Report Overview

Global Maize Market - Highlights

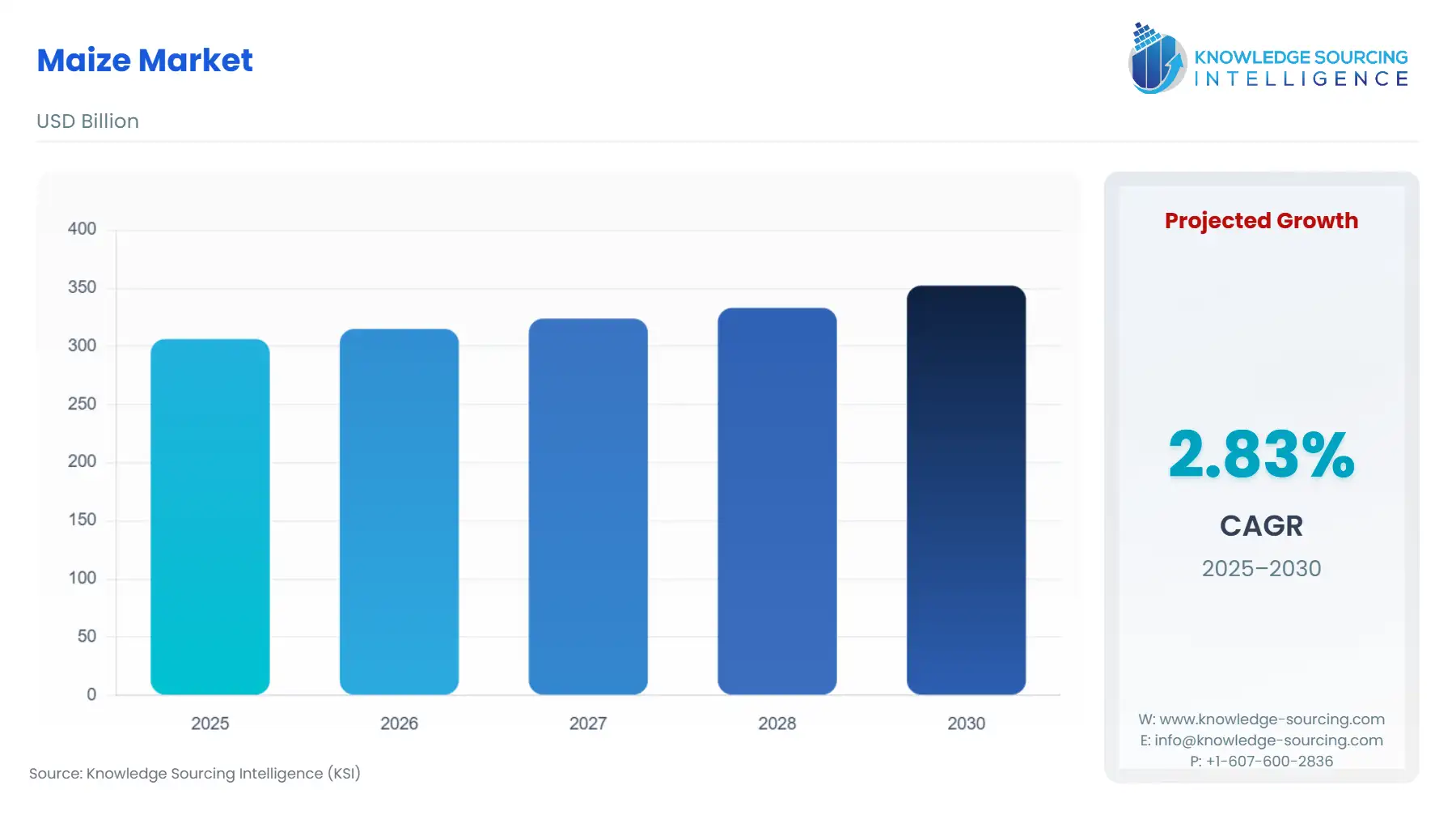

Maize Market Size:

Global Maize Market is expected to grow at a 2.83% CAGR, increasing to USD 352.288 billion by 2030 from USD 306.357 billion in 2025.

The most significant crop according to hybrid breeding is maize. More cereals are in demand as a result of the expanding meat industry, particularly maize, and soybean, which are both excellent sources of protein for feeding animals. The cultivation of maize has expanded around the world because it is a type of annual plant with a high productivity rate and the extraordinary key quality of regional adaptation. In terms of total crop output, maize ranks third, and it is increasingly the most widely planted crop worldwide. Although being one of the most important crops, only a small portion of maize is consumed by people; instead, it is mostly used as animal feed. In the chemical, pharmaceutical, culinary, and animal feed industries, maize has a wide range of uses.

More than 95% of all feed grain production and consumption in the US is accounted for by corn. It accounts for 39% of the world's grain production and is planted on over 190 million hectares in roughly 165 nations with a broad variety of management techniques. The grain is largely utilized for livestock and feed. The area per corn farm has expanded recently, despite a fall in the number of cornfield farms.

Plants with high starch or sugar content are fermented to create ethanol, which may be used in place of gasoline and diesel fuel right away. Given its high starch content, maize is the primary source of ethanol. The market is expanding as a result of the increased use of maize in the manufacturing of biofuels. Although maize is a fantastic source of protein and delicious food, consuming it excessively may also lead to health issues and difficulties, including allergic responses, bloating, and gas, and is dangerous for diabetic individuals.

The Global Maize Market is a crucial agricultural commodity due to its diverse uses in food security, animal nutrition, industrial processing, and renewable energy production. Maize, also known as corn, is the world’s leading cereal crop by cultivated area and serves as the primary grain for global trade and a foundation of agricultural economies. The market has grown consistently during the last ten years, driven by population growth, higher demand for animal protein, expanding biofuel industries, and advancements in agricultural biotechnology.

The maize market is significantly influenced by policy changes in agricultural subsidies, trade tariffs, and biofuel mandates in major economies. The U.S. Farm Bill, European Union Common Agricultural Policy (CAP), and China’s food security regulations significantly influence production patterns and global pricing dynamics. Environmental issues, such as climate change, soil degradation, and water scarcity, are driving industry players to adopt precision farming, regenerative agriculture, and sustainable sourcing practices. Additionally, innovations in data-driven farming, satellite monitoring, and AI-based crop management are enhancing productivity and supply chain transparency.

Maize Market Overview

The Global Maize Market forms the core of the global agricultural and food economy. It includes a large value chain that extends from seed production and farming to processing, trading, and industrial applications. Maize, which is also called corn, is one of the most widely grown cereal crops in the world. It continues to be a primary food source, an animal feed component, and a basic material for various industries like biofuels, starches, sweeteners, and pharmaceuticals.

Leading manufacturing nations in 2024–2025 include 4% share of Argentina, the United States with 31%, China with 24%, Brazil with 11%, and the European Union with 5% of the world's corn production. Additionally, the need for eco-friendly farming methods, easily traceable supply chains, and clean energy sources is changing the way maize is grown and processed in different parts of the world. The food division is delighted with maize as a multipurpose raw material for products like cornmeal, snacks, cereals, and sweeteners, whereas the industrial side is using maize for bioplastics and ethanol.

On the other hand, the market is subjected to challenges of climate variabilities, unstable commodity prices, and geopolitical disruptions that impact global trade routes and the export of grains.

The global maize market is governed by several regulatory frameworks and policies that are primarily aimed at maintaining food security, promoting sustainability, and ensuring fair trade. Some of the major regulations include the U.S. Farm Bill, which regulates maize subsidies and biofuel mandates, the European Union Common Agricultural Policy (CAP) that manages maize production and ensures compliance with environmental laws, and China’s Grain Security Law that monitors domestic reserves and imports. Additionally, there are internationally accepted standards from organizations, such as the Codex Alimentarius Commission and the World Trade Organization (WTO), which establish regulations for maize safety, labeling, and trade practices.

Furthermore, the policies enacted to address the climate crisis, such as the EU Renewable Energy Directive (RED II) and the U.S. Renewable Fuel Standard (RFS), are also determining the demand for maize for bioethanol production, thereby influencing global supply chains and pricing dynamics.

Key players in the Global Maize Market are top agribusiness and seed companies such as Archer Daniels Midland Company (ADM), Cargill, Inc., Bunge Limited, Syngenta AG, Bayer AG, Corteva Agriscience, KWS SAAT SE & Co. KGaA, Limagrain Group, Buhler Group, Ingredion Incorporated, Roquette, and Olam International. These organizations influence the market through their extensive global supply chains, cutting-edge seed genetics, processing methods, and the wide range of maize-based products in their portfolios, becoming primary drivers of innovation, sustainability, and competition in the entire value chain.

The maize market is expected to grow consistently during the next few years, largely due to technological innovation, broadening of industrial applications, and the global shift towards eco-friendly agricultural systems and the use of renewable energy.

Maize Market Drivers:

An increase in the need for sources of animal protein

Global livestock consumption has increased as a result of urbanization, growing affluence in emerging countries, and population expansion. The consumption of milk, meat, and eggs, which is rising at the cost of staple foods, has been proven to be closely connected with income levels and population increase. Hence, to fulfil the growing demand for meat and high-value animal protein, pressure on the livestock business has increased over the past several years. For instance, to increase milk output, dairy producers in India are progressively substituting crossbred cows and buffaloes for native, low-yielding dairy bovine breeds. One of the main components of practically all forms of compound feed for animals, including ruminants, poultry, swine, and aquaculture, is maize. Hence, the worldwide trade and market for maize are projected to be driven by the rising need for sources of animal-based protein.

The growing interest in products derived from maize as alternatives to conventional snacks.

Businesses that offer a healthy breakfast plan made up of ready-to-eat goods have dramatically increased due to consumer demand. There has also been a move towards healthier diets to lower cholesterol and manage blood sugar levels. This has led to a rise in the demand for maize. They also use maize to cover meals in their homes and eateries. A rising number of fast food restaurants are including maize on their menus.

Rising demand from the animal feed industry

According to the United States Department of Agriculture (USDA), maize remains the predominant feed grain and is used in over 95 per cent of total feed grain produced and consumed in the United States. This remains true since maize is the primary energy source for feed manufacturing for poultry, beef, and hogs. The USDA Economic Research Service (ERS) Feed Grains Market Outlook (August 2025) predictions indicate a 250 million bushel increase for the 2025/26 marketing year in feed and residual use, representing strong feed demand required by stable livestock production. For total feed demand, the USDA Foreign Agricultural Service (FAS) indicates that in China, demand in 2024/25 is estimated at about 286.5 million metric tons, with maize remaining the most important component of total feed demand due to cost-effectiveness and high energy density compared to alternatives.

In India, demand for poultry feed showed a steady increase in demand for maize or corn. Total Indian maize consumption is now about 60% for domestic poultry feed. In developing regions, due to rising meat and dairy consumption and industrialisation of livestock production, feed demand continues to grow as a trade factor, resulting in maize demand. Maize utilisation for feed is expected to continue growing in the long term, which will support the expansion of maize trade. Additionally, maize utilisation for feed is becoming established as a key component of overall maize demand.

According to the United States Department of Agriculture (USDA), the harvested area for maize in 2025 is projected at 88.7 million acres, marking an increase of nearly 2 million acres from the previous year. The average yield is estimated at 188.8 bushels per acre, resulting in a total production forecast of 16.7 billion bushels. This growth reflects strong supply conditions supporting the U.S. animal feed industry, which remains the largest consumer of domestic maize. The increased production helps stabilise feed availability for livestock and poultry sectors, reinforcing maize’s central role in sustaining feed demand nationwide.

Maize Market Segmentation Analysis

By Application: Animal Feed

By Application, the global maize market is segmented into Food & Beverage, Animal Feed, Pharmaceutical, Paper & Pulp, and Others. The largest industrial usage of maize internationally, animal feed, is the largest demand category in the coarse grain consumption, and the rising production of livestock and poultry directly leads to increased purchases of maize by feed formulators and integrators. The energy values, starch profile, and relative economic aspects make maize the prime base ingredient of commercial rations, ranging from intensive poultry farming operations to extensive cattle operations. As a result, feed mills and integrators purchase maize in bulk during predictable seasonal cycles. The regional demand situation is important. In the United States, increasing herd sizes, improvements in feed utilisation efficiency ensure stable domestic demand for maize, despite competition from ethanol and exports. USDA figures, both projections and monthly outlooks, indicate that feed and residual use will be a principal category in the maize disappearance figure.

On the supply side, changes in government production forecasts and intervention policies (such as stockpiling, minimum purchase prices and import controls) influence the purchasing behaviour of buyers: as official supply forecasts tighten, large feed buyers are using forward purchase contracts to maintain their positions. When prices or policy signals render maize relatively expensive, they switch the rations, substituting maize with alternative grains. Additionally, the global outlook for coarse grains indicates a year-on-year increase in their consumption, largely driven by feed consumption. As a result, feed buyers will remain a major core of stable demand for maize. The procurement departments, feed millers, and integrators view maize as a strategic raw material. They closely monitor government supply reports, seasonal yield reports, and national consumption ratios of feed to determine the most propitious time to purchase and effectively manage their risks.

According to the USDA’s Foreign Agricultural Service, the European Union’s total corn supply increased from 86,626 thousand metric tons in 2024 to 86,826 thousand metric tons in 2025, reflecting a slight recovery in availability. This improvement stems from stable domestic production and moderate import growth to support feed manufacturing needs. Maize remains a primary feed grain across the EU, particularly in the livestock and poultry sectors, due to its high energy content and nutritional value. The consistent rise in supply strengthens the animal feed segment by ensuring steady input availability, supporting livestock productivity, and contributing to the overall stability of the regional maize market.

Maize Market Geographical Outlook:

North America is projected to be the prominent market shareholder in the maize market globally and is anticipated to continue throughout the forecast period.

The increase in the production of Biofuel, which is Ethanol in the United States, is a major driver for the demand for maize, with about 40 percent, i.e., about 5 billion bushels, in the last 10 years, according to the data from the U.S. Department of Agriculture (USDA) reported in February 2023. The growing biofuel production and export are also being fueled by stringent country policies and regulations, such as the Renewable Fuel Standard Program Implementation, and emerging incentives regarding low-carbon fuel incentives, along with state low-carbon fuel standards across the region. They are fueling the maize production and demand.

Moreover, maize is also utilized as the country’s primary feed grain, accounting for a considerable share of the total feed grain consumption and production. This is promoted by the expansion of the livestock sector in the country, along with growing domestic and global consumption of livestock products such as meat, eggs, and dairy.

The country is experiencing a rise in meat consumption, which is expected to remain high due to population growth, thereby increasing the feed demand in the coming years. According to OECD data, poultry meat consumption in the country was 34.9 kilograms per capita, while pork and beef & veal meat consumption were 21.8 and 23.3 kilograms per capita in 2024. This represents a steady growth in domestic consumption, which will promote maize production and demand in the region.

The country ranks first in maize production, accounting for 30.6 percent of the global production in 2024, as per USDA data. Maize production in 2024/2025 was 377.63 million metric tons, an increase from 346.7 million metric tons in 2022/2023. This is largely utilized in feed consumption and ethanol production in the country.

In addition to this, the maize production in the country is majorly concentrated in the corn belt region, which includes states like Iowa and Illinois, representing about 33 percent of the country's crop production. Besides the application of maize in animal feed and ethanol production for biofuel, it is also utilized in the food and other industrial sectors in the form of oils, sweeteners, and starches.

Furthermore, the significant export demand for maize, which accounts for 10-15 percent of the total production, with main markets including Mexico, China, and Japan, also promotes the market. The export is expected to remain consistent due to a rise in global food security concerns, along with supply chain disruption from competitor countries like Ukraine, which offers the US maize market a significant growth opportunity.

Maize Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 306.357 billion |

| Total Market Size in 2030 | USD 352.288 billion |

| Forecast Unit | Billion |

| Growth Rate | 2.83% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Cultivation Method, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Maize Market Segmentation:

BY TYPE

Flint Maize

Dent Maize

Sweet Maize

Others

BY CULTIVATION METHOD

Genetically modified (GMO)

Organic

BY DISTRIBUTION CHANNEL

B2B (Business-To-Business)

B2C (Business-To-Consumer)

BY APPLICATION

Food & Beverage

Animal Feed

Pharmaceutical

Paper & Pulp

Others

BY GEOGRAPHY

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

Japan

China

India

South Korea

Indonesia

Taiwan

Others