lanthanide element products, individually and in combination. Europium is often sold as oxides or salts, but Neo Chemicals can also modify it to fulfill specific prerequisites, including physical qualities.

- Samarium Europium Gadolinium Oxide Concentrate: Samarium Europium Gadolinium Oxide Concentrate, also known as Sm-Eu-Gd Concentrate provided by Hefa Rare Earth Canada Co. Ltd., is used largely for its unusual luminous properties. Its atomic number is 63, and its symbol is Eu. The emission of visible light can be caused by certain energy level transitions occurring within the excited Europium atom, which is excited by the absorption of ultraviolet radiation.

Europium supplies both the necessary red and blue in energy-efficient fluorescent lighting. Sm-Eu-Gd Concentrate's description contains a Grade of Phosphor A, a white powder with a little pinkish tint called europium oxide. It is the activation ingredient for X-raw intensifying screens and is mostly utilized in producing CTV fluorescent powders and three-band fluorescent phosphors. It can be ordered in a plastic woven bag with double PVC bags inside that weigh 5kg, 10kg, or 50kg net each, or it can be customized to meet the customer's needs.

Europium Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Europium Market Size in 2025 | US$290.470 million |

| Europium Market Size in 2030 | US$408.159 million |

| Growth Rate | CAGR of 7.04% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Europium Market |

|

| Customization Scope | Free report customization with purchase |

The global europium market is segmented and analyzed as follows:

- By End Use Industry

- Semiconductors

- Chemicals

- Energy And Power

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America