Report Overview

EUV Lithography Market Report, Highlights

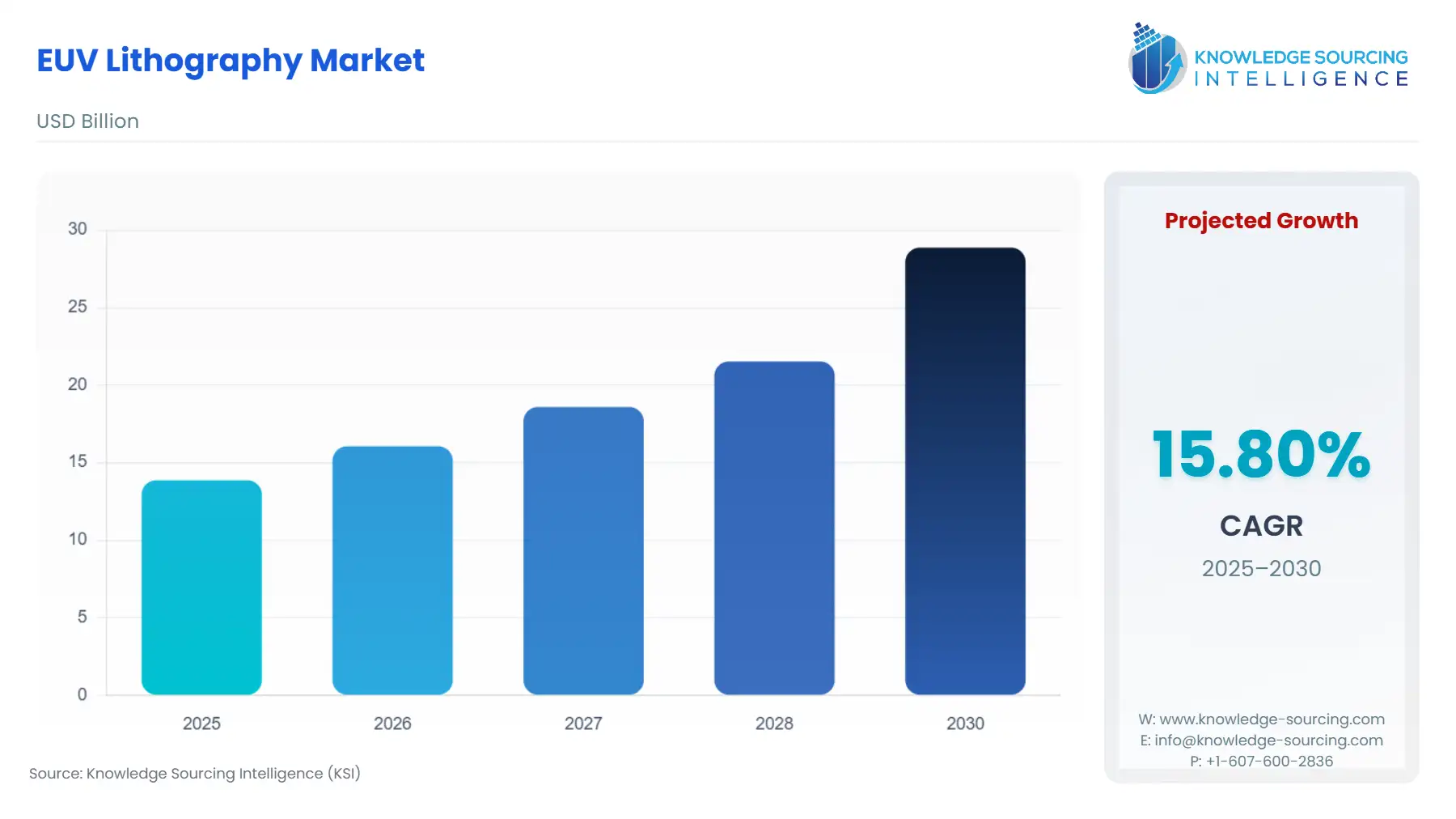

EUV Lithography Market Size:

The EUV Lithography Market will climb from USD 13.866 billion in 2025 to USD 28.873 billion by 2030, with a 15.80% CAGR.

Extreme Ultraviolet (EUV) Lithography remains the definitive, non-substitutable patterning technology driving the semiconductor industry’s adherence to Moore's Law. Operating at a 13.5nm wavelength, EUV enables the mass production of sub-7nm features required for modern processors and advanced memory. The market is defined by unparalleled complexity, extreme capital expenditure, and a highly concentrated supply chain. The strategic decisions made by leading Foundries and IDMs concerning their technology roadmap for High-Performance Computing (HPC) and Artificial Intelligence (AI) directly dictate the colossal demand for the primary EUV Scanner Tool and its ecosystem, including specialized Photomasks and advanced Photoresists.

EUV Lithography Market Analysis

- Growth Drivers

The relentless pursuit of transistor density and energy efficiency for High-Performance Computing (HPC) directly propels growth. The technological imperative for Foundries to scale logic chips below the 3nm node is the single greatest catalyst, as this cannot be achieved economically without the single-pass patterning capability of EUV. This necessity is now compounded by the introduction of the High-NA EUV system, which reduces process complexity and improves yield for 2nm architectures. Concurrently, the mass adoption of EUV for multiple critical layers in advanced Dynamic Random-Access Memory (DRAM) production necessitates the procurement of a larger installed base of EUV Scanner Tools to sustain global HVM volumes.

- Challenges and Opportunities

The primary market challenge is the prohibitive capital cost of the EUV Scanner Tool, which exceeds USD 250 million per unit, creating an economic barrier to entry that restricts the end-user base primarily to tier-one Foundries and IDMs. A key technical obstacle is the inherent difficulty in achieving low defectivity in Photomasks and the challenge of low sensitivity in traditional Photoresists. This hurdle, however, creates a vast opportunity in the Components segment, specifically driving rapid innovation in next-generation Metal Oxide Photoresists (MORs), which offer superior performance-to-cost ratios, and fostering demand for high-speed Metrology and Inspection Systems to ensure defect-free production runs.

- Raw Material and Pricing Analysis

Pricing for the EUV lithography system is significantly influenced by the specialized and complex raw materials required for the Light Source and Mirror/Optical System. The Light Source relies on ultra-pure, continuously fed molten tin, and the system's performance is critically dependent on the purity and supply chain reliability of this material. The Mirror/Optical System, manufactured by ZEISS, demands extremely high-purity, ultra-low-expansion glass ceramic blanks, which are then coated with specialized molybdenum/silicon (Mo/Si) multilayer films. The scarcity of these highly specialized materials and the ultra-low defectivity requirement for Photomask substrates maintain a persistently high cost floor for all major EUV Scanner Tool components.

- Supply Chain Analysis

The EUV supply chain is uniquely consolidated and strategically vulnerable, centering on the single-source dominance of ASML for the complete EUV Scanner Tool. This concentration extends to key sub-components: ZEISS International provides the highly complex reflective optical system, which is a critical technological bottleneck. Logistical complexity is extreme, as an EUV scanner requires multiple cargo aircraft and dozens of transport crates, tying delivery cycles to highly specialized freight and precision installation services. Furthermore, the market relies heavily on Japanese materials suppliers, such as JSR Corporation and Shin-Etsu, which control a significant share of the global, technologically arduous Photoresists market, creating geopolitical and logistical dependencies.

EUV Lithography Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Export Administration Regulations (EAR) / Bureau of Industry and Security (BIS) |

Restricts Shipment: The US, through extraterritorial controls, restricts the export of advanced EUV Scanner Tools and related Metrology and Inspection Systems to certain entities and high-end fabrication facilities in China. This reallocation of demand accelerates EUV adoption and capacity expansion in non-restricted regions (e.g., USA, South Korea) while mandating a technological pivot towards DUV multi-patterning in restricted geographies. |

|

Netherlands |

Export Control Regime (Aligned with US) |

Controls Tool Access: The Dutch government, home to ASML, enforces export license requirements on specific advanced semiconductor manufacturing equipment, including EUV and certain immersion DUV systems. This control directly limits the total available supply of the most advanced EUV Scanner Tools globally and prioritizes non-restricted partners. |

|

Japan |

Ministry of Economy, Trade and Industry (METI) / Export Controls |

Controls Materials and Sub-systems: Japan aligns with US and Dutch controls, imposing restrictions on exporting a range of critical semiconductor manufacturing materials and sub-systems, including those related to Photoresists, deposition, and etching. This mandates a strategic focus by Japanese chemical companies (JSR, Shin-Etsu) on securing capacity and R&D in non-restricted global locations. |

EUV Lithography Market Segment Analysis

- By Components: Photoresists

The Photoresists segment, while a smaller component by value compared to the EUV Scanner, is fundamentally essential to achieving pattern fidelity, driving demand through continuous performance improvement. The need to maintain high wafer throughput with high resolution and minimal line-edge roughness (LER) is the primary growth catalyst. Traditional Chemically Amplified Resists (CARs) struggle with the high quantum yield and stochastic effects of 13.5nm light. This limitation creates robust demand for next-generation materials like Metal Oxide Photoresists (MORs), which possess a higher EUV absorption cross-section. MORs allow Foundries to use lower exposure doses, increasing the wafer-per-hour (WPH) output of the expensive EUV Scanner Tool, thereby directly improving the return on investment (ROI) for the entire lithography process. Suppliers are therefore forced to invest heavily in MOR capacity and R&D to address this critical HVM need for sub-3nm nodes.

- By End-User: Foundries

The Foundries segment, comprising leading contract chip manufacturers, is the most demanding and significant end-user of EUV Lithography. The expansion is driven by the necessity of delivering cutting-edge process nodes (e.g., 5nm, 3nm, 2nm) to their fabless clients, who require the highest transistor density for AI accelerators, mobile System-on-Chips (SoCs), and HPC applications. For Foundries, EUV is not merely a tool but an economic necessity: it replaces complex, multi-pass 193nm immersion patterning steps (multi-patterning) with a single EUV pass. This reduction in process steps dramatically lowers manufacturing cycle time, cuts overall defectivity, and reduces capital expenditure on non-EUV tools, enabling the HVM required to amortize the scanner's enormous cost. The successful deployment of High-NA EUV, enabling 2nm with fewer process steps, acts as the core technological differentiator in the highly competitive foundry market, maintaining intense demand for the latest EUV Scanner Tool generation.

EUV Lithography Market Geographical Analysis

- US Market Analysis

The US market is structurally driven by the necessity of maintaining technological leadership and securing domestic manufacturing capacity under the auspices of the CHIPS Act. This legislation directly encourages Integrated Device Manufacturers (IDMs) like Intel and new Foundries to accelerate their EUV adoption and fab construction. The US is a critical early-adopter market for new EUV generations, notably being the first to receive the High-NA EUV system. The necessity is specifically focused on the latest EUV Scanner Tools and advanced Metrology and Inspection Systems to facilitate the rapid R&D and process qualification of 2nm and sub-2nm nodes for defense and high-performance computing applications.

- Brazil Market Analysis

The EUV Lithography market expansion in Brazil is nascent, primarily centered on secondary-tier Integrated Device Manufacturers (IDMs) or local assembly and test facilities. Growth drivers are not currently focused on leading-edge EUV Scanner Tools but rather on the peripheral ecosystem components and mature-node equipment. The market relies on established, high-volume manufacturing practices for 28nm and above nodes, with limited immediate local demand for the latest EUV technology. However, the presence of local academic institutions and research consortia creates a small, specialized demand for advanced Metrology and precursor Photoresists for long-term R&D efforts.

- Germany Market Analysis

Germany’s demand profile is distinct, focusing on both component R&D excellence and local foundry development. The market is defined by the core presence of key EUV supply chain contributors like ZEISS International (optics) and established R&D centers. The need for EUV Scanner Tools and related Metrology is driven by the European initiative to build regional semiconductor self-sufficiency (European Chips Act). This accelerates the construction of new fabs (e.g., in Dresden), creating local demand for advanced EUV systems and requiring large-scale procurement of all supporting Components, including EUV Photomasks manufactured within the region.

- Saudi Arabia Market Analysis

EUV Lithography demand in Saudi Arabia is virtually non-existent in the context of high-volume manufacturing. Demand, if any, originates from government-led "Vision 2030" initiatives focused on establishing a strategic national capability in advanced technologies. Any procurement would be driven by strategic intent rather than commercial volume, primarily focused on establishing basic research and development facilities within universities or specialized centers. This translates into highly sporadic, single-unit demand for older-generation EUV Scanner Tools or specialized Metrology equipment for academic research purposes.

- South Korea Market Analysis

South Korea represents one of the largest and most critical demand centers, driven by its globally dominant IDMs (Samsung, SK Hynix) in both logic and memory segments. The need for EUV Scanner Tools and Photoresists is colossal and non-negotiable, fueled by the aggressive race to mass-produce the 1α and 1β DRAM nodes and the 3nm and 2nm logic processes. This market requires the highest-throughput EUV systems and is a primary driver for materials innovation, such as the adoption of MORs for next-generation memory, where high-volume production dictates that every gain in process window and resolution translates directly into competitive advantage.

EUV Lithography Market Competitive Environment and Analysis

The competitive landscape of the EUV Lithography market is characterized by a hierarchical oligopoly, where the EUV Scanner Tool supplier holds the primary bottleneck position, supported by a highly concentrated, technically advanced ecosystem of Components suppliers. Competition occurs not in pricing the core scanner, but in achieving technological performance metrics, specifically uptime, wafer throughput (WPH), and overlay accuracy, which directly impact end-user profitability.

- ASML

ASML is the sole manufacturer of commercial EUV Scanner Tools, giving it a de facto monopoly on the system segment. The company's strategic positioning is predicated on its continuous technology leadership, evidenced by the rollout of the High-NA EUV platform (TWINSCAN EXE:5200) crucial for 2nm logic. ASML secures long-term demand by tightly integrating its R&D with key Foundries and IDMs (e.g., the joint High NA EUV Lithography Lab with imec), ensuring its machines remain essential to the next process node transition and effectively controlling the industry's scaling roadmap.

- ZEISS International

ZEISS International occupies the second most critical position by serving as the exclusive supplier of the complex Mirror/Optical System for ASML's EUV scanners. The strategic importance of ZEISS lies in its ability to achieve the angstrom-level precision required for the multi-layer reflective optics. Its competitive strategy focuses on continuous innovation in metrology and optics, as highlighted by the launch of the AIMS® EUV 3.0 mask qualification tool in September 2025, which triples mask throughput, directly mitigating a critical inspection bottleneck for Foundries transitioning to high-volume 3nm and 2nm production.

- JSR Corporation

JSR Corporation is a critical player in the high-value Photoresists segment, strategically controlling a significant share of the specialized chemical supply chain. The company’s focus is on leading the transition from traditional CARs to next-generation Metal Oxide Photoresists (MORs), which offer superior resolution for sub-5nm features. A key strategic move was becoming a private entity and divesting non-core assets in April 2025 to concentrate investment on core materials. This focus, coupled with the 2024 groundbreaking on its first South Korean MOR production base, is aimed at securing its supply chain resilience and addressing the acute demand from major Foundries and IDMs in the Asia-Pacific region.

EUV Lithography Market Developments

- September 2025: ZEISS Semiconductor Manufacturing Technology successfully launched the AIMS® EUV 3.0 mask qualification tool, a capacity addition that triples mask throughput and supports High-NA technology. This launch directly addressed the increasing inspection time bottleneck for advanced EUV Photomasks in HVM.

- April 2025: JSR Corporation sold its in vitro diagnostics division as part of a strategy to sharpen its focus on core materials, including EUV Photoresists. This capacity streamlining aims to allow for transformative investment and long-range R&D to support 2nm and beyond process nodes.

- June 2024: ASML and imec opened a joint High NA EUV Lithography Lab in Veldhoven, Netherlands. This capacity addition provides an early development platform for the semiconductor ecosystem, accelerating the process qualification and eventual mass manufacturing adoption of High-NA EUV technology.

EUV Lithography Market Segmentation

By Components

- EUV Scanner Tool

- Light Source

- Mirror/Optical System

- Photomasks

- Photoresists

- Metrology and Inspection Systems

- Others

By End-User

- Integrated Device Manufacturers (IDMs)

- Foundries

- Others (Research, equipment vendors, and others)

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others