Report Overview

Global Immunoassay Market Report, Highlights

Immunoassay Market Size:

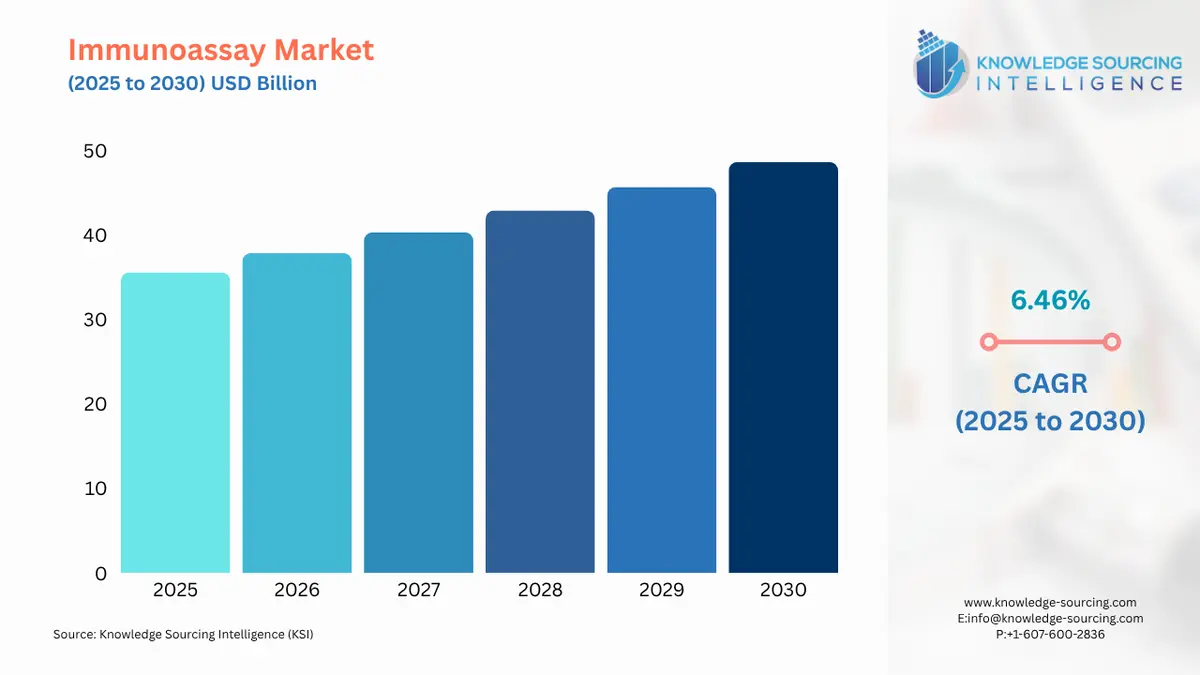

The immunoassay market is estimated to grow at a CAGR of 6.46%, reaching US$48.644 billion by 2030 from US$35.571 billion in 2025.

Immunoassays are bioanalytical methods that employ antigen-antibody affinity to identify and quantify molecules of interest in biological samples. They are quick and accurate tests performed in the lab for the identification of particular substances.

Immunoassay Market Trends:

The increase in the cases of chronic illnesses such as cancer, diabetes, cardiovascular, and autoimmune diseases is mostly responsible for the immunoassays market growth, as they are important in early diagnosis and monitoring for improved disease management.

The global prevalence of diabetes in the adult (20-79 years) age group is projected to increase to 643 million by 2030, as per the estimates provided by the International Diabetes Federation (IDF). The number is projected to rise to 783 million by 2045, which was around 537 million in 2021. The statistics portray that there will be an increasing need for early diagnosis and apparent detection devices; hence, the requirement for immunoassay will grow in the future.

Additionally, the increasing prevalence and incidence of infectious diseases are fuelling the market growth. As per the World Health Organization data released in May 2024, the burden of healthcare-associated infections and antimicrobial resistance is substantial, with more than 24% of patients with sepsis, 52.3% of patients in the intensive care unit dying every year, and patients with antimicrobial-resistant infections increasing two to three times the death rates.

In addition, public health education campaigns focusing on recognizing the signs of different infectious diseases and how to take precautions against them help in the growing of public awareness and the management of other diseases. This increased patient awareness is expected to lead to high demand for immunoassays.

The global immunoassay market is also expected to witness major growth with the ongoing innovation, by various leading companies and research institutes that are introducing advanced technologies into the market. For instance, in January 2025, BioMérieux, a French biotechnology company, announced the acquisition of SpinChip Diagnostics ASA, a Norwegian Diagnostic start-up, that offers enhanced and game-changing immunoassay diagnostic platforms. The immunoassay platform technology developed by SpinChip help in reducing the diagnostic cost in the healthcare industry.

Some of the major companies include Fujirebio, QuidelOrtho Corporation, Roche Diagnostics, and Immunodiagnostic Systems.

- Fujirebio is the leading provider of innovation in molecular diagnostics and multiparameter immunoassay testing, employing INNO-LIA Line immunoassay samples for various disease conditions.

- QuidelOrtho Corporation is a global group with a POC immunoassay portfolio, allowing physicians to receive reliable information. It also allows patient evaluation and treatment in real-time while still considering the community's interests in the long run.

- Roche Diagnostics offers advanced immunoassay tests such as high-quality test kits, benchmark quality reagents, and medical devices for in vitro immunochemistry as well as clinical chemistry for applications focused on the analysis of body fluids, mainly blood, urine, CSF, and saliva.

Immunoassay Market Growth Drivers:

- Increasing Prevalence of Chronic Diseases

There has been an increase in the number of individuals suffering from chronic diseases such as cancer and diabetes, among others. Due to this, there has been a growth in the necessity of immunoassay devices that are used to detect a particular biomarker in a patient. The International Agency for Research on Cancer (IARC) provided statistics on absolute new cases of cancer and cancer incidence in global regions in 2022. In Asia, there was an incidence of 9.826 million cancers, which accounted for the highest number of cases, which was 49.2% of total incidences. Followed by Europe at 22.4% with 4.471 million cancer cases and North America at 13.4%, that is, 2.673 million cases of cancer. Immunoassays are essential in the collection of chronic illness biomarkers to improve the treatment management of patients. These assist in medicine personalization, where patients’ treatment plans are designed according to their disease condition, followed by monitoring treatment response and modification of the treatment strategy after the disease diagnosis.

Similarly, in neurological disorders, the immunoassay system ensures a convenient, rapid, and cost-effective solution for detecting various types of neurological disorders. The increasing global cases of neurological disorders, which include diseases like Alzheimer's, Ataxia, epilepsy, and seizures, are also expected to boost the growth of the immunoassay market during the forecasted timeline. The National Library of Medicine, of the USA, in its 2023 report stated that in the nation, about 6.7 million adults, aged 65 years and above, are living with Alzheimer's disease, which is expected to surge to 13.8 million by 2060.

The immunoassay also offers key applications in diseases like celiac disease and rheumatoid arthritis (RA). Various studies conducted worldwide stated that the immunoassay platform helps in the early detection of seronegative rheumatoid arthritis, and with the constant increase in the prevalence rate, the demand for immunoassay is set to pick up pace. According to the “Rheumatoid Arthritis – Global Clinical Trial Landscape report issued by Novotech, the global cases of rheumatoid arthritis are expected to reach 31.7 million by 2050.

- Rising demand for early disease detection and monitoring.

In pharmaceutical research for drug development and biomarker discovery, the potential uses of immunoassays are on an upward adoption trend. Immunoassays are invaluable in hospitals and clinics for early and accurate disease diagnosis, monitoring, and therapy management. They are useful in detecting and quantifying proteins, hormones, viruses, and other specific markers in blood and other liquid body fluids to diagnose infections, autoimmune diseases, and cancer correctly.

Immunoassays are therefore crucial in emergency as well as routine diagnostics and guide therapeutic decisions by yielding accurate results within a short time. They are even more efficient with advancements in automated systems allowing for high-throughput testing in busy clinical environments with constantly improved patient outcomes. With improvements in automation and point-of-care testing, immunoassays are an indispensable tool for efficient, high-throughput testing in a clinical environment, supporting routine and urgent diagnostics and enhancing overall patient care.

The increasing number of cancer cases worldwide is fuelling the immunoassay market in the projected period. For instance, according to the Indian Journal of Medical Research (ICMR), the estimated number of cancer cases in India in 2022 was 14,61,427, which is 100.4 cases per 1,00,000 people. In India, every one out of nine people is likely to suffer from cancer in his/her lifetime. Lungs and breast cancer are leading sites for cancer in males and females. Additionally, cancer incidents are expected to increase by 12.8% in 2025 compared to 2020. Hence, with increasing demand for diagnostics, the immunoassay market is anticipated to grow in the coming years.

Strategic collaboration and partnerships to develop the immunoassay market in developing countries will positively influence market growth in the coming years. For instance, in January 2024, Fujirebio Holdings, Inc. and Agappe Diagnostics Ltd announced a Contract Development and Manufacturing Organization partnership for the Cartridge CLIA system reagents manufacturing project for immunology equipment Mispa i60 and Mispa i121. The partnership is set on a mutual belief that combining the distinct strengths of the two entities will fuel growth in India's immunoassay market and greatly affect the revolution and growth of immunoassay solutions within India.

Immunoassay Market Segmentation Analysis:

- The hospital & clinic segment is anticipated to grow notably

The immunoassay market is segmented by end-user into hospitals & clinics, diagnostics, pharmaceutical & biotechnology companies, and research & academic laboratories. Immunoassays are invaluable in hospitals and clinics for early and accurate disease diagnosis, monitoring, and therapy management. They are useful in detecting and quantifying proteins, hormones, viruses, and other specific markers in blood and other liquid body fluids to diagnose infections, autoimmune diseases, and cancer correctly.

Immunoassays are therefore crucial in emergency as well as routine diagnostics and guide therapeutic decisions by yielding accurate results within a short time. They are even more efficient with advancements in automated systems, allowing for high-throughput testing in busy clinical environments with constantly improved patient outcomes. With improvements in automation and point-of-care testing, immunoassays are an indispensable tool for efficient, high-throughput testing in a clinical environment, supporting routine and urgent diagnostics and enhancing overall patient care.

The increasing number of cancer cases worldwide is fuelling the immunoassay market in the projected period. For instance, an estimated 2,001,140 new cases of cancer and 611,720 cancer-related deaths were anticipated in the US in 2024. Hence, with increasing demand for diagnostics, the immunoassay market is anticipated to grow in the coming years.

Recent technological advancements in the applications of immunoassay have improved the diagnosis and treatment of connective tissue diseases in hospitals and clinics. Such advancements are essential for improving patient outcomes by means of accurate monitoring and early detection.

For instance, AliveDx's automated, multiplexed MosaiQ® solution, which speeds up the diagnosis of CTDs, has earned three IVDR CE Marks. The diagnostic process has become simple and detects more than one autoantibody simultaneously with the novel technique.

Additionally, several studies have been conducted for CTD screening, which indicate that sensitivity and specificity are greater when measured using ANA-ELISA when compared to other ANA-immunofluorescence assays. This allowed better precision and efficacy of a patient assessment.

Immunoassay Market Geographical Outlook:

- The Asia Pacific region is expected to witness significant growth in the immunoassay market.

Asia Pacific is poised to hold a prominent position in the immunoassay market, particularly due to its growing investment in robust healthcare infrastructure and the increasing prevalence of chronic diseases. The Japanese immunoassay market is displaying stable growth. Its growth has been characterized by an aging population, a high prevalence of chronic diseases, and increased demand for early diagnostic tools. Japan boasts some of the world's best healthcare infrastructure and quality care, with implementations of immunoassay technologies widespread in most of its hospitals, clinics, and research institutions. The proportion of Japan's elderly population, representing a percentage of the total population, witnessed a gradual increase, reaching 28.56% in 2020, 28.86% in 2021, and 29.00% in 2022. The RUO immunoassay is an invaluable tool for research to diagnose and treat this growing chronic disease in the population.

Further major developments, such as Sysmex Corporation, headquartered in Kobe, Japan, and Fujirebio Holdings, Inc., headquartered in Tokyo, Japan, agreed on a business collaboration in October 2023. This agreement enhances their collaboration in various areas, including research and development, production, clinical development, and sales-marketing within the immunoassay field. Additionally, they have agreed on a supply agreement for reagents and raw materials specifically for immunoassay applications. Both companies will leverage their expertise and capabilities in immunoassay, which expedites their global growth and contributes significantly to advancing this field of diagnostics.

Further major developments in Japan are also boosting market growth, for instance, in October 2024, Scientists from Science Tokyo created a new, adaptable OpenGUS immunoassay that efficiently and rapidly detects analytes. This platform offers an easy-to-use yet highly sensitive method for identifying pertinent biomarkers, allergens, or other biomolecules due to specially made β-glucuronidase (GUS) probes and ideal reaction conditions. In situations where advanced labs are not available, this expands the use of homogenous immunoassays for point-of-care diagnostics, high-throughput testing, environmental monitoring, and food safety analysis.

Additionally, Sysmex Corporation declared that its HISCL TARC Assay Kit, a unique parameter in the field of immunochemistry testing, was covered by insurance in Japan beginning in December 2024 to aid in the multiple diagnosis of drug-induced hypersensitivity syndrome/drug response with eosinophilia and systemic symptoms, a type of severe drug rash. Early diagnosis is critical for severe drug rashes, for which the assay kit is the only serum biomarker available in Japan. Under national insurance coverage, patients will be able to use this quick and objective testing method in the future.

With the advancement of ultrasensitive technologies, the demand is increasing, particularly in the neurology, infectious disease sector, and oncology testing. The higher sensitivity enables the discovery of new markers at lower levels in all fields, detection, and diagnosis. Hence, in the projected period, with the development of new and innovative product launches, the immunoassay market is expected to grow.

Technological advancements are playing an important role in the growth prospects of Japan's RUO immunoassay market. In November 2023, JSR Life Sciences Company released an automated mono-test chemiluminescence immunoassay (CLIA) analyzer, “istar 500”. Its compact design and highly sensitive CLIA technology make it an option for emergency diagnostics or small- to medium-sized laboratories seeking precise testing outcomes. This CLIA analyzer provides a comprehensive array of testing parameters encompassing cardiac markers, reproductive health, liver function, tumor markers, and autoimmunity.

Immunoassay Market Key Developments:

- In July 2024, Beckman Coulter, Inc., a global leader in diagnostic solutions, announced the launch of DxC 500i, a new integrated immunoassay and chemistry analyzer. The analyzer features enhanced flexibility and capability of scalability for the users.

- In 2024, Abbott and Fujirebio partner with each other for the development of an RUO neurofilament-chain neurology biomarker assay.

Immunoassay Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 35.571 billion |

| Total Market Size in 2031 | USD 35.571 billion |

| Growth Rate | 6.46% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Therapeutic Area, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Immunoassay Market Segmentation:

- By Type

- Radioimmunoassay (RIA)

- Enzyme Immunoassay or Enzyme-linked Immunosorbent Assays (ELISA)

- Counting Immunoassay (CIA)

- Fluoroimmunoassay (FIA)

- Chemiluminescence Immunoassay (CLIA)

- By Therapeutic Area

- Infectious Diseases

- Bone Metabolism

- Immunology

- Neurobiology

- Others

- By End-User

- Hospitals & Clinics

- Diagnostics

- Pharmaceutical & Biotechnology Companies

- Research & Academic Laboratories

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- France

- Germany

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- Thailand

- Taiwan

- Indonesia

- Others

- North America