Report Overview

Insect Repellent Market - Highlights

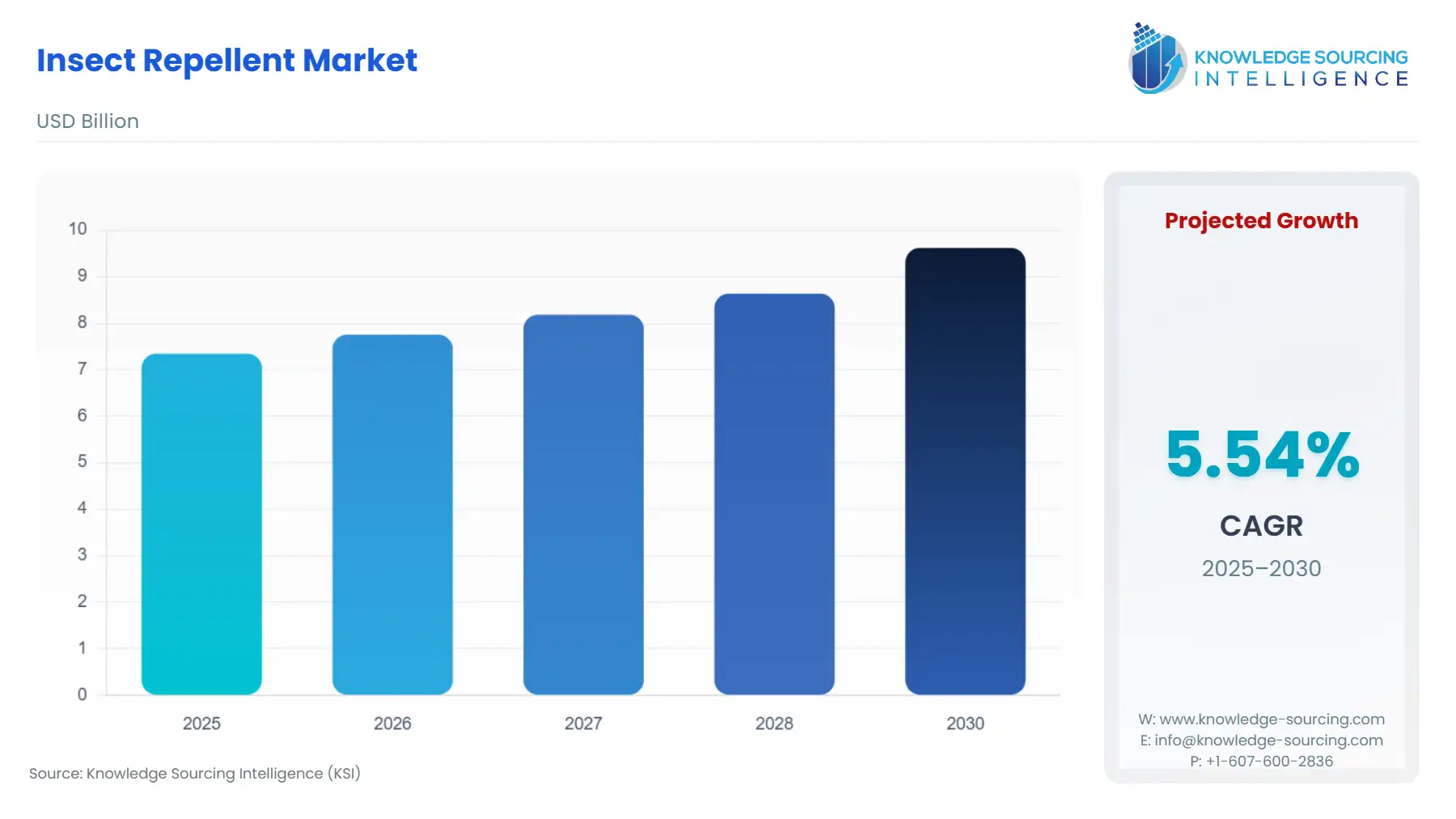

Insect Repellent Market Size:

The insect repellent market is expected to grow from USD 7.346 billion in 2025 to USD 9.619 billion in 2030, at a CAGR of 5.54%.

The market is expected to grow during the forecast period owing to the rising threats across the world of diseases like dengue, malaria, chikungunya, Zika virus, and yellow fever. According to a report by the World Health Organization (WHO), these diseases have been on a rise since 2019. For instance, per 1000 population, 59.5 were at risk of being infected by malaria. Consequently, the number of deaths caused by malaria has increased from 569,000 in 2014 to 627,000 in 2020 according to the World Health Organization. Moreover, the rising investment and funding done in order to eradicate the diseases on a global level have also increased in recent years, with WHO reporting about USD 3.5 billion of funding done in 2021 for malaria control and elimination. Along with that, in 2021, 40% of global malaria investments were received through the Global Fund. Hence, such efforts owing to curb the spread of diseases caused by insects are propelling the market demand for insect repellents as well.

Insect Repellent Market Driver:

- The insect repellent market is driven by the rising threat of diseases and government initiatives.

A major factor driving the market demand for insect-repellent solutions is the increasing threat of diseases caused by coming in contact with insects causing dengue, malaria, chikungunya, Zika virus, and yellow fever. The surging incidences of such diseases globally have increased the demand for insect-repellent solutions. For instance, the WHO reported 241 million malaria cases in 2020. Furthermore, according to the World Health Organization, malaria is responsible for a greater proportion (7.8%) of fatalities among children under the age of five. This has led to mounting concern over the safety measures that are required to prevent such diseases. Various initiatives by government institutions, along with the launch of vaccines are being undertaken in order to curb the rising number of cases and spread awareness amongst the citizens. For example, The E-2025 initiative was launched by WHO in April 2021 to assist 25 nations in their attempts to eradicate malaria by 2025. It has been built on the foundation of the E-2020 initiative.

Furthermore, WHO approved the RTS,S malaria vaccine for children in Sub-Saharan Africa and other places with moderate to high P. falciparum malaria transmission in October 2021. The advice was based on an examination of the entire body of data on RTS,S, including the findings of a pilot program in Ghana, Kenya, and Malawi that has reached over 830 000 children since 2019. In another instance, WHO modified its worldwide malaria strategy in 2021 to incorporate lessons learned during the previous five years. Meeting the strategy's objectives, which include reducing global malaria incidence and fatality rates by 90% by 2030.

Insect Repellent Market Geographical Outlook:

- North America accounts for major shares of the insect repellent market.

The growing prevalence of insect-borne diseases in major Asia Pacific countries namely India, Indonesia, and Thailand coupled with a growing initiative to prevent the increase of such diseases is driving the market demand for insect repellent.

Insect repellents are used to provide protection from major vector-borne diseases namely malaria, chikungunya, and dengue. India is endemic to such major vector-borne diseases (VBD), and with the fluctuations in climatic conditions coupled with a lack of taking necessary precautions, the country is witnessing a significant increase in the prevalence of such disease. For instance, according to the National Center for Vector Borne Diseases Control, in 2021, India reported 1,93,245 cases of dengue which represented a significant increase of 333.4% over 44,585 cases reported in 2020. Furthermore, as per the same source, the deaths reported due to dengue stood at 346 in 2021 in comparison to 56 deaths reported in 2020. Such an increase in the vector-borne disease will boost the demand for insect repellent in India, thereby propelling the overall market growth.

Insect Repellent Market Segmentation Analysis:

- Based on sales channels, the insect repellent market is expected to witness positive growth through the online segment.

The online segment will witness promising growth since the expansion of distribution channels and growing internet penetration, particularly in developing economies which are supporting the growth of this segment during the given time frame. The key factors supplementing the growth of this segment include the inclination of consumers to make purchases online coupled with the booming penetration of the internet primarily in developing economies such as India and China among others. Moreover, the expansion of sales channels and the growing availability of these products on online platforms also play a significant role in shaping market expansion.

List of Top Insect Repellent Companies:

- Reckitt Benckiser Group plc

- Sawyer Products, Inc.

- GODREJ LTD.

- Dabur Odomos

- Spectrum Brands, Inc.

Insect Repellent Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

Insect Repellent Market Segmentation:

- By Insect Type

- Mosquito

- Bugs

- Others

- By Product Type

- Aerosol

- Coil

- Creams and Lotions

- Vaporizers

- Patch

- Others

- By Active Ingredient

- Synthetic

- Natural

- By Application

- Humans

- Pets

- By Sales Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America