Report Overview

Global LED Track Light Highlights

LED Track Light Market Size:

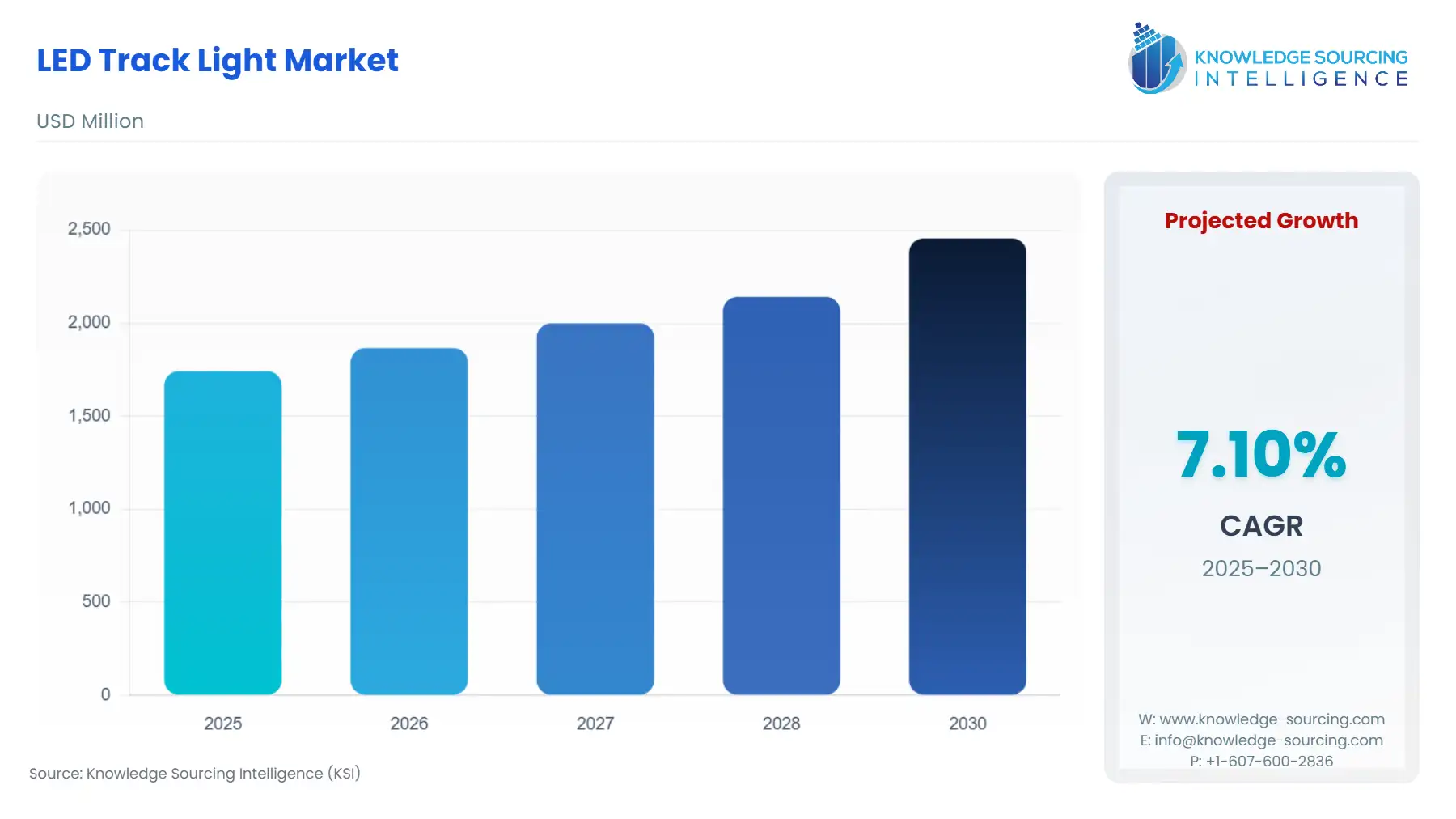

The Global LED Track Light Market is expected to grow from USD 1.743 billion in 2025 to USD 2.456 billion in 2030, at a CAGR of 7.10%.

LED Track Light Market Introduction:

The LED track light market has emerged as a dynamic segment within the broader lighting industry, driven by the demand for versatile, energy-efficient, and aesthetically appealing lighting solutions. LED luminaires with adjustable spotlight heads have transformed commercial, retail, hospitality, and residential spaces, offering precise illumination and design flexibility. These systems, integral to track lighting installation, enable businesses and homeowners to highlight architectural features, merchandise, or artwork while achieving significant energy savings. As urbanization, sustainability goals, and smart city initiatives reshape global markets, LED track lighting has become a cornerstone of modern lighting design, blending lighting efficiency with innovative technology.

The LED track light market traces its roots to traditional track lighting systems introduced in the mid-20th century, initially using incandescent or halogen lamps to provide directional lighting for retail and museum settings. These early systems, while flexible, were energy-intensive and limited in lifespan. The adoption of LED technology in the early 2000s marked a pivotal shift, with companies like Philips (now Signify) introducing LED luminaires that offered superior lighting efficiency and longevity. The transition to LEDs enabled track lighting installation to become more cost-effective, as retrofit lighting solutions allowed existing fixtures to be upgraded without replacing entire systems.

Advancements in spotlight head design, such as adjustable beam angles and high Color Rendering Index (CRI) options, have enhanced the market’s appeal. For instance, Zumtobel’s track lights now feature CRI values above 90, ensuring accurate color representation for retail and art galleries. The integration of smart controls, including IoT-enabled sensors and dimmable systems, has further revolutionized the market. Projects like Dubai’s Museum of the Future showcase LED track lighting with connected systems that adjust brightness based on occupancy, enhancing both aesthetics and energy savings. The rise of e-commerce platforms has also made LED track lights more accessible, with retailers like Alibaba offering customizable solutions for global markets. This evolution reflects the market’s alignment with sustainability, technological innovation, and consumer demand for versatile lighting solutions.

LED Track Light Market Dynamics:

Market Drivers

- Push for Sustainability and Energy Efficiency

The global emphasis on sustainability is a key driver, with LED luminaires offering significant energy savings compared to traditional lighting. These systems consume less power and have longer lifespans, aligning with environmental regulations and green building standards. For instance, Signify’s Ultra Efficient LED track lights reduce energy consumption while maintaining high performance, making them ideal for commercial spaces. The UK’s Green Homes Grant encourages businesses to adopt energy-efficient lighting, boosting demand for retrofit lighting solutions that upgrade existing tracks. High CRI LEDs further enhance appeal by providing superior light quality, supporting sustainability goals in retail and hospitality. This focus on eco-friendly solutions drives market growth as organizations prioritize cost-effective, environmentally responsible lighting.

- Advancements in Smart Lighting Technologies

Technological innovation, particularly in smart track lighting and IoT lighting, is transforming the market. Wireless lighting control and DALI lighting systems enable remote management and integration with smart building ecosystems, as seen in Zumtobel’s connected track lights that adjust via occupancy sensors. Tunable white LEDs allow dynamic color temperature adjustments, enhancing ambiance in spaces like hotels and offices. These advancements improve lighting efficiency and user experience, with platforms like Delta Light offering customizable solutions for diverse applications. The ability to integrate with IoT platforms drives adoption in smart cities and commercial complexes, where real-time control and data analytics optimize energy use and operational performance, fueling market expansion.

- Growth in Commercial and Retail Sectors

The expansion of retail, hospitality, and commercial spaces drives demand for track lighting installation, as businesses seek versatile, aesthetically appealing solutions. Spotlight heads provide precise illumination for product displays and architectural features, as implemented in high-end retail environments by Ansorg. Minimalist lighting design aligns with modern aesthetics, with magnetic track lighting offering flexibility for dynamic store layouts. Urbanization and government initiatives for smart cities, such as India’s Smart Cities Mission, promote LED track lights in commercial hubs to enhance functionality and visual appeal. This sector’s growth, driven by the need for customer-centric and energy-efficient lighting, positions LED track lighting as a critical component of modern commercial design.

Market Restraints

- High Initial Investment Costs

The high upfront costs of LED track lighting systems pose a significant barrier, particularly for small businesses and budget-constrained projects. Advanced smart track lighting and DALI lighting systems require substantial investment in hardware, software, and installation, as highlighted by challenges in retrofitting older buildings. For instance, integrating tunable white LEDs or IoT lighting involves costly infrastructure upgrades, which can deter adoption in emerging markets. Track lighting installation for large-scale projects, such as museums or retail chains, further escalates expenses due to customized spotlight heads and wiring requirements. These costs can delay projects and limit market penetration, particularly in regions with limited access to financing for sustainable technologies.

- Compatibility and Integration Challenges

Compatibility issues with existing infrastructure hinder the adoption of LED track lighting, especially in retrofit lighting projects. Older track systems may not support modern LED luminaires or wireless lighting control, requiring costly replacements or adapters, as noted in commercial renovation projects. For example, integrating magnetic track lighting with legacy fixtures can lead to performance issues, impacting reliability and user satisfaction. The complexity of syncing IoT lighting with diverse building management systems further complicates deployment, particularly in older facilities. These challenges slow adoption, as businesses must navigate technical hurdles to achieve seamless integration, limiting the market’s growth potential in retrofit-heavy sectors like hospitality and heritage sites.

Choosing the Right LED Track Lighting System

Selecting the optimal LED track lighting system for a business requires careful evaluation of operational needs, design goals, and technical specifications. The following factors should be considered:

- Lighting Requirements and Application: Assess the space’s purpose—retail, hospitality, or residential—and choose spotlight heads with appropriate beam angles and CRI values. For instance, museums benefit from high-CRI LED luminaires to ensure accurate color rendering.

- Energy Efficiency and Cost Savings: Prioritize systems with high lighting efficiency, such as those certified by ENERGY STAR, to maximize energy savings and reduce long-term costs.

- Compatibility and Installation: Ensure the system supports retrofit lighting for existing tracks or seamless track lighting installation for new setups. Cooper Lighting’s modular designs simplify upgrades.

- Smart Features and Connectivity: Opt for LED track lights with IoT-enabled sensors or dimming capabilities for enhanced control, as seen in Signify’s connected lighting solutions.

- Durability and Maintenance: Select durable systems with lifespans exceeding 50,000 hours to minimize maintenance costs, as offered by Sunme Lighting’s vibration-resistant designs.

- Aesthetic and Customization Options: Choose systems with customizable spotlight heads and finishes to align with design aesthetics, such as HALO’s 3D-printed track lights in 22 colors.

By aligning these factors with business objectives, organizations can select systems that enhance functionality, reduce costs, and elevate user experiences. For example, a retail chain might prioritize high-CRI LED luminaires for product displays, while an office may focus on smart controls for energy savings.

LED Track Light Market Trends:

The LED track light market is evolving rapidly, driven by technological advancements and design innovation. Smart track lighting, integrated with IoT lighting, enables remote control and automation, as seen in Signify’s connected systems that adjust brightness based on occupancy. Tunable white LED technology allows dynamic color temperature adjustments, enhancing ambiance in retail and hospitality settings. Human-centric lighting prioritizes well-being, with platforms like Cooper Lighting Solutions offering circadian rhythm-aligned systems for offices. Magnetic track lighting simplifies installation, enabling flexible minimalist lighting design for modern spaces, as showcased by Sunme Lighting’s modular tracks. High CRI LED ensures accurate color rendering, critical for art galleries and retail, with Ansorg’s fixtures exceeding CRI 90. Wireless lighting control and DALI lighting systems enhance scalability, allowing seamless integration with smart building ecosystems. These trends reflect the market’s shift toward intelligent, user-focused, and aesthetically versatile solutions, redefining lighting for commercial and residential applications.

LED Track Light Market Segmentation Analysis:

- By Track Type: H-Style

The H-style track type dominates the LED track light market due to its widespread compatibility, robust design, and versatility in commercial and residential applications. Named for its H-shaped profile, this track system supports a variety of LED luminaires and spotlight heads, offering easy installation and flexibility for adjusting light direction. Companies like Signify utilize H-Style tracks in retail and hospitality settings for their ability to support heavy fixtures and integrate with smart track lighting systems. The design’s durability and compatibility with DALI lighting systems make it ideal for large-scale track lighting installations, such as in museums or shopping malls, where precise illumination is critical. Its dominance is further driven by its adoption in retrofit lighting projects, enabling seamless upgrades from older systems, enhancing lighting efficiency, and supporting energy savings in diverse environments.

- By End-User: Commercial

The Commercial segment leads the market, driven by the demand for high CRI LEDs and minimalist lighting design in retail, offices, and hospitality venues. LED track lights provide precise illumination for product displays and workspaces, enhancing customer experiences and operational aesthetics. For instance, Ansorg’s track lighting solutions are widely used in high-end retail to highlight merchandise with tunable white LEDs. Commercial applications benefit from IoT lighting integration, enabling wireless lighting control for energy management, as seen in Delta Light’s smart office installations. The segment’s growth is fueled by government initiatives for smart cities, such as Dubai’s urban projects, which prioritize energy-efficient lighting in commercial complexes. The flexibility of magnetic track lighting further enhances its appeal, allowing businesses to adapt layouts dynamically while maintaining lighting efficiency.

LED Track Light Market Geographical Outlook:

- By Geography: Asia Pacific

The Asia Pacific region is the largest market for LED track lights, propelled by rapid urbanization, infrastructure development, and government policies promoting energy savings. China, a global manufacturing hub, drives the region’s dominance with widespread adoption of smart track lighting in commercial and public spaces. India’s Smart Cities Mission integrates LED luminaires in urban projects, boosting demand for track lighting installations. Japan and South Korea lead in human-centric lighting, with companies like Panasonic deploying tunable white LEDs in offices and retail to enhance well-being. The region’s growth is further supported by IoT lighting adoption in smart buildings and cost-effective production, making the Asia Pacific a key driver of global market expansion.

LED Track Light Market Players:

Finally, the competitive intelligence section deals with major players in the market, their market shares, growth strategies, products, financials, and recent investments, among others. Key industry players profiled as part of this section are Lumens Light + Living, YDesign Group, LLC, Lamps Plus, Inc., LYCO GROUP LTD., and General Electric Company.

LED Track Light Market Key Developments:

- In March 2025, Signify, the parent company of Philips, announced a joint venture with Dixon Technologies, a leading Indian electronics manufacturer. This partnership aims to produce high-quality and cost-effective lighting products and accessories for the competitive Indian market. The venture will focus on a wide range of LED lighting solutions, including bulbs, downlights, spotlights, and track lighting, all manufactured in India. This strategic move is intended to strengthen Signify's presence and market share in the rapidly growing lighting sector of India.

- In 2024, PROLICHT launched its "JUST BLACK" system, a minimalist surface track designed to be a sleek black line that seamlessly integrates into architectural spaces. This hyper-miniaturized system can be affixed to any surface, creating a subtle, almost invisible, electrified stripe. The system is designed to provide both form and function, offering a visually impeccable appearance while allowing for versatile lighting configurations. It represents a trend toward smaller, more discreet lighting solutions that prioritize a clean aesthetic.

The LED track light market is poised for sustained growth, driven by lighting efficiency, urbanization, and technological innovation. Emerging trends, such as biometric ticketing solutions for integrated smart systems and cashless payment kiosks for retail lighting, will further expand applications. Government initiatives for smart cities, like those in China and Europe, will continue to promote LED track lighting in public and commercial spaces. However, addressing cost barriers and compatibility challenges will be critical to broadening adoption, particularly in emerging markets. As businesses and consumers prioritize sustainability and design, LED track lights will remain a vital tool for creating efficient, visually appealing, and future-ready spaces.

LED Track Light Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.743 billion |

| Total Market Size in 2031 | USD 2.456 billion |

| Growth Rate | 7.10% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Track Type, Capacity Type, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

LED Track Light Market Segmentation:

- By Track Type

- H-Style

- J-Style

- L-Style

- By Capacity Type

- Up to 7W

- 7 to 18W

- Greater than 18W

- By Distribution Channel

- Online

- Offline

- By End-User

- Residential

- Commercial

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others