Report Overview

Global Liquified Petroleum Gas Highlights

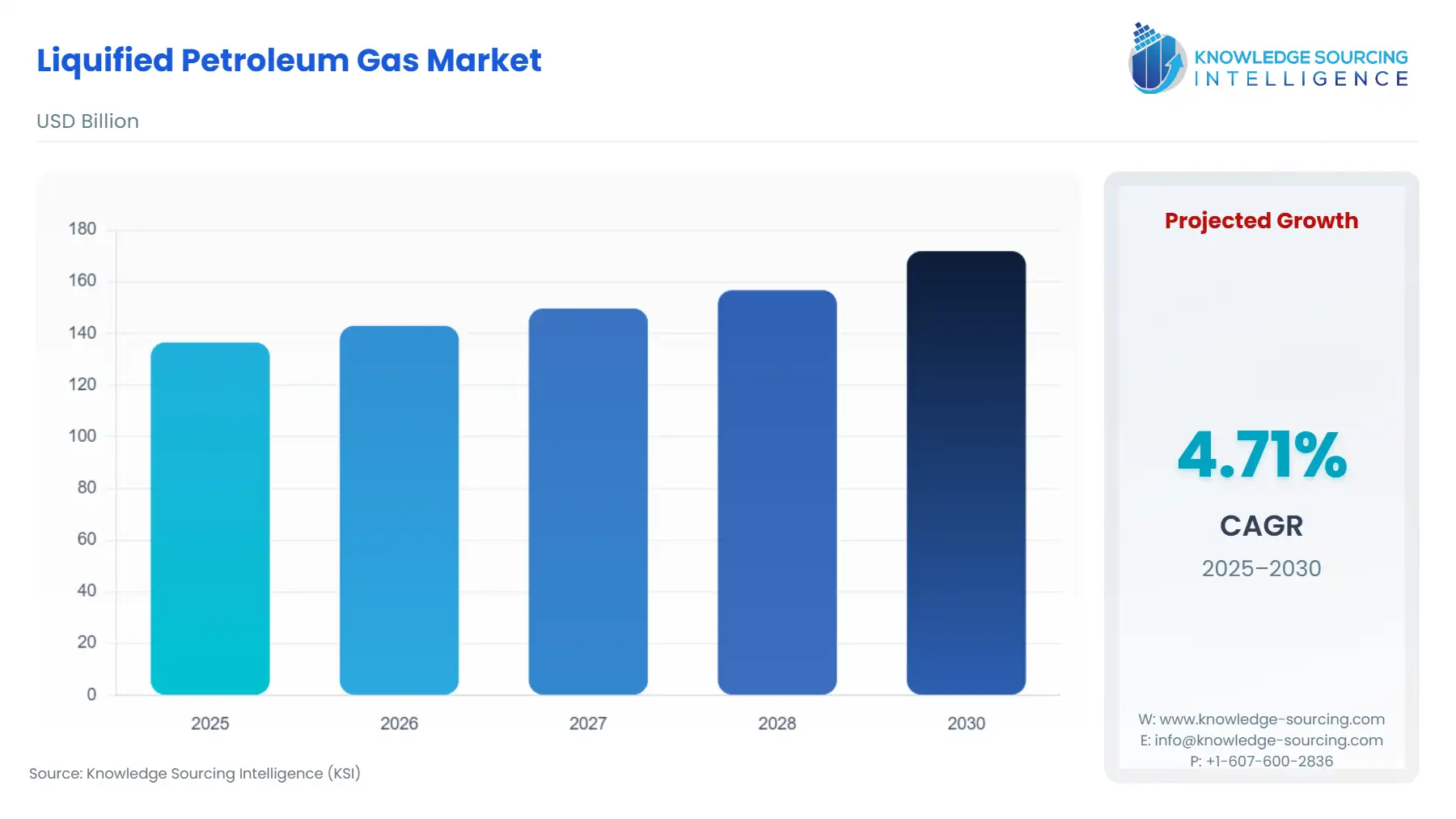

Liquified Petroleum Gas Market Size:

The Global Liquified Petroleum Gas Market is set to expand from USD 136.548 billion in 2025 to USD 171.880 billion by 2030, at a CAGR of 4.71%.

Global Liquified Petroleum Gas Market Analysis

- Growth Drivers

Three observable drivers raised LPG demand in 2024–2025. First, petrochemical feedstock substitution — higher propane/butane feedstock use in PDH and steam-cracker feedstock — increased industrial offtake in Asia, directly expanding merchant LPG purchases (IEA reporting). Second, residential adoption in emerging markets (India, Southeast Asia, parts of Africa) for clean cooking sustained packaged-cylinder and bulk demand; national procurement data (PPAC, MOSPI) show rising household LPG sales. Third, logistics expansion and new export/transport infrastructure (US fractionation and Gulf export ramps, plus downstream pipeline solicitations) improved physical availability, enabling larger term contracts and stimulating demand from bulk buyers who require secure supply. Each driver raises tangible physical demand or eases market access for buyers.

- Challenges and Opportunities

Constraints that reduce or re-route demand are: price volatility from producer OSP/CP adjustments (creates short-term demand switching), infrastructure bottlenecks at import terminals (limiting uptake in import-dependent markets), and policy/tariff shifts that change sourcing economics (e.g., trade/levy decisions). Opportunities visible in 2024–2025: (1) supply arbitrage — increased US LPG volumes enable new supplier–buyer pairings (stimulates demand where transport economics permit); (2) industrial fuel-switching toward LPG where natural gas is constrained — this creates incremental industrial demand; and (3) consolidation of retail distribution (M&A) which increases marketing efficiency and can expand cylinder penetration. Each factor either increases or diverts actual tonnage demanded by observable buyers.

- Raw Material and Pricing Analysis

LPG is a downstream hydrocarbon coproduct of crude refining and natural gas processing. Pricing follows petroleum product cycles and official selling prices from state producers; large exporters (Gulf producers, US exporters) periodically adjust OSP/CPs which ripple into spot and term prices. The key supply-side determinants are crude/refinery throughput and NGL recovery rates from gas processing. The recent rise in US LPG production increased available exportable volumes, exerting downward pressure on delivered prices to some Asian buyers when freight and logistics allow arbitrage. Freight, rail/road cylinder distribution costs, and fractionation capacity are the principal additions to raw-product economics that influence buyer demand for term versus spot purchases.

- Supply Chain Analysis

The LPG supply chain is: feedstock recovery (refineries and gas processing plants) → fractionators/storage hubs (US Gulf Coast, Middle East, Southeast Asia) → sea transport by VLGC/parcel carriers → import terminals and bottling plants → distribution (bulk for industry, cylinders for households). Key production hubs are the US Gulf Coast, Middle East refineries, and China’s coastal refineries. Logistical complexities include seasonal storage cycles (winter heating), port/terminal berthing availability, and limited VLGC tonnage during tight periods. Dependence on freight and fractionation capacity makes downstream demand sensitive to port congestion and export-slot availability; where transport is constrained, buyers switch to regional suppliers or reduce volumes.

Liquified Petroleum Gas Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Federal Energy Regulatory Commission (FERC) / DOT pipeline & maritime rules |

Pipeline permits and open seasons (e.g., Phillips 66 Blue Line open season) affect inland LPG transportation capacity and thus inland offtake patterns. |

|

India |

Ministry of Petroleum & Natural Gas / PPAC |

Government procurement and subsidy structures influence household cylinder demand and state refiners’ purchasing decisions (PPAC data show rising household LPG sales). |

|

European Union |

European Commission energy/fuels policy (fuel quality and transport rules) |

Fuel and safety regulations influence commercial LPG use (autogas, industrial), affecting demand composition and compliance costs. |

Liquified Petroleum Gas Market Segment Analysis

- Transport segment (By Application)

Transport-sector LPG (autogas, domestic vehicle fleets) demand is determined by policy incentives, refueling infrastructure density, and relative on-road fuel economics. In countries with supportive taxation or fleet-conversion programs, LPG becomes an economically attractive lower-emission alternative for light- and medium-duty fleets. Observed patterns in 2024 show selective growth where governments combine incentives with refueling network expansion; without refueling density, fleet uptake stalls. For long-haul heavy transport the fuel density and energy-per-volume disadvantage versus diesel constrains LPG adoption except where dedicated infrastructure and conversion ecosystems exist. Demand from transport thus materializes primarily where (a) fiscal incentives lower delivered cost relative to diesel, (b) cylinder or autogas station networks remove refueling friction, and (c) buyers (fleet operators) can secure long-term supply contracts. Consequently, investments in midstream and retail LPG infrastructure (terminals, autogas stations) are demand enablers: companies expanding transport-focused logistics see direct, measurable increases in autogas offtake.

- Industrial segment (By End-User)

Industrial LPG demand stems from two observable drivers: petrochemical feedstock use (notably PDH and cracking feed) and process heating where pipeline gas is unavailable or more expensive. In 2024, petrochemical demand exhibited the largest incremental tonnage growth, particularly in Asia where new PDH and derivative polymer plants continue commissioning; companies procuring merchant LPG for feedstock have larger, contract-based offtake and rely on fractionation and shipping reliability. Industrial end-users also switch from heavy fuel oil or kerosene to LPG to meet emissions targets or compliance needs, increasing volumes where logistics permit. Demand elasticity at the industrial level is low—industrial buyers prioritize security of supply over spot price volatility—so investments in term contracts, storage, and regas/fractionation capacity directly stimulate long-term industrial LPG purchases. Where downstream industrial clusters co-locate near export hubs, localized demand spikes follow capacity additions in crackers or PDH units.

Liquified Petroleum Gas Market Geographical Analysis

US Market Analysis

US is a major LPG producer (NGL recovery from gas and condensate). Export infrastructure growth and fractionation capacity shape global flows; domestic industrial demand benefits from price-competitive local supplies.

- Brazil Market Analysis

Brazil’s LPG demand is dominated by residential cylinders; refinery output and imports determine availability. Social pricing and distribution programs influence household uptake.

- Germany Market Analysis

In Germany LPG is a niche transport and off-grid heating fuel; regulatory decarbonization policies limit growth, but specialty industrial demand persists.

- Saudi Arabia Market Analysis

Saudi production and OSP announcements from the national oil company influence Asian import parity and term contracting; domestic consumption is linked to petrochemical feedstocks.

- India Market Analysis

India is one of the largest LPG consumer markets; PPAC data show expanding household sales and state refiners’ procurement strategies (including new import sourcing) that directly lift tonnage demand.

Liquified Petroleum Gas Market Competitive Environment and Analysis

Major companies active in verified public filings/press releases: Saudi Aramco, China Gas Holdings, Phillips 66, Repsol, ExxonMobil, Reliance, Bharat Petroleum.

- Phillips 66 Company — downstream integration with refining, fractionation and pipeline assets. In June 2024 P66 launched a binding open season for its Blue Line System to solicit LPG transportation commitments, signaling a strategic push to enable inland LPG distribution capacity. (company newsroom).

- China Gas Holdings Ltd — large city-gas and LPG distributor in China; HKEX filings (2024–2025) report rising LPG sales revenue and confirm expansion of storage/retail operations, reflecting demand from urban residential and industrial segments. (company filings).

- Saudi Arabian Oil Co (Aramco) — major exporter whose official selling prices and production decisions materially influence global term pricing and cargo flows; Aramco’s FY2024 releases and OSP announcements are primary market signals for buyers.

Liquified Petroleum Gas Market Developments

- June 2025 — China Gas Holdings filed FY results showing LPG sales revenue growth in filings to HKEX (June 2025). (company filing).

- June 2024 — Phillips 66 announced a binding open season on the Blue Line System for propane/butane pipeline transportation (June 7, 2024). (company press release).

- May 2024 / Dec 2024 — Wesfarmers / Kleenheat LPG divestment: WesCEF announced sale of Kleenheat’s LPG distribution business (May 30, 2024); the asset was transferred to Supagas/Nippon Sanso group (completion announcements through late-2024). (company press releases).

Liquified Petroleum Gas Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 136.548 billion |

| Total Market Size in 2031 | USD 171.880 billion |

| Growth Rate | 4.71% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Liquified Petroleum Gas Market Segmentation:

- By Technology

- Refinery

- Associated Gas

- Non-associated gas

- By Application

- Residential segment

- Transport segment

- Industrial segment

- Commercial segment

- Refinery segment

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America